A Water Stressed World

- Water scarcity is an escalating global risk, threatening industries and liveability.

- Companies that actively manage water use and pollution reduce operational risks and position themselves favourably for the long term.

The narrative of water scarcity is not a new one. We often hear, like a broken recorder, that only 0.5% of the Earth’s water is directly usable for human needs. Yet, the growing concern is not this widely known statistic but how that fraction is being reshaped by human activities. Global environmental challenges like novel entities entering our waterways alter both the quality and reliability of already scarce water supplies. The challenge then is no longer just about “how little” water we have, but about how volatile and contested the supply of water has become. Ultimately, without proper management, this instability in water resources caused by competing demand would hamper sustainable economic growth.

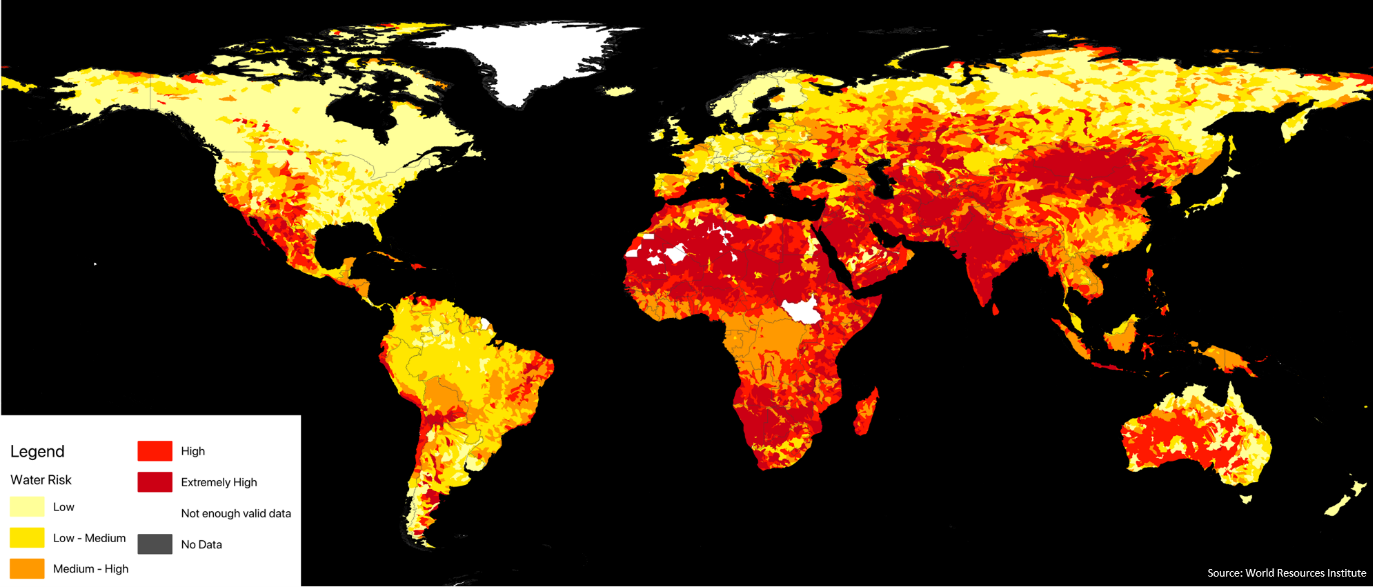

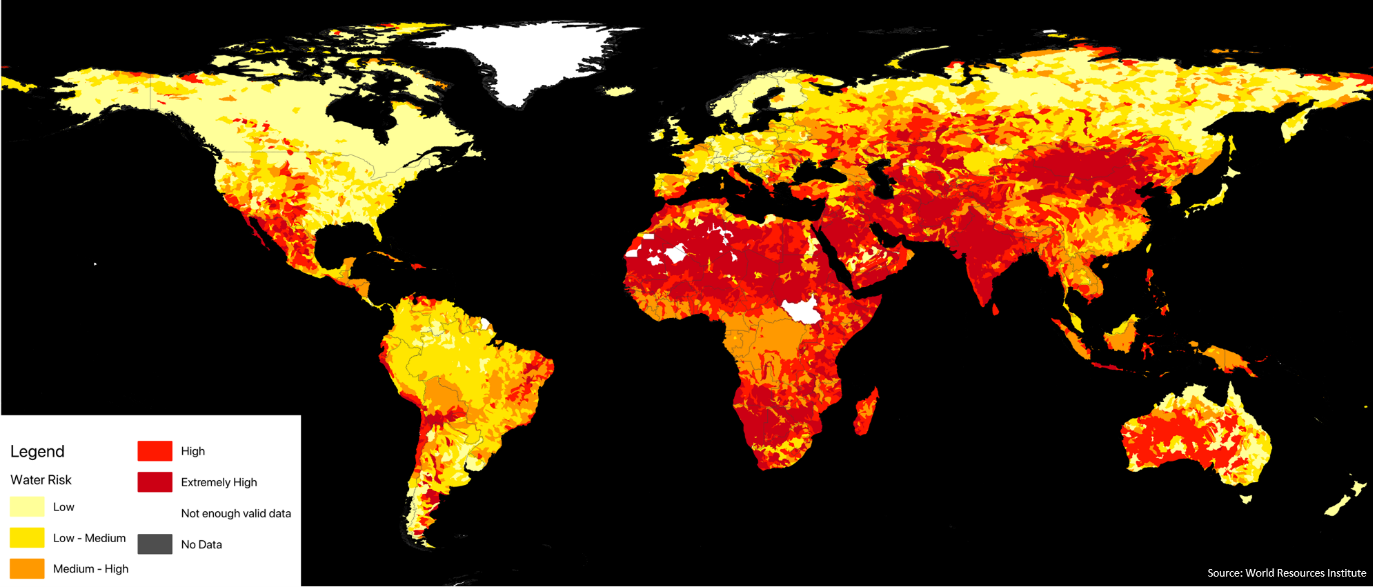

Fig.1: Water Risk around the World

Economic growth and population increase will continue to drive water demand. Global water consumption is projected to rise 20% to 25% by 2050, further intensifying water stress. WWF estimates that direct economic benefits from water use for households, irrigated agriculture, and industries amount to at least US$7.5 trillion annually. With mounting water stress, these benefits will become harder to sustain, leading to significant financial losses worldwide. Water risks are also unevenly distributed, with some regions facing far greater challenges than others. Striking a balance between industrial water use and human needs is essential to ensure that vulnerable communities are not marginalised in the pursuit of economic development.

Fig.2: Selected industries with high dependence on water

The agricultural sector, a primary sector of the economy, remains as one of the most water-intensive sectors and is highly vulnerable to water shortage. Crop yields depend heavily on stable irrigation and climate conditions. Poor harvests from water shortages or extreme weather reduce profits and increase food insecurity. In Japan, rice harvests have declined since 2023 due to rising temperatures and dry conditions, driving up prices and inflation. Closer to home, Malaysia and Indonesia rely heavily on agricultural exports, which also underpin Singapore’s food security. Recent El Niño and La Niña events have lowered palm oil and other crop yields, affecting stock prices and derivative markets. Water scarcity, therefore, extends beyond water itself, linking directly to food security and economic stability. Proper stewardship of this fundamental resource to many industries is not only important for the environment but also for capital markets.

Today, however, agriculture is no longer alone in its demand for water. The rise of Artificial Intelligence and digital infrastructure has introduced a new, fast-growing competitor: data centers. Water is a paramount resource in keeping them cool. Large data centers can “consume” up to 5 million gallons are water per day just for cooling purposes. To put this into perspective, 5 million gallons of water per day is equivalent to cultivating 6,000 to 10,000 kilograms of rice which is enough to feed tens of thousands of people for a day. While agriculture represents the traditional cornerstone of water dependence, AI-powered industries are quickly emerging as the new challengers for this scarce resource. As reliance on both sectors grows, so too does the urgency of effective water management.

In Singapore, we are fortunate to have four national taps: NEWater, desalination, reservoirs, and imported water, which ensure a reliable domestic water supply. However, as a highly globalised economy, our resilience cannot be viewed in isolation. With 14.3% of Singapore’s nominal GDP in 2024 contributed by the financial sector, global water scarcity poses a direct risk to our capital markets. Droughts and water stress abroad can disrupt agriculture, manufacturing, and technology supply chains, eroding company earnings, driving market volatility, and ultimately affecting investor confidence. This is why Singapore must not only secure its own water supply but also push for stronger water management standards across industries and geographies. Both government and companies have a stake in addressing water risks, because what happens to water security abroad can flow straight into our financial system at home.

As investors, we recognise water’s critical role in business continuity and resilience. We value companies that understand their water risks, actively manage them, and implement plans to operate within environmental limits. Those operating in high water stressed regions must demonstrate greater stewardship of this resource. By preventing waterways pollution, companies can manage their double materiality risks. We favour companies which set measurable targets to reduce both water consumption and pollution aligned to SDG Goal 6.3. By doing so, companies can sustainably manage their water resources and reduce substantial business costs.

The Blueprint

With the ever-changing landscape around us, it can get overwhelming to stay up-to-date. The Blueprint highlights pertinent global Environmental, Social, and Governance (ESG) issues and their importance to investors and the wider community. We look forward to engaging in discussions about the interconnections between climate, nature, and social outcomes that impact our investments and our futures.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.