Market Commentary – September 2024

Equity Market Update:

Source: Bloomberg

Source: Bloomberg

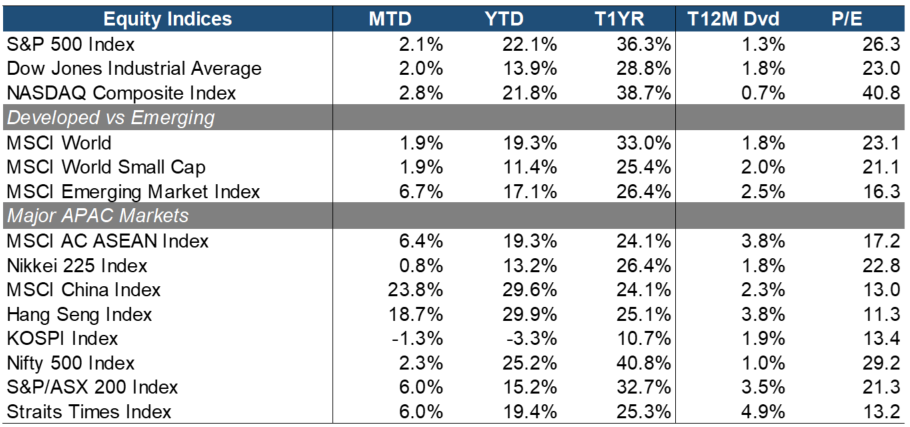

In September, global equity markets continued their positive trajectory. The S&P 500 gained 2.1% month-to-date (MTD), driven by strong corporate earnings and expectations of rate cuts. Growth trumps value as the NASDAQ Composite (+2.8% MTD) posted stronger performance over the Dow Jones Industrial Average (+2.0% MTD).

Developed markets performed solidly, with the MSCI World Index rising 1.9% MTD, although emerging markets were outpacing with a gain of 6.7% MTD. Small-caps (+1.9% MTD) also rose similarly to large-caps, reflecting equity investors’ caution amidst mixed economic signals.

Across the Asia-Pacific region, ASEAN markets surged (+6.4% MTD), led by strong performances from Singapore (+6.0% MTD) and Australia (+6.0% MTD). China rebounded significantly (+23.8% MTD), reflecting optimism over renewed top-down policy support. In contrast, South Korea (-1.3% MTD) and Japan (+0.8% MTD) lagged behind, impacted by weaker economic data.

Source: Bloomberg

Source: Bloomberg

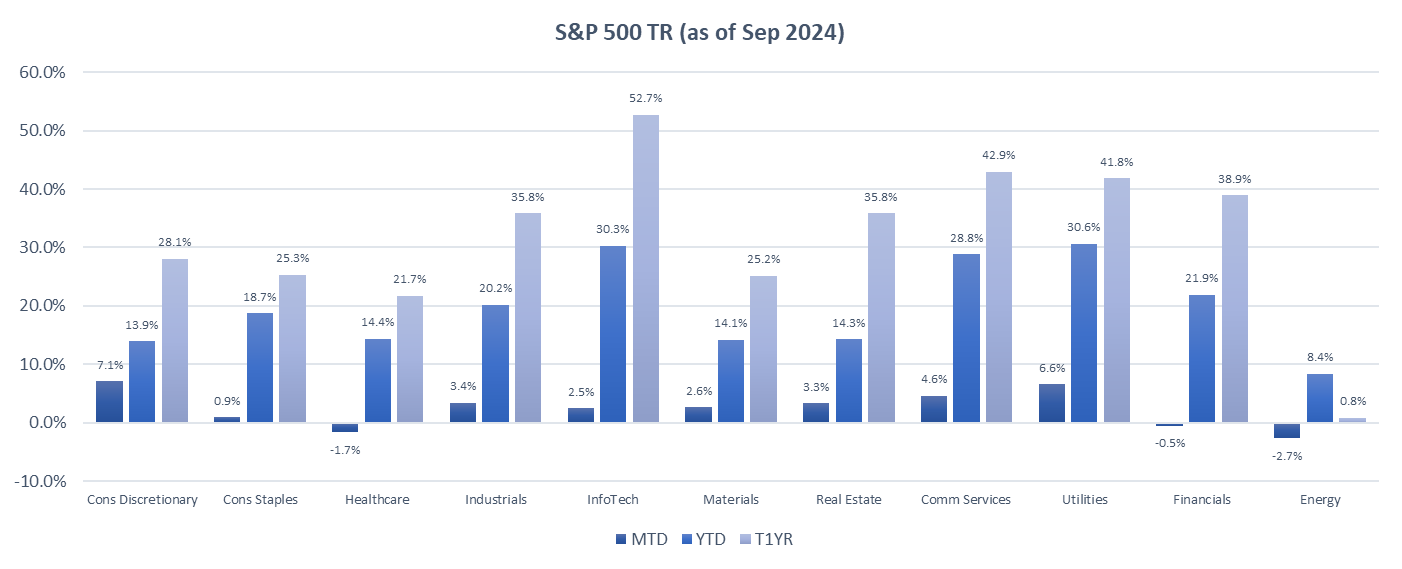

The S&P 500 sectors generally exhibited positive performance, with the exceptions of Energy (-2.7% MTD, +8.4% YTD), Healthcare (-1.7% MTD, +14.4% YTD), and Financials (-0.5% MTD, +21.9% YTD). Energy stocks was particularly impacted by subdued global demand and declining oil prices which have been falling consistently since April.

In contrast, Consumer Discretionary (+7.1% MTD, +13.9% YTD) led all sectors for the month, supported by resilient consumer spending and strong earnings from key industry players. Communication Services (+4.6% MTD, +28.8% YTD) and Utilities (+6.6% MTD, +30.6% YTD) also performed relatively the best, reflecting the continued investor interest in a balanced growth and defensive plays.

Source: Bloomberg

Source: Bloomberg

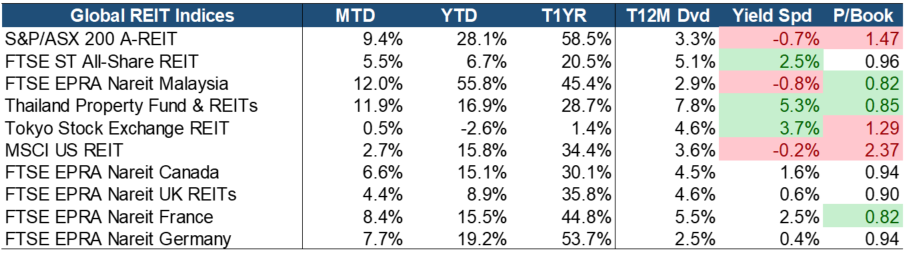

REIT markets globally have maintained their momentum in September, supported by declining interest rate expectations and increasing demand from income-focused investors seeking yield. Singapore REITs advanced by 5.5% MTD, while Australian REITs led with a robust 9.4% MTD rise. Germany (+12.0% MTD) and Thailand (+11.9% MTD) were the top performers globally. Japan (+0.5% MTD) and U.S. (+2.7% MTD) REITs relatively underperformed in comparison.

Central banks worldwide are preparing to initiate or continue interest rate cuts, marking the end of an era of historically high borrowing costs. In light of ongoing economic uncertainties, we maintain a preference for operationally resilient and recession-proof subsectors such as Healthcare, Industrial, and Data Centers. These sectors are better positioned to weather near-term challenges, including high borrowing costs and rising cap rates, which may impact distributions as loan maturities approach.

Despite these headwinds, our medium-to-long-term outlook for the sector remains positive. The high quality of underlying assets provides a strong foundation for sustained performance. Additionally, SREITs remain particularly attractive, supported by a globally competitive yield spread of 2.9%, second only to Thailand and Japan. With high-quality assets and fair valuations, currently trading at a Price-to-Book ratio of 0.96, SREITs present a compelling investment opportunity for those seeking both value appreciation and stable income in the current market environment.

Equity Market Sentiment and Outlook:

Source: Bloomberg

Source: Bloomberg

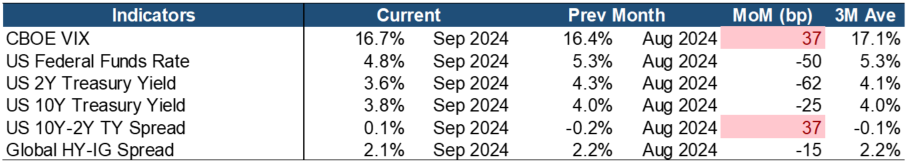

The stock market moved towards a more risk-off sentiment, with the VIX rising by 37 basis points month-over-month, approaching its three-month average. The yield curve has finally reversed its prolonged inversion, which had persisted since 2022, indicating growing optimism in response to the Federal Reserve’s monetary policy easing. This is further highlighted by the steeper decline in the 2-year Treasury yield compared to the 10-year. Moreover, the narrowing of the credit spread points to an increased risk appetite in the corporate bond market.

Source: Bloomberg

Source: Bloomberg

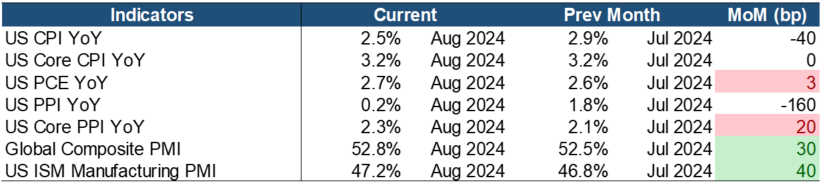

The current economic landscape presents both positive and concerning signals. On the positive side, the ISM Manufacturing PMI inched up to 47.2 in August, still in contraction territory (below 50) but showing signs of stabilization in industrial activity. Additionally, inflationary pressures have broadly eased, with the U.S. Consumer Price Index (CPI) falling to 2.5% YoY, suggesting that price stability could be within reach.

However, core inflation remains stubborn at 3.2% year-over-year, raising concerns about underlying inflationary pressures that are not entirely behind us and may prompt the Federal Reserve to adopt a more cautious approach. Furthermore, the Personal Consumption Expenditures (PCE) index, a key measure for the Fed, rose slightly by 3 basis points, alongside increases in both headline and core Producer Price Index (PPI), which often serve as leading indicators of future inflation.

On a brighter note, both U.S. and global composite PMIs showed slight expansions, demonstrating economic resilience despite the broader slowdown. Corporate earnings also remain strong, with 75% of S&P 500 companies surpassing earnings estimates in 2Q2024 – above the average of the last four quarters. However, sectors like industrials, materials, and real estate underperformed, likely due to their sensitivity to interest rate fluctuations and economic cycles. Given the current economic environment, the Fed’s cautious stance on rate cuts may shape market dynamics for the foreseeable future. Nonetheless, the Fed’s reaffirmation of its intention to gradually reduce benchmark interest rates is positive for equities, particularly in the long run.

In this context, investor attention may increasingly shift toward emerging market equities and small-cap stocks, which could offer opportunities for outperformance. However, given the prevailing market uncertainties, a diversified sector allocation remains prudent. Large-cap stocks, particularly in the technology sector, continue to stand out as a favorable option. These companies’ strong cash flows, substantial reserves, and limited dependence on external borrowing make them resilient to economic volatility and higher interest rates.

Large-cap tech stocks remain attractive investment opportunities, especially given their strong track record in low-interest-rate environments. Their blend of growth potential and defensive characteristics offers a balanced approach for investors facing uncertain macroeconomic conditions. Therefore, maintaining exposure to large-cap stocks, particularly in the tech sector, is a strategic choice, while also diversifying portfolios with allocations to small-cap and emerging market equities.

China Market Update:

The Chinese Bazooka

The People’s Bank of China took consolidation action on three fronts – problem of monetary contraction, housing meltdown and slump in equity markets.

Monetary Easing

- The reserve requirement ratio (RRR) was cut by 50 basis points releasing RMB1 trillion (US$143 billion) in liquidity. More RRR cuts are possible, if needed.

- The short-term repo rate was cut by 20 basis points, with a further reduction of 25-50 basis points possible before year-end.

- An injection of core Tier-1 capital for state banks to provide more liquidity for lending.

Housing Market

- Aligning existing mortgage rates with those on new mortgages, effectively reducing the average mortgage rate by 50 basis points. This will help 50 million households, with an average saving of $428 per household annually from lower mortgage costs.

- A further reduction in the down payment ratio to 15% from 25%, regardless of how many homes are purchased.

- The central bank will provide 100% financing for local governments to buy unsold homes. The financial support for property developers will be extended to 2026 to help property developers speed up home delivery.

Equity Market

- The PBOC now allows non-banking financial institutions to use “swap facilities” to obtain liquidity by using their equity holdings as collateral.

- A special loan facility will be established to help and support stock buybacks. The pool of money is small, starting at $42 billion, but more funding will be provided if the program works well.

- A stabilization fund will be established to steady the stock market, whenever necessary.

Implications – What is different?

This is the first time that China has made consolidated action instead of piecemeal actions until now. These actions and announcements were poorly received by the markets. This time monetary stimulus package is more aggressive and comprehensive than all previous reflation efforts. Central bank governor Pan Gongsheng sounded more determined than ever to steady the economy. The central bank announced immediately follow up by a Politburo meeting in which President XI reaffirmed his commitment to use “active” fiscal and monetary policies to stabilize the housing market and the economy.

This time, Chinese market responded with big rally. The reason for the big bang policy actions were uncertain global environment with US changing governments and Fed cut rates which reduced fears of sharp fall of CNY.

Outlook

MSCI Chinese equity Forward earnings have stopped falling due to profit recovery and share buybacks. The forward PE is 8-9x. This shows that a lot of bad news has been discounted by the Chinese equity market. Chinese equities are offering a value buy opportunity even after the recent run up.

Fixed Income Update:

Source: Bloomberg

Source: Bloomberg

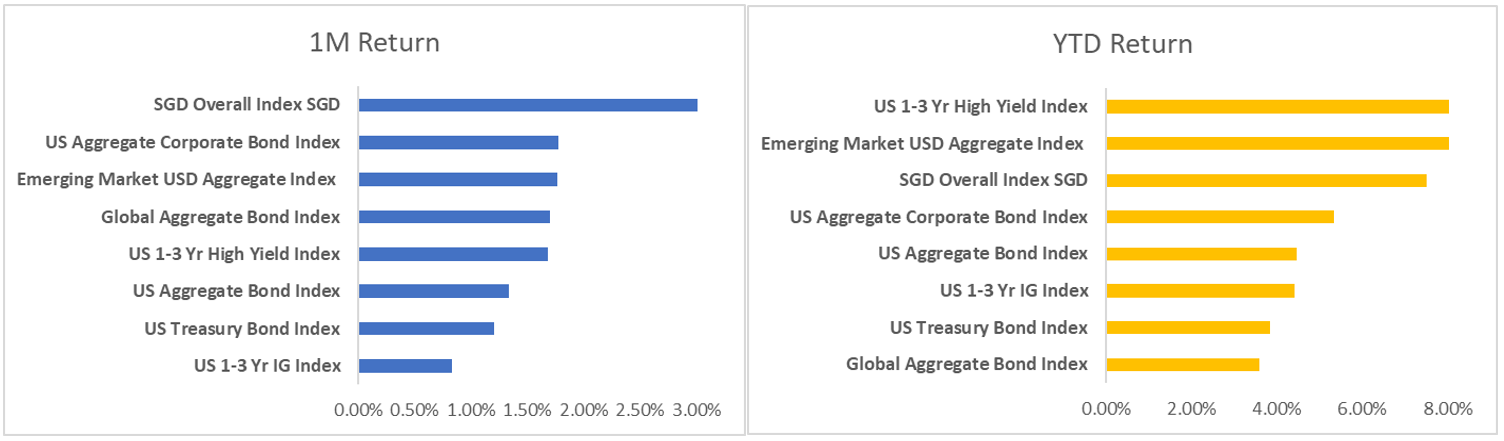

It was another September to remember for the bond markets with strong gains recorded across the board, further building on the strong YTD returns registered by all the indices being tracked. We also note that this is the fifth straight month going back to May where all the major bond indices above have registered back to back positive monthly gains.

Indices tracking bonds outside the US continued to outperform their US peers in September due to sustained weakness in the USD. The SGD overall index was up by 3.13% in September as the Singapore dollar appreciated 1.5% against the greenback over the same period contributing to the strong returns of this index in USD terms. The emerging market aggregate index also advanced 1.76%. Interestingly, US corporate bonds also performed well in September, likely bolstered by a resilient US economy while longer term inflation expectations remain well-anchored.

Going forward, we do expect the US dollar to find some strong support at these levels. FED Chair Jerome Powell in a speech on Sep 30 2024 pushed back against aggressive market pricing on more supersized interest rate cuts which could cause the US dollar to gain against other major currencies in October and result in market dominance to switch back to US based bond indices again.

Are we in a ‘golden era’ for fixed income?

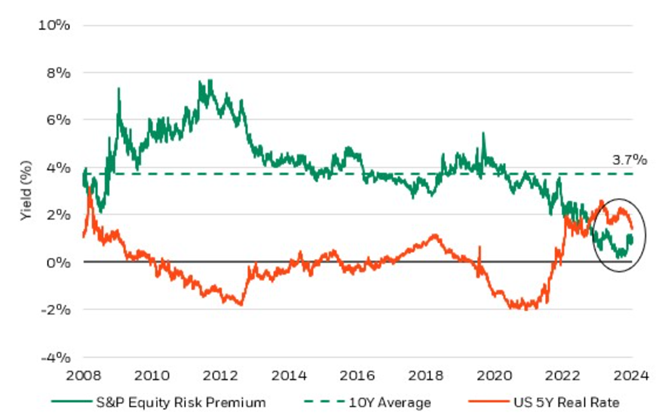

2024 has been a rip-roaring year for equities thus far. The stock market had already been building up a head of steam in anticipation of interest rate cuts and following the 50bps rate cut from the FED in September, the S&P 500 closed at an all-time high of 5745.37 on Sep 26 2024. This has however prompted some such as Rick Rieder, CIO of fixed income at Blackrock to say that we could be in a golden age for bonds instead. With stocks trading close to record territory, he is of the opinion that fixed income is an attractive option for investors as real rates in the belly of the curve now exceed the S&P 500 equity risk premium which is the compensation investors get for buying stocks.

Source: Rick Rieder, Bloomberg – Data as of Sep 24 2024

Source: Rick Rieder, Bloomberg – Data as of Sep 24 2024

We share this sentiment here in the Singapore markets. With the STI also having rallied by about 10.6% YTD on a price return basis, valuations could be a bit stretched here in the short term, which make bonds an attractive option.

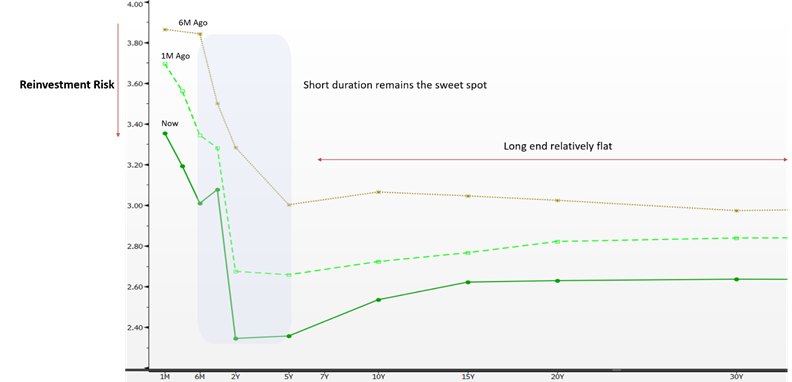

Source: Bloomberg – Data as of Sep 23 2024

Source: Bloomberg – Data as of Sep 23 2024

As seen in the graph above, the long end of the yield curve remains rather flat meaning investors are not being compensated adequately for taking on duration risk. At the same time, though the curve is inverted, going ultra-short could mean investors incur very high reinvestment risk when such front-end rates drop sharply in a relatively short period of time. This is where we find the belly of the SGS yield curve (1Y – 5Y maturities) to be the most attractive segment to mitigate both duration and reinvestment risks. We are hence of the opinion that in such an environment short duration bond funds could be a good addition to investors’ portfolios which will help them strike a good balance of achieving regular income while minimizing volatility from interest rate fluctuations.

China launches bazooka fiscal stimulus to revive ailing economy

In the face of faltering economic growth and rising deflationary pressures, the Chinese government has finally put aside their hesitation for bold economic stimulus packages and come out guns blazing with a fiscal and monetary “bazooka” that rivals that of the one fired in November 2008 during the global financial crisis. The scale of China’s massive stimulus effort has even prompted the likes of American hedge fund billionaire David Tepper to say that it’s a “buy everything” moment in China. The slew of measures includes cuts to mortgage rates and minimum down payments to support the property sector as well as cuts to the reserve requirement ratio and an issuance of RMB 1Tn in special sovereign bonds to stimulate consumption. A separate RMB 1Tn sovereign bond issuance is also being floated to help local governments with their mounting debt problems.

It may also be prudent to keep in mind other second order effects that could arise from China’s fiscal stimulus. A stimulus package of this size and scale coupled with a jumbo rate cut from the FED could put upward pressure on commodity prices and spark reinflation. This may result in the market having to pare back the aggressiveness of rate cut bets which could cause bond yields especially on the long end to surge again.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.