Market Commentary – November 2024

CHINA MARKET UPDATE

Chinese equity markets saw a mixed performance as both the Shanghai and Shenzhen component experienced modest declines in November. The indices were down by roughly 2-3% during the month, with volatility remaining high due to concerns over global economic conditions and China’s domestic challenges.

China’s GDP growth continued to grow at slower pace of 4%-4.5%, slowdown driven by weak domestic, challenges in the property market and subdued manufacturing activity. Market experts expect 1.1% 4Q/4Q growth in 2025. Potential tariffs on its exports weigh on China’s growth. They see China growth slowing further to 3.2% in 2025. The PBOC reduced its one-year loan prime rate (LPR) by 10 basis points, signaling ongoing efforts to support the economy amid stagnating growth. On the fiscal side, local governments were directed to increase infrastructure spending, with a focus on transportation, green energy projects, and high-tech industries. While these measures were aimed at boosting short-term growth, there were concerns about the longer-term effectiveness of stimulus programs in driving sustainable recovery.

Consumer spending showed signs of recovery, though at a slower pace than expected. Data for Singles’ Day (11.11) sales in November revealed strong performance in online retail, particularly for high-end products and e-commerce platforms like Alibaba and JD.com. However, while premium goods and tech gadgets performed well, more affordable consumer goods still faced slower sales, reflecting the ongoing concerns around household income and job security. The government rolled out further measures to support consumer spending, including tax cuts and subsidies for specific goods, but overall, consumption remained cautious as families prioritized savings.

However, geopolitical tensions and currency depreciation risks continue to weigh on the market. The US dollar and Chinese yuan exchange rate has faced pressure could influence trade and investment dynamics.

The government announced additional support for the domestic semiconductor industry, including tax incentives and subsidies for local chip manufacturers. This was seen as part of China’s broader strategy to reduce reliance on foreign technology and build a more resilient supply chain. The government’s push for green energy also intensified, with new policies aimed at accelerating the adoption of electric vehicles (EVs) and increasing investments in solar and wind power. This came amid global calls for greater climate action and China’s pledge to peak carbon emissions by 2030 and achieve carbon neutrality by 2060. The government announced a new set of guidelines to reduce coal dependence and accelerate the deployment of renewable energy. Efforts to promote electric vehicles (EVs) were also ramped up, with new incentives and investments in EV infrastructure such as charging stations.

China made progress in regional trade agreements, particularly with the Regional Comprehensive Economic Partnership (RCEP). The agreement, which includes China and other Asia-Pacific countries, continued to foster trade flows, especially in electronics, automotive parts, and agricultural products.

Investor sentiment for China has rebounded on expectations of supportive economic policies ahead of net week’s Central Economic Work Conference (CEWC). CEWC could introduce new fiscal and monetary measures which could have moderate impact. Proposed policies may focus on supply-side reforms rather than direct consumer stimulation as policy makers navigate a complex economic environment.

China’s A share market saw increased in trading activity and optimism. The optimism comes as China’s manufacturing sector shows signs of stabilization. The Purchasing Manager’s Index (PMI) for manufacturing edged to 50.3 in November, signaling expansion for the second straight month. This measure aimed at boosting infrastructure investment through concerns about weak consumer demand persist.

We remain optimistic about the Chinese market recovery. However, geopolitical tensions and currency depreciation risks continue to weigh on the market. The US dollar and Chinese yuan exchange rate has faced pressure could influence trade and investment dynamics.

FIXED INCOME UPDATE

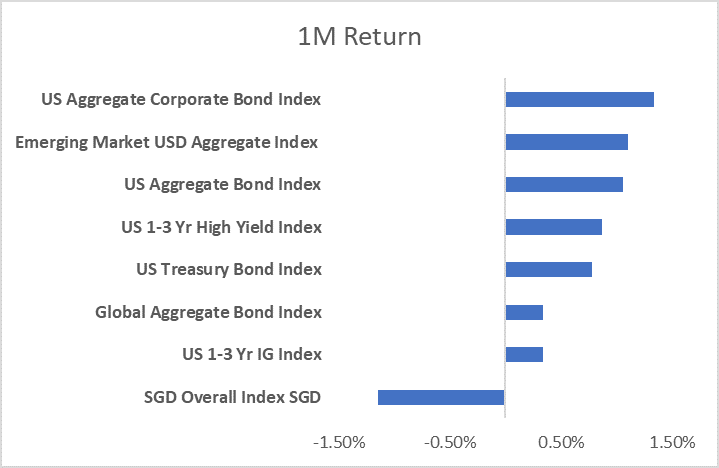

Source: Bloomberg; Returns are presented in USD terms

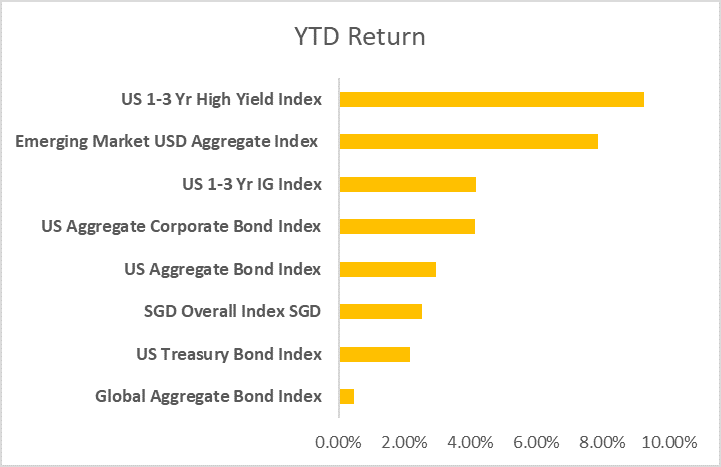

Source: Bloomberg; Returns are presented in USD terms

Most major bond market indices swung back into positive territory in November, following a sharp correction in October from rising bond yields. Gains were generally muted across the board with US corporate bonds leading the way up 1.34% in November while the SGD overall index was the laggard on the month when the returns were adjusted in USD terms. This is in line with the SGD depreciating 2% in November relative to the USD. On a YTD basis, short duration high yield bonds are the strongest performer up 9.23% with emerging market bonds coming in at a close second at 7.86%.

On the US macroeconomic front, the market is still pricing in another 25bps rate cut for December though the rate cut trajectory in 2025 is expected to be more gradual. This comes amidst the backdrop of a US economy that continues to be resilient with Q3 2024 real GDP growth coming in at 2.8% on an annualized basis. The US labour market also added 120000 jobs in October. Furthermore, many of President-elect Trump’s policies while being pro-growth are also expected to be inflationary. With headline CPI in the month of October already starting to tick up to 2.6% from 2.4% the previous month, the FED is likely to be vigilant about the risk of inflation expectations rising again and adopt a more cautious approach going forward.

French Debt Risk Premiums Surge Following Government Collapse

France has descended into political turmoil. As of this writing, the government of Prime Minister Michel Barnier is facing a no-confidence vote and is on the verge of collapse after Barnier invoked a constitutional mechanism to pass his 2025 budget without parliamentary approval. His budget proposal, which included around $60 billion in spending cuts and tax increases was largely opposed by Marine Le Pen’s National Rally along with a left-wing coalition which they believed would harm citizens already struggling with economic hardship.

Financial markets have reacted adversely to the government crisis and the instability has led to increased risk premiums on French government debt. The spread between French and German 10-year bond yields reached 74 basis points as investors sought the relative safety of German Bunds amid the uncertainty. Astonishingly for the first time, French 10-year bond yields even briefly surpassed those of Greece.

In the event of a collapse of the Barnier government, President Macron could appoint a new prime minister who might be able to garner enough support from the fragmented parliament which could temporarily stabilize the situation or aim to achieve some policy concessions to appease both the left- and right-wing factions. Alt If no viable solution is found, France could face prolonged political instability which could cause their bond spreads to widen even further.

Fears of Deflation Grip Chinese Bond Market

On November 29, 2024, the yield on China’s 30-year government bond fell below that of Japan’s 30-year bond for the first time. The rally in the Chinese 30-year bond yield which began in late 2020 has pushed bond yields down from 4% to its current level of about 2.2%. Conversely, Japan’s 30-year bond yield which for years has been stuck below 1% has gone the opposite direction and is now trading close to 2.3%.

This astonishing development in the bond markets of Asia’s two largest economies, reflects the differing economic trajectories of the two countries. China’s lower yields indicate persistent economic weakness and expectations of looser monetary policy, while Japan’s higher yields suggest rising inflation and the potential for policy normalization. In an even more ominous sign, some investors believe the macroeconomic environment conditions in China echo those of Japan in the 1990s when the collapse of the real estate market resulted in prolonged economic stagnation.

Chinese authorities on their part have been fighting back against the market’s perception that its economy is in the midst of “Japanification.” In addition to “bazooka” stimulus packages and direct interventions in the bond market, Beijing has also made huge investments in high-tech, green and EV sectors which is starting to pay dividends and could boost growth in the long-term. With domestic consumption also starting to show signs of recovery, the recent strong performance in online retail during the Singles’ Day (11.11) sales being one instance, there is hope yet that China could claw its way out of a deflationary spiral.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.