Market Commentary – April 2025

EQUITY MARKET UPDATE

Source: Bloomberg (Total Return in USD terms)

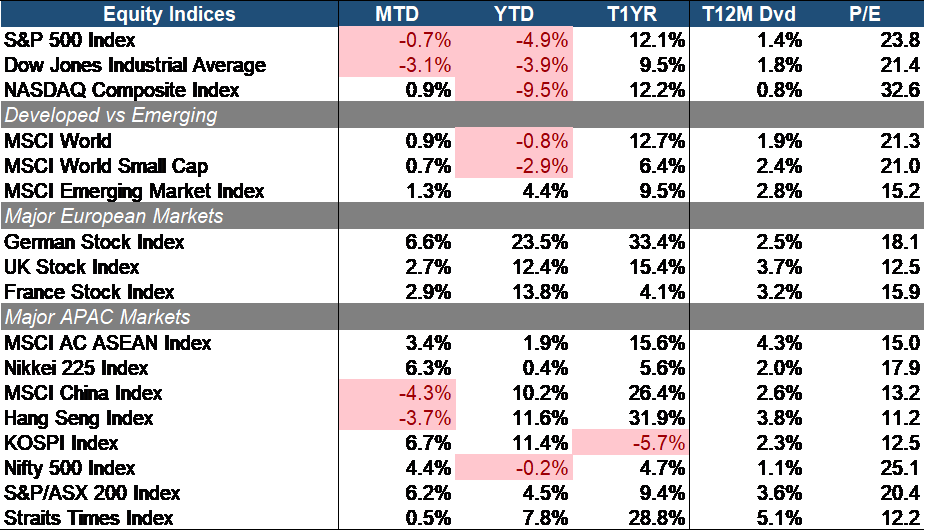

The stock market extended its retreat by the end of April, primarily driven by deteriorating sentiment amid escalating tariff tensions between the two global superpowers – the US and China. These developments raised concerns over potential economic slowdowns and added inflationary pressure. Growth stocks were hit hardest, with the NASDAQ Composite (-3.1% MTD) underperforming both the Dow Jones Industrial Average (+0.9% MTD) and the S&P 500 Index (-0.7% MTD). Overall, the US stock market emerged as the worst-performing region globally year-to-date.

Developed market equities continued to lag their emerging market counterparts. The MSCI World Index (+0.9% MTD) underperformed the MSCI Emerging Markets Index (+1.3% MTD). Small caps (+0.7% MTD) posted the weakest performance, reflecting a broader risk-off sentiment in the market. Developed regions such as the US and Europe faced mounting headwinds due to the uncertainty surrounding trade negotiations, whereas emerging markets showed greater resilience.

European equities, particularly the German market (+6.6% MTD), fared better. Most ASEAN markets outperformed on a relative basis as well, with the exception of China and Hong Kong equities (-4.3% to -3.7% MTD). Meanwhile, South Korea (+6.7% MTD), Japan (+6.3% MTD), and Australia (+6.2% MTD) were among the top performers, supported by capital outflows from the US following President Trump’s “Liberation Day” declaration, as investors sought alternative investment opportunities. China and Hong Kong came under early pressure due to the direct impact of tariffs. Singapore (+0.5% MTD) remained relatively steady after a rebound in early April, supported by resilient economy and regional financial hub status, which helped buffer against broader trade-related volatility.

Source: Bloomberg (Total Return in USD terms)

Source: Bloomberg (Total Return in USD terms)

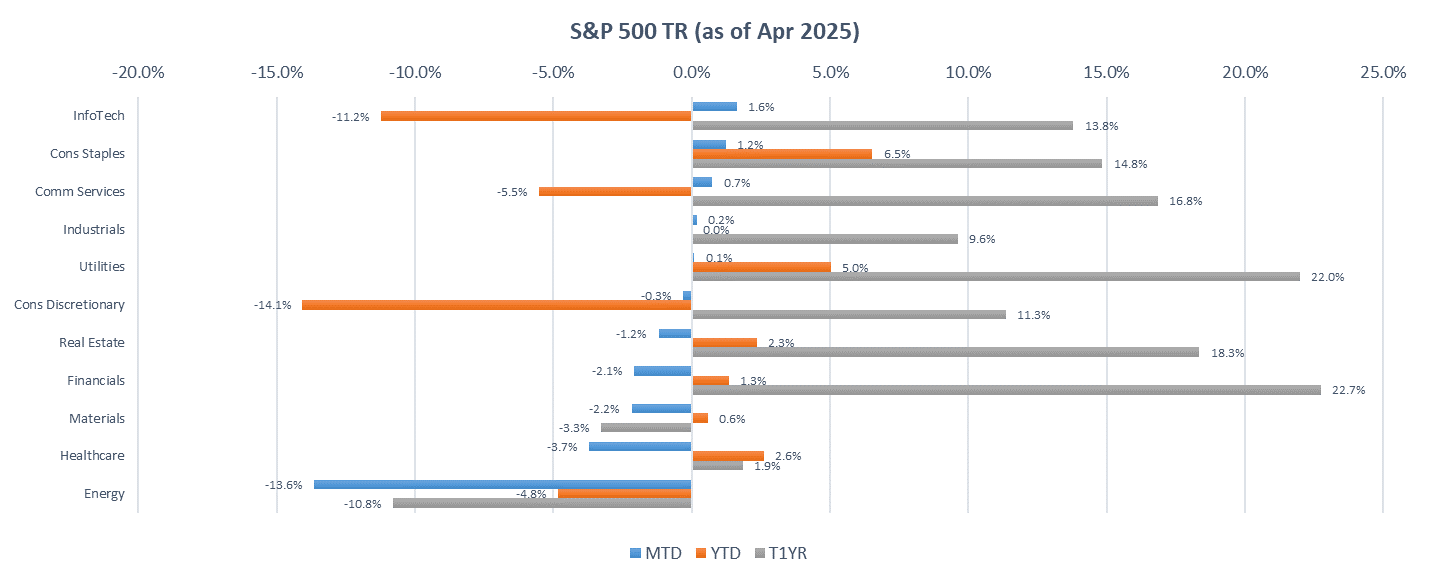

Sector performance was mixed amid ongoing trade discussions and recession concerns. Some investors saw value in oversold tech names, while others adopted a more defensive stance. Growth-oriented sectors such as Information Technology (+1.6% MTD) and Communication Services (+1.2% MTD) led the way, along with the defensive Consumer Staples (+0.7% MTD).

On the other hand, Energy (-13.6% MTD), Healthcare (-3.7% MTD), and Materials (-2.2% MTD) underperformed. Energy and Materials were pressured by negative sentiment surrounding business cyclicality, while Healthcare (particularly Big Pharmas) faced a sell-off spurred by heightened regulatory scrutiny and drug pricing reforms being put forward by the Trump administration.

Source: Bloomberg (Total Return in USD terms)

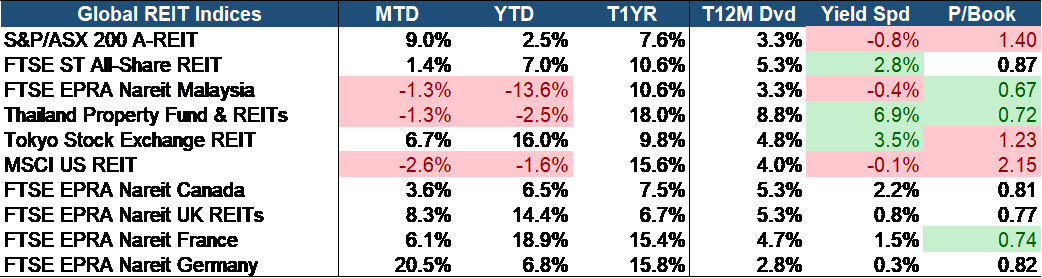

The global REIT markets largely rebounded from the previous month’s selling pressure, as the Fed maintained its rate pause amid mixed inflation expectations and resilient labor market data. Any indication of a more dovish Fed stance would be a positive catalyst for the REIT sector, which has been weighed down by rising borrowing costs and cap rate compression. Overall performance across regions was mixed. Notably, Germany (+20.5% MTD), Australia (+9.0% MTD), and the UK (+8.3% MTD) outperformed, supported by resilient fundamentals and attractive valuations.

Despite near-term headwinds, the medium-to-long-term outlook for REITs remains constructive. Singapore REITs (+1.4% MTD) continue to offer a compelling yield spread of 2.8%, the third highest globally and currently trade at a discounted Price-to-Book ratio of 0.87, presenting both value and income opportunities. We maintain a positive view on resilient and recession-proof subsectors such as Industrial and Data Center SREITs, which are better insulated from economic volatility. In addition, Singapore-focused Retail and Grade-A Office players are expected to benefit from resilient domestic demand, a constrained supply pipeline over the next 3–5 years, and potential re-rating opportunities due to current valuation mispricing.

EQUITY MARKET OUTLOOK

Risk-Off Sentiment Deepens Amid Macro Uncertainty and Widening Credit Spreads

Source: Bloomberg.

Source: Bloomberg.

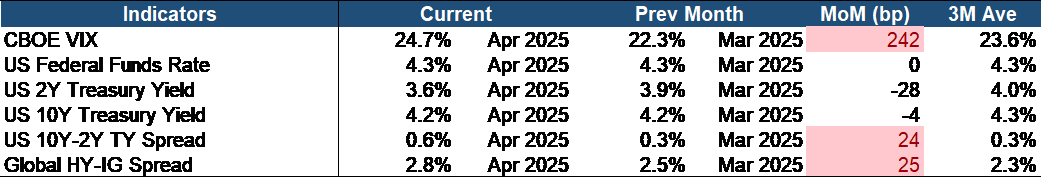

By the end of April, investor sentiment turned decisively risk-off amid escalating macroeconomic uncertainties. The equity fear index (VIX) rose sharply by 242 bps MoM, surpassing its three-month average and signaling heightened investor anxiety. Meanwhile, the U.S. yield curve steepened modestly, led by a more bullish move in the 2-year Treasury yield, reflecting improved short-term growth expectations, while the 10-year yield remained steady. At the same time, credit spreads widened further in the corporate bond market, highlighting deteriorating risk sentiment and rising concerns over credit quality and liquidity conditions.

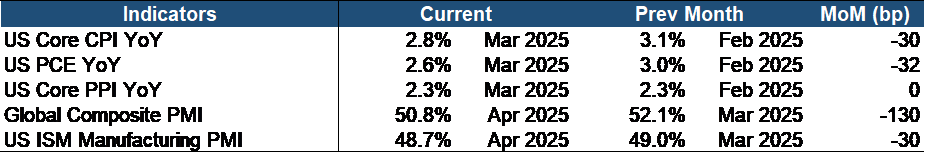

Macroeconomic Trends Reflect Lingering Inflation and Slowing Manufacturing Activity

Source: Bloomberg.

Key economic indicators are signaling some concerning trends. Inflation continues to be persistent despite signs of cooling down. Core CPI and the PCE index, a critical gauge for the Federal Reserve, have fallen MoM below 3% although still significantly above the 2% target. The leading PPI remains flat however, showing that inflation is still not out of the picture. Both the global and U.S. manufacturing PMIs continued to slow, with the U.S. manufacturing PMI notably dipping deeper in contractionary territory.

Short-Term Pressure on the USD, but Long-Term Fundamentals Remain Strong

We hold a negative-to-neutral view on the USD in the near term, as uncertainties surrounding new tariffs are expected to fuel higher prices and weigh on economic growth. Additionally, investor outflows in search of better growth opportunities in other markets may further add pressure.

However, the long-term outlook remains positive, supported by resilient economic fundamentals. While the Fed appears to be leaning toward a monetary policy pause or potential easing, robust labor market data and improving current account and fiscal deficits are likely to underpin renewed demand for the USD. Moreover, the lack of a viable alternative to the U.S. dollar as the world’s reserve currency reinforces its long-term strength. Its dominance is underpinned by unmatched characteristics – i.e. having the most liquid bond market, a strong legal structure, and its role as the primary currency for global financial transactions.

Market Volatility Persists, But Long-Term Drivers Remain Solid

The equity markets are navigating a challenging landscape marked by persistent inflationary pressures, geopolitical instability, trade wars, and uncertainty around global monetary policy. Despite these headwinds, we maintain a constructive medium-to-long-term outlook for equities, as opportunities are expected to outweigh the risks. While near-term volatility is likely to remain elevated, particularly as investors digest the impact of newly implemented tariffs and adjust earnings expectations, the broader trajectory appears positive. Notably, the stock market is trading at an 5-8% discount, this is a sufficient margin of safety for long-term investors. 1Q25 earnings have largely indicate that corporate fundamentals also remain solid. Moreover, transformative secular growth drivers such as AI adoption and digital infrastructure investments continue to provide a compelling backdrop for long-term equity performance. As macroeconomic visibility improves and central banks pivot toward a more accommodative stance, equities are well-positioned for a rebound.

CHINA MARKET UPDATE

For April, the A-share market underwent a roller-coaster performance, much like the rest of the world, on the back of the new “Liberation Day” tariff regime announced by US President Trump and a subsequent temporary reprieve as he delayed their implementation. Both the key Shanghai Composite Index and the Shenzhen Component Index ended down for the month, even after the rebound within the month. The risk-aversion sentiment increased ahead of the China May holiday, with some investors choosing to take profits and exit the market. Towards month-end, trading volume continued to shrink, reflecting a decline in market enthusiasm. Overall, with the earnings season having concluded and external shocks gradually easing, the A-share market may be entering a relatively balanced phase.

In terms of sector performance, generally the outperformers for the month were the Utilities and Consumer Discretionary sectors, while more cyclical sectors such as Technology, Materials and Consumer Discretionary sectors were laggards. Overall, the market is likely to continue a structurally driven trend powered by both policy and earnings, with technology sectors such as Media and Computers maintaining a prominent position as key medium- to long-term themes.

Valuations of A-shares remain relatively low. The PE valuation percentiles for the Wind All A Index, Shanghai Composite Index, and CSI 300 are 59%, 62%, and 50%, respectively. The top three industries by historical PE valuation percentile are Real Estate (99%), Computers (93%), and Steel (79%), while the bottom three are Telecommunications (8%), Agriculture, Forestry, Animal Husbandry & Fishery (9%), and Non-bank Financials (11%). Currently, the industries with the lowest absolute PE (TTM) ratios are Banking (6.43x), Insurance (7.80x), and Construction (10.51x); those with the highest are Defence & Military (140.41x), Computers (140.13x), and Comprehensive Financials (96.02x). In terms of PB ratios, the lowest are Banking (0.65x), Construction (0.74x), and Real Estate (0.82x), while the highest are Alcoholic Beverages (4.79x), Computers (3.86x), and Electronics (3.53x).

The current capital market is exhibiting a structural divergence between equities and bonds. On the bond market side, supported in the short term by macroeconomic pressures and ample liquidity, the market has been steady. On the equity side, the “barbell strategy” of combining dividend-yielding and technology growth stocks is showing increasing allocation value. An approach of seeking earnings certainty within dividend assets while capturing the investment benefits of industrial breakthroughs in the technology growth sector may be fruitful for the equity investor in this market.

To elaborate further, against the backdrop of lingering uncertainty over Trump’s tariff policies and the sharper-than-expected drop in April’s PMI data, capital is being reallocated along more certain investment paths. Dividend-yielding sectors—such as banking and utilities—continue to attract capital inflows. Their high dividend characteristics in a low interest rate environment, providing defensive value for investors. This trend may further strengthen during the normalization of U.S.-China trade frictions, especially as narrowing net interest margins among China’s major banks limit the room for broad-based rate cuts, thereby highlighting the relative appeal of dividend assets.

On the other hand, the technology sector is showing strong recovery momentum driven by a triple resonance of policy support, capital inflows, and improving fundamentals. Policy-wise, signals from the latest Politburo meeting are highly targeted, indicating that the tech sector is returning to the spotlight. From a capital flow perspective, tailwinds are also favouring this sector, with strong buying interest in late April for sub-sectors such as the computer, electronics, telecommunications sectors, as well as market-leading inflows for robotics-themed ETFs. Fundamentally, following Q1 earnings releases, the market has entered a temporary earnings vacuum. The valuation correction pressure that previously weighed on the tech sector has eased, opening up room for a re-rating in areas with clear industrial trends such as robotics and computing infrastructure.

Looking ahead, investors should remain cautious of two key potential risks: first, if the U.S. Federal Reserve significantly delays its rate-cutting schedule, it could constrain China’s room for monetary easing via exchange rate pressures; second, if Trump’s tariff-related risks escalate beyond expectations, it may trigger a temporary reversal in risk appetite. In a complex and ever-changing macroeconomic environment, identifying policy anchors and trends with industrial certainty could be key to navigating through the cycle.

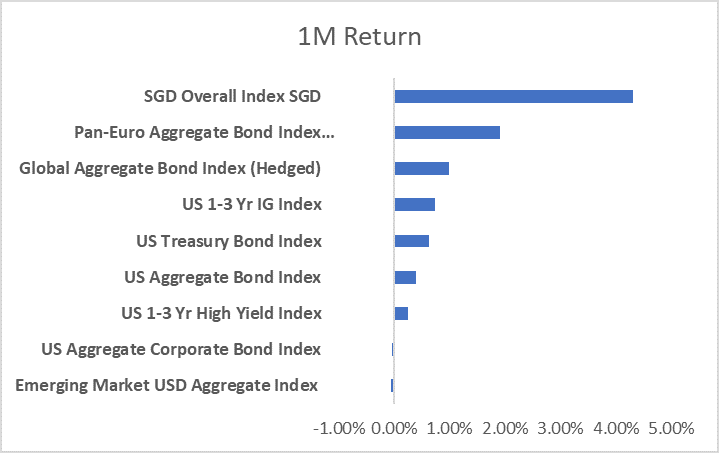

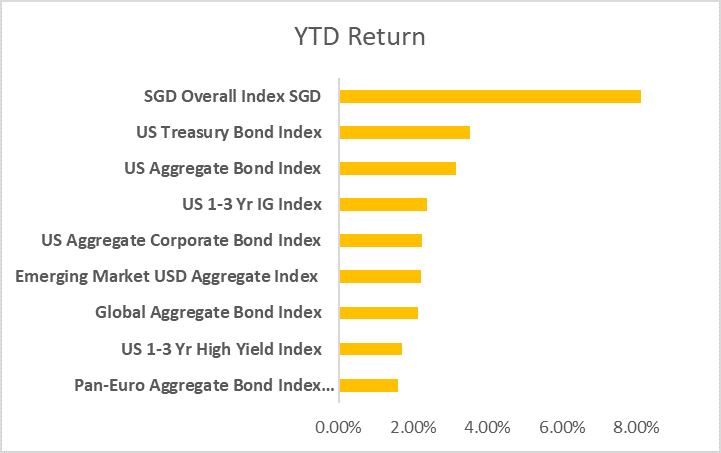

FIXED INCOME UPDATE

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

April was generally a positive month for most major global bond market indices with the exception of US corporate bonds and emerging market debt which ended the month slightly negative. While the global aggregate index and European bonds performed well, the SGD overall index was the key outperformer with a solid 4.32% gain on the month in USD terms. Much of the gain can also be attributed to the relative strength of the Singapore dollar relative to the greenback which has continued its slide on the back of US President Donald Trump’s tariff war which is likely to hurt the US economy.

All eyes will now be on the US Federal Reserve as it prepares to announce its latest interest rate decision on May 7. Despite mounting pressure from former President Trump to lower borrowing costs, the Fed is widely expected to maintain its current rate range of 4.25% to 4.50%, citing persistent inflation concerns and economic uncertainty. The recent wave of tariffs introduced by the Trump administration has further complicated the outlook, with policymakers wary of potential price increases that could delay future rate cuts. Investors will closely watch Fed Chair Jerome Powell’s remarks for any hints on the central bank’s next move, as markets brace for any further potential volatility in the month of May.

Trump’s Economic Gamble Meets the Wrath of Bond Traders

In April, we witnessed an ongoing saga as the bond market played a crucial role in restraining the Trump administration’s aggressive trade war policies. As tariffs escalated, bond investors reacted swiftly, triggering a sharp sell-off in U.S. government debt. As bond yields spiked, there were also several reports of hedge funds being forced to unwind leveraged basis trades which added further selling pressure on US treasuries. At one point during the turmoil, yields on 10-year Treasury notes surged to almost 4.5% which prompted several key members of the Trump administration to come out and make statements reassessing its stance on tariffs and fiscal policy which helped to assuage the fears of the bond market.

With inflation concerns mounting and stagflation looming, the administration faced intense pressure to recalibrate its approach. Ultimately, the bond market vigilantes sent a clear message: reckless fiscal policies would not go unchecked, and financial markets would hold the government accountable. Beyond just the immediate economic concerns brought on by tariffs, a loss in trust in US treasuries – the risk-free asset, could prove to be far more ominous and risk upending the current global financial system as we know it.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.