Market Commentary – August 2024

Equity Market Update:

Source: Bloomberg

In August, the stock market maintained its upward momentum, with the S&P 500 (+2.4% MTD) continuing to rise. Investors gravitated towards value stocks, leading the Dow Jones Industrial Average (DJIA, +2.0% MTD) to outperform the NASDAQ Composite (+0.7% MTD).

Developed market equities (+2.7% MTD) outperformed emerging markets (+1.6% MTD), widening their year-to-date lead to approximately 7%. However, small-caps (+0.5% MTD) lagged behind large-caps (+2.7% MTD), likely due to mixed economic data despite the anticipated rate cut in September.

In the Asia-Pacific region, equities overall performed well, with ASEAN markets (+8.1% MTD) leading the charge. Singapore (+5.5% MTD), Australia, and Hong Kong (+5.1% MTD) were among the top performers. Conversely, South Korea (-1.1% MTD) and India (+0.8% MTD) were the laggards in the region.

Source: Bloomberg

Source: Bloomberg

The S&P 500 sectors generally exhibited positive performance in August, except for Energy (-1.7% MTD) and Consumer Discretionary (-1.0% MTD). Communication Services (+1.2% MTD) also relatively lagged behind other sectors. In contrast, defensive sectors such as Consumer Staples (+5.9% MTD), Healthcare (+5.1% MTD), and Utilities (+4.9% MTD), along with Real Estate (+5.8% MTD), outperformed as economic uncertainty persisted.

Throughout the month, disappointing U.S. economic data continued to emerge. The July ISM manufacturing index came in well below expectations (46.8 vs. 48.8), and the July jobs report showed the smallest payroll increase (144k) in over three years, further heightening recession fears. This prompted investors to step back from growth and cyclical sectors.

Source: Bloomberg

Source: Bloomberg

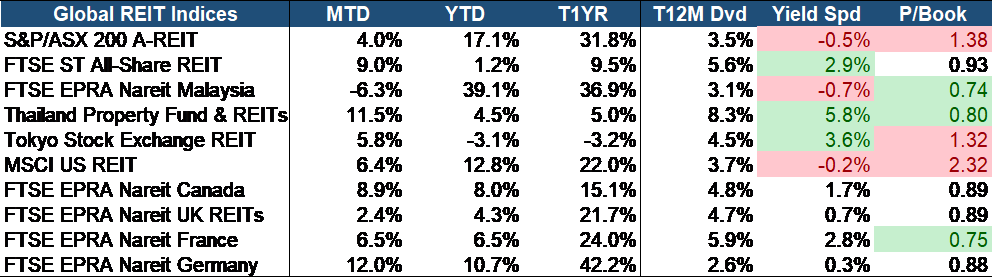

The global REIT markets saw positive stock performance across the board last month, with the exception of Malaysia (-6.3% MTD). Germany (+12.0% MTD) and Thailand (+11.5% MTD) recorded the strongest gains while Singapore REITs (SREITs, +9.0% MTD) also posted robust performance, supported by a highly attractive yield spread on a global scale, standing at 2.9%, just behind Thailand and Japan. The sector has rebounded as the market begins pricing in the upcoming interest rate cuts.

Central banks worldwide are set to initiate or continue interest rate cuts this fall, signaling the end of an era of historically high borrowing costs. In light of ongoing economic uncertainties, we continue to favor more operationally resilient and recession-proof subsectors such as Healthcare, Industrial, and Data Centre. We anticipate near-term (1-2 years) challenges as well as high borrowing costs and rising cap rates may still impact distributions as loan maturities approach.

Despite these near-term challenges, our medium-to-long-term outlook for the sector remains positive due to the high quality of the underlying assets, which provide a strong foundation for sustained performance. Additionally, SREITs are currently undervalued, with a Price-to-Book ratio of 0.93, below historical averages. This valuation gap, combined with the attractive yield, presents a potential opportunity for investors seeking value appreciation and income. The combination of high-quality assets, attractive yields, and undervalued valuations positions SREITs favorably in the current economic environment.

Equity Market Outlook:

Source: Bloomberg

Source: Bloomberg

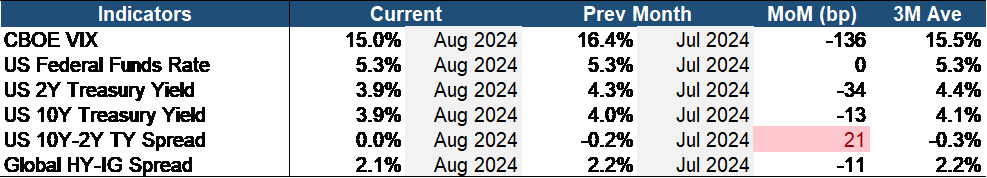

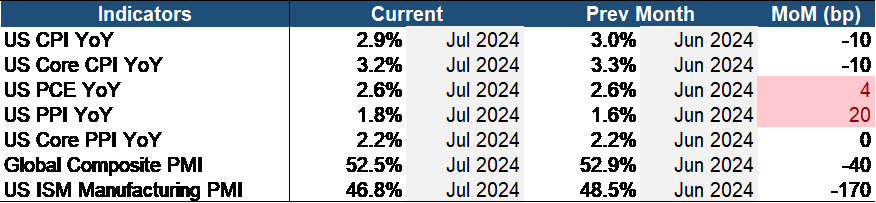

The stock market shifted towards a risk-on sentiment in August, with the VIX decreasing by 136 basis points month-over-month, dipping below its three-month average. The yield curve is finally emerging from its prolonged inversion, a state that has persisted since 2022, signaling growing optimism in response to the Fed’s easing of monetary policy. Despite this, investors remain cautious, as evidenced by the sharper decline in the 2-year Treasury yield compared to the 10-year yield. Additionally, the tightening of the credit spread between High Yield and investment-grade bonds reflects increased risk appetite in the corporate bond market.

Source: Bloomberg

The inflation data released in August presented a mixed picture. While both headline and core inflation year-over-year (YoY) continued to decline, the Personal Consumption Expenditures (PCE) index saw a slight increase. The ongoing rise in the headline Producer Price Index (PPI), despite stability in the core PPI, indicates persistent inflationary pressures, as PPI often serves as an early indicator of broader inflation trends.

Additionally, both U.S. and global composite PMIs contracted month-over-month, intensifying concerns that the recent rate cut may have been too late to prevent a rapidly cooling economy. This contraction, combined with weak job report data and an interest rate hike by the Bank of Japan, triggered a sharp sell-off across global equity markets. The resulting shift in market sentiment has seen investors move away from growth stocks and towards more stable, income-generating defensive sectors. This trend underscores rising apprehension over economic stability and growing fears of a potential recession.

On a positive note, 2Q24 earnings have been largely positive so far and the Fed has confirmed its intention to gradually reduce its benchmark interest rate, which could provide long-term support for equities. This environment may attract investors’ attention to emerging market equities and give small-caps an opportunity to outperform.

However, we maintain a preference for a diversified sector exposure without discounting the large caps in the near term due to ongoing market uncertainty. Big techs, with their strong cash flow generation and substantial reserves, are well-positioned to withstand economic downturns. Their minimal reliance on external borrowing for growth further enhances their defensive appeal, particularly if interest rates remain elevated for an extended period. Additionally, tech stocks have historically performed well in low-interest-rate environments, which could be advantageous if the Fed begins to cut rates more aggressively. Moreover, we remain optimistic about AI’s potential to substantially boost productivity and support a favorable long-term outlook for large-cap tech stocks

China Market Update:

In August 2024, China’s equity market experienced notable volatility. Key indices, such as the Shanghai Composite and the Shenzhen Component, saw significant swings as investors reacted to mixed economic data and government policy announcements. The market fell over concerns of renewed trade war between the US and China. China also criticized the tighter controls imposed by the USA which are hindering the normal exchange of goods.

Economic indicators revealed a slowing growth rate, which raised concerns about the sustainability of recent recovery trends. Additionally, uncertainties related to the property sector and its impact on broader economic stability were prevalent. The People’s Bank of China’s monetary policy decisions also influenced market sentiment, with investors closely watching for signals on interest rate adjustments and liquidity measures.

Monthly Economic Indicators:

- The Purchasing Managers’ Index (PMI) data for both manufacturing and services showed weaker-than-expected results. The manufacturing PMI indicated a slowdown in industrial activity, while the services PMI suggested moderated growth in the services sector.

- Retail sales growth was weaker than anticipated, reflecting slower consumer spending and potential impacts from ongoing economic uncertainties.

- Data on industrial production revealed a slower growth rate, contributing to concerns about the strength of the industrial sector and overall economic momentum.

- The trade balance data showed fluctuations, with changes in export and import levels influencing market expectations regarding China’s external economic interactions.

- The factory activity contracted for a fourth straight month in August according to the official poll of manufacturers.

UBS Investment Bank cut its 2024 GDP growth forecast for China to 4.6% from 4.9% as it expects weaker property activity to have a bigger drag on the overall economy than previously assumed. It has also cut its 2025 GDP growth forecast to 4% from 4.6% China Vanke Co. (One of the nation’s biggest developers) reported a half-year loss for the first time in twenty years. The other growth engines are showing signs of revival while the property market is dragging the economy. The Chinese government and the People’s Bank of China took steps to address the economic slowdown, including potential fiscal stimulus measures and monetary policy adjustments. However, the effectiveness of these measures was closely watched by the market.

Overall, while some sectors showed resilience, particularly technology and green energy, others, including traditional manufacturing and real estate, faced headwinds. Market participants remained cautious, balancing optimism about potential policy support with concerns about the broader economic environment.

Fixed Income Update:

Source: Bloomberg

Source: Bloomberg

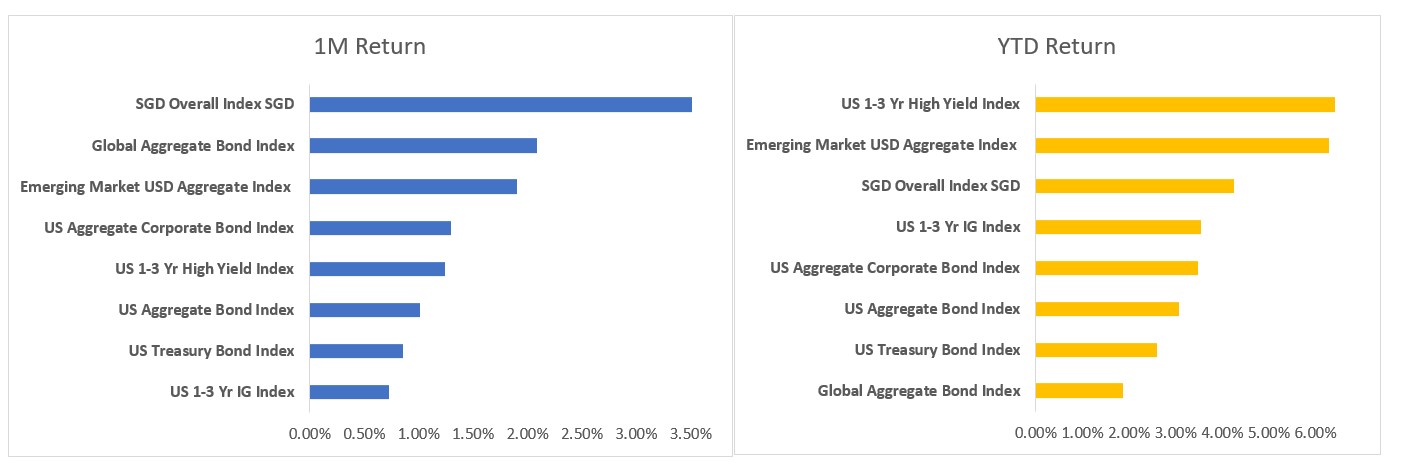

Bond markets continued their stellar run in August with strong price gains on the month across the board for all the major indices tracked above. This is the fourth straight month going back to May where all the major bond indices above have registered back-to-back positive monthly gains.

The catalyst for this summer rally in the bond market was the sharp drop in the benchmark US 10-year treasury yield which was down almost 80bps from a high of 4.7% in late April to where it now stands at 3.9% as of end August. At the Jackson Hole Symposium on Aug 23rd, FED chair Jerome Powell stated that “The time [had] come for policy to adjust,” reaffirming the market’s expectations for rate cuts in September. The 10Y yield plunged almost 30bps on the back of his comments, resulting in the biggest monthly drop in bond yields this year as the market began pricing in a more aggressive FED rate cut trajectory leading into year-end than earlier anticipated.

Interestingly, we also note some outperformance in indices tracking bonds outside the US in August led by the SGD overall index which was up 3.6% on the month. The Global Aggregate Bond Index and Emerging Market Aggregate Index also advanced 2.1% and 1.9% respectively over the same period. The reason for this outperformance in foreign bond indices may be attributable to weakness in the USD with the dollar index following US treasury bond yields down over the past few months. SGD especially performed well against the greenback in the month of August appreciating about 1.5% in relative terms which contributed positively to returns.

Bond Markets at a Critical Juncture after Breathless Summer Rally

Following the impressive price gains recorded by global bond markets all throughout summer, question marks are now being raised about the sustainability of this rally going forward. Though inflation has been on a steady glide path down in the recent months, core inflation still remains sticky and some analysts are warning that risks are skewed towards inflation coming in higher than expected in the coming quarters which could send bond yields surging again.

There are other tailwinds that could send bond yields higher. Recent US macroeconomic data has been surprising to the upside with US Q2 2024 GDP growing at a healthy 3% annual pace while corporate profits and consumer spending also showed signs of resilience. The US labor market while slowing, appears to be doing so in a more gradual fashion than was feared at the start of August when the unemployment rate ticked up to 4.3%. This keeps the soft-landing narrative solidly in play which means that the FED may opt for a 25bps cut in September rather than 50bps which would force traders to pare back the aggressiveness of the rate cut trajectory heading into year end.

We are also steadily approaching the November US elections and regardless of which candidate ends up triumphant, both have indicated being in favor of high fiscal spending and a weaker US dollar which will put upward pressure on inflation. With all the aforementioned factors, it is likely that the huge gains in the bond market may lose some steam in the coming months.

PBOC Commences Government Bond Trading

In an interesting recent development, the People’s Bank of China (PBOC) has intervened in the government bond market and is buying and performing open market operations to ensure the orderly functioning of local markets and temper a government bond buying frenzy.

With domestic equities stuttering and the real estate market flat on its back, local government bonds which are perceived to be a safe, risk-free asset have seen strong appetite. According to a report by Nikkei Asia, China’s top insurance companies have been loading up on long-dated bonds to the tune of RMB 1.2T ($169B) in the first of the year alone. This poses a dilemma for the PBOC that is concerned that excessive demand for government bonds could cause long-term interest rates to fall sharply giving the impression of poor economic growth and even affecting the profitability of Chinese banks.

To counteract this situation, the PBOC has been actively selling long-dated bonds into the secondary market with the hopes of keeping yields from continuing their plunge downwards. China’s 10-year government yield was last seen trading at around 2.17%, down around 40 basis points this year.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.