Food Security

- Rising global demand for food and climate change are straining agricultural systems, driving land use changes, supply chain risks, and food insecurity.

- Climate change threatens crop yields, especially in tropical regions like Southeast Asia, raising food prices and impacting capital markets.

Sometimes, the biggest question for many living in first-world countries is, “What should I eat today?” Such a question of privilege stems from economic development and globalization, which allow people in cities easy access to diverse food supplies. As people get richer, their diets often shift from one focused on carbohydrates to one focused on protein. However, this shift places a burden on agriculture, as more land, water, and energy are required to produce protein-rich foods. This burden is further compounded by global warming driven by anthropogenic factors. As countries pursue economic development beyond the Earth’s carrying capacity, natural resources and ecological systems become increasingly strained. Ultimately, if these systems collapse, food production could reach an irreversible tipping point.

Fig.1: Global Land Use for Food Production

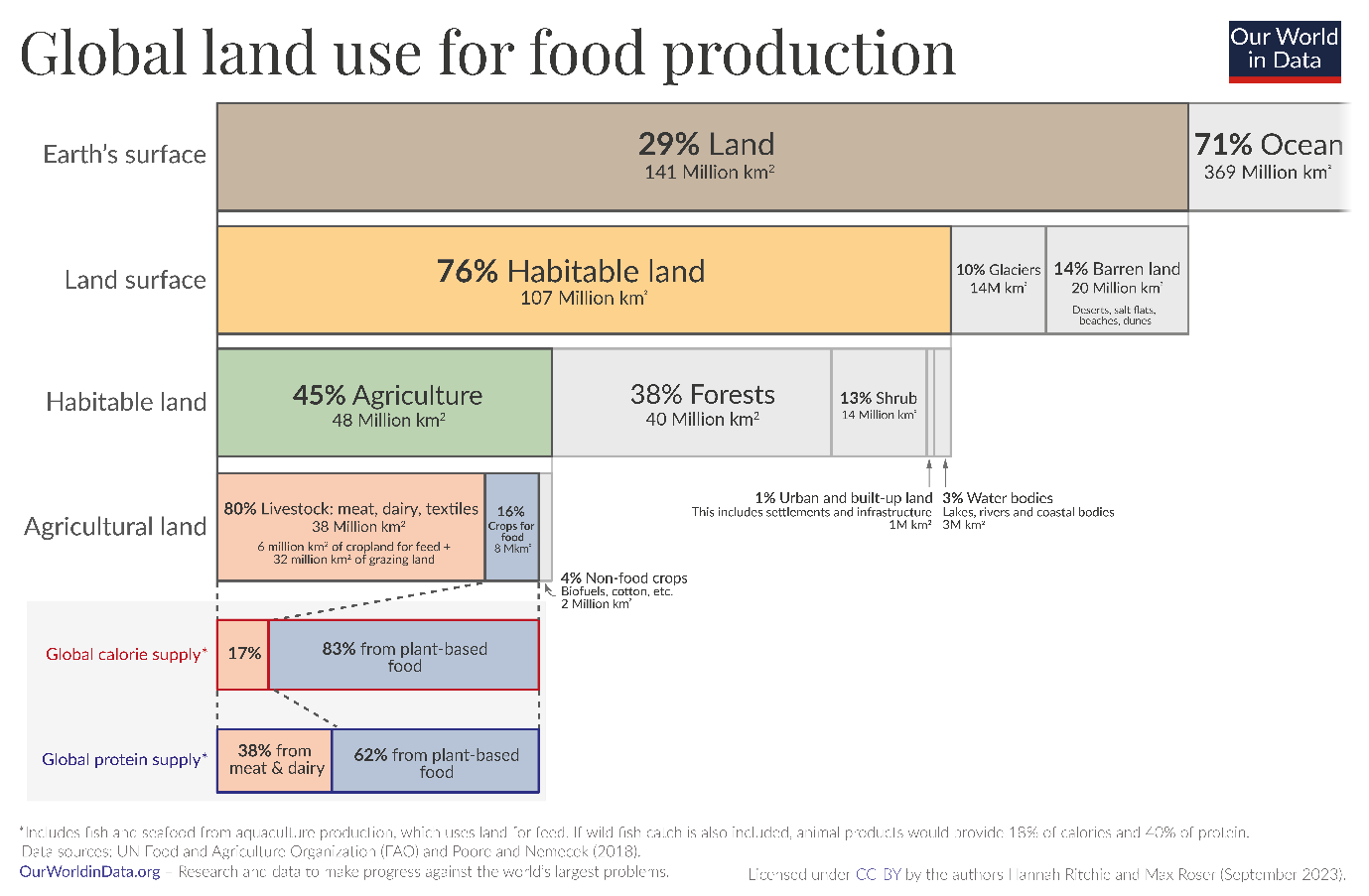

Today, nearly half (44%) of the world’s habitable land is used for agriculture, covering about 48 million square kilometers, roughly five times the size of the US. When global grazing land is combined with cropland used for animal feed, around 80% of agricultural land is dedicated to raising livestock for meat and dairy. With the rise of emerging economies lifting millions out of poverty, this figure is expected to increase further, driving greater land use to meet global food demand.

Food production is also tightly linked to weather conditions. The world’s climate systems regulate these conditions, but anthropogenic activities, such as the burning of fossil fuels, are disrupting them. Greenhouse gas emissions trap heat in the atmosphere, raising global temperatures and intensifying weather extremes like droughts, floods, heatwaves, and erratic rainfall. These shocks cascade into commodity markets, making food prices more volatile and futures contracts harder to price. The traditional assumption that past data is a reliable predictor of future performance is increasingly untenable.

Fig.2: Crop Failure

Because crops are highly sensitive to the environments in which they grow, these climatic shifts pose major challenges for maintaining stable yields. Researchers estimate that, under a high-emissions scenario, global calorie yields from staple crops could be 24% lower in 2100 compared to a world without climate change. This decline in supply, combined with rising global demand for both the quality and quantity of food, draws many countries towards food insecurity.

Fig.3: Chicken Rice

Although research shows that warming temperatures may reduce crop yields in tropical and subtropical regions, some temperate regions may experience gains. Unfortunately, this is not good news for tropical Singapore that relies heavily on food imports from neighboring countries that are also in the tropics. The rising temperature is likely to result in Southeast Asia’s regional food supply to decline. This could translate into higher import costs as supply chains extend further afield, amplifying consumer price inflation and potentially eroding disposable income. For capital markets, food system fragility is a systemic risk. Supply shocks can trigger price volatility and increase default risks for companies with thin margins. For a normal salaryman, this would mean an increase in the cost of enjoying a simple plate of chicken rice at the coffee shop.

As investors, we believe financial institutions play a critical role in channeling capital toward sustainable economic development. We favor companies that acknowledge the negative impacts their operations have on Earth’s systems. By embedding sustainability into strategy and aligning operations within the Earth’s carrying capacity, companies can reduce financial risks, safeguard the environment, and build long-term resilience.

The Blueprint

With the ever-changing landscape around us, it can get overwhelming to stay up-to-date. The Blueprint highlights pertinent global Environmental, Social, and Governance (ESG) issues and their importance to investors and the wider community. We look forward to engaging in discussions about the interconnections between climate, nature, and social outcomes that impact our investments and our futures.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.