The Economic Cost and Opportunity of Food Waste

- Food waste is a major climate and social issue, contributing up to 10% of global greenhouse gas emissions while millions face hunger, making reduction of food loss and waste from farm to fork an urgent priority.

- Singapore is strengthening food waste policies and infrastructure to reduce incineration and support more sustainable food waste management and recycling.

Every lunchtime, as we walk into a hawker centre, we are faced with a familiar question: What should I eat today? At the same time, another question should follow, how much food are we going to waste today?

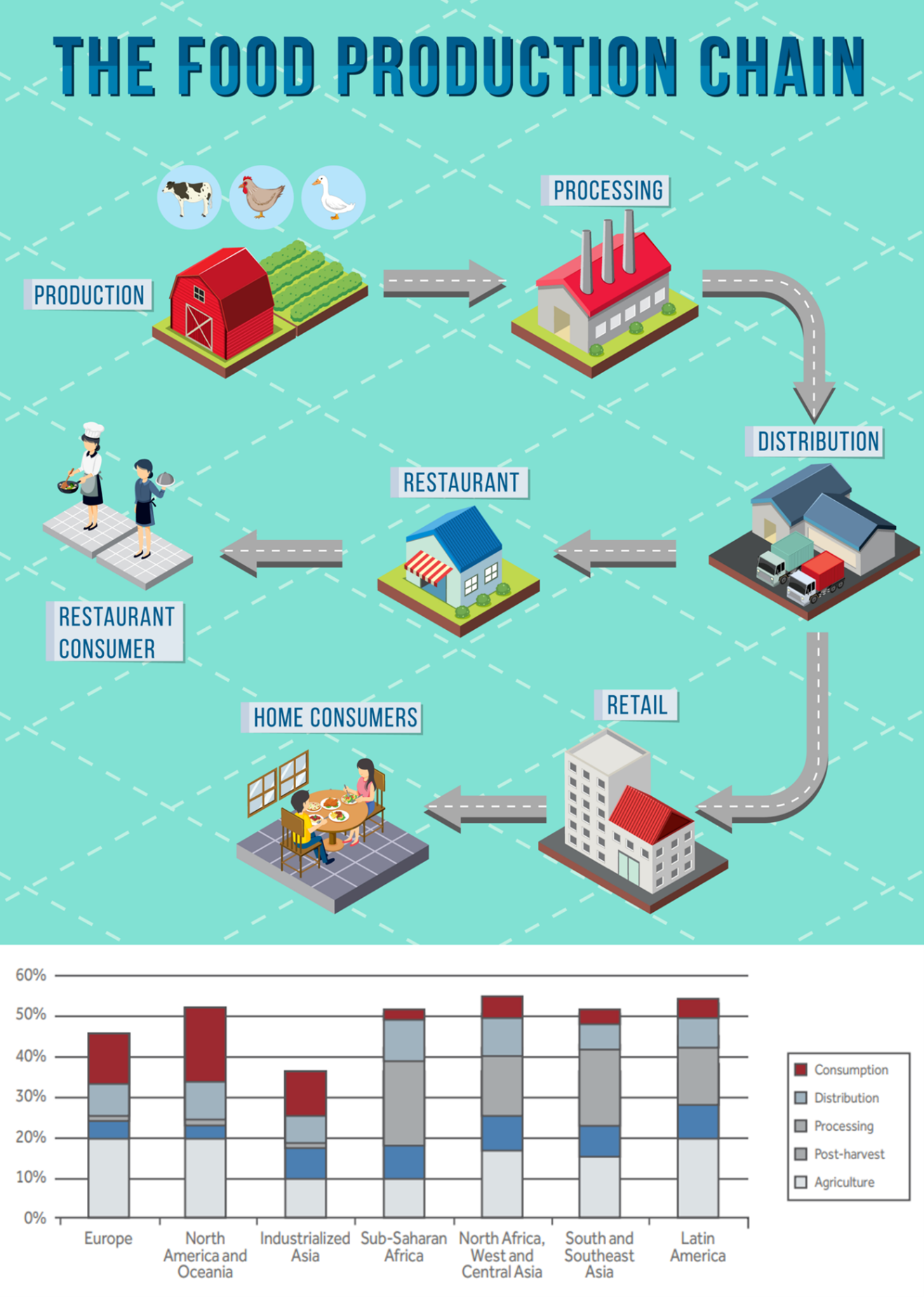

Fig.1: Food waste represents a loss of valuable resources used in agriculture and additional wastage occurs throughout the supply chain.

Food waste is a major issue affecting many parts of the world. In 2022 alone, a whopping 1.05 billion tonnes of food were wasted, while 783 million people went hungry and one-third of the global population faced food insecurity. This stark contradiction reveals that the world produces more than enough food for everyone, yet large volumes go uneaten every day. Food waste is therefore not only an environmental challenge but also a profound social concern.

Food loss and waste account for 8 to 10% of annual global greenhouse gas emissions, nearly five times the total emissions from the aviation sector. Given the vast resources needed for food production, throwing food away also means wasted land, water, energy, and labour. The global economic cost of food loss and waste is estimated at USD 1 trillion every year.

As the first week of COP30 comes to a close, food waste emerged as a critical topic of discussion. The UN Environment Programme and the UN Climate High-Level Champions launched the Food Waste Breakthrough initiative, aimed at halving global food waste by 2030 and reducing methane emissions by up to 7%. Additionally, the No Organic Waste (NOW) Plan was introduced, committing to cut 30% of methane emissions from organic waste by 2030, recover 20 million tonnes of surplus food, and provide meals for 50 million people. A common theme between these two initiatives is the aim to reduce methane emissions. Methane emissions from food waste accounts for up to 14 per cent of total methane emissions. This climate pollutant that is 84 times more potent at warming the atmosphere than carbon dioxide over 20 years. Hence, the need to reduce food waste is an urgent one.

In 2022, according to the UN Environment Programme (UNEP), 19% of food available to consumers was wasted at the retail, food service, and household level, on top of the 13% of food lost in the supply chain, as estimated by the FAO. Such waste represents a missed opportunity to nourish vulnerable communities and poses a significant burden on our planet. To zoom into fruits and vegetables, in South and Southeast Asia, the processing stage is where the most amount of waste happens. This presents opportunities to reduce the waste generated at this stage.

In Singapore, we often pride ourselves for our food culture that even hawker food is Michelin Starred. However, we too are not spared from the negative externality of food waste which we generate. These costs of the negative externalities are not only the value of the food and its disposal, but also the environmental damage that food waste causes. Looking into the consumption stage of the food supply chain in Singapore, food that is not recycled is sent to Waste-to-Energy (WtE) plants for incineration. Food waste is treated as Municipal Solid Waste (MSW), and every ton of MSW incinerated releases about 134 kg of CO₂, 88 g of CH₄, and 69 g of N₂O.

| Global Warming Potential | Emissions(kg) | CO2e | |

| CO2 | 1 | 134 | 134 |

| CH4 | 28 | 0.088 | 2.464 |

| N2O | 265 | 0.069 | 18.285 |

| Total CO2e (metric tonnes) | 0.154749 | ||

| Carbon Tax (at the rate of S$25 in 2024)(S/tonne) | 3.868725 | ||

| Food waste disposed of in 2024 (tonnes) | 646,000.00 | ||

| Environmental Cost (S$) | 2,499,196.35 | ||

Table 1: Calculation of the environmental cost of food wastes in Singapore in 2024

To better understand the environmental cost of the negative externality of food waste, the approach of calculating carbon tax can be used to provide a rough estimation. In 2024, around 646,000 tonnes of food waste were disposed of, resulting in an estimated environmental cost of about SGD 2.5 million. With the average household in Singapore spending about S$1,800 per month on food and non-alcoholic beverages, the economic cost of food waste could have supported the monthly food needs of approximately 115 families. Instead of being lost through waste, these resources could have strengthened social safety nets and provided meaningful support for low-income households. Redirecting the value of wasted food into community assistance would not only reduce financial strain for vulnerable families but also contribute to greater food security and social equity in Singapore.

To encourage food waste recycling, Singapore uses policies that target both demand and supply. On the demand side, the government supports proper food waste management through financial and regulatory measures. One key initiative is the 3R Fund, which co-funds projects to up to 80% of qualifying cost. In addition, the Resource Sustainability Act (RSA) requires large food waste generators, such as shopping malls and hotels, to segregate their food waste from other wastes starting from 2024. These policies aim to reduce the amount of food that is disposed of at incineration plants.

On the supply side, the government invests in infrastructure and enforces regulations to improve food waste treatment. A major development is the SGD 1.5 billion Tuas Nexus facility, which will process food waste and produce energy. Under the RSA, new large commercial and industrial buildings are also required to set aside space for on-site food waste treatment systems, to build capacity to ensure that future developments can manage waste more sustainably.

As investors, we prefer companies that actively reduce their resource use and recycle the waste generated from their operations. This is especially important for industries involved in food and beverage production and services, such as hotels. By reducing food waste, these companies support SDG 12.3, which aims to halve global food waste at the retail and consumer levels and reduce food losses along the supply chain, including after harvest. Food waste reduction also aligns with the new COP30 targets to lower methane emissions from organic waste.

The Blueprint

With the ever-changing landscape around us, it can get overwhelming to stay up-to-date. The Blueprint highlights pertinent global Environmental, Social, and Governance (ESG) issues and their importance to investors and the wider community. We look forward to engaging in discussions about the interconnections between climate, nature, and social outcomes that impact our investments and our futures.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.