Market Commentary – October 2024

CHINA MARKET UPDATE

On the global front, Trump’s election victory, triggered the concerns of restarting the China Trade war. China has been preparing for it and strategy on how it will approach second Trump term. China recently announced $1.4tn package over five years to tackle local government hidden debt. The policies would reduce hidden debt from 14.3 trillion yuan to 2.3 trillion yuan by 2028. We expect an increase in the scale of fiscal support after Donald Trump won the presidential elections. But some analysts are still cautious that Beijing will remain conservative and not issue direct support to consumers.

Macro Data

Real GDP grew +4.6%YoY in 3Q 2024, as September activity staged a broad-based uptick. In contrast to softer export data, retail sales, Industrial Production (IP) and unemployment came in better than July/August figures, allaying fears of a downward spiral. The economy stayed in deflation as nominal GDP rose 4%. Consumer spending is showing signs of stabilizing after weakness in August. Sales of autos also turned positive for the first time in seven months, albeit by just +0.7% (vs YTD: -4.5%)

The unemployment rate fell to 5.1% in September (5.3% in August). The youth jobless rate has yet to be announced, but should likely taper from the 18.8% in August. To be sure, the official data regards having worked at least an hour a week as “employed”, so the overall figure may mask underemployment. Recent announcements of income support for underprivileged families will be key to a sustained recovery in consumption.

Before the authorities announced a barrage of favourable policies supporting the property sector, the downward momentum in the market remained a concern. September property sales plunged by -19.2%, a slight improvement from the -20.4% fall in August.

We are expecting the augmented fiscal deficit for FY2024 to be raised to 4.9% of GDP (from 4.3% previously), and for the FY2025 to exceed 5.0%. Besides the fiscal deficit, we expect the annual special central government bond and local government bond issuance quota to be raised from this year’s RMB 4.9trn to around RMB 10trn (7.4% of GDP) in FY2025.

Outlook

MSCI Chinese equity Forward earnings have stopped falling due to profit recovery and share buybacks. The forward PE is 8-9x. This shows that a lot of bad news has been discounted by the Chinese equity market. Chinese equities is offering a VALUE BUY OPPORTUNITY even after the recent run up.

FIXED INCOME UPDATE

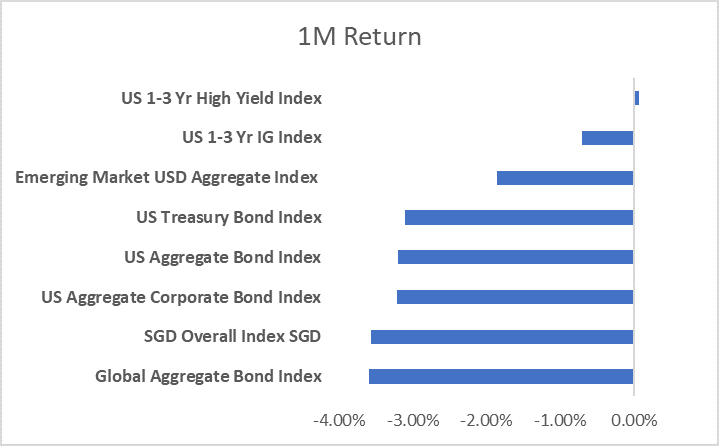

Source: Bloomberg; Returns are presented in USD terms

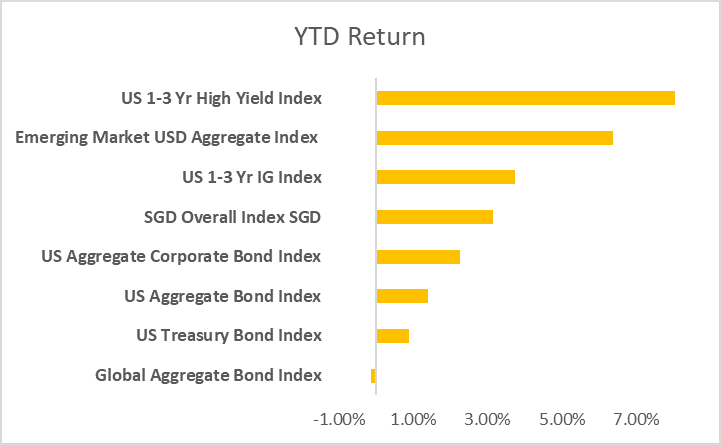

Source: Bloomberg; Returns are presented in USD terms

October proved to be a difficult month for fixed income markets with the bond indices down across the board except the US 1-3 Yr High Yield Index which was able to eke out a tiny gain of 0.06%. This weakness can be largely attributed to the sharp rise in long end bond yields with the US 10 Yr yield starting out the month at 3.7% and making a steep climb of almost 60bps before settling at about 4.3% towards the end of the month. A strong rally in the US dollar in October also meant a double whammy for bond market indices tracking bonds outside the US. The decline in October also sees a spectacular five-month rally in global bond markets come to an abrupt halt leading up to a pivotal US election on Nov 5.

FED cuts 25 bps on the back of Trump’s Historic Comeback Election Win

Though our commentary usually only covers the period up to the previous month, we felt that due to the significance of the US election on financial markets and how early on it was in the month of November that it would be included as part of October’s commentary to lend more relevance and timeliness to the report.

As of this writing on Nov 8 2024, Donald Trump has secured a decisive win in the 2024 US elections, edging out Kamala Harris in all six battleground states which could take him to 312 electoral college votes. Capital markets responded to the election victory with euphoria across the board with the DJIA surging by more than 1500 points on Nov 6 to a record close of 43729. The S&P 500 and Nasdaq both also registered strong gains of 2.53% and 2.95% respectively to close at record levels as well. Bitcoin prices also surged to a record high nearing USD 77000.

With Republicans set to take control of both the Senate and the House of Representatives, their pro-growth policies such as corporate tax cuts and deregulation will likely be positive for the stock market. However, the risk of tariffs as well as widening fiscal deficits could also reignite inflation – the US 10-year yield was seen trading close to 4.5% on Wednesday’s session. We expect long-end rates to stay elevated in the medium term.

A Trump presidency is also likely to apply pressure on FED chairman Jerome Powell to maintain a looser monetary policy posture. On Nov 7, the FED cut interest rates by 25bps which was largely in line with market expectations a decision which we feel was designed to not make the FED appear overtly political. The market is pricing in a further 25bps rate cut in the Dec FOMC meeting though going forward we are of the opinion that the FED will have to adopt a more gradual easing trajectory in spite of Trump’s likely protestations in order not to pour gasoline on an already overheated US economy.

Spike in UK Gilt Yields Harkens Back to 2022 LDI Crisis

Following the budget announcement on Wed Oct 30 by the newly-appointed Chancellor of the Exchequer Rachel Reeves, UK 10-year gilt yields were seen spiking by almost 30 bps from around 4.2%, hitting a high of about 4.56% on Thursday afternoon, the highest point the UK 10-year gilt yield has hit since Aug 2023. This comes on the back of UK 10-year yields that had already been rallying in line with US 10 year yields since mid-September.

The reason for the spike on Oct 30 however has been attributed to bond vigilantes who were spooked by the Chancellor’s budget proposal that would see state spending increase by almost GBP 70Bn a year of which GBP 32Bn would have to be funded by extra borrowing. While a general semblance of calm has been seemingly restored to the UK gilt markets, the sharp spike on Oct 30 did conjure up memories of the 2022 gilt market meltdown precipitated by then Prime Minister Liz Truss’ mini-budget which also went on to wreak havoc across the UK pension system.

However, many market commentators have been quick to point out the differences between the two scenarios. The Liz Truss mini budget called for unfunded tax cuts in the midst of a post-pandemic inflationary crisis. With inflation in the UK currently on a downward trajectory and set to hover around 2%, this government may have a little more wiggle room on the fiscal front to play with. Having said that, the debt-fueled spending of the UK government is likely to keep inflation and borrowing costs higher in the coming years.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.