Rising Climate Risk Threatens Bank Portfolios

In less than 100 days, governments and world leaders will convene in Dubai for the UN Climate Change Conference (COP28).

The Conference marks the final stage of the first Global Stocktake – where countries will determine their progress and response to limit warming to 1.5 degrees Celsius (Milken Institute).

As temperatures climb, more frequent extreme weather events could spell major credit losses for banks. Abrupt carbon tax requirements or drops in consumer demand could impair the ability of issuers to repay debts due to unexpected drops in income.

To safeguard financial institutions and other businesses against climate risk, the Task Force on Climate-Related Financial Disclosures (TCFD) provides a set of disclosure recommendations. This helps the company and its investors understand the long-term risks and opportunities of climate change and how to integrate climate risk into business strategies.

Currently, the Singapore Exchange (SGX) requires listed companies in 3 sectors – finance, agriculture, food, forest products, and energy – to provide TCFD-aligned climate reporting. By 2024, this will expand to include the (i)transport, and (ii) materials and building sector.

Harmonising sustainability disclosures

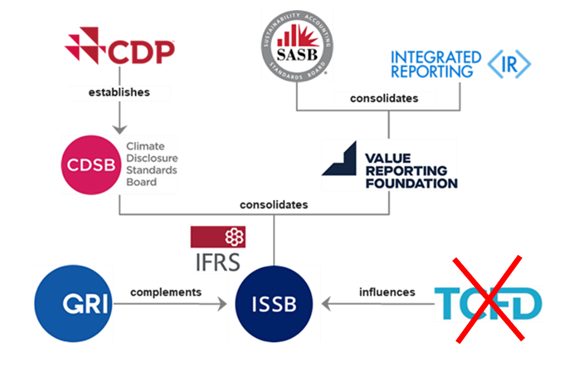

On 26 June 2023, the International Sustainability Standards Board (ISSB) – under the International Financial Reporting Standards (IFRS) Foundation – released the IFRS Sustainability Reporting Standards.

Essentially, the ISSB strives to do for sustainability disclosures what the International Accounting Standards Board has achieved for financial accounting – by providing a uniform framework applicable to all sectors and industries to consolidate the fragmented reporting landscape. From 2024, the ISSB will take over the responsibilities of the TCFD.

Photo source : Kirkland and Ellis

Photo source : Kirkland and Ellis

The ISSB consolidates various investor-focused reporting initiatives, including the Value Reporting Foundation’s SASB Standards

As of August 2023, the ISSB has released two standards, with more expected to be released in the coming months:

- IFRS S1: General Requirements for Disclosure of Sustainability-Related Financial Information (the “General Requirements Standard”), and

- IFRS S2: Climate-Related Disclosures framework (the “Climate Standard”).

The General Requirements Standard will apply across all of the ISSB’s upcoming sustainability topic-specific standards, including the Climate Standard.

Adoption of ISSB Standards

The release of IFRS S1 and S2 could influence mandatory disclosure requirements by regulators. Already, Singapore has proposed to make climate reporting compulsory for listed companies by FY2025 and large non-listed companies with SG$1 billion revenue from FY2027. Meanwhile, Hong Kong is conducting public consultations on mandatory ISSB and TCFD disclosures for listed companies and could come into play as early as January 2024 (HKEX).

There is a growing consensus among policymakers that credit risk is influenced by climate risk. For example, as we face more frequent and intense floods and droughts, agricultural firms could be exposed to sudden revenue drops from mass crop losses – leaving them unable to repay loans (BIS). To address this, PCM ESG Research Objective 1 (Managing ESG Risks) looks into how banks incorporate the financial implications of physical and transition risks into their operations and businesses.

At PCM, we assess how banks extend ways that clients contribute to “global goals” such as the Kunming-Montreal Global Biodiversity Framework and UN SDGs. For example, under the Social consideration of PCM ESG Research Objective 2 (Mitigating Negative Externalities), we consider how the bank provides green finance options for customers e.g. SMEs.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.