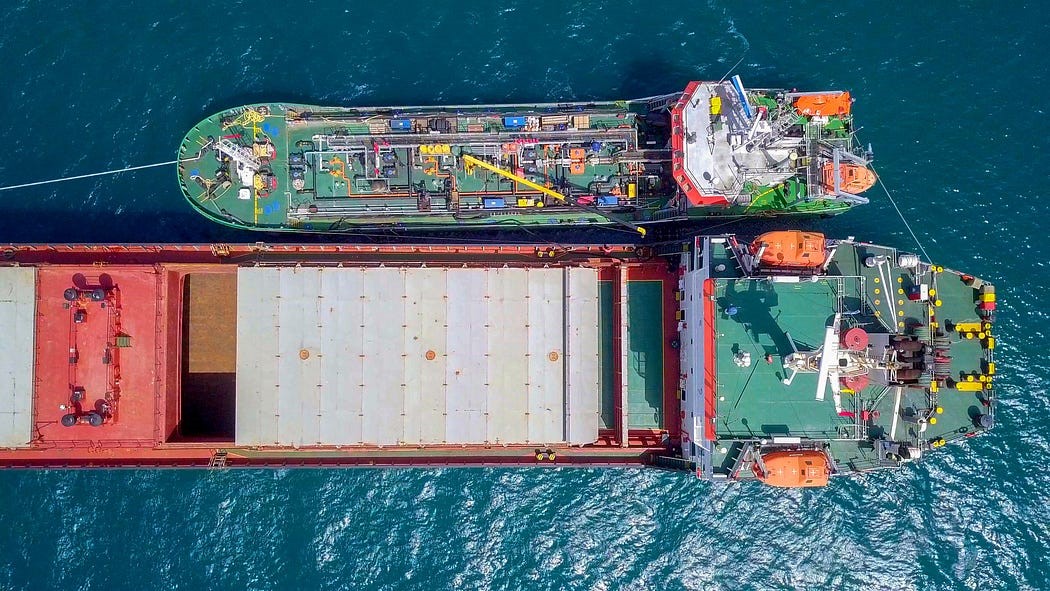

Food or fuel?

- With demand from Singapore’s maritime sector set to double by 2025, marine biofuels are one alternative to help ships reduce emissions

- There exists a tradeoff between using food-based crops for sustenance versus fuel

Photo source: Medium

The maritime industry faces considerable challenges in emissions reductions. Shipping supports over 80% of global trade and it is not slowing down. Without intervention, shipping emissions could rise by five-fold within the next three decades.

In 2020, the IMO implemented a global limit on ships’ fuel oil – where the maximum limit for sulphur content underwent a major cut from 3.5% to 0.5%. This will substantially reduce sulphur oxide emissions from ships, benefiting the environment and human health. One of the ways to comply with the IMO requirement is to use biofuels or biofuel blends. Biofuels already in common use worldwide are made from crops or vegetable oil.

However, using food-based crops limits their scalability. About 4% of agricultural land is used for growing biofuels. As the world’s population grows, how can we better manage our existing land and water resources? One emerging area of interest is using non-food waste biomass feedstocks from forestry or crop production – though these are in the nascent stages of trials and production.

Demand for cleaner fuels has largely been driven by IMO regulations on carbon intensity, as blending biofuels could cut carbon emissions by close to 20%. To support the development of cleaner fuels, the Zero Emission Maritime Buyers Alliance (ZEMBA) was set up to consolidate buyer interest and enable economies of scale for freight buyers and suppliers. As technology matures, the maritime sector presents business opportunities to tap into the future fuel market, sized at over US$1 trillion.

As an established maritime hub, Singapore plays a key role in facilitating global trade. To meet the future needs of maritime transport, the country is working with international players to deploy cleaner marine fuels, secure supply chains, and support the development of new technologies. For instance, Singapore trialed the world’s first ocean-going ammonia-powered vessel in 2024 with a successful 6-week run.

Looking forward

At PCM, our ESG analysis highlights the importance of a transition plan and evaluates how it ties in with the firm’s business. Shipping firms can revise their business models to prioritise cleaner fuels, improve fuel efficiency, and avoid air and sea pollution. In support of the transition to net zero, we take into account the whole life cycle of fuel production. We reinforce actions for sustainable production of fuel such as incorporating renewables, using alternative feedstock to food-based fuels, or innovating to improve resource efficiency and yield.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.