- Sustainable Investing Position and Sustainable Investing Philosophy

- Environmental Risk Management and Sustainable Investment Governance Structure

- ESG Research Process

DRIVING POSITIVE CHANGE

Sustainable Investing Position

By incorporating ESG considerations to our investment decisions, we protect capital, apply our responsible investment principles to purposeful investments, and achieve our fiduciary, societal, and environmental responsibilities.

Through our capital flow, we aim to reinforce companies that are contributing and transitioning to a low-carbon and circular economy in socially-just and nature-positive ways. We seek rewards from those who are well-positioned to succeed financially from their commitments to the global climate, biodiversity, and sustainable development goals that ultimately drive necessary change for a more sustainable economy.

Sustainable Investing Philosophy

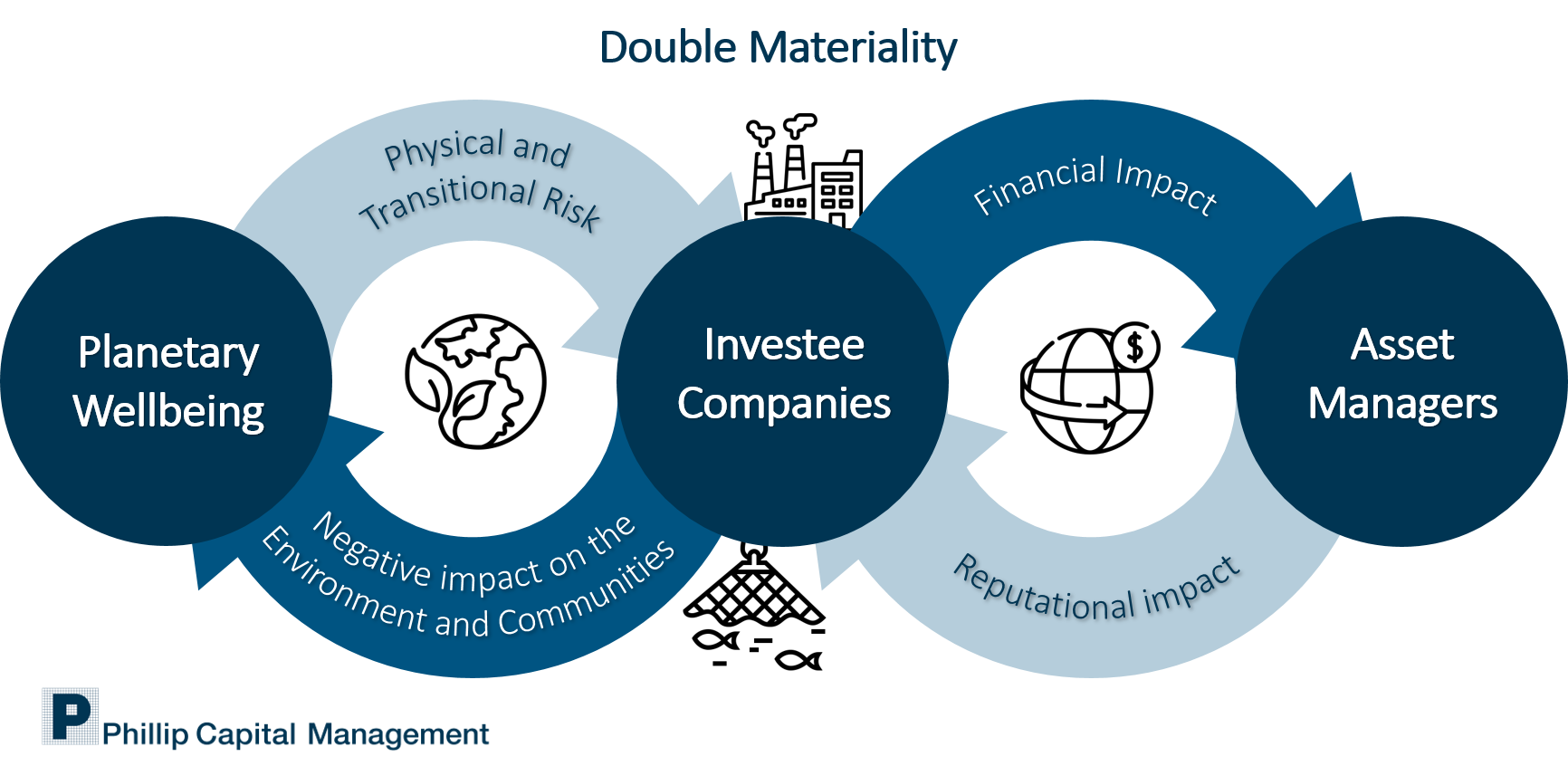

Our position compels us to assess double materiality impacts and adopt an inclusionary approach to sustainable investing for our ESG Funds.

We focus on what matters – a Strong Return on Investment, a Sustainable Environment and Economy.

ESG Integrated Investment Process

- We REVIEW inadequate efforts to take necessary action on risks material to the company’s performance and long-term survival.

- We REINFORCE transitions and contributions to a low-carbon and circular economy that seek just benefits for communities and greater gains for biodiversity.

- We REWARD commitments to global climate, biodiversity and sustainable development goals that lead to a sustainable economy.

Important Information:

Please note that the Sustainable Investing position does not apply to all products. Please refer to the respective product prospectus for specific details before making any investment decision.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

FOCUSING ON WHAT MATTERS

Environmental Risk Management

We incorporate environmental risks into our broader risk management framework and investment decision making. We consider environmental risks across key risk areas such as physical risk, transition risk, and reputational risk, and assess their potential impact at both issuer and portfolio levels across our equity and fixed income asset classes.

Our approach includes, where relevant and practicable:

- Identification, assessment and monitoring of environmental risk exposures.

- Use of risk indicators and metrics (such as carbon emissions and intensity).

- Portfolio-level monitoring and escalation of material risks to the Investment Committee and/or Board of Directors.

Climate Scenario Analysis

We conduct quarterly climate scenario analysis as part of climate stress testing to assess portfolio resilience under different climate pathways. Scenario analysis is used to:

- Identify portfolio exposures to climate-related physical and transition risks.

- Support portfolio monitoring discussions and prioritisation of risk actions.

- Key observations are highlighted to the Investment Committee.

Sustainable Investment Governance Structure

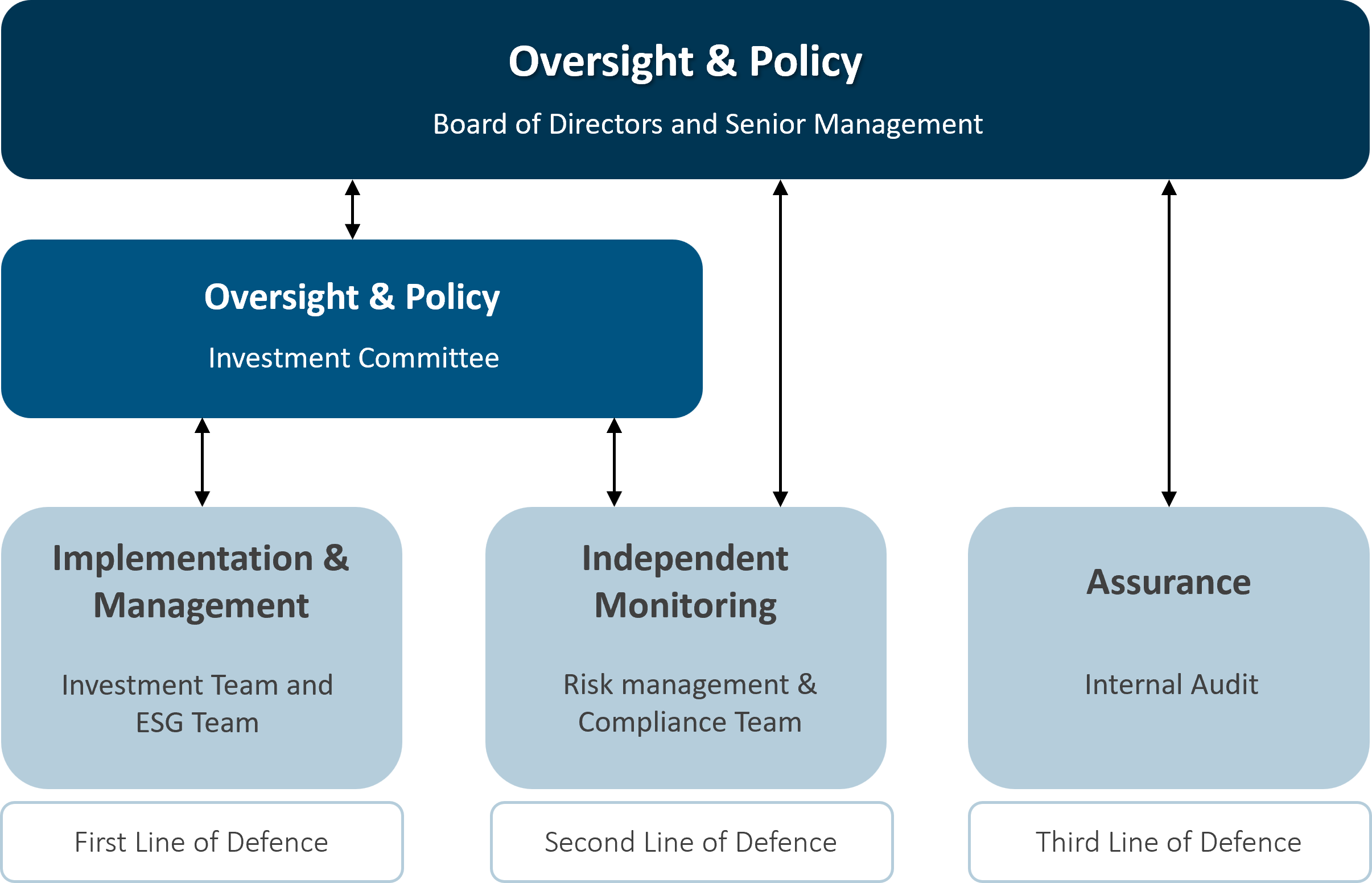

Our sustainable investment governance structure provides oversight and accountability for how environmental and climate-related risks are managed across our investment activities. The Board of Directors provides strategic direction and oversight, while management and control functions support implementation through defined roles and escalation pathways.

Oversight & Policy

Board of Directors and Senior Management

Sets direction and provides oversight of the environmental and climate-related risk management framework, ensuring appropriate resources, and reporting and disclosures are in place.

Our approach is guided by relevant international frameworks such as Task Force on Climate-related Financial Disclosures (TCFD) and Principles for Responsible Investment (PRI).

Investment Committee

Provides oversight of both the Investment and ESG Teams. Review risks relevant to investment selection decision making, which includes material ESG risks, highlighted by members from Investment, ESG, Risk Management and Compliance Teams.

Monitors that appropriate actions are taken in a timely manner.

Significant matters are highlighted to senior management and to the Board of Directors.

Implementation & Management (First Line of Defence)

Investment Team

Integrates ESG framework, including environmental risk management, into research, security selection and portfolio construction. Team members maintain ongoing monitoring of portfolio environmental risks.

ESG Team

Leads the development and ongoing enhancement of the ESG framework, which includes environmental risk management.

This covers tools, assessment metrics and reporting. Conducts proprietary ESG research (internally referred to as ESG Rapid Reports), under specific conditions, to assess and provide an overall ESG rating on investee companies.

Independent Monitoring (Second Line of Defence)

Risk Management & Compliance Team

Provides independent oversight to ensure ESG-related risks are identified, assessed and managed across portfolios. Conducts ongoing compliance monitoring, which includes ensuring that the firm complies with paragraph 8 of Circular No. CFC 02/2022 Disclosure and Reporting Guidelines for Retail ESG Funds (as issued by the Monetary Authority of Singapore), which requires that at least two-thirds of the net asset value of the Sustainable Reserve Fund is invested in companies which the firm deems to have satisfactory overall ESG rating.

Material findings are escalated to Investment Committee for review and action.

Assurance (Third Line of Defence)

Internal Audit

Provides independent assurance over governance arrangements, processes and controls.

Important Information:

Please note that the Sustainable Investing Philosophy and ESG Integrated Investment Framework do not apply to all products. Please refer to the respective product prospectus for specific details before making any investment decision.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

VALIDATING COMPANY VALUE

ESG Research Process

We believe industry-specific transition is necessary in order to meet the global goals for climate, nature and sustainable development.

Targets and goals that can be adequately measured and managed allow us to monitor performance and change over time. We take reference from scientific bodies, such as IPCC and IPBES, and the Global Goals set within the Paris Agreement, the Global Biodiversity Framework and the SDGs.

ESG Assessment Process – ISS Indicators

To support our ESG integration framework approach, we engage Institutional Shareholder Services (“ISS”) as an ESG data provider, whose methodology aligns with our ESG double materiality objectives.

We customise the use of ISS ESG data by using up to five (5) indicators from ISS to assess each investee company in our portfolio of investments. Of the five, we internally classify two (2) as primary indicators and three (3) as secondary indicators. The five indicators from ISS are:

Primary Indicators

- ESG Corporate Rating

- Carbon Risk Rating

Secondary Indicators

- Average Peer Emission Intensity

- ESG Momentum

- Carbon Budget

This customised assessment is performed on a monthly basis for Sustainable Reserve Fund and on a quarterly basis for all other funds that we manage. This assessment is also conducted on a new underlying investment in the Sustainable Reserve Fund.

An investee company is deemed by us to have a satisfactory overall ESG rating when:

- Both primary ISS indicators meet our internally set thresholds; or

- At least two of the three secondary ISS indicators meet our internally set thresholds.

For a satisfactory overall ESG rating, we internally assign either “low risk” or “medium risk” rating to an issuer.

For clarity, we deem that an ISS indicator scores a fail when there is absence of data or when the indicator carries a rating being below our internally set threshold.

The three secondary ISS indicators were chosen because they are, amongst others, the underlying components of the ESG Corporate Rating and Carbon Risk Rating. Below are descriptions of the two primary ISS indicators and the three secondary ISS indicators:

ESG Corporate Rating

ESG Corporate Rating assesses the ESG performance of corporate issuers. ESG performance refers to a company’s demonstrated ability to adequately manage material ESG risks, mitigate negative and generate positive social and environmental impacts, and capitalize on opportunities offered by transformation towards sustainable development. ESG Corporate Rating works on a “rating hierarchy” whereby assessments take place at the indicator level only and these scores are aggregated at all higher levels of the rating hierarchy. This assessment draws on a pool of approximately 700 indicators, with a total of approximately 100 assessed indicators per overall rating. The ESG Corporate Rating methodology builds on international frameworks, such as the United Nations (UN) Global Compact Principles and the UN Sustainable Development Goals (SDGs). The methodology also takes into account mandatory and voluntary disclosure standards such as the IFRS Sustainability Disclosure Standards (IFRS S1 and IFRS S2) issued by the International Sustainability Standards Board (ISSB), as well as regulatory changes and technological developments.

Carbon Risk Rating

Carbon Risk Rating is a metric for evaluating how well companies are prepared for a low-carbon economy by looking at how well they manage their climate-related transition risks. This metric is an aggregated score indicating a company’s overall climate-related physical and transition risks, using the company-specific risk exposure as a baseline from which a company can take steps toward better alignment with a low carbon economy.

Average Peer Emission Intensity

The emission intensity approach used for this metric considers direct (Scope 1) and indirect (Scope 2) emissions in the alignment analysis. If the company’s carbon intensity is in line with, or below the carbon intensity for the sector the company is in, the company is considered aligned. If not, the company is considered unaligned.

ESG Momentum

ESG Momentum provides a signal on the year-on-year trend of a rated company’s overall rating (i.e. the ESG Corporate Rating). It is calculated based on the difference between the numerical grade of the current final rating and the numerical grade of the last regular final rating. ESG Momentum is classified into five levels, from significantly negative to significantly positive, depending on the numeric grade change.

Carbon Budget

The carbon budget of an issuer is assessed through climate scenario analysis using the International Energy Agency Sustainable Development Scenario (IEA SDS). ISS sets an issuer’s carbon budget by comparing its emission intensity against industry peers. Lower emission intensity relative to industry peers indicates higher efficiency and stronger alignment with industry decarbonisation pathways. Such issuers are assigned higher carbon budgets. Issuers with higher emission intensity relative to industry peers receive lower carbon budgets. The factor then identifies the year in which the issuer’s estimated future carbon emissions are no longer aligned with the issuer’s estimated carbon emissions budget required to be aligned with the IEA SDS.

ESG Assessment Process – Proprietary ESG Research

Under specific conditions, we will conduct ESG risk assessment on an investee company using our proprietary ESG research. The research reports produced by our proprietary ESG research are internally referred to “ESG Rapid Reports”. This research is based on three (3) research objectives:

- Objective 1 – Managing ESG risk.

- Objective 2 – Mitigating negative externalities.

- Objective 3 – Measuring positive change and impact.

Each research objective includes Environmental, Social, and Governance metrics financially material to the industry and where relevant, specific to the assessed investee company. Each research objective assesses risks and opportunities across domains that address, amongst others, social injustice, health, climate change, biodiversity loss, and pollution.

We use our proprietary ESG research to assess an investee company if any of the following conditions is met:

- The investee company is a new underlying investment in the Sustainable Reserve Fund that has scored an unsatisfactory overall ESG rating based on the ISS indicators described above.

- The investee company is one of the top ten (10) largest holdings in the Sustainable Reserve Fund, irrespective of its overall ESG rating based on the ISS indicators described above.

- The investee company is one of the issuers named in the high carbon intensity or high nature impact watch list. This watch list is guided by Climate Action 100+ and Nature Action 100. Climate Action 100+ is a global, investor-led initiative that engages 169 companies globally to drive stronger climate governance, reduce greenhouse gas emissions, and improve climate-related disclosures and transition plans. Nature Action 100 is a global, investor-led initiative that engages 100 large companies across eight key sectors that are systemically important for nature and ecosystem services.

The issuance of the ESG Rapid Reports is prioritised based on the above order of 1 to 3.

The primary sources of ESG information used for the ESG Rapid Reports are:

- Sustainability reports and annual financial reports issued by the company.

- Information, such as company policies, made publicly available by the company.

- Controversial news on the company, published by credible and reputable news organisations.

Based on information we extract from the above sources, we use a scoring system of at least 35 metrics and these metrics are relevant to each of the three research objectives. The metrics assess, amongst other things, the level of action taken by the issuer, the issuer’s contribution/transition to the green economy, and the issuer’s commitment to its own targets and to global goals. Some of the metrics are associated with the Sustainability Accounting Standards Board (SASB), Task Force on Climate-Related Financial Disclosures (TCFD) and UN-supported Principles for Responsible Investment (PRI).

Each metric is scored on a scale of 1 to 10. For objectives 1 and 2, scoring focuses on the quality of disclosures and strength of commitments. For objective 3, scoring focuses on measurable, time-bound targets with a clear implementation trajectory.

The overall ESG rating of the investee company, whether satisfactory or unsatisfactory, is determined by the weighted average score of the assessed metrics. This overall ESG rating derived from our proprietary ESG research will supersede the overall ESG rating, if any, derived from the ISS indicators.

For the purpose of paragraph 8 of Circular No. CFC 02/2022 Disclosure and Reporting Guidelines for Retail ESG Funds (“ESG Circular”) issued by the Monetary Authority of Singapore, at least two-thirds of the net asset value of the Sustainable Reserve Fund must be invested in companies we deem to have satisfactory overall ESG rating.

Important Information:

Please note that the ESG Research Process does not apply to all products. Please refer to the respective product prospectus for specific details before making any investment decision.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Our Sustainability Events & Content

________________

Driving the spirit of sustainability through engagement

Lastest ESG Insights

Memberships & Associations