Weekly Commentary: 29 November 2021 – 05 December 2021

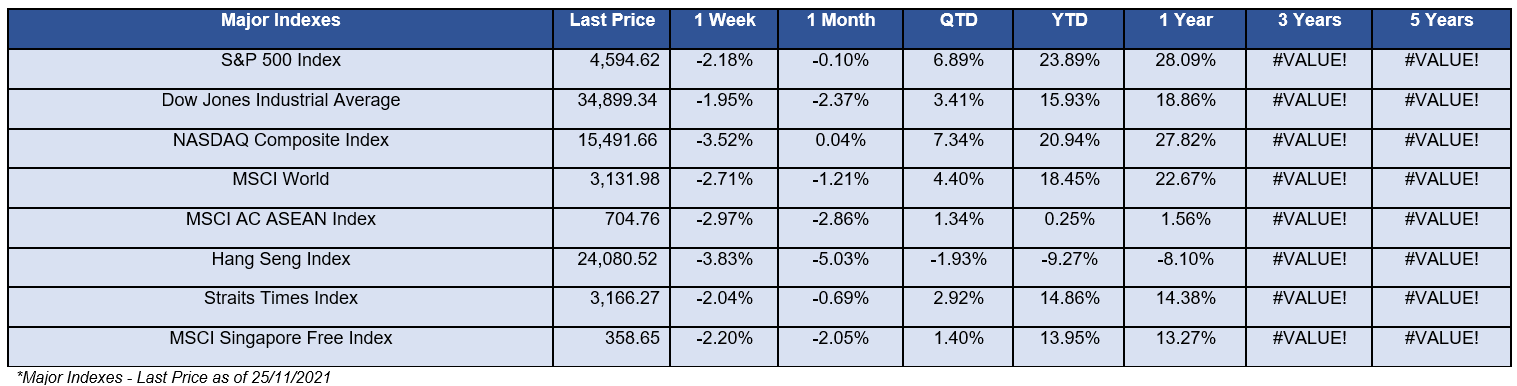

Stocks declined for the holiday-shortened week after Friday’s news that a new and potentially more transmissible coronavirus strain than the delta variant had emerged in South Africa. Riskier assets such as equities experienced sharp sell offs and a rally in safe havens such as Treasuries. The price of West Texas Intermediate crude oil, the U.S. benchmark for the commodity, plummeted more than 10% on Friday on fears that the new variant will damage demand for oil. Growth stocks as loosely represented by the NASDAQ Composite Index returned -3.52% within the week. In comparison, the S&P 500 saw a 2.18% decline, its worst day since late February and third worst decline of the year. All 11 S&P 500 sectors closed in negative territory, ten of which fell between 1.4% (consumer staples) and 4.0% (energy). The health care sector outperformed on a relative basis with a 0.5% decline due to strength in vaccine makers likes Pfizer (PFE 54.00, +3.11, +6.1%) and Moderna (MRNA 329.63, +56.24, +20.6%). Stay-at-home stocks like Zoom Video (ZM 220.21, +11.91, +5.7%) also posted decent gains. DJIA performed the best with a 1.95% loss. Closer to home, the STI dipped 2.04% in contrast with the Hang Seng’s loss of 3.83%.

Stocks declined for the holiday-shortened week after Friday’s news that a new and potentially more transmissible coronavirus strain than the delta variant had emerged in South Africa. Riskier assets such as equities experienced sharp sell offs and a rally in safe havens such as Treasuries. The price of West Texas Intermediate crude oil, the U.S. benchmark for the commodity, plummeted more than 10% on Friday on fears that the new variant will damage demand for oil. Growth stocks as loosely represented by the NASDAQ Composite Index returned -3.52% within the week. In comparison, the S&P 500 saw a 2.18% decline, its worst day since late February and third worst decline of the year. All 11 S&P 500 sectors closed in negative territory, ten of which fell between 1.4% (consumer staples) and 4.0% (energy). The health care sector outperformed on a relative basis with a 0.5% decline due to strength in vaccine makers likes Pfizer (PFE 54.00, +3.11, +6.1%) and Moderna (MRNA 329.63, +56.24, +20.6%). Stay-at-home stocks like Zoom Video (ZM 220.21, +11.91, +5.7%) also posted decent gains. DJIA performed the best with a 1.95% loss. Closer to home, the STI dipped 2.04% in contrast with the Hang Seng’s loss of 3.83%.

The yield on 10y note recorded its biggest one day (16bp to close around 1.47%) drop since March 2020. Moves were amplified by liquidity and positioning for a hawkish shift. The probability for a rate hike in May 2022 decreased to 36.4% from 55.3% on Wednesday, and the probability for a rate hike in June 2022 decreased to 61.8% from 82.1% on Wednesday. For an abbreviated trading session, volumes were massive, with ~9bn shares trading during the short trading week. This was reflected by the move in the CBOE Volatility Index (VIX) as it increased by 54% to 28.6. Appropriately, the fed-funds-sensitive 2-yr yield was down 12 basis points to 0.52% after rising 13 basis points over the prior three sessions. The U.S. Dollar Index fell 0.7% to 96.11.

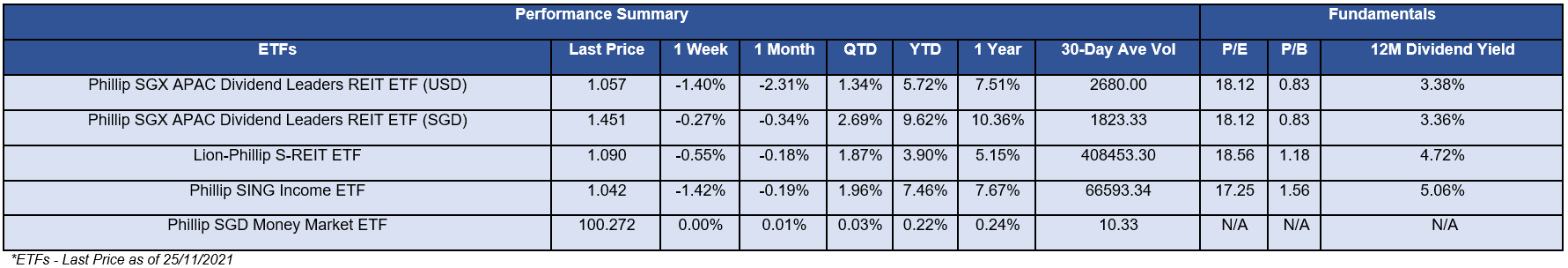

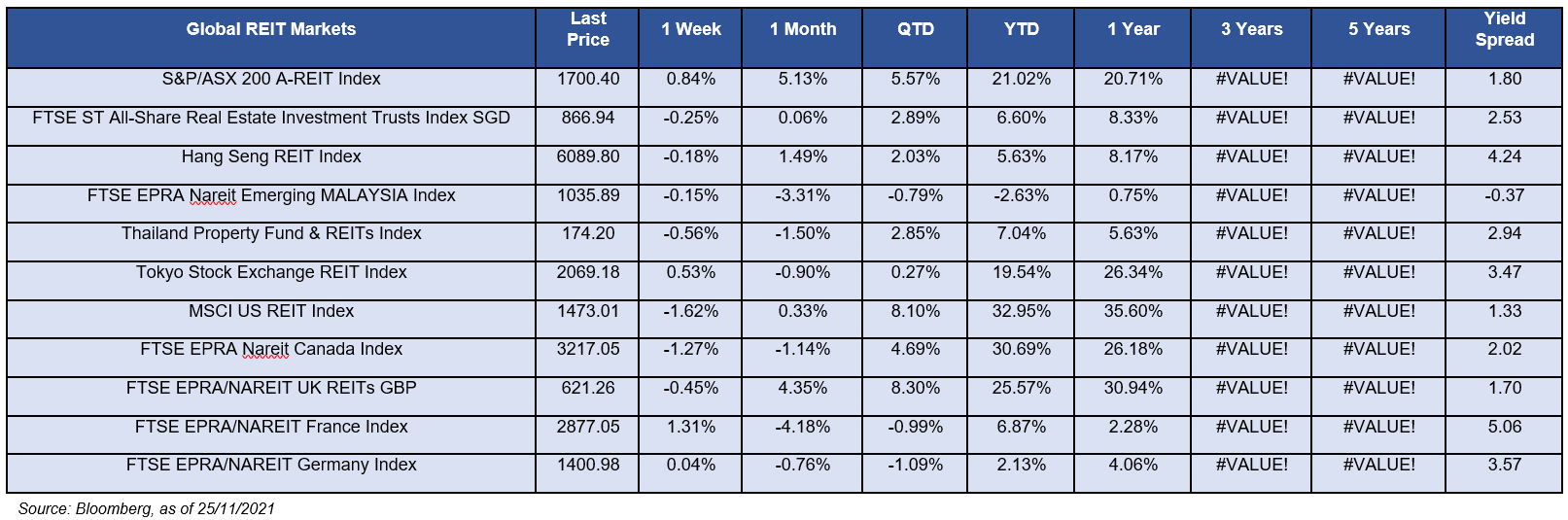

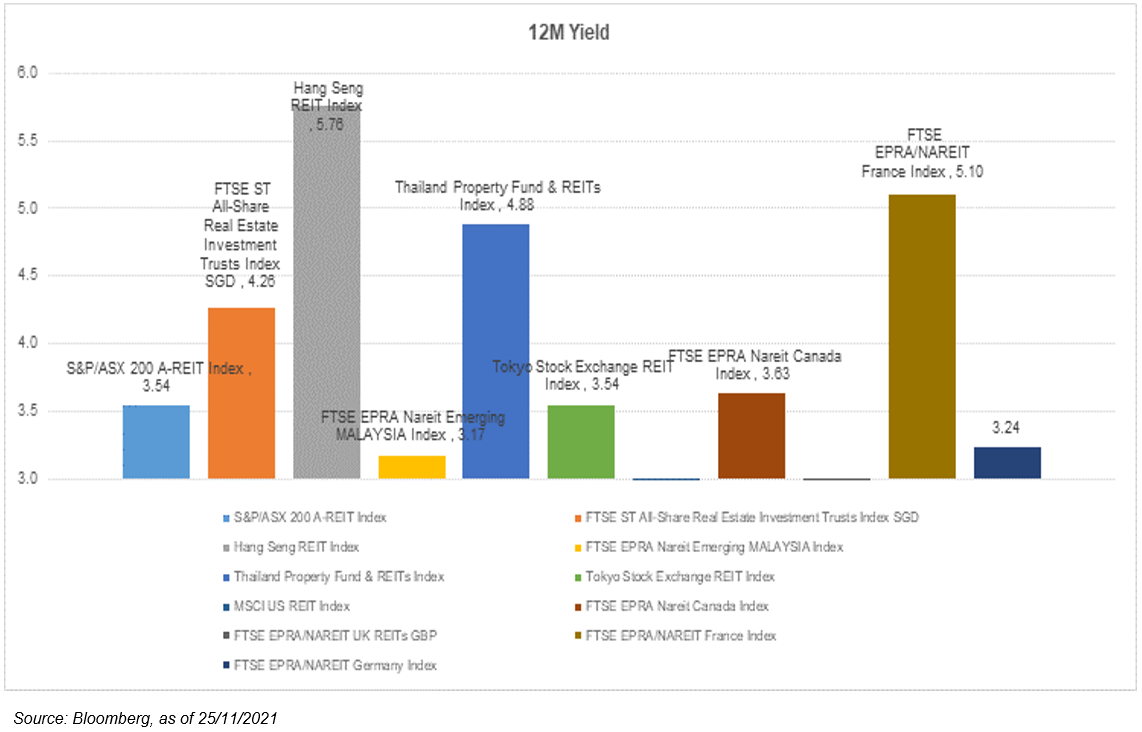

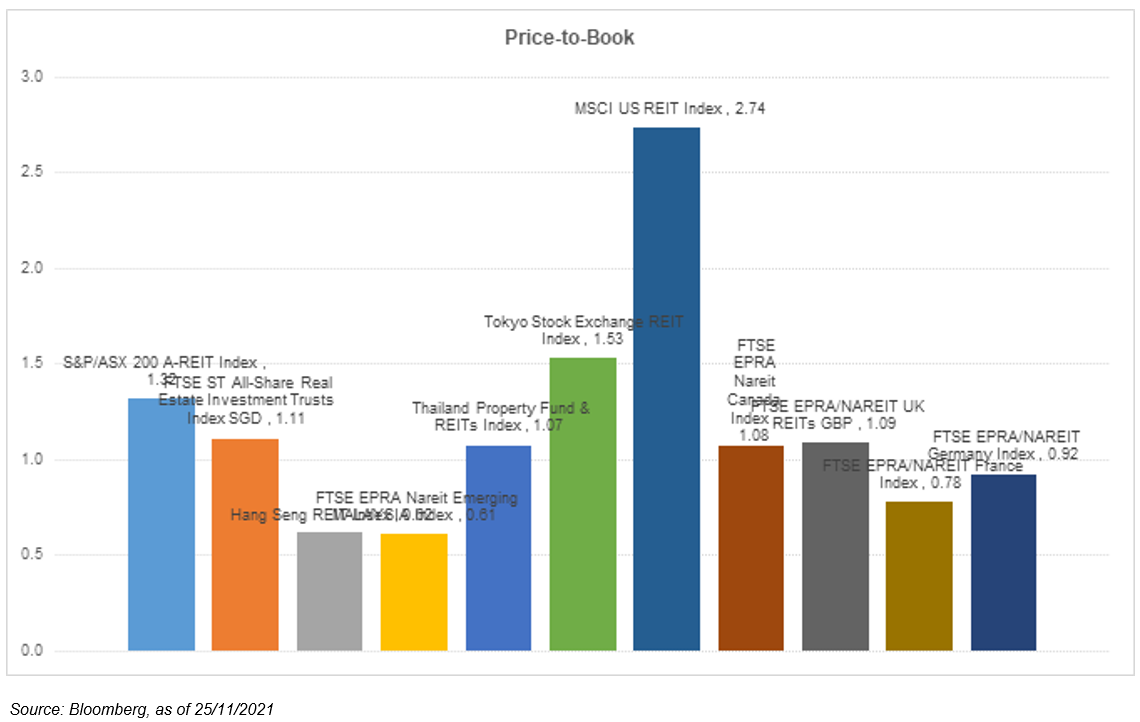

The global REIT markets reported negative returns with the exception of Australia, Tokyo, France and Germany. But the overall 12-month yield spreads remained positive (with the exception of Malaysia) and still favorable towards REIT’s forward total return. Back at home, the iEdge S-REIT Index dipped 0.25% over the week on fears that the new covid variant could dial back on reopening plans.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.