Japan’s fisheries under pressure: Fukushima wastewater release

- Hong Kong has banned seafood imports from 10 Japanese prefectures after the Aug 2023 release of treated Fukushima nuclear wastewater

- As businesses seek seafood in alternative locations near Japan and beyond, this may strain already vulnerable ecosystems facing overfishing

Source: International Atomic Energy Agency (IAEA) Imagebank

Did you know: sushi’s original purpose was to preserve fish which was stored in fermented rice for months! Today, you might be more familiar with the version of sushi that pairs vinegared rice with raw fish. Unfortunately, this beloved dish is facing pressure from declining seafood supply, wastewater pollution, and resultant seafood import bans.

In March 2011, three nuclear reactors experienced a meltdown after a magnitude 9.0 earthquake damaged a nuclear power plant in Fukushima, Japan. Seawater was pumped into the reactor cores to cool them down. In 2023, Japan released treated nuclear wastewater into the ocean from the Fukushima plant through a pipeline 1km away from the coast. The wastewater discharge sparked concerns over lingering amounts of tritium (a radioactive form of hydrogen). With mounting pressure on planetary resources, we need to look at issues beyond climate, like pollution and biodiversity loss.

Source: National Oceanic and Atmospheric Administration (NOAA), Pixabay, Ocean Era

A decline in Japan’s seafood exports

China (25% of exports) and Hong Kong (15% of exports) are the two biggest markets for Japanese seafood. Soon after the wastewater release in August 2023, China put in place a blanket ban while Hong Kong banned seafood imports from 10 Japanese prefectures, including Tokyo and Fukushima. With the affected prefectures estimated to provide about 15% of the total amount of imported aquatic products from Japan, the country’s fisheries have taken a hit.

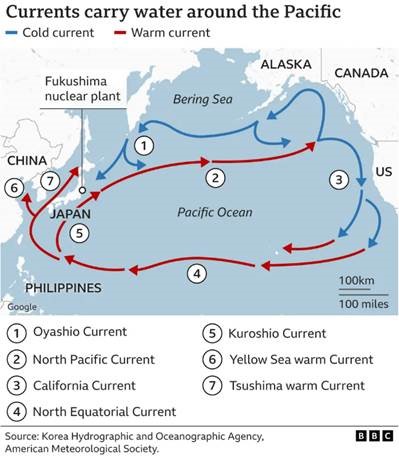

Consumer confidence in the safety of Japanese seafood dipped after the nuclear wastewater release, posing reputational risks to businesses that import seafood from Japan, even from regions unaffected by the ban. Wastewater could be dispersed by ocean currents and reach other regions. For instance, the Hokkaido fishing grounds in the North Pacific Ocean are a major source of popular fish such as salmon and pollock. The Yellow Sea region, which serves as important breeding grounds for shellfish, oysters and seaweed, is expected to be affected by the wastewater release as well.

The dampened demand coincides with a steady decline in Japan’s catch over the last decade, which tumbled to a 2022 record low of 3.85 million tonnes (7.5% decline from the year before). In response to climate change, prized catches such as Pacific saury and flying squid are moving further away from coasts into cooler waters. Consumers and restaurants face soaring seafood prices – the price of fish rose by 13.2% in Japan from 2022 to 2023.

Looking forward

This is the first release of wastewater from the Fukushima plant, a process that is estimated to take at least 30 years. While China has agreed to start relaxing its seafood ban, key exporters are still facing slowing demand. The crisis highlights the vulnerability of global supply chains to geopolitical and pollution risks. Under ESG Research Objective 1 (Managing ESG Risks), we support companies that mitigate risks affecting consumer well-being and satisfaction. For instance, the nuclear wastewater controversy may mean that the food industry must navigate greater consumer scrutiny, stricter food safety regulations, and higher compliance costs. To keep supply and consumer confidence up, restaurants and retailers may choose to source seafood from fisheries in unaffected regions or leverage radiation detection technologies that ensure food safety. Our environmental analysis helps to safeguard nature-dependent investments and lifestyles by supporting firms that identify and manage location-specific natural resource use.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.