Abundance of Liquidity To Create Opportunities In Tech Space Once Again

Making sense of Covid-19 volatility

The global stock market extended rally amidst the ongoing Covid-19 crisis, clawing back significant losses seen in March 2020. As at the time of writing, the Dow Jones Industrial Average was still down about 20% from mid-February high, but losses have been cut roughly half since late March.

The recent optimism was buoyed by indications that some states in the US with few Covid-19 cases could proceed to first phase of lifting restrictions on business activities. Potentially, 29 states that have not been hard-hit by the pandemic could move faster to resume economic and social activities.

Latest data from Gilead Sciences’s experimental drug, Remsdevir, also hinted to positive trials which spurred the market jump. Although effective drugs could still take some years to develop and pass clinical trials, the progress is a strong enough catalyst to suggest that the situation may not be as catastrophic as initially feared.

Still, China’s recent GDP data could provide some indications to what is in store for the global economy. The world’s second largest economy shrunk for the first time in almost three decades during the 1st quarter 2020. Official data showed that China’s 1st quarter 2020 GDP fell 6.8%, slightly larger than 6.5% expected. The silver lining was its factory output saw a smaller than expected contraction, and in fact registered an expansion in March. This suggested that stimulus from the Chinese government has managed to help jumpstart parts of its economy.

While governments around the world have already announced stimulus on unprecedented scale, talks of economic growth revival may yet still be too early. A quick v-shaped recovery is highly unlikely and the market has moved to hunker down for something more prolonged.

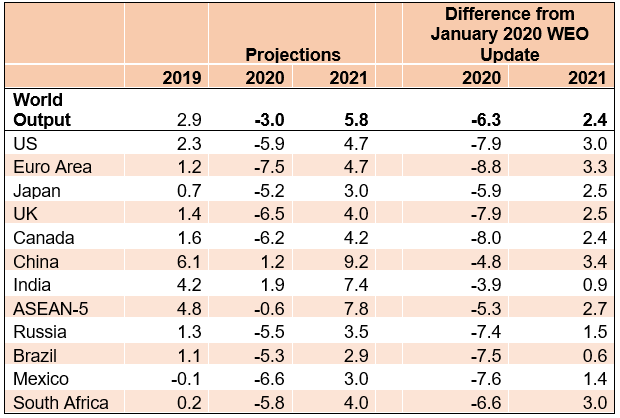

It has become almost certainty a global recession is an imminent reality. In its latest economic outlook projections, the International Monetary Fund (“IMF”) downgraded global growth by 6.3 percentage points to -3% from January 2020, marking a major downward revision over a short period of time. For context, global growth still eked out 0.1% during 2009’s Global Financial Crisis.

Source: Extract from IMF, World Economic Outlook (“WEO”) April 2020

Source: Extract from IMF, World Economic Outlook (“WEO”) April 2020

Lessons From Past Crisis

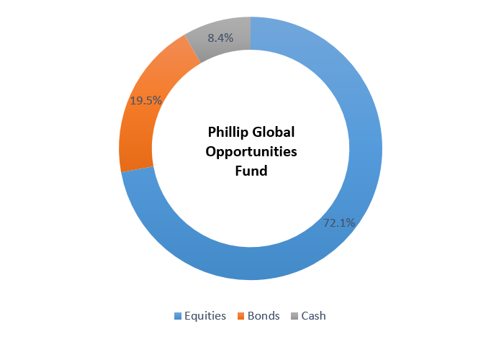

Our Global Opportunities Fund (“PGOF”) has rebalanced towards higher exposure in equities. As of end-March 2020, the allocation was 72.1% equities, 19.5% bonds and 8.4% cash. Prior the crash in February 2020, the fund allocation was more balanced with 50.4% on equities, 36.8% bonds and 12.8% cash.

Source: Phillip Capital Management; As of 31 March 2020

Source: Phillip Capital Management; As of 31 March 2020

The plunge of global equities in March presented opportunities as we believe it is of such magnitude and volatility to the downside that would similarly draw other institutional investors to the “scent of blood in the water”. From viewpoint of current price levels, overall market emanates cheap valuations retrospective to February-highs.

Unlike the Global Financial Crisis, the current Covid-19 crisis originates in the real economy through a collapse of overall demand. However, there are still some lessons that could be drawn upon.

Recall during the Global Financial Crisis, the implosion of the global financial system led to systemic credit crunch that stymied economic recovery. A concerted and spontaneous quantitative easing (“QE”) programme by the G20s helped shorten the recession timeframe.

This time around, governments have stepped in early to maintain liquidity before any implosion. While the crisis is still expected to do some damage, impacts would be limited, or if not delayed. Money has become cheap once again, and from past lessons learnt, would likely drive asset valuations as it did before.

PGOF maintains overweight in its exposure to the US, for the simple reason that the US Dollar remains the reserve currency for the world. In times of crisis, many foreign governments and companies face difficulties in paying bills or repaying debts denominated in US Dollars. Emerging Markets (“EM”) also rely on the US – through the IMF’s emergency funds – to provide them with US Dollars, which thus grant the US enormous power and privilege.

Another reason for the overweighting US equities over China, is that the globalisation of US corporates are more far-reaching than the Chinese counterparts.

Riding On Technology

PGOF is primarily invested in technology equities and the underlying long-term fundamentals correlate to the deepening entrenchment of technology in both social and economic aspects.

In the last decade, we have seen the rise of buzzwords like of Medtech, InsureTech, FinTech, all of which were never heard before in the early 2000s. These new models or ideologies are changing the landscape or disrupting the old ways of doing business. Somehow, much of the rapid development of technology can be attributed to the abundance of liquidity in the financial system, created by the QE programme. After all, cheap money is cheap source of financing in literal terms.

This is a key reason why PGOF is allocated towards the technological space, through its holdings of Fidelity NASDAQ Composite Index ETF and Technology Select Sector SPDR Fund, both of which are efficient exchange traded products which give us direct exposure to the tech theme.

Within the tech sector, there is reason to believe that models running on cloud-based Software-as-a-Service (“SaaS”) subscriptions, digital payments and digital commerce, would be more resilient during this crisis. It is of such reason we see why tech-theme ETFs are tilted toward companies like Microsoft, Alphabet, Apple, Amazon, Salesforce etc.

Nonetheless, our top holdings United Global Quality Growth Fund also gives us some diversification into other sectors. Exposure of United Global Quality Growth is predominantly in the IT sector, but has significant interest in healthcare, consumer discretionary, financials, industrials and communication services.

Quality Bond Exposure Still Gives Some Stability

As mentioned earlier, PGOF allocated 19.5% to high-quality bond exposure, deeming the Fund Manager is taking on a risk-on view on global markets.

Thanks to the recent massive injection through the US Federal Reserve’s bond buying programme, yield of risk-free assets have declined. Interest rates would likely stay low for a very long time in the horizon and we foresee yield spreads between investment grades and US treasuries to widen for sure. Yield-craving investors would have to take on higher risk and switch into BBB grades or even junk bonds to satisfy their risk appetite.

Although yield spreads will likely remain elevated in the near term, PGOF Fund Manager Mr. Charles Lee explained that “it would be more prudent to opt for investment grades to mitigate on the downside for PGOF, given the backdrop of deteriorating economic conditions and higher default risk in the foreseeable horizon.”

Investors hungry for returns could also benefit from PGOF’s equities exposure without proportionately taking on more risk with junk bonds. This is because even though low yields may not be great for fixed income assets, it does bode well for equities in general.”

Through its portfolio, PGOF investors can gain exposure tilted towards companies with powerful intangible assets – such as brands, patents and intellectual property – not only drive stronger resiliency in tough times but also offer long-term upside participation.

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.