The Threats of Floods

- Typhoon Ragasa’s devastation across Asia highlights how climate change is intensifying floods and exposing businesses to acute physical climate risks.

- In Singapore, rising sea levels and flash floods underscore the urgency of climate adaptation efforts such as Singapore’s Long Island Plan to protect homes, businesses and public spaces.

Imagine the Singapore River overflowing, flooding Clarke Quay and its surrounding areas. Such a sight was common until flood mitigation measures like the Stamford Diversion Canal and Stamford Detention Tank were constructed. Yet, floods remain a familiar experience for residents of Vietnam, the Philippines, Hong Kong, Taiwan, and the southern parts of China, where Typhoon Ragasa recently wreaked havoc. Although typhoons are a seasonal occurrence in these regions, their strength and frequency have significantly increased in recent years.

Typhoons form when warm sea waters provide the energy needed for their development. As sea surface temperatures rise due to anthropogenic activities, storms are becoming more powerful. These intensifying events remind us that what were once viewed as ‘acts of God’ are increasingly the consequences of human-driven climate change as we continue to operate beyond the planetary boundaries. The planetary boundary for climate change has already been significantly breached, and the removal of natural flood barriers such as mangroves and coral reefs further weakens the ecosystem service of coastal protection. As a result, coastal cities worldwide are becoming increasingly vulnerable to flooding and storm damage.

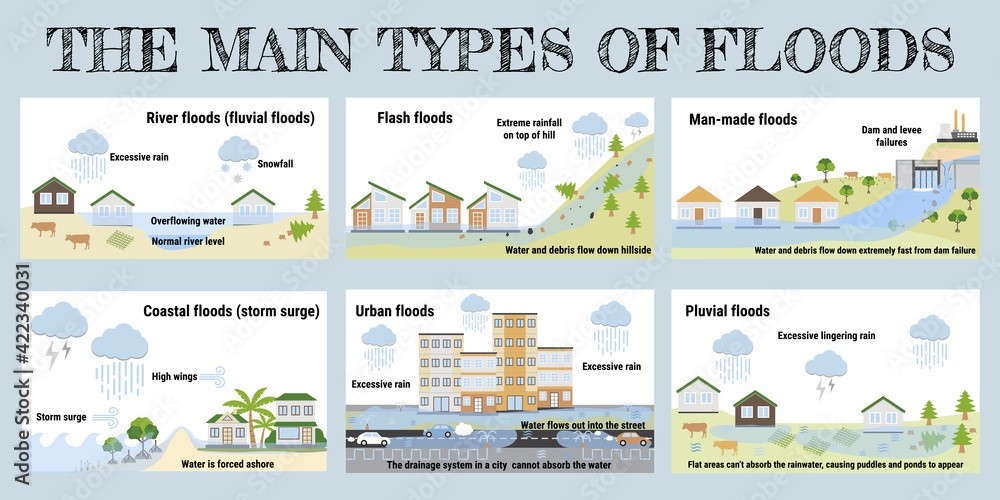

Fig.1: Various flood types. Source: Canda WaterPortal

Floods can be broadly categorized into several types: fluvial floods, flash floods, man-made floods, coastal floods, urban floods and pluvial floods, each arising from different causes. The floods caused by Typhoon Ragasa were primarily coastal and river floods. As rainfall intensifies during the typhoon’s approach, flooding becomes inevitable. Human activities exacerbate these flood occurrences, particularly through urbanization, where extensive concrete surfaces reduce infiltration and percolation of rainwater. Instead of soaking into the soil, rainwater runs off rapidly on concrete ground, amplifying flood risks especially in densely built environments.

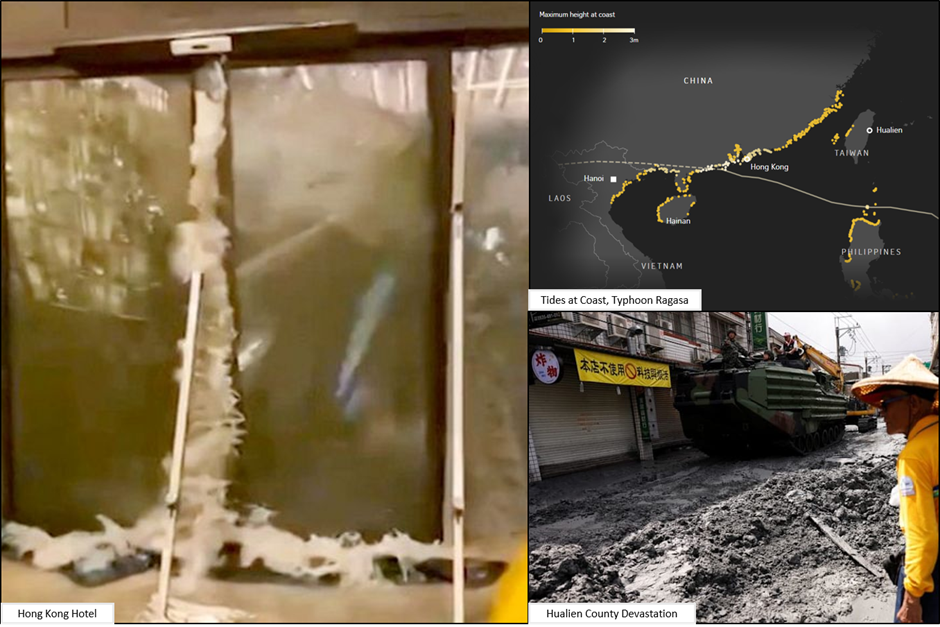

Fig.2: Typhoon Ragasa’s Impact. Sources: The Straits Times, BBC

After Typhoon Ragasa passed through Macau, social media was flooded with humorous posts of residents catching fish on the streets. While amusing at first glance, floods bring about significant social and economic consequences. During major flood events, many businesses are forced to close due to safety concerns. The floods induced by Typhoon Ragasa generated tidal surges reaching up to three meters in height. In Hong Kong, floodwaters driven by strong tidal energy shattered glass panels at the ground level of the Fullerton Ocean Park Hotel. In Taiwan’s Hualien County, a barrier lake burst, releasing an estimated 36 000 Olympic-sized swimming pools worth of water into nearby areas, resulting in at least 17 deaths. These events translate to enormous economic costs in disaster relief and infrastructure repair. Such flood risks represent acute physical climate risks that businesses in vulnerable regions must contend with. Lost business days and the costs of restoration can amount to millions in financial losses.

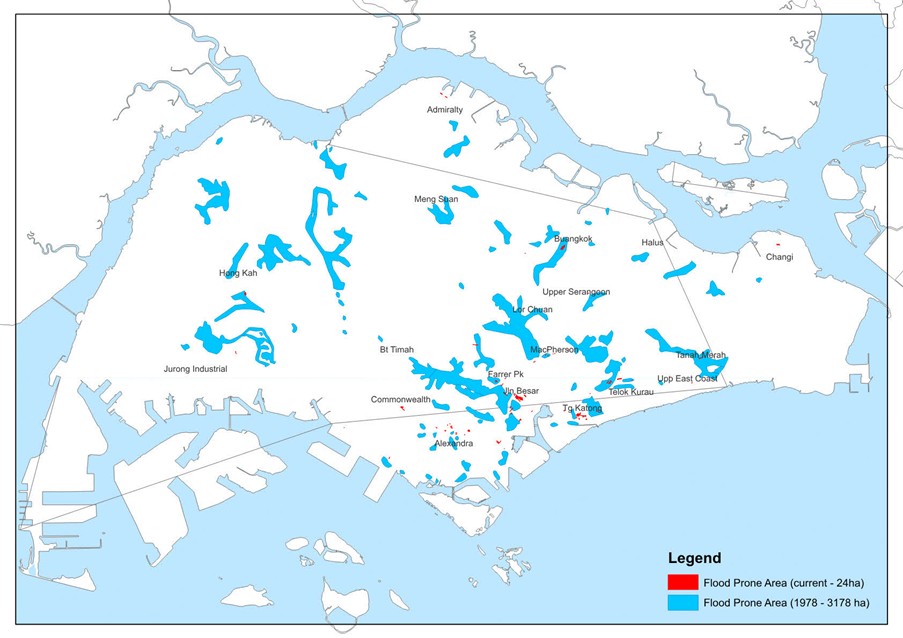

Fig. 3: Singapore Flood Zones. Source: PUB

While Singapore has thus far been spared from typhoons, we face both acute and chronic physical risks associated with floods. Acute risks include flash floods during episodes of heavy rainfall, while chronic risks involve sea-level rise. Research shows that equatorial countries are particularly vulnerable to rising sea levels as Arctic ice melts due to global warming. Gravitational forces cause ocean waters to swell more near the equator, resulting in higher sea levels at lower latitudes. With Singapore situated just 1° North of the equator and being an island state, land subsidence and coastal inundation are pressing threats.

According to the Third National Climate Change Study, the mean sea level around Singapore could rise by as much as 1.15 meters by 2100. When extreme high tides coincide with storm surges, sea levels could reach four to five meters. Given that about 30% of Singapore’s land lies below five meters above mean sea level, rising sea levels pose a critical threat to the nation. This risk is especially serious along the low-lying East Coast, which has already experienced flooding during high tide events.

The East Coast houses key infrastructure, including the award-winning Changi Airport, Changi Business Park and luxury condominium like Amber Park. Flood risks in this area could disrupt airport operations. Since tourism contributes significantly to Singapore’s GDP, such disruptions could have cascading impacts across the tourism and service sectors. This underscores the urgent need to mitigate climate-related physical risks. Singapore’s geographical characteristics mean that both businesses and households must grapple with this chronic risk. Therefore, accounting for the financial materiality of these risks and integrating mitigation strategies into business planning is vital for future readiness and resilience.

Fig. 4: Long Island Plan, Artist Impression. Source: URA

Behind every risk lies an opportunity. The “Long Island” Plan, announced in 2023, aims to safeguard homes, businesses, critical infrastructure, and public spaces along Singapore’s coast from rising sea levels. Under this initiative, land will be reclaimed at higher elevations to form a continuous coastal defense line. The design includes 12 outlet drains to channel water into a new reservoir, supported by two centralized barrages and pumping stations.

Beyond flood protection, the reservoir will also enhance Singapore’s water security. The project envisions the integration of green and blue spaces, recreational areas, waterfront housing, and nature-based solutions. This multi-functional, climate-resilient landscape will not only safeguard the nation but also improve livability and create new business opportunities. By aligning economic growth with climate resilience, Singapore can continue to thrive even in an era of unprecedented environmental change.

As investors, we value companies that proactively identify climate risks and integrate mitigation strategies into their business models. By assessing the financial materiality of these risks, businesses can safeguard against losses and strengthen long-term resilience. We reward firms that implement robust climate mitigation measures and align their ESG strategies with national climate initiatives to build a more resilient economy. In doing so, these companies advance UN Sustainable Development Goal 11: Sustainable Cities and Communities, particularly Target 11.5, which calls for a reduction in the adverse effects of natural disasters.

The Blueprint

With the ever-changing landscape around us, it can get overwhelming to stay up-to-date. The Blueprint highlights pertinent global Environmental, Social, and Governance (ESG) issues and their importance to investors and the wider community. We look forward to engaging in discussions about the interconnections between climate, nature, and social outcomes that impact our investments and our futures.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.