Wake up call for food sector

Our food comes from land and the sea. Land use change and forestry account for about one quarter of global greenhouse gas emissions and about 38% of global land area – equivalent to about 6 billion football fields. Forests are major carbon sinks that absorb over 7 billion tonnes of carbon a year, outweighing Singapore’s annual emissions by over 100 times. Stopping deforestation is crucial to limit human-induced warming to 1.5°C and facilitate nature recovery.

Commercial fishing is present in over half of the ocean, spreading across almost four times more of the Earth’s surface compared with agriculture. New research has uncovered a new major source of emissions – 1.47 billion tonnes of carbon – more than 20 times Singapore’s annual emissions have been released from bottom trawling.

With the ocean absorbing more than one-third of carbon emissions every year, human-induced greenhouse gas emissions may overwhelm the ocean’s storage abilities. Trawling will only exacerbate this issue by adding more ocean emissions while decimating bottom-dwelling biodiversity.

Photo source: Adapted from Visual Capitalist, icons from Flaticon

Towards a more sustainable, secure food system

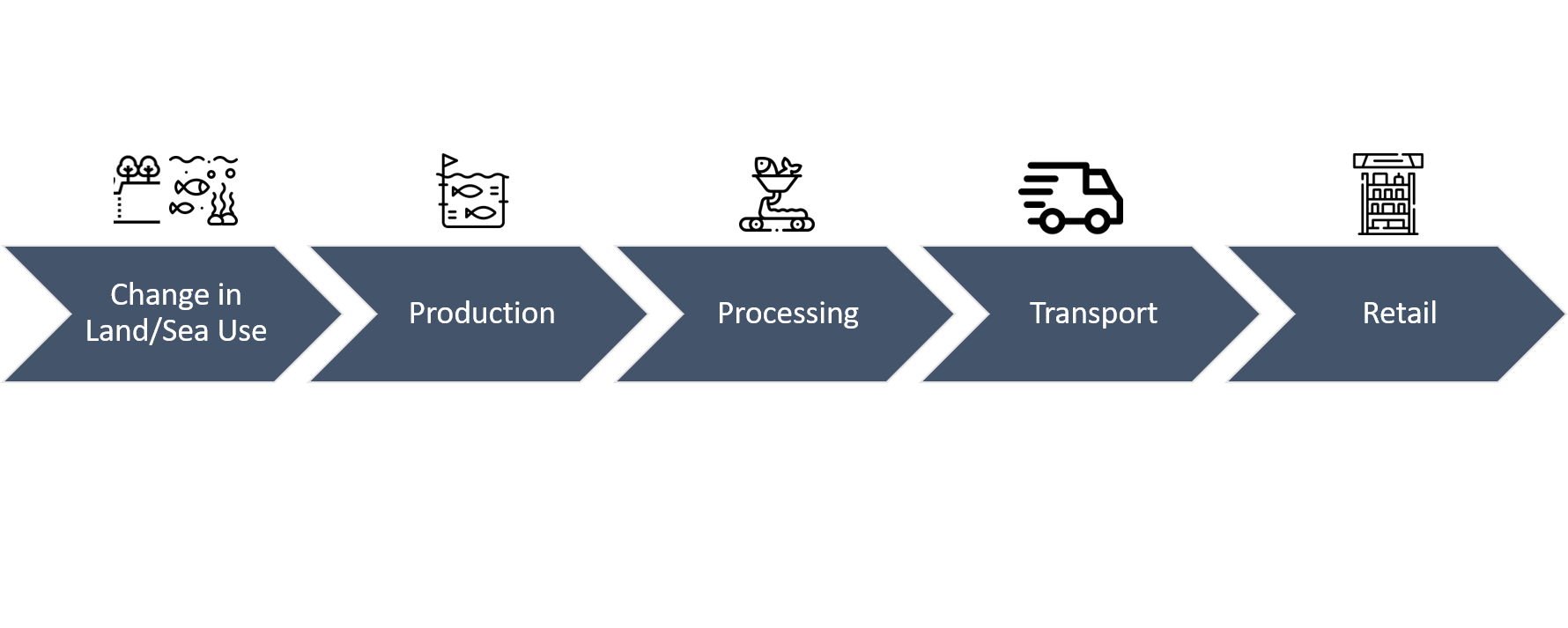

The Global Stocktake synthesis report concluded that about half of the agriculture industry’s emissions come from land use. Scientists have also pointed out that 18% of food industry’s emissions are contributed by transport, processing and packaging

Singapore imports more than 90% of its food as a land-scarce nation. This means that our food security is highly vulnerable to climate and supply chain disruptions. While less than 10% of imported food items (chilled pork, mutton, beef and fish) are flown in, these contribute over half of transport emissions. To boost food resilience and supply, Singapore has set a “30 by 30” goal to produce 30% of its nutritional needs by 2030. By importing food from neighbouring countries and boosting local production, Singapore can also reduce food transport emissions.

Looking forward

Last month, the International Coral Reef Initiative launched the Coral Reef Breakthrough which aims to secure the future of at least 125,000 km2 of shallow tropical reefs with investments of at least US$12 billion to support more than half a billion people by 2030. Achieving these targets will push forward action for SDG 14 (Life Below Water) – by conserving, protecting and restoring reefs. This brings about triple benefits – more biodiversity, fish stocks and less carbon.

Recognising the critical role of the ocean in regulating climate change, the COP28 Dubai Ocean Declaration calls for urgent reduction of greenhouse gas emissions, coupled with concrete steps to curb human-induced damage from habitat destruction and marine pollution. The Declaration also highlights a concerning lag in international investments for ocean observing systems – signalling that more funding is needed to enable marine protection.

We support healthy and productive land and oceans through PCM ESG Research Objective 2 (Mitigating Negative Externalities). We reinforce companies capitalising on opportunities to decarbonise value chains by shifting to efficient, zero-emissions logistics. Through our supply chain analysis, we invest in companies which source for deforestation-free and sustainably-produced food to protect natural capital and ecosystem services.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.