Market Commentary – March 2025

EQUITY MARKET UPDATE

Source: Bloomberg.

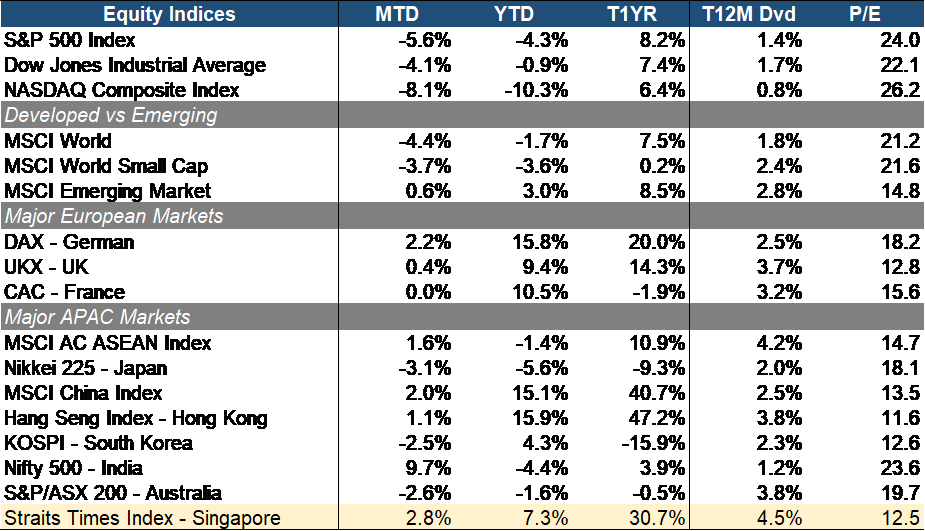

The equity market has experienced significant decline to end the month of March, primarily driven by the announcement of comprehensive President Trump’s trade tariffs. The implementation of these tariffs led to widespread concerns about escalating trade wars, potential economic slowdowns, and rising inflation. Growth fared worst as the NASDAQ Composite (-8.1% MTD) lagged both the Dow Jones Industrial Average (-4.1% MTD) and the S&P 500 index (-5.6% MTD). This decline was largely attributed to a sell-off in technology stocks amid fears of increased production costs due to tariffs.

Developed markets lagged the emerging market, with the MSCI World Index retreating by -4.4% MTD, significantly underperforming the MSCI Emerging Markets Index (+0.6% MTD). Small caps (-3.7% MTD) also underperformed overall in light of worsening economic expectations. Developed markets, including the U.S. and Europe, faced significant headwinds due to the tariff implementations. In contrast, emerging markets demonstrated resilience.

European equity, especially the German market (+2.2%) were showing more resiliency. In the other hand, most ASEAN markets underperformed, except for India (+9.7% MTD), China/HK (+2%/+1.1% MTD), and Singapore (+2.8% MTD). India’s strong rebound was due to renewed interest from domestic institutional investors and select foreign inflows – particularly into banking and infrastructure. Meanwhile, China and Hong Kong faced early pressure from direct tariff impacts but stabilized towards month-end on hopes of policy support. Singapore remained relatively steady, underpinned by its diversified economy and role as a regional financial hub, which helped buffer against broader trade-related volatility.

Source: Bloomberg.

Source: Bloomberg.

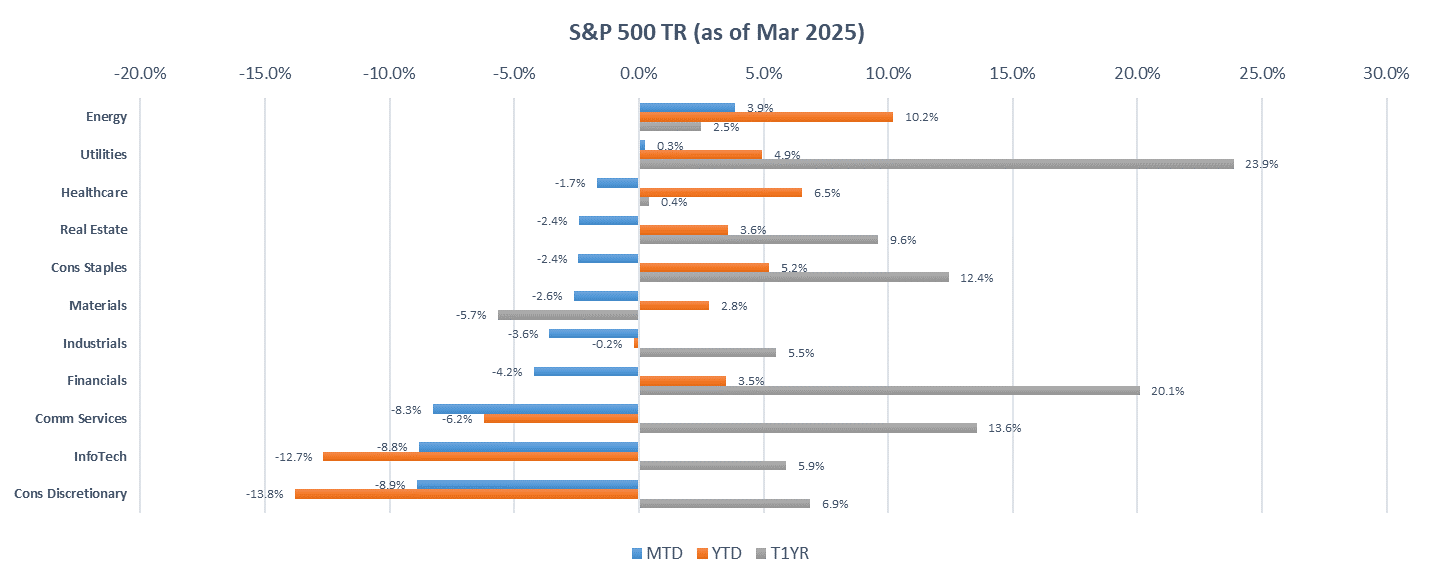

Sector performance in March 2025 reflected heightened investor caution amid renewed trade tensions and recession fears. Defensive sectors outperformed as investors rotated into areas perceived as more resilient during economic slowdowns. Energy (+3.9% MTD) led gains, buoyed by a surge in oil prices driven by renewed geopolitical risks and supply constraints. Utilities (+0.35% MTD) and Healthcare (-1.7% MTD) also held up relatively well, benefiting from their stable cash flows and lower sensitivity to the economic cycle.

In contrast, growth sectors bore the brunt of the market sell-off. Consumer Discretionary (-8.9% MTD) was hit by concerns over waning consumer spending power as inflation pressures lingered and tariff-driven price hikes loomed. Information Technology (-8.8% MTD) and Communication Services (-8.3% MTD) were dragged down by rising input costs, valuation compression, and fears of declining global demand, particularly in semiconductors and digital advertising. Investors also de-risked from richly valued tech names, which are more vulnerable to rising discount rates and policy uncertainty.

Source: Bloomberg.

The global REIT market remained under pressure in March, weighed down by persistent concerns over a higher-for-longer interest rate environment. While the sector continues to be one of the laggards in 2025 due to rising borrowing costs and cap rate compression, performance was mixed across regions. Notably, Singapore (+5.5% MTD), UK (+4.0%), and France (+3.4%) outperformed, supported by resilient fundamentals and attractive valuations.

Despite near-term headwinds, the medium-to-long-term outlook for REITs remains constructive. SREITs offer a compelling yield spread of 2.5%, the third highest globally, and trade at a discounted Price-to-Book of 0.87, presenting value and income opportunities. We maintain a positive view on resilient and recession-proof subsectors such as Industrial and Data Center SREITs, which are better insulated from economic volatility. Additionally, Singapore-focused Retail and Grade-A Office players stand to benefit from resilient domestic demand, a constrained supply pipeline over the next 3-5 years, and potential re-rating opportunities due to current valuation mispricing.

EQUITY MARKET OUTLOOK

Source: Bloomberg.

Source: Bloomberg.

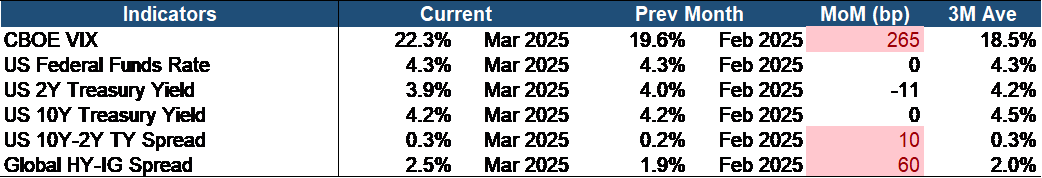

By the end of March, investors have turned decidedly risk-off amid escalating macro uncertainties. The equity fear index (VIX) rose sharply by 265 bps MoM, breaching its three-month average and signaling heightened investor anxiety. Meanwhile, the U.S. yield curve steepened modestly, driven by a pullback in the 2-year Treasury yield that reflected slower growth expectations in the longer term as the 10-year yield held steady. At the same time, credit spreads widened further in the corporate bond market, underscoring deteriorating risk sentiment and rising concerns over credit quality and liquidity conditions.

Source: Bloomberg.

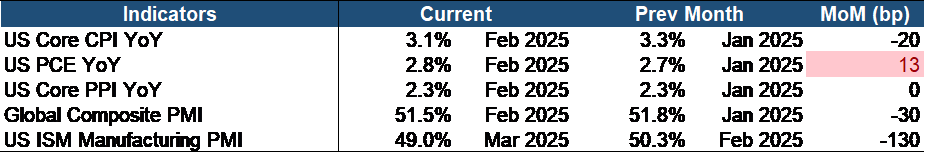

Key economic indicators are signaling some concerning trends. Inflation continues to be persistent, with core CPI remaining unchanged and the Personal Consumption Expenditures (PCE) index, a critical gauge for the Federal Reserve, rising to 2.8%, still significantly above the 2% target. The Producer Price Index (PPI) remains flat, while both the global and U.S. manufacturing PMIs showed signs of slowing, with the U.S. manufacturing PMI notably dipping into contractionary territory.

The equity markets are grappling with a challenging landscape, shaped by persistent inflationary pressures and the ongoing repercussions of trade policies. Nevertheless, we maintain a positive outlook for equities in the medium-to-long term, as opportunities are expected to outweigh the risks. The U.S. economy saw a 2.3% YoY growth in 4Q24, driven by strong consumer spending and rising incomes. It also added far more jobs than expected in March according to the latest employment report. However, this optimism has been tempered by the introduction of new tariffs by President Trump, which could further elevate inflationary pressures and increase costs across various sectors. These developments have amplified concerns of a potential slowdown, with geopolitical instabilities as well in the picture.

Despite the current volatility, a significant amount of capital remains uninvested. As of early April 2025, approximately $7 trillion is sitting in money market funds, signaling that once investor sentiment stabilizes, there is a substantial amount of capital ready to move into equities. Furthermore, corporate fundamentals remain solid. According to FactSet, for the 485 of S&P 500 companies that have reported their 4Q24 results, approximately 74% have posted positive EPS surprises, exceeding LT average of 67%. The strength of corporate earnings and economic indicators suggests that the economy is resilient, even amid rising trade tensions.

Looking ahead, we anticipate a brief period of heightened volatility in global equity markets as investors price in the full impact of the recently implemented tariffs and recalibrate earnings expectations accordingly. While the near-term outlook remains clouded by persistent inflationary pressures, ongoing geopolitical instability – including tensions in the Middle East and continued US-China trade friction -and uncertainty around global monetary policy, the medium and long-term trajectory appears to remain constructive. With a substantial amount of dry powder still on the sidelines, resilient fundamentals, and transformative growth prospects driven by AI adoption and digital infrastructure investments, equities are well-positioned for a rebound as macroeconomic visibility improves and central banks pivot towards a more accommodative stance.

CHINA MARKET UPDATE

There has been some stabilization in the macros for the China economy over the course of 2025 so far. On domestic consumption, the total retail sales of consumer goods went up by 4.0% year-over-year from January to February — lower than the long-term trend, but relatively stable compared to the near-term trend. With the policy support of the “trade-in old-for-new”, consumption continued to experience a moderate recovery. The fixed-asset investment from January to February increased by 4.1% year-over-year, with manufacturing and infrastructure investment making up for the weakness in real estate investment. Thus the domestic leg of China’s “dual circulation” economy has been relatively stable, weakness in housing notwithstanding. Over the same period, exports increased by 2.3% year-over-year, which has been a big drop from the previous 10% year-over-year level. Driven by Trump’s imposition of tariffs on exports, the previous rush to front-load trade on exports has basically come to an end. Uncertainties have increased in exports; the external leg of the “dual circulation” economy is more worrying from here.

A key event in March was China’s annual legislative sessions, known as the “Two Sessions”, where the political elite gather to decide the policy direction for the country. With the US now targeting China as its main strategic competitor, coupled with various domestic challenges such as chronic excess supply of demand (as reflected by drops in purchaser price index) as well as lack of confidence in the housing sector, the meetings have taken on an added level of significance. The government work report released at this year’s “Two Sessions” confirmed that the growth target for 2025 would remain at around 5%, which reflected the government’s commitment to incur fiscal deficit of 4% GDP to increase spending and support the economy.

Stock market wise, the Hong Kong and mainland China stock markets maintained their relatively buoyant momentum in March, after a strong February when they outperformed other markets around the globe, in particular the technology sector.

At time of writing, “Liberation Day” in the US on 2 April has unveiled the new broad-based tariffs on all countries that US President Trump has promised. It has largely been seen as much worse than expected, with at least 10% broad-based tariff on all imports into the US, and going up to 50-100% for certain countries, under Trump’s “reciprocal tariff” approach for countries that he sees as having adopted protectionist trade policies. There are several ways that the rest of the world could react to this: retaliate, negotiate or stimulate (domestically). We think the response of various countries would have a big bearing on how the end result pans out for the global economy, including China’s. One thing is certain: In case that subsequent economic data perform worse than expected as a result of the trade war, incremental policies are expected to be rolled out with greater intensity within China to boost it towards its 5% target 2025 GDP. It certainly has the capacity to do so.

FIXED INCOME UPDATE

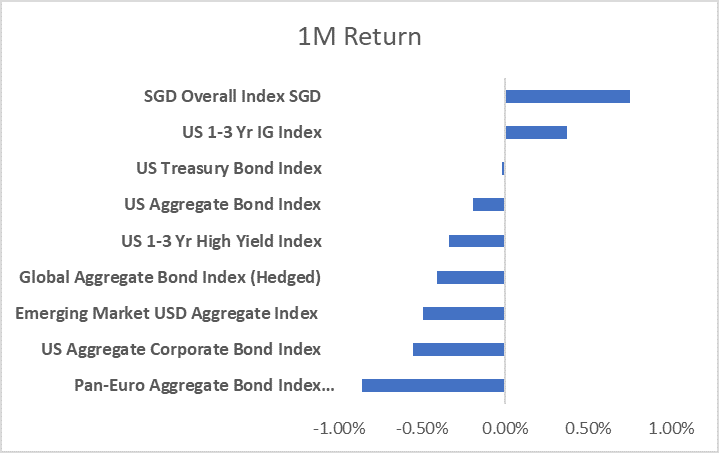

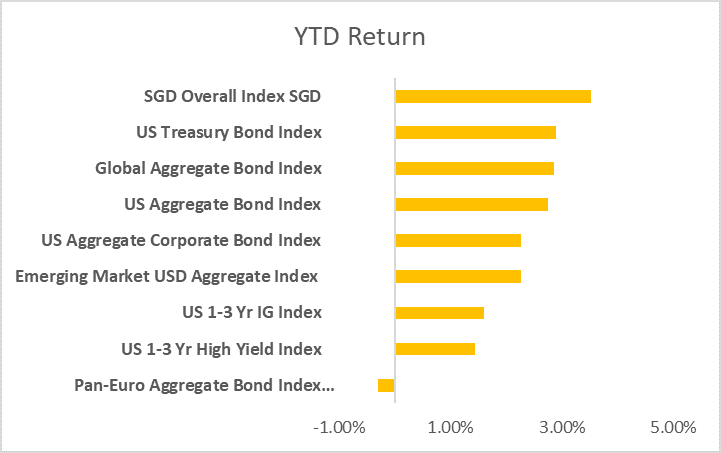

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

March was a weak month for fixed-income returns, with most major bond indices down slightly. The two exceptions were the SGD index and the US short-duration space which returned 0.75% and 0.37% respectively. The Singapore dollar appreciated modestly against the greenback in the month of March which could have contributed to the outperformance of the SGD index.

Year-to-date, bond market returns are generally in positive territory. This is in line with the decline in US treasury yields since the start of the year. The announcement of sweeping tariffs by the Trump administration has raised concerns about a potential global economic slowdown and has forced investors to seek the safety of US treasuries driving up their prices and pushing yields lower. As of this writing, the market is also pricing in about two to three 25bps rate cuts by the FED as the most probable outcome for the interest rate trajectory heading into year-end.

Though most of the major indices being tracked are up on a YTD basis, one notable exception is the Pan-Euro Aggregate Bond Index which is down 0.3% and is a laggard on the year. We will discuss more about the reasons for this in the next section.

Germany’s Fiscal Acceleration: The End of the Debt Brake Era

Germany is poised to undertake a transformative fiscal stimulus plan, marking a significant departure from its traditional fiscal conservatism, particularly with the easing of its “debt brake.” Triggered by the election of Christian Merz as Chancellor, this shift reflects his commitment to addressing domestic and global challenges through increased spending. The proposed constitutional amendment would allow for unprecedented borrowing to fund defense, infrastructure, and climate initiatives, with a projected impact of up to €1 trillion.

The fiscal expansion plan sent German sovereign bond yields surging. The 10Y bund yield spiked to almost 2.9%—its highest level since October 2023. The sell-off was not just confined to Germany with other Eurozone government bond yields rising in sympathy alongside German Bunds reflecting heightened inflation expectations and increased borrowing across the Eurozone.

Under Merz’s leadership, Germany’s fiscal recalibration is set to redefine the nation’s economic identity. Once a staunch advocate of austerity, the country is now signaling a readiness to leverage fiscal flexibility to achieve long-term strategic goals. This historic shift could be the catalyst for a broader re-evaluation of economic paradigms across the Eurozone. It will be worth monitoring in the coming months how Germany’s fiscal expansionism impacts inflationary pressures and bond yields in the Eurozone, especially at a time when the European Central Bank is in a policy easing cycle.

OUR VIEW

Chinese Stimulus and German Fiscal Support Signal Shifting Global Dynamics

Recent fiscal measures out of Germany, alongside China’s ongoing stimulus efforts, suggest that the era of U.S. economic outperformance—or “U.S. exceptionalism”—may be beginning to wane.

Ironically, a potential moderation in U.S. growth could be a net positive for emerging market (EM) fixed income. Slower U.S. momentum may lead to a more dovish Fed, easing global financial conditions and lowering pressure on EM currencies and interest rates. Combined with improved growth prospects in key global economies, this could create a more supportive backdrop for EM debt markets.

Investors may want to monitor this shift closely, as it could mark the start of a more balanced global recovery—one where opportunities extend beyond the U.S.

In Summary

As global dynamics shift and U.S. dominance shows signs of softening, investors may find renewed opportunities in emerging markets and beyond. Yet, with an increasingly unpredictable macro landscape, risk management remains paramount. Our approach—anchored in flexibility, discipline, and tactical portfolio construction—offers a compelling blueprint for navigating both the known and the unknowable. In today’s market, staying nimble may be just as important as staying informed.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.