Market Commentary – November 2025

EQUITY MARKET UPDATE

Source: Bloomberg (Total Return in USD/Local Currency terms)

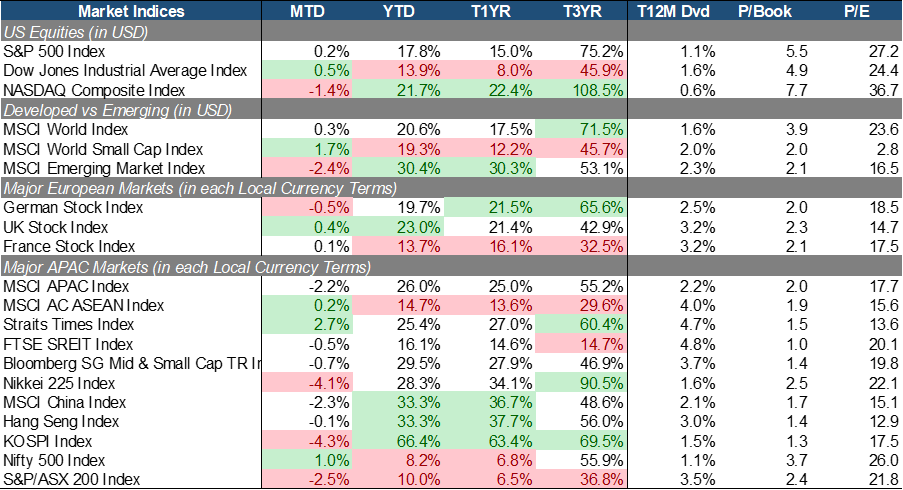

Equity movements were quite mixed in November. The S&P 500 returned flat MoM while value stocks as loosely represented by the DJIA (+0.5% MoM) held out better than the tech-heavy NASDAQ Composite (-1.4% MoM). Mounting concerns over lofty valuations in technology stocks, on top of fluctuating expectations surrounding the Federal Reserve’s interest rate policy, were the primary reasons for the value preference.

Global Small-Caps (+1.7% MoM) outperformed Large-Caps (+0.3% MoM), while Emerging Markets slipped (-2.4% MoM), likely caused by the tech sector pullback as well in countries such as South Korea. In Europe, performance continued to be mixed with UK equities (+0.4% MoM) leading on the back of hopes of an imminent Bank of England rate cut and a relatively attractive valuation level. German equities (-0.6% MoM) fell due to concerns of a stagnant economy, macro trade uncertainties, and weakness in the industrial sectors.

Closer to home, most of APAC and ASEAN equities had fallen into the negative territory except for Singapore (+2.7% MoM) and India (+1% MoM). Singapore continued to be an attractive safe haven for investors given its low inflation, on top of resilient economic growth, strong banking sector fundamentals and attractive valuation level. In contrast, South Korea (-4.1% MoM) and Japan (-4.1% MoM) were the worst performing APAC markets. Both countries have a heavy concentration of semiconductor and AI-related companies in their benchmarks. Investors also mull over Japan’s fiscal sustainability and rising trade tensions with China.

China/HK equities (-2.3%/-0.1% MoM) ended the month notably weaker as investors booked profits after earlier gains and rotated out of risk assets amid mixed economic signals and heightened volatility. The drop was driven by a combination of external risk-off sentiment from global markets and muted domestic catalysts amid a policy vacuum and lack of strong new economic drivers. This was compounded by soft economic data showing slowing industrial and retail activity that weighed on investor confidence and valuation sentiment.

Source: Bloomberg (Total Return in USD terms)

Source: Bloomberg (Total Return in USD terms)

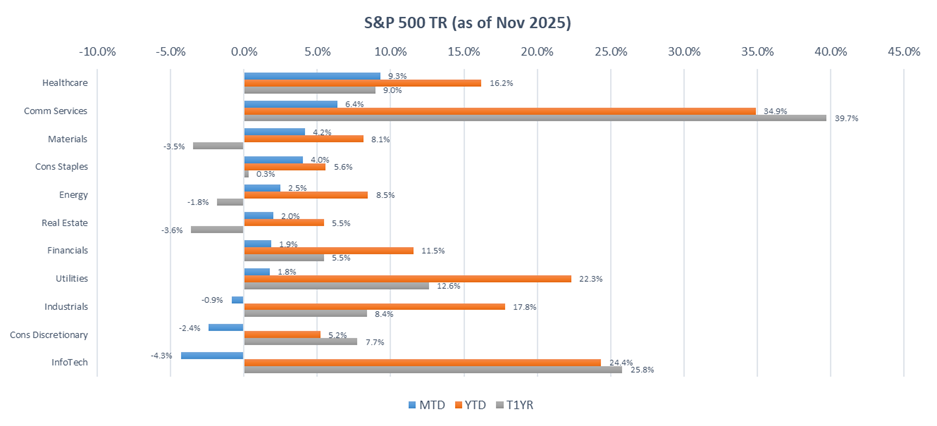

Within the S&P 500 we observed renewed appetite for sectors tied to tangible economic drivers against a backdrop of ongoing macro volatility. Healthcare (+9.3% MoM) was the top performer for the month as investors rotated toward sectors with stronger near-term fundamentals. The sector has recently reported strong earnings beats, resilient clinical pipelines, and increased M&A activity in biotech/pharma bolstered confidence in both defensive and growth-oriented subsegments, underpinning relative strength despite broader market volatility. Comm Services (+6.4% MoM) advanced on improving advertising revenue trends and renewed interest in AI-driven content and media platforms. Meanwhile, Materials (+4.2% MoM) benefited from structural demand tied to energy transition infrastructure (e.g., power-grid upgrades, electrification) and data-center expansion materials demand.

In the other hand, InfoTech (-4.3% MoM), Consumer Discretionary (-2.4% MTD), and Industrial (+1.4% MTD) lagged. InfoTech underperformed as broad tech shares faced valuation pressure. Consumer Discretionary also lagged on signs of softening consumer demand and earnings miss risk, with the sector feeling the pinch from weakening spending indicators and cautious outlooks that dampened sector sentiment during the month. Industrials trailed the broader market’s stronger sectors as mixed data and uncertainty around manufacturing momentum led investors to favor more resilient areas, with volume tied to traditional industrial activity unable to keep pace with defensive and growth-oriented flows despite pockets of strength in specific industrial subsectors.

Source: Bloomberg (Total Return in Local Currency terms)

Source: Bloomberg (Total Return in Local Currency terms)

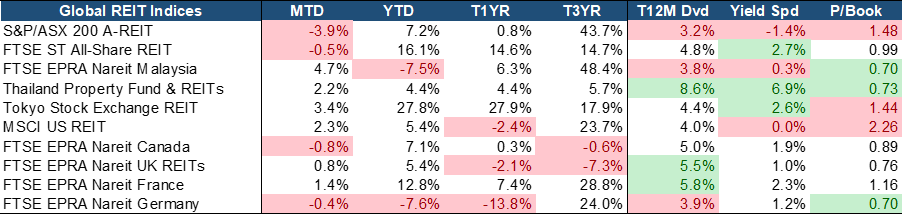

Global REITs reported a mostly positive performance in November, with Malaysia (+4.7% MoM) and Japan (+3.4% MoM) delivering the only positive returns MoM. S-REITs (0.5% MoM) have relatively lagged, but continue to benefit from resilient fundamentals, attractive dividend yields, and broad-based sector strength, including recovery in hospitality, and continued industrial and retail. Valuations and yields remain attractive with a compelling 3% trailing yield spread, the second highest globally, and trading at a fair 1x PB, reflecting both value and income potential.

EQUITY MARKET OUTLOOK

Market Remains Highly Sensitive: Positioned for Optimism, Prone to Sharp Repricing

Source: Bloomberg.

Source: Bloomberg.

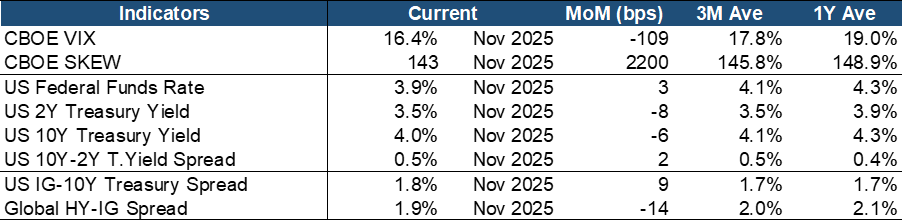

Volatility has cooled down in November, with the VIX falling by 109 bps MoM, crossing under both the Trailing 3M (~18%) and 1Y (~19%) averages. The SKEW also gone up, hovering near 150 level. Both volatility indicators are still pointing to a risk-on equity market. Concerns for an AI bubble or an unexpected tail risk event still exist, but the increased probability for the Fed’s December rate-cut still bring positive sentiment to equities.

Treasury yields continued to shift lower across the yield curve, with the US 2Y Treasury yield down -8 bps MoM to 3.5% and the 10Y also lower by -6 bps to 4%, reflecting market positioning for eventual Fed easing. The 10Y-2Y spread is roughly unchanged 0.5% (2 bps MoM), but stil marking a bull-steepening of the yield curve. This means that the bond market is growing more bullish overall and has better short-term outlook. In parallel, credit markets also showed a growing risk appetite as the global high yield and investment-grade (HY–IG) spread tightened to 1.9% (-14 bps MoM)

Overall, the equity market still has a risk-on backdrop but with investors hedging against tail risks (high SKEW). Expectations for a December Fed rate cut supported sentiment, driving Treasury 10Y-2Y yields lower across the curve and contributing to a modest bull-steepening of the treasury yield spread, consistent with improving near-term growth expectations. Credit markets also showed firmer risk appetite, with HY–IG spreads tightening through November. Yet, this equilibrium remains fragile. While cooling inflation and AI-driven productivity themes underpin risk-taking, markets stay highly sensitive to any upside inflation surprise or hawkish shift that could quickly reprice both rates and equities.

Mixed Macro Backdrop: Stabilizing Growth but Persistent Inflation Keeps Policy Cautious

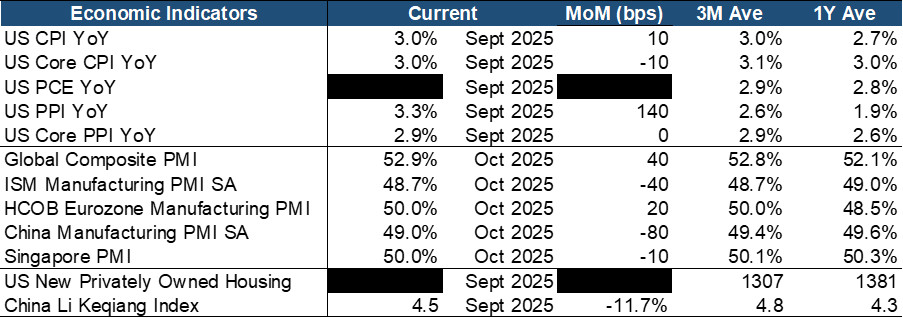

Source: Bloomberg.

Source: Bloomberg.

The U.S. government shutdown earlier in Q4 disrupted key data releases, including delayed inflation, employment, and GDP reports. The Fed will be more cautious given its data-dependent policy framework and complicating real-time assessments of price pressures and growth trends. Despite this, global growth indicators showed pockets of stabilization, with the Global Composite PMI further gained in the expansionary territory (52.9%), signaling resilient services demand and broad order momentum outside the U.S. even as trade and export conditions subside. In contrast, the U.S. manufacturing sector continued to struggle, with the ISM Manufacturing PMI (48.7%) falling further in contractionary range, reflecting persistent weakness in factory activity and softened new orders amid higher input costs.

Sticky core inflation remains a policy constraint, reinforced by tariff-related price pressures and services inflation that have kept underlying price gains elevated, dampening the Fed’s appetite for aggressive easing until a clearer disinflation path is evident. At the same time, services sectors and consumer spending indicators have shown relative resilience, particularly outside the US, helping counterbalance industrial softness and suggesting that growth trajectories will likely hinge on continued services demand, external demand contributions (notably from Europe and Asia), and the persistence of underlying inflation trends. This balance of forces points to cautious central bank positioning, with policymakers unwilling to pre-emptively ease until disinflation is more durable and broader-based growth momentum is reaffirmed.

AI-Led Momentum Supports a Constructive Outlook, but Fragile Macro Undercurrents Persist

We maintain a constructive medium-term outlook as the momentum behind the AI investment cycle and solid corporate earnings continue to anchor market confidence. AI-related capital spending supports demand across semiconductors, cloud infrastructure, data-center supply chains and industrial automation, while earnings strength has broadened beyond a handful of mega-caps to include infrastructure, utilities and select industrials. Macro conditions are also becoming more supportive. The US labour market is cooling in an orderly manner, inflation has moderated from mid-year peaks, and the Federal Reserve is moving closer to a gradual pivot toward rate cuts as financial conditions stabilize.

Looking further out, the long-term backdrop remains cautiously optimistic but is shaped by several structural risks. Valuations within leading AI beneficiaries are increasingly stretched, market concentration has intensified, and investor scrutiny of central-bank independence and policy consistency is rising. These factors heighten sensitivity to any signs of premature easing, renewed inflation pressure or a shift in policy credibility. In this environment, investors can still participate in the equity upside, but doing so prudently remains essential, with an emphasis on diversification beyond U.S. mega-caps and clear awareness of potential tail risks around geopolitics, inflation dynamics and the sustainability of AI-driven market enthusiasm.

FIXED INCOME UPDATE

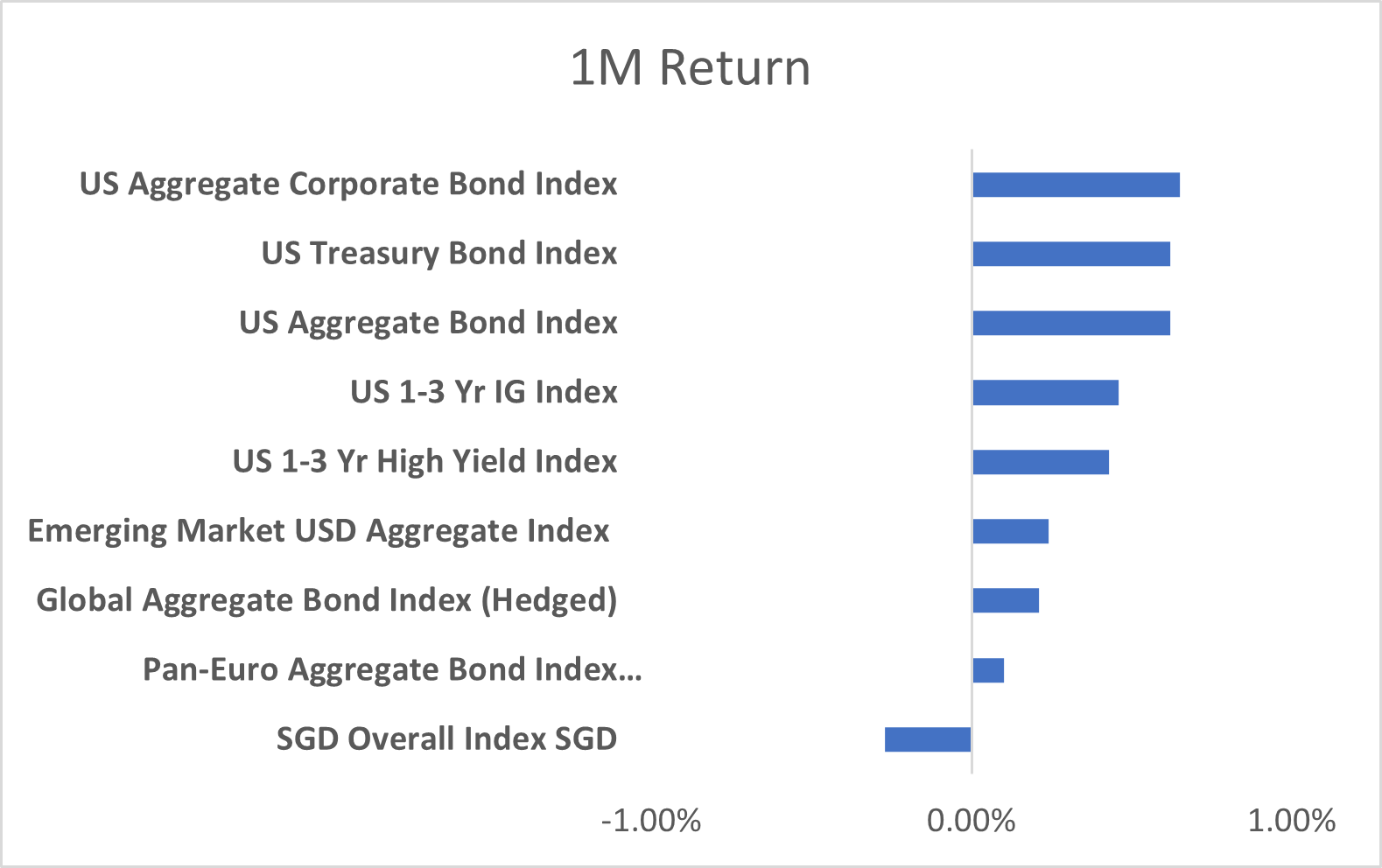

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

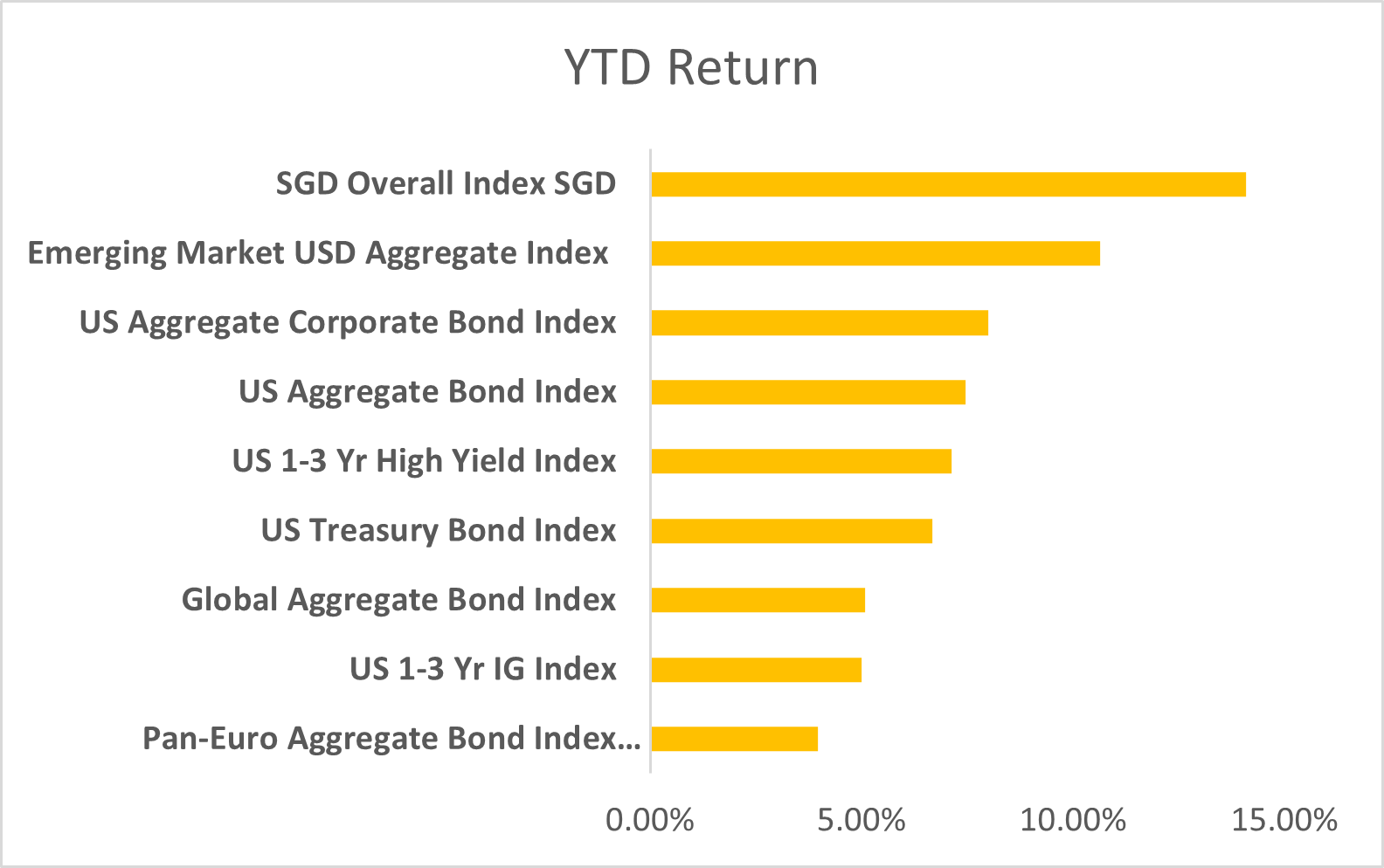

Bond markets extended their gains in November, with most major indices posting positive returns. The exception was the SGD Overall Index which posted a modest decline in USD terms due to continued currency translation effects as the Singapore dollar weakened further against the US dollar. The marks the third consecutive month in which FX movement have weighted on SGD-based returns, despite stable domestic credit fundamentals. The weakness partly reflected the unwinding of USD funded carry trades, as heightened geopolitical uncertainty, crowded positioning, and technical rebound dynamics prompted investors to close positions and repay funding, generating renewed demand for dollars. While such episodes have temporarily bolstered the USD, the broader narrative remains that Fed easing makes the dollar an increasingly attractive funding currency for carry strategies, a dynamic that could reassert itself once risk sentiment stabilizes.

In contrast, the Emerging Market (“EM”) USD Aggregate Index continued its strong performance, supported by improving fundamentals, easing inflation pressures, and renewed investor appetite for carry. EM high yield default rates remain low, and growth in key economies such as India and Brazil- has exceeded expectation. In addition, investors have gradually diversified away from dollar denominated exposures, partly as a hedge against unpredictable U.S. policy. This secular shift has bolstered demand for EM debt, amplifying cyclical tailwinds.

European bonds remained the weakest performers on a year-to-date basis, with the Pan-Euro Aggregate Index still trailing peers. Persistent rate volatility and macro uncertainty particularly around fiscal consolidation and growth risks continue to weigh on sentiment. Although yields have moderated, the recovery in eurozone debt remains uneven.

Despite recent FX-related setbacks, the SGD Overall Index maintains its leadership year-to-date, with gains approaching 15%. Strong domestic credit and favourable rate dynamics have been the key drivers. EM debt and US corporates also remain significant contributors to YTD performance, while global aggregate and eurozone indices continue to lag.

Singapore Monetary Policy: Stability Amid Shifting Crosscurrents

At its October meeting, MAS left the parameters of the S$NEER policy band unchanged — slope, width, and level all steady — maintaining the prevailing modest and gradual appreciation path intact for a second consecutive quarter, after two easings earlier in 2025. The decision reflected stronger than expected economic performance, with Q3 GDP advance estimates beating market expectations, and the output gap is now projected to remain positive through year end.

Core inflation is projected to average around 0.5% in 2025 before gradually rising to 0.5–1.5% in 2026 as temporary disinflationary factors fade. CPI All Items inflation is expected to remain within the 0.5–1.0% this year and 0.5–1.5% next year. While risks are considered as more balanced than before, MAS continues to monitor potential upside pressures stemming from geopolitical supply shocks. Against this backdrop, the central bank judged that there was no urgency to adjust its stance, opting instead to balance resilient growth with the aim of securing low and stable inflation over the medium term.

For the Singapore dollar, policy stability has helped temper volatility in the trade weighted basket, anchoring expectations even as a stronger USD has weighed on bilateral performance. In the domestic bond market, MAS’s steady hand has reinforced the attractiveness of SGD denominated assets. Yields remain supported by favourable rate dynamics and solid credit fundamentals. At the front end, rates which fell sharply earlier in 2025 are now expected to consolidate rather than decline further, reflecting the absence of fresh easing signals. At the long end, resilient growth and balanced inflation risks are likely to keep yields firm limiting excessive flattening. Overall, the curve reflects a shift from the earlier bull steepening trend toward a more stable profile, underpinned by MAS’s credibility and sustained investor demand for SGD assets.

Looking further ahead, Singapore may stand to benefit structurally from ongoing tariff realignments in global trade. As a major trans shipment hub with a relatively low base tariff rate of 10%, Singapore is positioned to capture incremental trade flows as regional trade activities is diverted to avoid higher bilateral tariffs elsewhere in APAC. Such potential re routing of supply chains could reinforce Singapore’s growth resilience, support continued demand for SGD-denominated assets, and further strengthen the credibility of MAS’s policy framework in sustaining investor confidence.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.