What does the Election Supercycle mean for Sustainability?

- Changes in leadership and policy priorities from the national elections in G7 countries could slow down climate action

- While major industrial nations have led sustainability in the past, we need to watch emerging markets (e.g. India) which will form 7 out of 10 of the world’s biggest economies by 2030

This year, about 2 billion voters – or close to half the world’s adult population – from 70 countries including the United States, the United Kingdom, and India will head to the polls. Voters’ choices will shape the policies on climate change and natural resources, which are critical for maintaining global trade and environmental health.

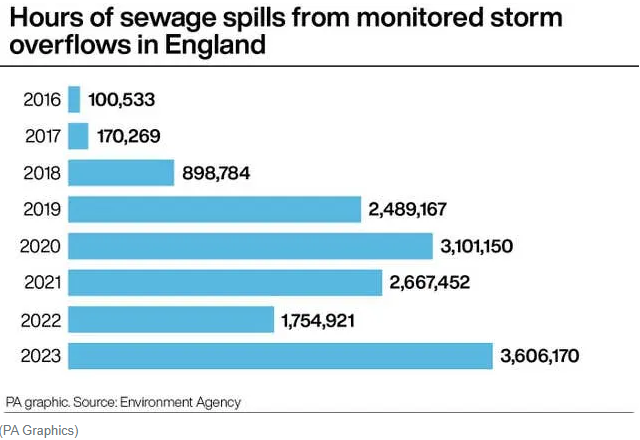

The world is linked through flows of goods, services, and people. As the world’s biggest exporter of hard liquors ($9.58B), the UK needs land and water to grow juniper for gin and grain for whisky. Our previous Blueprint highlighted how climate change could exacerbate desertification and water scarcity through changes in temperature, rainfall, and winds. What’s worse – companies in the UK are permitted to release raw sewage into waterways during heavy rainfalls. The country saw record highs of over 3.6 million hours (412 years) of spillage into England’s rivers and seas last year.

After securing the parliamentary majority (>60%), the Labour Party aims to implement stricter water sector regulations. In response to public outcry over a report indicating that no waterway in England or Northern Ireland is below the safe limit of toxic chemicals, the Party is looking to ensure that companies clean up water bodies and support farmers with land-use frameworks and environment management schemes.

France, as the world’s 2nd largest exporter of caviar (13.1% of the market share), faces a unique intersection of environmental and economic concerns. Today, almost all caviar comes from farms which require sea space and effective waste management. The unexpected outcome of France’s election where no single party secured the majority will further complicate policymaking and could impact the regulatory landscape for aquaculture. Over the next 6 years, the caviar market is predicted to grow to around $452 million by 2030 with a compound annual growth rate (CAGR) of roughly 4.5%. Increasing international demand for the prized product promotes its economic importance and endangerment, with all 27 sturgeon species listed in the International Union for Conservation of Nature’s (IUCN) Red List. The political uncertainty raises questions on whether France can maintain its competitive edge in caviar farming and exports while ensuring sustainable practices.

On average, emerging markets (E7) could grow twice as fast as advanced economies (G7). However, emerging economies will need to build up infrastructure and create secure economies to overtake developed nations in the battle for global economic power. It is necessary to watch emerging economies as influence and wealth shifts away from past industrial powerhouses.

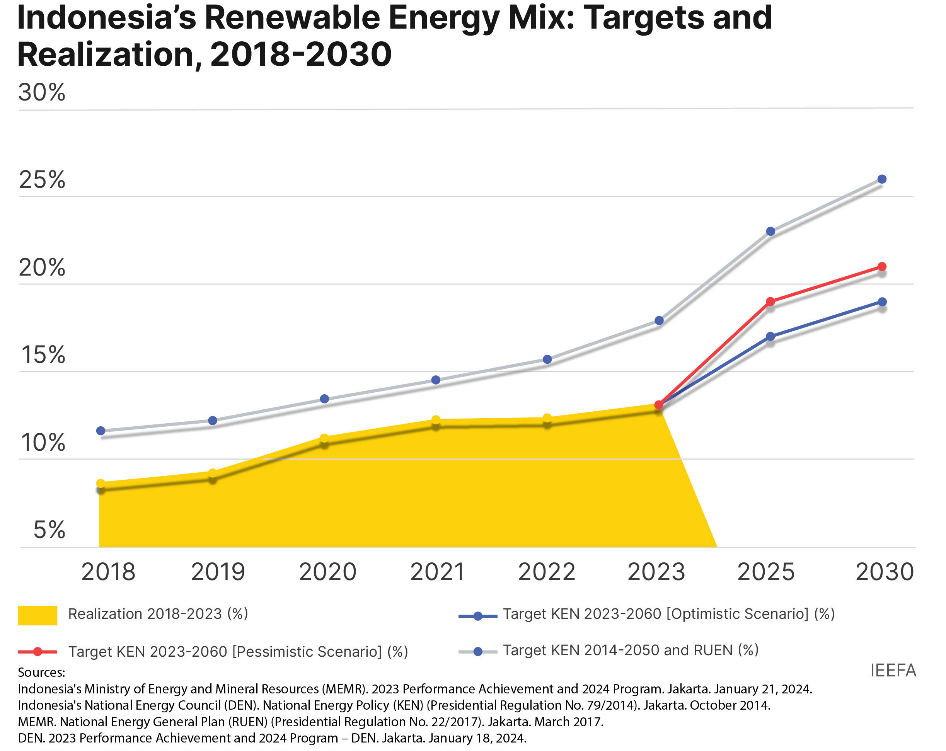

In Indonesia, inflation and rising concerns over green energy costs have led to a softening of renewables targets to 17% to 19% by 2025, down from the original 23% target. Indonesia has consistently missed its targets for the past five years, with the current share at 13.1%. This is well below the 17.9% target for 2023. All 3 presidential candidates from Southeast Asia’s largest economy announced intentions to cut coal and increase renewables during their election campaigns, signalling a possible tide shift. The country has major potential to generate nearly five times of its current power generation capacity using sources such as geothermal, wind and hydropower energy – some of which could be exported to neighbouring countries keen to switch out carbon-intensive energy for renewables and meet net-zero commitments.

For instance, Singapore has granted conditional approval to import up to 2 gigawatts of low-carbon electricity from Indonesia, making up about half of the national 2035 target. We could see imports coming in within five years, based on the agreement signed in 2023. Singapore’s economy thrives on international trade, with exports and imports accounting for a substantial part of its gross domestic product. The country sees major inflows of goods as the busiest port in the world and a major aviation hub. Power generators, machinery, and pharmaceutical products make up the largest imports between Singapore and the United Kingdom. The demand for these goods is supplemented by the resources unique to the UK. Singapore seeks to work with industry and government partners to develop and scale enablers such as sustainable fuels, power systems, and low emissions steel to decarbonise its most emissions-intensive sectors – industry, power and transport.

Looking forward

This year’s superelection cycle will have major implications for domestic policies, international collaboration and achieving climate goals. The transition to a net-zero economy is already underway in both developed and developing nations. For example, Labour’s victory in the UK could push forward decarbonisation and inspire other countries to do the same. Shared challenges such as resource scarcity, supply chain disruptions and extreme weather remain, impacting the bottom line and operations of companies. This is why under our environmental analysis, we reward companies that prevent pollution in their operations while safeguarding against climate impacts like floods and droughts. The industries that underpin national economies also contribute to environmental outcomes.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.