Market Commentary – August 2025

EQUITY MARKET UPDATE

Source: Bloomberg (Total Return in USD terms)

Source: Bloomberg (Total Return in USD terms)

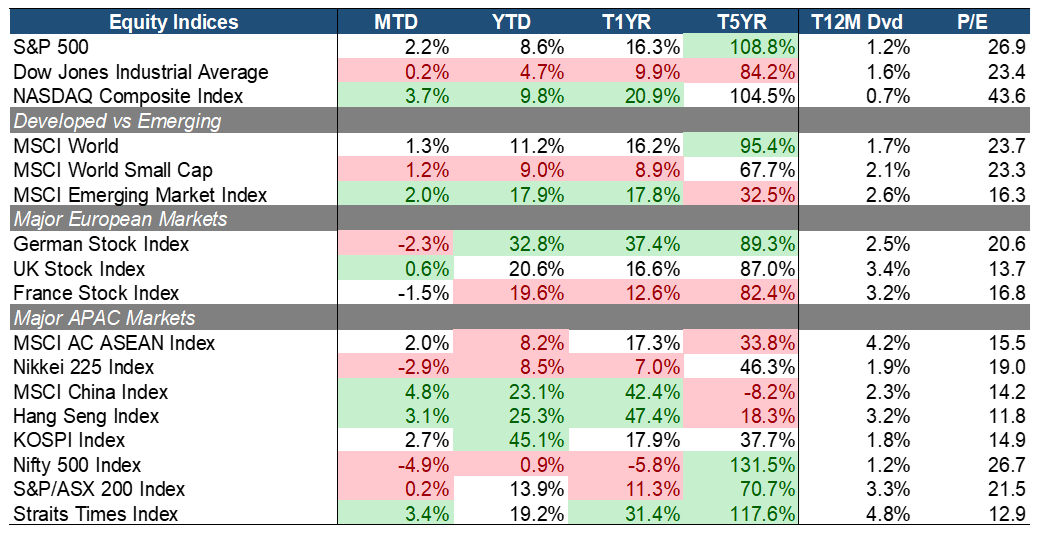

Global equity markets continued to grind higher in July, buoyed by resilient earnings, easing inflation expectations, and soft-landing optimism. US indices led the advance, with the NASDAQ (+3.7%) and S&P 500 (+2.2%) outperforming, supported by renewed strength in large-cap tech and AI-related names. Year-to-date (YTD), NASDAQ has returned +9.8%, with a trailing 1-year (T1YR) return of +20.9%, albeit with rich valuations (P/E: 43.6x).

Meanwhile, emerging markets continued their resurgence, with the MSCI EM Index gaining 2.0% MTD and 17.9% YTD, outpacing developed market peers. Notably, China and Hong Kong equities staged a robust comeback amid signs of policy support and bottoming fundamentals. The MSCI China Index jumped 4.8% MTD and is up 42.4% T1YR, while the Hang Seng Index surged 3.1% MTD and 47.4% T1YR, both offering attractive relative valuations (P/Es of 14.2x and 11.8x, respectively).

In Europe, performance was more mixed. The German DAX fell 2.3%, giving back some gains after a stellar YTD rally (+32.8%), while the UK and France markets posted muted returns, weighed down by macro uncertainty and FX headwinds. That said, UK equities remain relatively attractive on valuation, trading at 13.7x P/E with a solid 3.4% dividend yield.

Closer to home, sentiment was lifted by broad-based recovery across North Asia. Korea’s KOSPI rose 2.7% MTD and remains one of the best performers YTD at +45.1%, driven by semiconductor tailwinds. The Straits Times Index (STI) also gained 3.4% MTD, with a T1YR return of 31.4%, offering an appealing 4.8% dividend yield and a 12.9x P/E, underscoring its value proposition in a yield-seeking environment. Japan underperformed, with the Nikkei sliding -2.9% MTD, amid profit-taking and yen volatility.

Source: Bloomberg (Total Return in USD terms)

Source: Bloomberg (Total Return in USD terms)

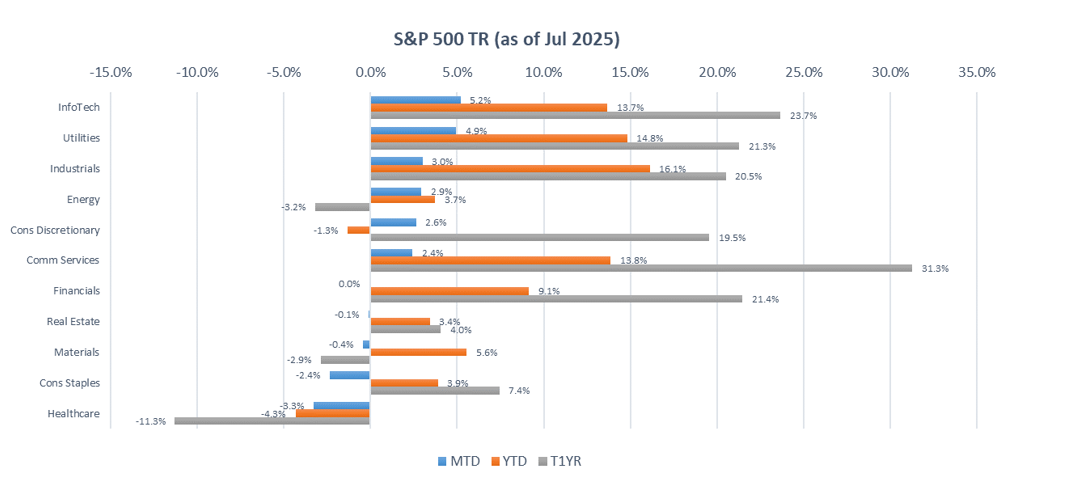

July’s market activity reflected continued investor enthusiasm for AI-driven growth, coupled with signs of resilience in cyclicals and selected defensives. Growth sectors remained at the forefront, while traditional defensives like Healthcare and Consumer Staples underperformed amid shifting inflation expectations and softening consumer sentiment. Information Technology (+5.2% MTD) and Utilities (+4.9% MTD) led the market, supported by ongoing enterprise demand for AI infrastructure and power grid upgrades. For example, Microsoft and Broadcom posted strong results, citing expanding cloud capex and AI accelerator demand, while regulated utilities benefited from improving margin outlooks amid falling input costs and more favorable rate case outcomes.

On the flip side, Healthcare (-3.3% MTD) and Consumer Staples (-2.4% MTD) were notable laggards. In Healthcare, drug pricing headwinds and lackluster earnings from major biotech and pharma players weighed on sentiment. Meanwhile, Staples faced pressure from slower retail sales and margin compression, reflecting a cautious consumer backdrop despite moderating inflation. Real Estate (-0.1% MTD) was flat as rate cut bets faded slightly after stronger-than-expected macro data, while lingering CRE weakness and tepid REIT earnings guidance limited upside. A slight risk-on bias favored Cyclicals such as Industrials (+3.0%) and Energy (+2.9%), the latter supported by geopolitical tensions and tightening crude inventories.

Source: Bloomberg (Total Return in Local Currency Terms)

Source: Bloomberg (Total Return in Local Currency Terms)

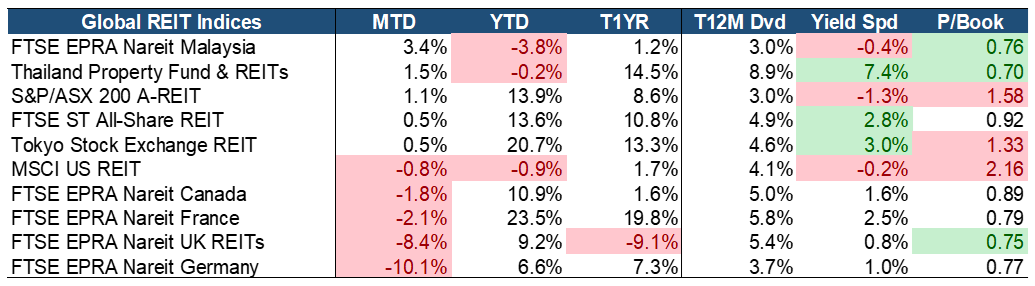

Global REITs delivered mixed performance in July, with top performers being Malaysia (+3.4% MTD), Thailand (3.4% MTD), and Australia (+1.1% MTD). Persistent inflation data reignited concerns over borrowing costs and resiliency of REITs dividends in the near term and has triggered the sell-off in some markets.

Valuations and yields remain attractive. Many REITs continue to trade below book value, with Price-to-Book (P/B) ratios under 1.0x. Singapore REITs (+0.5% MTD) stand out, offering a compelling 2.8% yield spread, the third-highest globally, and trading at a 0.87x P/B, reflecting both value and income potential. We maintain a constructive outlook on defensive and resilient subsectors such as Industrial and Data Center SREITs, which remain well-insulated from macroeconomic volatility. Additionally, Singapore-focused Retail and Grade-A Office REITs are well-positioned to benefit from robust domestic demand, a tight supply pipeline over the next 3-5 years, and valuation re-rating opportunities driven by current mispricing.

EQUITY MARKET OUTLOOK

Signs of Resilience Despite Sticky Yields and Repricing Risks

Source: Bloomberg.

Source: Bloomberg.

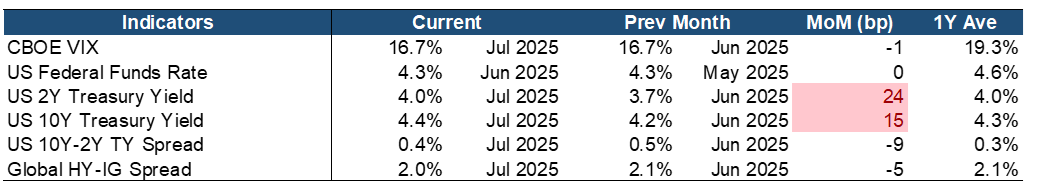

Market volatility remained subdued in July, with the CBOE VIX steady at 16.7%, well below its 1-year average of 19.3%, indicating continued investor calm amid steady earnings and AI-related optimism. Credit spreads tightened modestly, as the Global HY-IG spread narrowed to 2.0%, suggesting sustained risk appetite despite a slight pullback in equities mid-month. While investor conviction in a soft landing remains intact, incremental macro upside surprises and mixed inflation prints led to a repricing in front-end yields, pausing expectations for aggressive Fed easing.

The US yield curve bear-flattened again, with the 2Y yield rising to 4.0% (+30 bps MoM) and the 10Y yield up to 4.4% (+20 bps MoM), compressing the 10Y–2Y spread to 0.4%. This flattening reflects a recalibration of policy path expectations amid firmer inflation and labor data. The Fed Funds Rate held steady at 4.3%, and while markets still price in a potential cut by 4Q25, timing and magnitude have become less certain. Overall, investors appear to be navigating between optimistic growth prospects and lingering rate volatility.

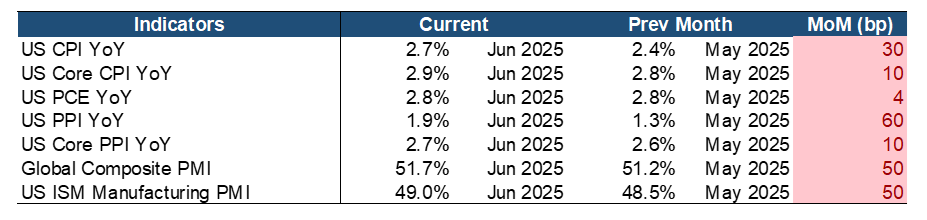

Persistent Inflation and Early Signs of Global Growth Stabilization

Source: Bloomberg.

Key macro indicators for June 2025 suggest inflationary pressures remain persistent but manageable, with underlying trends showing modest firming. Headline CPI rose to 2.7% YoY, while Core CPI edged up to 2.9%, driven by sticky shelter costs and rising import prices linked to recent tariff actions. The Fed’s preferred inflation gauge, Core PCE, held firm at 2.8%, underscoring the central bank’s continued caution. Meanwhile, Core PPI increased slightly to 2.7% YoY, pointing to building cost pressures at the producer level that may gradually feed through to consumer prices, despite some easing in headline PPI.

On the growth front, recent PMI prints show tentative signs of stabilization. The ISM Manufacturing PMI improved to 49.0 in June from 48.5 prior, marking the sixth straight month in contraction but with a slight rebound in production. More encouragingly, the Global Composite PMI rose to 51.7, helped by resilient services activity. While manufacturing remains soft, global demand conditions appear to be gradually normalizing as supply chains adjust and credit conditions ease modestly.

Overall, while inflation has not meaningfully reaccelerated, the lack of broad-based disinflation and firm consumer spending suggest the Fed will maintain a data-dependent pause for now. Improving PMIs, coupled with modest growth momentum and easing financial conditions, provide a more constructive backdrop for risk assets as we move into 2H25. However, lingering tariff impacts and labor market developments will remain key swing factors for the monetary policy outlook.

Constructive Outlook Amid Volatility, Policy Ambiguity, and Rising Political Risks

Equity markets remain resilient despite a complex macro backdrop characterized by persistent inflation, delayed Fed policy easing, geopolitical tensions, and weak industrial activity. Investor sentiment has been buoyed by optimism around AI-driven productivity gains, a robust labor market, and steady consumer spending. With global equities trading at a dispersed premium and discount to fair value, selective long-term opportunities continue to emerge.

Corporate earnings in 1Q25 were broadly solid, led by tech sector strength underpinned by structural trends in AI adoption, cloud infrastructure, and automation. Market breadth has improved modestly beyond mega-cap names, while stabilizing inflation and tighter credit spreads offer additional support. Nonetheless, near-term volatility remains likely, given narrowing market leadership and ongoing policy uncertainty.

Political risks add another layer of complexity, with concerns over the Fed’s institutional independence under a potential Trump administration raising questions about future monetary policy direction. While such developments could impact market confidence, continued disinflation and improving macro data could pave the way for policy easing in 2H25, providing a constructive medium-term backdrop for risk assets.

CHINA MARKET UPDATE

July saw some significant developments which pointed to some optimism for the China economy.

Externally, eyes are on the crucial bilateral relationship between China and the United States, with particular emphasis on the US tariff developments in recent months. To this end, there have been three rounds of US-China trade talks in less than three months, with the tariff truce set to expire on 12 August; the US have hinted on an extension of this deadline. Meanwhile, the US has already had preliminary tariff agreements with other major economies such as the European Union and Japan already. Meanwhile, the US lifted some export licence requirements for chip design software sales in China, and also appeared to allow resumption of sales of high-end artificial intelligence accelerator chips to China from Nvidia, signalling that it was ready to exercise flexibility in order to finalise a deal with China.

Domestically, China’s 2Q25 GDP data showed that the economy remained resilient, with growth year on year recorded at a better than expected 5.2%. In particular, industrial output, supported by export demand, saw growth of 6.8% year on year outpaced expectations, while retail sales growth of 4.8% was relatively muted.

The ruling party held its Politburo meeting in mid-July. It continued to emphasise many of the key messages from the previous years. It signalled that policy stance would remain supportive, and emphasised its focus on building domestic demand and supporting the hardest hit exporters. What caught market attention was official acknowledgment of the need to curb “involution” (or “neijuan”), a term for excessive and destructive internal competition between companies in many industries such as solar equipment, electric vehicles and even e-commerce. This has been a major factor in price deflation and also caused unsustainable profit margins that are forcing many manufacturers out of business.

The next important policy meeting to look forward to are the Fourth Plenum meetings which would be held in October. These would lay down proposals for the 15th Five Year Plan.

The MSCI China A 50 Connect index, which tracks leading China A shares listed on the Shanghai and Shenzhen exchanges across a range of sectors, maintained its recent strength within the month. It delivered total return of 4.5% within the month of July.

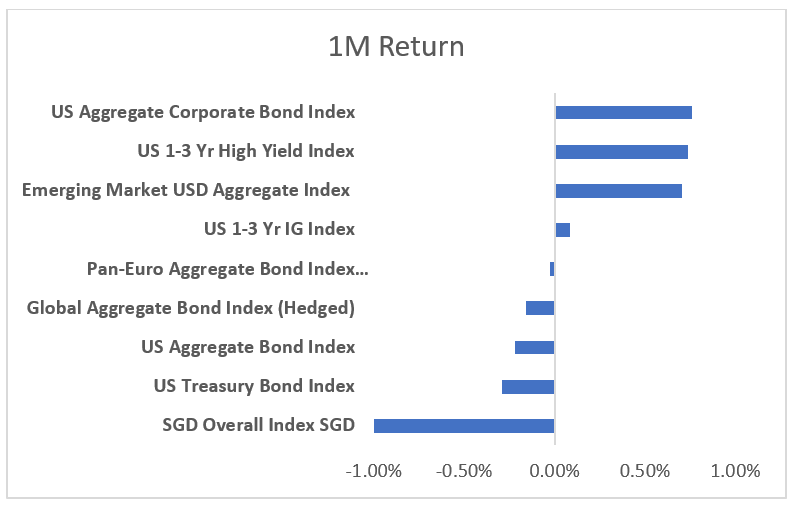

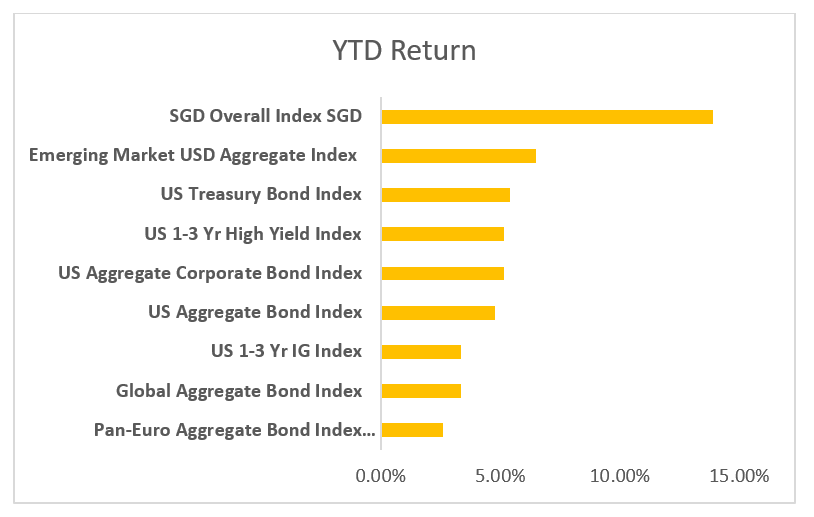

FIXED INCOME UPDATE

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

Global bond markets delivered mixed results in July, with considerable performance dispersion across the major indices. Short-duration U.S. credit—both investment grade and high yield—posted modest gains, supported by higher front-end yields which enhanced carry appeal. Emerging market debts outperformed, rising 0.7%.

Singapore dollar bonds fell 1.1% in USD terms, though they remained positive in local currency as the US dollar’s July strength weighed on FX-adjusted returns. Core U.S. benchmarks including the Aggregate Bond Index and Treasuries remained flat, as hawkish Fed signals pushed back rate-cut expectations and kept yields elevated.

Year-to-date, Singapore bonds still remain a strong outperformer delivering about 14%, well ahead of global peers. Their safe-haven appeal, underpinned by a AAA sovereign rating, currency strength and a stable policy backdrop—continues to attract investors navigating a fragmented macro environment. Emerging market credit has also performed strongly year-to-date, supported by USD weakness, improving fundamentals and an attractive yield premium over developed market credit. As Warren Hyland, portfolio manager at Muzinich & Co., notes, a combination of better-than-expected data in several regions and rising commodity prices have helped keep EM credit spreads stable.

Turning Point: Labour Market Weakness Forces Potential Policy Recalibration

In early to mid-July, the Federal Reserve struck a firmly hawkish tone, emphasizing inflation vigilance and signalling no imminent policy shift. At July 30 press conference, Chair Jerome Powell reinforced this stance, citing a “broadly balanced” labour market and lingering inflationary risks. Rate futures mirrored this caution, pricing the probability of a September cut at below 40%.

The landscape shifted sharply on August 1, after the July jobs report delivered a significant downside surprise. Nonfarm payrolls rose by just 73,000, well below expectations, while downwards revisions to May and June erased a combined 258,000 jobs—the largest two-month downward cut in 46 years. The unemployment rate rose to 4.2%, and labour force participation softened, revealing a softer labour market backdrop than previously assumed.

Markets responded swiftly to the weak jobs data. The 2-year Treasury yield tumbled more than 25bps in a single session, while rate futures repriced aggressively repriced, lifting the probability of a September cut to over 90% as of this writing. The dovish pivot was further reinforced by the resignation of Fed Governor Adriana Kugler, creating an opening for a Trump-nominated successor expected to lean toward policy easing.

This abrupt policy repricing is reverberating across global bond markets, influencing curve positioning, FX hedging strategies, and valuation dispersion within credit. As expectations for U.S. rate cut build, a bull steepening of the yield curve could revive interest in duration extension and other tactical steepening trades.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.