The High Seas Treaty: A Milestone for Global Ocean Governance

- The High Seas Treaty will enter into force in January 2026, establishing a global framework to protect biodiversity beyond national jurisdictions.

- As demand for critical minerals and ocean resources grows, the treaty seeks to balance conservation and economic interests, preventing overexploitation and ensuring sustainable, transparent ocean governance.

Earlier this year in September, the High Seas Treaty, also known as the Biodiversity Beyond National Jurisdiction (BBNJ) Agreement, reached the threshold of 60 ratifications. This milestone triggers its entry into force in January 2026, marking a new chapter in global ocean governance.

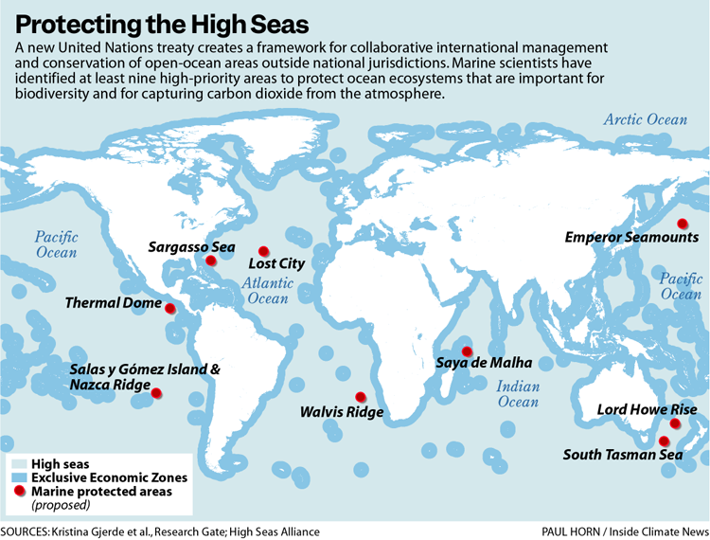

Fig.1 : Location and High Seas. Photo source: Kristina Gjerde et al., High Seas Alliance, Inside Climate News

Although around 70% of the Earth’s surface is covered by water, nearly two-thirds of these waters lie beyond national jurisdictions, where regulations are limited and less than 1% is currently protected. This governance gap has long exposed the high seas to the risks of unregulated resource exploitation.

Fig.2: Fish trawlers

The High Seas Treaty seeks to address this by enabling the creation of marine protected areas (MPAs) in international waters, mandating environmental impact assessments (EIAs) for activities such as fishing and deep-sea mining, and promoting the equitable sharing of scientific discoveries and genetic resources derived from the ocean. Together, these measures bring the world closer to achieving global conservation goals such as Target 3 of the Kunming-Montreal Global Biodiversity Framework (GBF), which calls for protecting 30% of the world’s land and sea areas by 2030.

Unbeknownst to many, the stability of Earth’s systems is deeply dependent on the ocean. Ocean circulation regulates global temperatures, and the high seas contain over 90% of ocean habitats which is home to some of the planet’s richest biodiversity. This marine biodiversity, from microscopic plankton to sperm whales, provides valuable genetic materials used in pharmaceuticals, biotechnology, and industrial enzyme production. These innovations underpin industries and supply chains, contributing to global health, food security, and economic productivity. In short, a healthy ocean sustains both life and the economy. This interconnection presents opportunities for investment in marine biotechnology, sustainable aquaculture, and nature-based solutions that strengthen the resilience of ocean ecosystems while supporting economic growth.

However, the continued lack of protection for the high seas contributes to the breaching of planetary boundaries, including those related to genetic biodiversity integrity and freshwater system changes. If unsustainable exploitation persists, these breaches could lead to irreversible environmental degradation, undermining the planet’s ability to support human wellbeing and long-term economic stability. By directing capital toward companies developing low-impact technologies, resource-efficient processes, and biodiversity-positive business models, it can help restore planetary balance.

As the global economy advances into a new era of rapid technological growth and the green energy transition, demand for critical minerals is accelerating. These minerals are essential to industries such as transportation, defence, aerospace, electronics, energy, construction, and healthcare. The International Energy Agency projects that global demand for key minerals like cobalt, copper, nickel, and rare earth elements will at least double over the next two decades. In response, deep-sea mining has emerged as a potential avenue to secure new sources of these materials, supporting the world’s transition towards advanced technologies and clean energy systems. Yet, this also places the high seas at significant risk of ecological disruption.

Growing geopolitical tensions and economic pressures underscore the need for protected areas within the high seas. Without binding international regulations, environmental degradation could become unrestrained, pushing the Earth further beyond its safe operating space and diminishing the ecosystem services on which all economies depend.

While it is likely that deep-sea mining will proceed despite environmental concerns, what remains preventable is its overexploitation beyond the point of recovery. One of the treaty’s core provisions mandates that EIAs be conducted before any large-scale fishing or mining activities begin. These assessments provide a critical safeguard, ensuring that environmental damages are identified, minimized, and managed in a sustainable manner.

Equally important, EIA findings must be submitted to and reviewed by international regulatory bodies before project approval. This oversight ensures objectivity, transparency, and accountability, preventing conflicts of interest and strengthening the treaty’s role as a cornerstone of responsible ocean governance.

Fig.3: Local communities’ reliance on the ocean

Beyond environmental and economic dimensions, the High Seas Treaty also carries significant social implications. By safeguarding marine ecosystems that support global fisheries, the treaty helps protect the livelihoods and food security of coastal and island communities that depend on ocean resources. It also promotes equity through the fair sharing of marine genetic resources, ensuring that scientific and economic benefits are accessible to both developed and developing nations.

Singapore was among the first countries to sign the BBNJ Agreement on 20 September 2023, underscoring its commitment to responsible ocean stewardship. As a leading global hub for finance, technology, and innovation, Singapore is well positioned to play a pivotal role in advancing sustainable practices in emerging industries such as deep-sea exploration and marine biotechnology. The High Seas Treaty signals a growing emphasis on environmental due diligence, sustainable resource extraction, and biodiversity risk management, factors that are likely to become key considerations in future investment decisions and corporate sustainability strategies.

As investors, our ESG analysis identifies companies that are well positioned to contribute to a sustainable blue economy. We view favourably those that actively reduce their reliance on natural resources through research and development, enhancing the efficiency of their operations and value chains. Beyond reduction strategies, it is crucial for companies to embed circularity into their processes, recycling and reusing resources to minimise waste and environmental impact. Overall, we reward companies that are transitioning towards low-carbon, circular, and nature-positive business models.

The Blueprint

With the ever-changing landscape around us, it can get overwhelming to stay up-to-date. The Blueprint highlights pertinent global Environmental, Social, and Governance (ESG) issues and their importance to investors and the wider community. We look forward to engaging in discussions about the interconnections between climate, nature, and social outcomes that impact our investments and our futures.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.