Market Commentary – December 2024

EQUITY MARKET UPDATE

Source: Bloomberg.

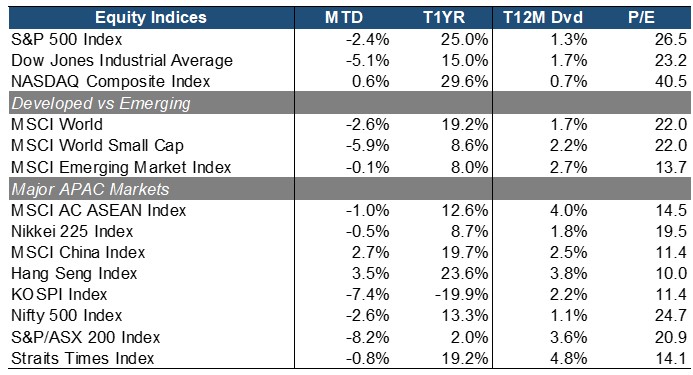

The equity market declined in December but capped off a strong overall performance for 2024. The S&P 500 fell 2.4% month-to-date (MTD) as investors likely locked in profits after a year in which the index gained an impressive 25%. Growth outperformed value, with the NASDAQ Composite (+0.6% MTD) showing resilience compared to the Dow Jones Industrial Average (-5.1% MTD). Growth stocks and Big Tech led the market in 2024 with an impressive 29.6% total return, bolstered by expectations of rate cuts, robust earnings, and surging investments in AI.

Developed markets posted strong aggregate returns, with the MSCI World Index up 19.2% for the year, far outpacing the MSCI Emerging Markets Index (+8% YTD). The rotation to small has yet to be realized as large caps (+19.2% YTD) continued to significantly outperform small caps, reflecting investor caution amid mixed economic signals that raised the likelihood of a pause in The Fed’s rate cuts.

Across the APAC region, ASEAN markets underperformed their Western counterparts. The region’s performance was lifted by strong gains in Hong Kong (+23.6% YTD), China (+19.7% YTD), and Singapore (+19.2% YTD) stocks. China has rebounded sharply in the second half of the year, supported by renewed optimism around top-down policy measures. Singapore’s stocks recorded their best year since 2017, driven by strength in the Financial sector, with the banks trio of DBS, OCBC and UOB contributing to more than half of the STI’s weighting and performance.

Conversely, South Korea (-19.9% YTD) was the region’s worst-performing market. Weakness in its semiconductor sector, compounded by a series of domestic political crises that include a failed attempt to impose martial law, has spurred concerns over prolonged political instability. This uncertainty weighed on investor sentiment and raised fears about its potential impact on Korea’s global credibility and economic prospects.

Source: Bloomberg.

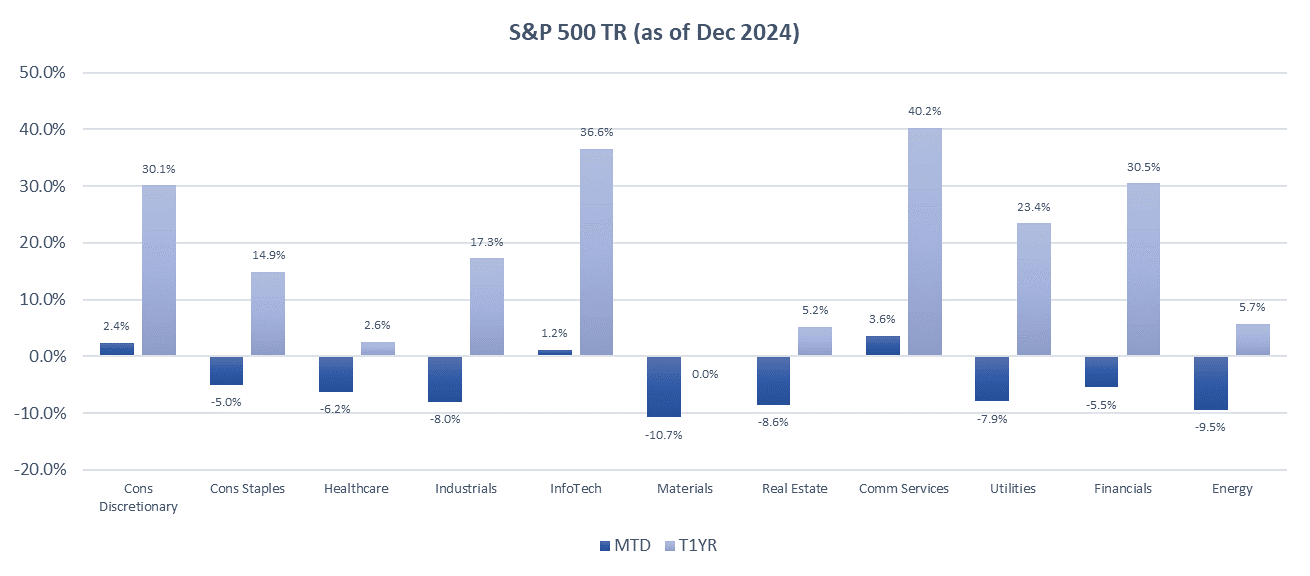

The S&P 500 sectors delivered mixed performance in 2024, with the top line being contributed by the growth sectors – i.e. Communication Services (+40.2% YTD) and InfoTech (+36.6% YTD), in addition to the Financials (+30.5% YTD). These sectors benefited from monetary policy easing, strong earnings from key players, and alignment with long-term growth drivers such as AI, semiconductors, and digital innovation. The key catalysts for Financials are also clear as well given the stronger-than-expected economic growth, expectations of deregulation under Trump, attractive valuations, and lower interest rates.

In contrast, Materials (+0% YTD), Healthcare (+2.6% YTD), and Real Estate (+5.2% YTD) were the worst-performing sectors. The global economic uncertainty dampened demand for commodities and materials, which typically struggle during economic slowdowns. Healthcare underperformed due to its defensive nature and heightened concerns about regulatory risks, including fears surrounding the potential appointment of vaccine skeptic Robert F. Kennedy Jr. as head of the Department of Health and Human Services, which weighed on insurers and pharmaceutical stocks. Real Estate lost momentum in December, surrendering most of its gains for the year, as concerns about a potential pause in rate cuts negatively impacted the sector.

Source: Bloomberg.

The global REIT markets faced significant pressure in December, surrendering most of their gains as the prospect of a higher-for-longer interest rate environment weighed on sentiment. Slower-than-expected rate cuts further dampened the outlook, leaving most REIT markets in negative territory for the year. Exceptions included the US (+8.8% YTD), Australia (+7.3% YTD), and Thailand (+7.4% YTD). Conversely, REITs in Japan (-14% YTD) and the UK (-13.5% YTD) were the worst performers, while Singapore REITs declined sharply by 9.5% MTD, reflecting investor concerns over rising borrowing costs and cap rate adjustments.

Despite near-term challenges such as high borrowing costs and cap rates, our medium-to-long-term outlook for the REIT sector remains positive, underpinned by the high quality of underlying assets. SREITs stand out with a globally competitive yield spread of 2.9%, third only to Thailand and Japan. Valuations are also very attractive relative to historical averages with the sector trading at a Price-to-Book ratio of 0.86. This presents a compelling opportunity for investors seeking value appreciation and stable income. We continue to favor operationally resilient and recession-proof subsectors such as Industrial and Data Centers, which are well-positioned to navigate economic uncertainties and support sustained performance. Singapore-focused Retail and Grade-A Office players are also poised to benefit from resilient domestic demand, limited new supply in the next 3-5 years, and potential upside from current valuation mispricing.

EQUITY INCOME UPDATE

Source: Bloomberg.

Source: Bloomberg.

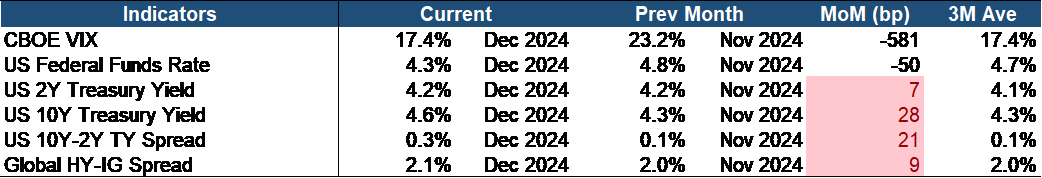

The stock market shifted toward a more risk-on sentiment, with the VIX declining by 581 basis points month-on-month, aligning with its three-month average. Meanwhile, the steeper rise in the 10-year Treasury yield compared to the 2-year reflects growing investor skepticism about the economy’s long-term growth prospects. Additionally, the slight widening of credit spreads signals a reduced risk appetite in the corporate bond market.

Source: Bloomberg.

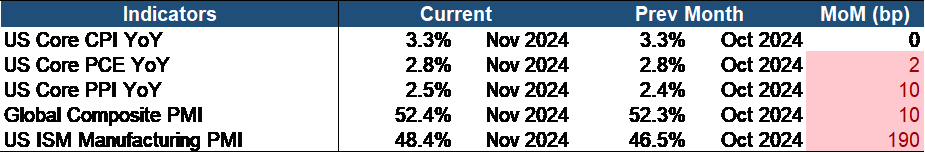

The current economic landscape is marked by concerning signals. The ISM Manufacturing PMI contracted sharply to 47.2 in August, indicating continued weakness in industrial activity. Inflation data also highlights persistent challenges, with increases in both Core CPI and PPI. The Personal Consumption Expenditures (PCE) index, a key metric for the Federal Reserve, has remained elevated at around 2.7% year-over-year for six consecutive months, well above the Fed’s 2% target.

Our outlook for the equity market in the coming year remains positive, as opportunities are expected to outweigh the risks. That said, it is important to recognize the challenges posed by a higher-for-longer interest rate environment, driven by persistent inflationary pressures and strong economic growth. US GDP growth stood at a solid 2.8% year-over-year by the third quarter of 2024, bolstered by strong consumer spending and income growth. Inflation risks could further intensify if President-elect Trump’s proposed tariffs are implemented, adding further upward pressure on prices. Furthermore, geopolitical instability remains another key risk, potentially triggering a flight to safety, though its impact will likely be region-specific and may even benefit certain equity sectors, such as Aerospace and Defense. Encouragingly, Trump has indicated a willingness to resolve ongoing conflicts, beginning with the war in Ukraine.

On the opportunity front, significant liquidity remains untapped, with approximately $7 trillion in money market funds poised to flow into equities. Corporate fundamentals also remain robust, as evidenced by strong third-quarter earnings reports – 75% of S&P 500 companies surpassed EPS expectations, while 61% exceeded revenue estimates. Markets broadening out and diversifying into the small-caps stocks is an inevitable trend as their earnings are expected to outpace large caps. Lower interest rates are set to reduce funding costs, enhancing the appeal of small caps by making long-term earnings trajectories more attractive. Furthermore, Trump’s pro-growth policies present additional opportunities; as small caps derive a smaller share of revenue from international markets compared to large caps, potential trade barriers could bolster their relative competitiveness.

However, it would be premature to discount Big Tech in this environment, given the persistent economic uncertainties that could shift market sentiment quickly. Big Techs continue to exhibit strong defensive qualities, supported by robust cash flow generation and substantial cash reserves, positioning them to navigate economic downturns effectively. Their minimal reliance on external borrowing further enhances their appeal, particularly in a prolonged high-interest-rate environment. Historically, Big Tech has also outperformed in low-interest-rate scenarios, which could prove advantageous when the Federal Reserve starts loosening its monetary policy aggressively. Moreover, as the largest investors in AI, these companies are set to reap early benefits from its transformative potential. The AI trade is broadening, with optimism growing around its ability to enhance productivity across early-adopting sectors. This transformation could lower unit labor costs and potentially reduce core inflation to levels below current market expectations. As AI’s impact on earnings is only beginning to materialize, we remain optimistic about its long-term ability to drive growth and reshape industries.

CHINA MARKET UPDATE

China’s gross domestic product (GDP) is expected to expand around 5 percent for the full year of 2024 contributing to 30% of global growth. The precise figure will not be available until February 2025. Initially, this 5% target was seen as a “target without a plan” but its outlooks improved as policymakers rolled out stimulus.

Mr. Xi commented that China’s economy was “overall stable and progressing amid stability” at a New Year’s event on Jan 1, according to a speech published by the official Xinhua news agency. Mr Xi signalled that support for the economy will continue into 2025 during the New Year’s Eve remarks to the nation’s top political advisory body, reiterating a call to adopt more proactive macroeconomic policies.

Officials at key meetings in December pledged to use greater public borrowing and spending as well as monetary easing to spur growth in 2025, in an unusually direct call that sought to boost confidence. They endorsed the first shift in monetary policy stance in 14 years to a “moderately loose” one.

But the economy is still weighed down by weak domestic demand and an uncertain outlook for exports, which have been a key growth driver in 2024. Deflation is likely to persist well into 2025, while the property market is still slumping.

In December, Beijing implemented further policy easing measures, such as lowering interest rates on mortgage loans and expanding subsidies for first-time buyers in lower-tier cities. Despite these efforts, the property market faces a long road to recovery, and there are concerns over the rising inventory of unsold homes.

The digital yuan (e-CNY) has seen broader adoption, with more pilot programs across Chinese cities. By December 2024, cross-border transactions using digital currency were being tested, a major step toward China’s goal of internationalizing the yuan.

Beijing’s initial stimulus in 2025 is expected to fall short of this kind of radical action. Market Analysts believe is required to stem the downward spiral in prices, but officials may step up support later when growth falters, just as they did in 2024.

FIXED INCOME UPDATE

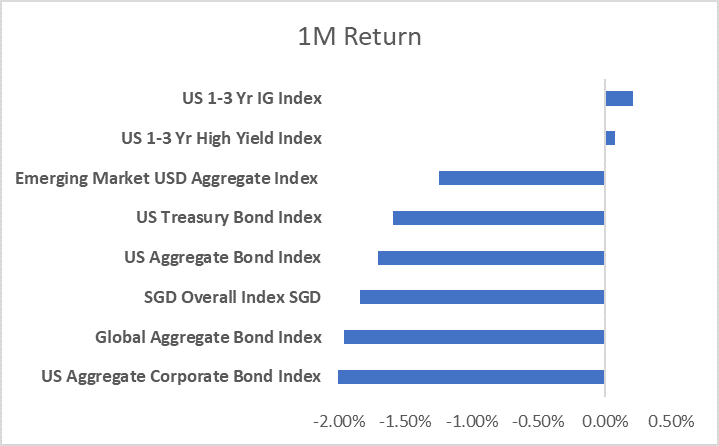

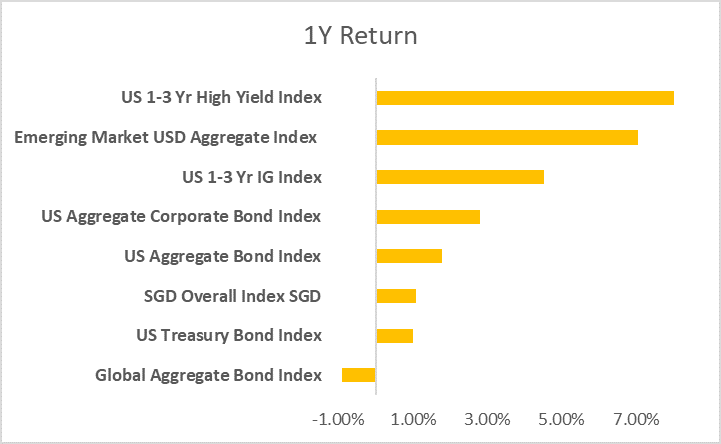

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

December 2024 saw significant turmoil in the bond markets with most of the major indices ending the month in the red. On Dec 18 2024, the FED cut its key interest rate by 25 bps, bringing it to a target range of 4.25%-4.5%, but also indicated that the pace of future rate cuts would be more gradual than previously anticipated. This readjustment in rate cut expectations clearly rattled the market and precipitated a further selloff in treasuries to cap off what has been a challenging and volatile year for bonds. The gulf in returns between fixed income and equities in 2024 was also notably wide, with the S&P 500 returning approximately 25% while US bonds as measured by the Bloomberg US Aggregate Bond Index had a more muted return of about 1.8%. The Bloomberg Global Aggregate Bond Index was also a major underperformer, returning -0.9% on an unhedged basis, though on a hedged basis, its return of 3.75% was slightly better.

2024 was a year typified by two contrasting extremes in the bond markets. The mid-year period saw strong rallies across major bond indices driven by falling inflation and hence optimism around the likelihood of an interest rate cut by the FED in September. However, towards the end of the year, bond markets sold off sharply as they adjusted to the new realities of potentially higher inflation and a slower pace of future rate cuts. The best-performing fixed-income sub-asset classes in 2024 were clearly high-yield and emerging market bonds which were the biggest beneficiaries of the risk-on sentiment especially in the middle of the year.

As we conclude the year, let us reflect on the performance of various fixed-income sub-asset classes in 2024 and explore the risks and opportunities that lie ahead in 2025.

“2024 Fixed Income Performance Review: High Yield and Emerging Market Bonds Shine Amid Market Volatility”

In 2024, the fixed-income market witnessed a wide range of performance across its sub-asset classes. While high-yield and emerging market bonds led the way with impressive returns, developed markets, and Singapore bonds struggled to keep pace.

Outperformers:

1. High Yield Bonds: These bonds had a strong performance in 2024, with returns of around 9.58% based on the Bloomberg US 1-3 Year High Yield Index. According to Bob Michele, global head of fixed income at JPMorgan Asset Management, the outperformance in high-yield bonds was driven by stronger corporate profitability and the soft economic landing that kept default rates low and recovery rates high. In fact, according to Northern Trust Asset Management, the proportion of BB and B-rated issuers relative to CCC-rated issuers was higher compared to its 20-year average which improved the overall credit quality of high-yield bonds and reduced the risk of defaults. Separately, bank AT1 debt was also another segment that performed well in 2024.

However, looking ahead to 2025, high-yield bonds could face challenges due to higher refinancing costs if interest rates remain elevated. Investors will need to pay closer attention to the balance sheet strength of issuing firms, focusing on metrics such as free cash flow and strong interest coverage ratios to ensure the creditworthiness of such firms. High yield spreads also remain at record tight levels which could prompt some investors to question the risk-reward of staying invested in this space especially if economic conditions were to deteriorate.

2. Emerging Market Bonds: Emerging market bonds had a solid year in 2024, benefiting from higher yields and strong economic growth in key markets with the Bloomberg Emerging Market USD Aggregate Index producing a respectable 7.0% annual return.

-

- India: These bonds performed well, driven by several factors. Significant foreign capital inflows resulted from the inclusion of Indian Government Bonds in the JPMorgan-Emerging Market Bond Index. However, risks in 2025 include potential foreign institutional investor (FII) outflows and further rupee depreciation. “For 2025, foreign inflows into the Indian government bond market are expected to remain strong but may not match the record levels of 2024,” remarked Wei Li from BNP Paribas SA.

- China: Chinese bonds also showed strong returns, influenced by aggressive monetary and fiscal easing measures implemented by the People’s Bank of China. The economic recovery theme and low inflation contributed to higher real yields, attracting investors. Looking ahead, China’s key risk for 2025 includes potential tariffs resulting from ongoing trade tensions.

Laggards:

- Developed Market Bonds: Developed market bonds produced a more modest return in 2024. While interest rate cuts by developed market central banks were generally expected to benefit bond prices by lowering yields, the situation in 2024 was somewhat unique. The cuts were largely driven by easing inflationary pressures, which should have been positive for bonds. However, the market’s reaction was influenced by other factors, such as concerns about future inflation and economic growth. This led to a rise in inflation expectations, which negatively impacted bond prices. The longer durations of developed market bonds also made them more sensitive to rate changes, leading to greater price declines. Other idiosyncratic developments such as the political crisis in France, UK’s mini-budget debacle as well as policy normalization in Japan adversely affected bonds prices in these countries.

- Singapore Bonds: These bonds underperformed slightly, with the iBoxx SGD Overall index returning about 4.2% in SGD terms but only about 1.1% in USD terms. The performance of Singapore bonds was affected by several local economic factors, including slower economic growth and market volatility. Additionally, the relatively lower yields compared to other regions made Singapore bonds less attractive to investors seeking higher returns. The Singapore bond market presents promising opportunities heading into 2025. One key factor is the government’s decision to raise the issuance limit for government securities to $1.5 trillion. This increase is expected to deepen the bond market, enhance liquidity, and attract a broader range of investors. Additionally, the Monetary Authority of Singapore (MAS) could potentially reduce the slope of the S$NEER policy band due to easing inflationary pressures. This adjustment can support economic growth and create a favourable environment for bond investments.

Looking ahead to 2025, investors should be aware of potential risks and opportunities in the fixed-income market. Economic conditions, interest rate changes, geopolitical tensions, and policy shifts will all play crucial roles in shaping the performance of these sub-asset classes.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.