Market Commentary – June 2024

Equity Market Update:

Source: Bloomberg

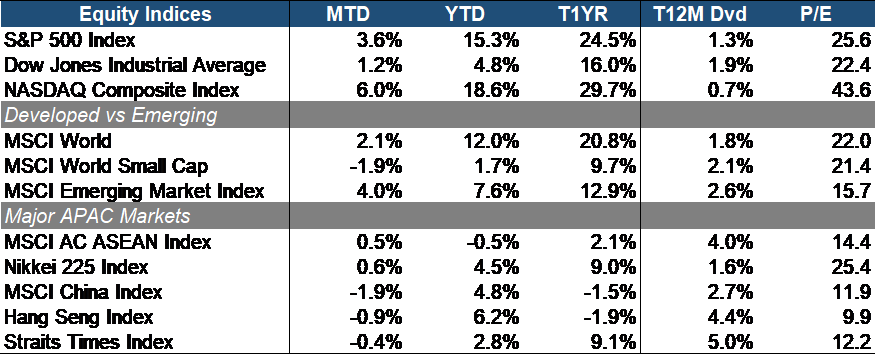

In June, the equity market sustained its upward momentum, with the S&P 500 advancing 3.6% month-to-date (MTD). Growth stocks outperformed value stocks, as evidenced by the DJIA’s modest 1.2% MTD return trailing the tech-heavy NASDAQ Composite’s robust 6% MTD return.

Developed market equities gained 2.1% MTD, but lagging the emerging markets, which rose 4% MTD. Nevertheless, developed markets maintain a year-to-date (YTD) lead of approximately 4.4%. Small-cap stocks lagged, declining by 1.9% MTD, as investors gravitated towards higher quality large and mid-cap stocks.

APAC equities underperformed relative to their U.S. counterparts. Specifically, equities in China (-1.9% MTD), Hong Kong (-0.9% MTD), and Singapore (-0.4% MTD) posted negative returns, contrasting with positive returns in Japan (0.6% MTD) and the broader ASEAN region (0.6% MTD).

Source: Bloomberg

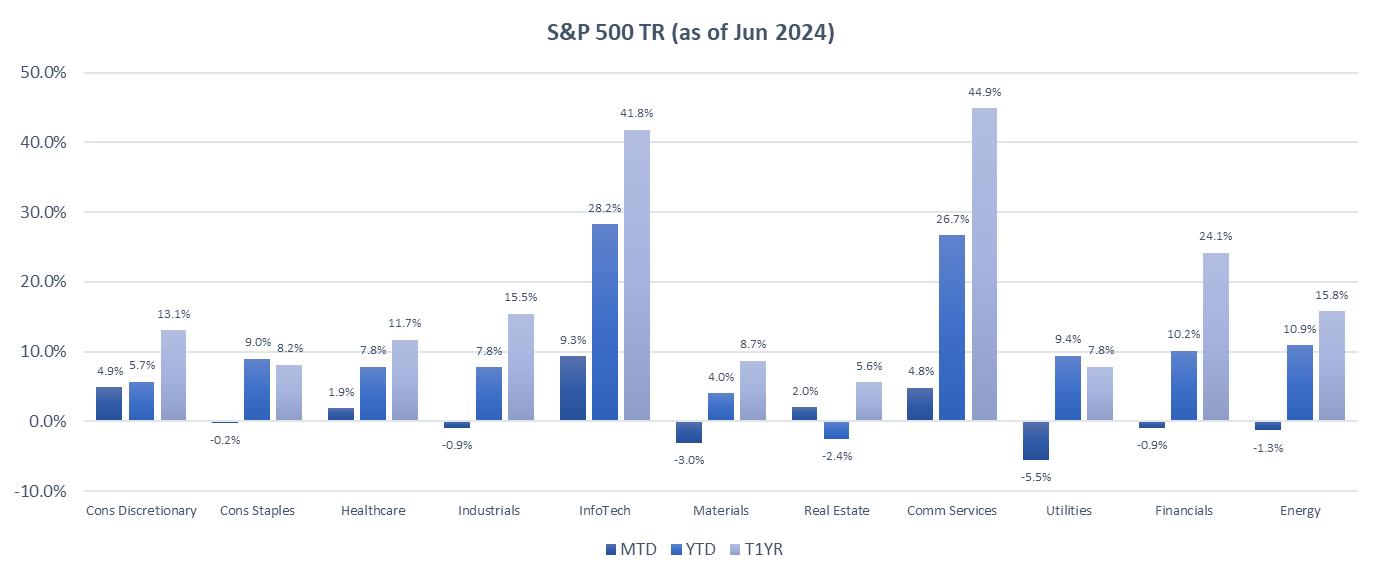

Performance was mixed across the S&P 500 sectors. Growth sectors led the way, with Information Technology up 9.3% month-to-date (MTD), Consumer Discretionary rising 4.9% MTD, and Communication Services increasing 4.8% MTD, buoyed by positive Q1 2024 earnings results and cooling inflation data. Conversely, defensive sectors underperformed, with Utilities down 5.5% MTD, Materials declining 3% MTD, and Energy falling 1.3% MTD, as investors sought better yields and lower risk in Treasury bonds amid the prevailing higher-for-longer interest rate environment expected to persist until early next year.

Source: Bloomberg

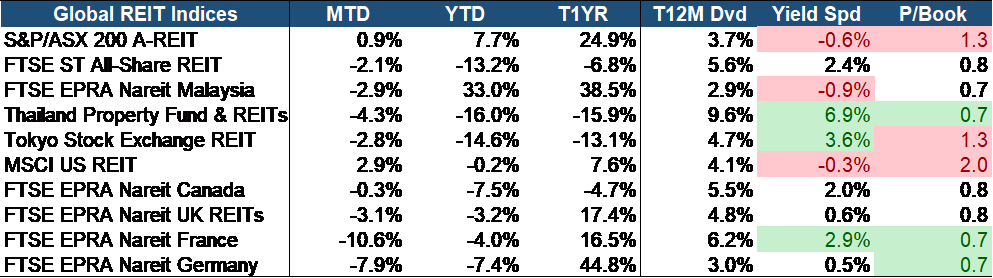

In the global REIT markets, most sectors declined last month, with the exceptions of Australian and U.S. REITs. Singapore REITs fell by 2.1% month-to-date (MTD), but the yield spread for SREITs remained among the most attractive globally at 2.4%. Despite challenges such as inflation and policy tightening impacting SREITs’ distributions, we maintain a positive medium-to-long-term outlook for the sector. SREITs continue to be appealing due to the quality of their underlying assets, attractive yield, and undervalued valuation (0.8 Price-to-Book), which is significantly below historical averages.

Equity Market Outlook:

Source: Bloomberg

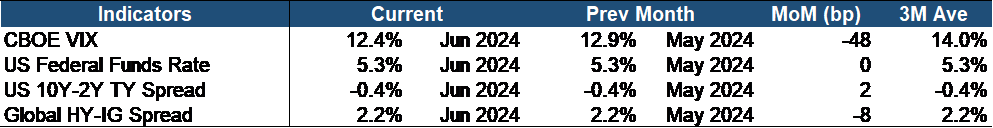

The stock market maintained a risk-on mode, with the VIX declining further by 48 bp month-over-month, falling below its three-month average. Despite this, investor caution remains evident as the yield curve continues to be inverted. However, sentiment may be slightly improving, indicated by an 8 bp contraction in the credit spread between High Yield and Investment Grade bonds.

Source: Bloomberg

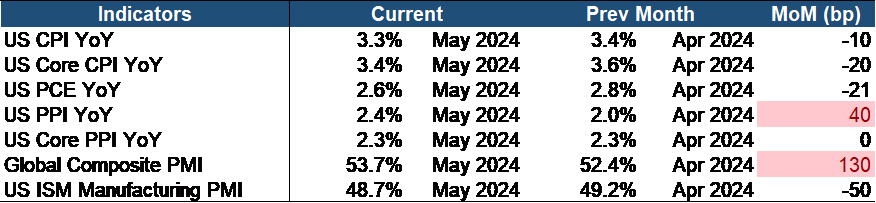

Recent economic data has been largely positive, bolstering the equity market rally. Inflation metrics, encompassing both the headline and core Consumer Price Index (CPI), as well as the Personal Consumption Expenditures (PCE) index, have shown month-over-month declines, indicating a degree of moderation. The PCE index, a critical gauge monitored by the Fed, provides a favorable signal for the overall equity market. However, the uptick in the headline Producer Price Index (PPI), despite the core PPI remaining stable, suggests persistent inflationary pressures. The PPI frequently acts as an early indicator for broader inflation trends.

The first quarter of 2024 has delivered notably favorable earnings results, demonstrating resilience amidst current market uncertainties. Equity benchmark indices have continued to reach new highs, driven by expectations of sustained infrastructure spending and advancements in AI. The technology sector, led by companies like Nvidia, has significantly outperformed traditional market indices, buoyed by the enthusiasm surrounding AI which has bolstered equities, eased financial conditions, and extended valuations.

We maintain an optimistic outlook regarding AI’s potential to enhance productivity across early adopter sectors, thereby alleviating unit labor cost inflation and potentially lowering core inflation below market expectations. However, persistent inflation pressures remain, driven by ongoing increases in service prices and positive real wage growth.

Looking ahead, we anticipate continued positive earnings in the second half of 2024, particularly driven by leading tech firms known for their ability to generate strong cash flows even during economic downturns, supported by substantial reserves. Furthermore, the transformative impact of AI on earnings is only beginning to unfold. While another rate cut could further boost equities, we expect rates to remain unchanged until Q1 2025 as the Fed focuses on addressing inflation and achieving its 2% target.

China Market Update:

In June 2024, equities in China and Hong Kong declined significantly as offshore investors sold CNY 44.4 billion worth of China A-shares via the Stock Connect Scheme. The People’s Bank of China’s setting of the reference rate at CNY 7.1268 per US dollar contributed to the Chinese yuan reaching a seven-month low.

During the same period, China’s manufacturing activity fell for the second consecutive month, with services activity also dropping to a five-month low. Analysts suggest that actual industrial activity may be stronger than indicated by the official PMI, which doesn’t fully capture the robust export momentum seen this year.

The weak PMI figures underscore the need for supportive policies from the Chinese government. Fiscal measures are likely to take precedence, given limited scope for further monetary easing. Recently, China’s central bank introduced a relending program aimed at boosting affordable housing sales to better align supply with demand. There is also pressure on Chinese officials to diversify economic growth away from property dependence.

Premier Li Qiang highlighted at the World Economic Forum the growth of new industries as a pillar of China’s economic development. This is evident in the official PMI for high-tech manufacturing, which rose to 52.3 in June from 50.7 in May, reflecting increased investment in advanced sectors like computer chips and electric vehicles.

Looking forward, economists and investors are anticipating the Third Plenum scheduled for July 15-18, where top Communist Party officials will convene in Beijing for strategic planning.

Despite current challenges, we maintain optimism about China’s economic outlook, expecting government stimulus measures and necessary market adjustments to support future growth.

Fixed Income Update:

Source: Bloomberg

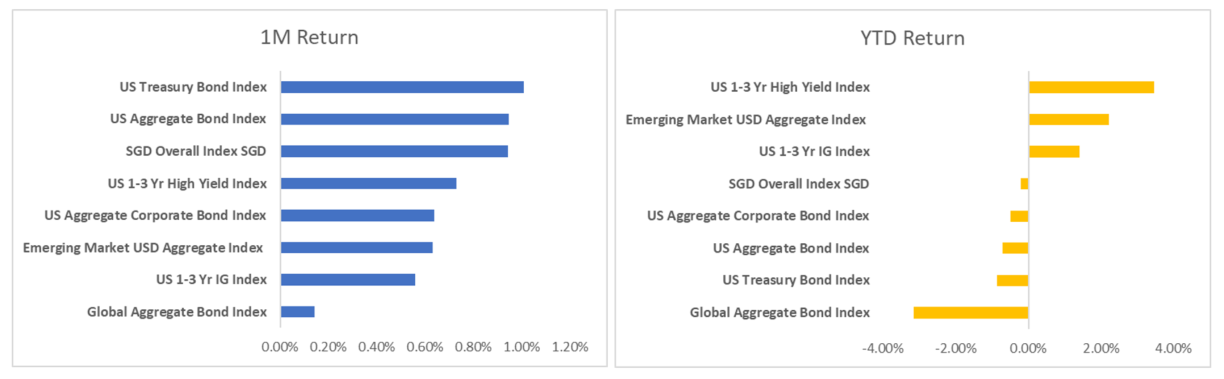

Major bond market indices were largely positive in the month of June, though we observe some clear outperformance in US bonds as well as SGD bonds which achieved a 1M total return of 1.0% and 0.95% respectively, far exceeding the global aggregate which was only able to seek out a mere 0.15% return. The reason for this outperformance in US bonds in June can be attributed to the weak macroeconomic data prints in the month of June which were supportive of FED rate cuts prompting bond yields to decline. The change in US CPI and PCE were flat on a MoM basis and even ISM Manufacturing PMI edged lower to 48.5 compared to May’s 48.7 reading. The market is now pricing in a high likelihood of a 25bps rate cut in the September meeting.

On a YTD basis however, bond indices are generally still in negative territory except for the shorter duration space (which we highlighted in last month’s commentary) and interestingly we also note some strength in the emerging market bond index which has returned 2.2%. We will touch on this later in the commentary.

Global Central Banks Set to Commence Policy Easing Cycle

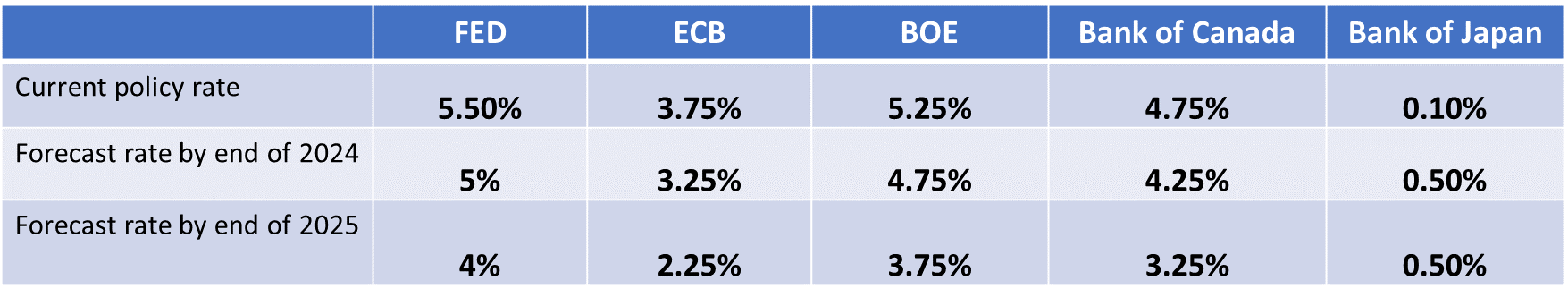

According to reporting by Bloomberg Economics, policymakers around the world have their eyes firmly set on lower rates with some central banks such as the Swiss National Bank and the Bank of Canada already having commenced rate cuts. The Bank of Japan is the only major central bank expected to hike rates. The table below summarizes the key policy rate forecast for G7 economy central banks:

Source: Bloomberg

Stubborn inflation (particularly in core inflation and services) however remains a primary obstacle to the global policy easing cycle and means that rate cuts are unlikely to be swift nor synchronized across the various central banks. Crude oil prices have also been on the rebound in June on the back of lower bond yields and heightened geopolitical tensions in the Middle East. WTI crude prices which made a low of $73.25/bbl in early June are as of this writing now trading with an $83/bbl handle which represents a sharp 13% rise in just the span of a month.

French Parliamentary Election Results Roil Eurozone Bond Markets

With all the talk of central banks around the world slashing borrowing costs, there were some idiosyncratic developments in Europe in June that have sent Eurozone bond yields in the opposite direction.

In the first round of voting in French parliamentary snap elections, the right-wing National Rally party led by Marine Le Pen secured a decisive victory with 33.1% of the votes while Emmanuel Macron’s Ensemble coalition finished third with only 21% of the votes. This comes on the back of a strong showing by right-wing parties across Europe in EU Parliamentary elections earlier in the month.

The election results rattled European bond markets as populist right-wing parties are likely to raise public spending and further widen budget deficits. European bond yield spreads were seen widening in June, particularly in France where the 10Y French bond-German bund yield spread, a key barometer of risk in French government bonds was seen widening to its highest levels since 2017.

Emerging Market Debt Sees Strong First Half Sales in 2024

Earlier in the commentary we mentioned how the emerging market bond index has been a strong outperformer with 2.2% in total returns YTD which far outstrips the global aggregate bond index which is down 3.16% YTD. According to Bloomberg reporting, hard currency emerging market bonds have seen brisk sales, increasing by 32% YoY in the first half of 2024. With a US election looming and all the geopolitical volatility that could ensue from that, EM issuers have been in a rush to load up on debt in early 2024 which could also explain the surge in sales as well as net issuance.

“In terms of 2024 funding need, probably 80% is already done,” according to Alexander Karolev, head of bond syndicate for Central and Eastern Europe, Middle East and Africa at JPMorgan. This means we are likely to see demand exceed supply going forward in 2024 which could lead to the juicy EM yields available at the start of the year start to be pared back.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.