The Importance of Circularity in Critical Minerals and Rare Earths

- Critical minerals and rare earths are essential to renewable energy and modern technologies, including batteries, wind turbines, EV motors, and semiconductors.

- Building a circular economy through recycling and resource recovery is key to ensuring long-term supply chain resilience, reducing environmental impacts from mining, and supporting UN Sustainable Development Goals.

Fig.1: Critical Minerals and Rare Earths

The use of critical minerals and rare earths (CMRE) are essential for today’s energy technologies and the future. Different technologies rely on different mineral resources. Lithium, nickel, cobalt, manganese, and graphite are key to battery performance, while rare earth elements are vital for the permanent magnets used in wind turbines and electric vehicle motors. Electricity networks also require large amounts of aluminium and copper, with copper serving as the backbone of all electricity-related technologies. As demand surges, securing the CMRE supply chain is paramount.

With COP30 approaching, we mark a decade since the Paris Agreement in 2015, shifting from negotiation to implementation. As climate action accelerates, the use of renewable energy has also grown. The IEA’s 2025 renewable forecast projects that global renewable power capacity will double by 2030, rising by 4,600 gigawatts. Renewable energy depends heavily on CMRE and without them, the global energy transition is at risk.

Beyond the energy transition, advanced technologies also depend on these resources. The rise of artificial intelligence (AI) has driven rapid growth in data centres and demand for high-powered graphic processing units (GPUs). The semiconductor industry, which powers computers, phones, fighter jets, and satellites, relies heavily on CMRE. This highlights the extent of modern technology’s dependence on these finite resources.

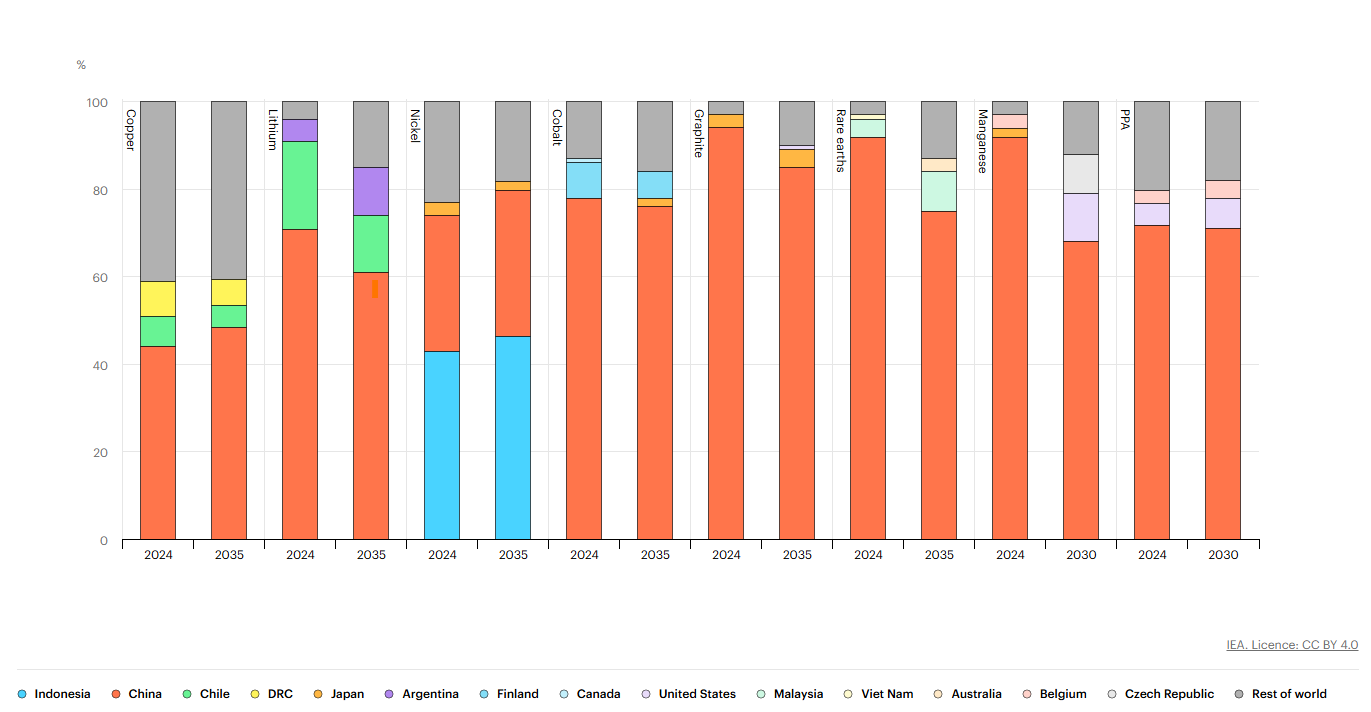

Fig.2: Geographical distribution of refined material production for key minerals in the base case.

Source: IEA (2025), Geographical distribution of refined material production for key minerals in the base case, IEA, Paris https://www.iea.org/data-and-statistics/charts/geographical-distribution-of-refined-material-production-for-key-minerals-in-the-base-case, Licence: CC BY 4.0

Currently, the supply of CMRE is concentrated in only a few nations, exposing a major vulnerability in the global supply chain. China controls about 70% of global mining and 90% of processing for CMRE. Recent tensions between China and the United States, such as China tightening controls on rare earth exports and the U.S.’s counter tariffs have triggered market volatility, showing how deeply these materials are tied to global capital markets.

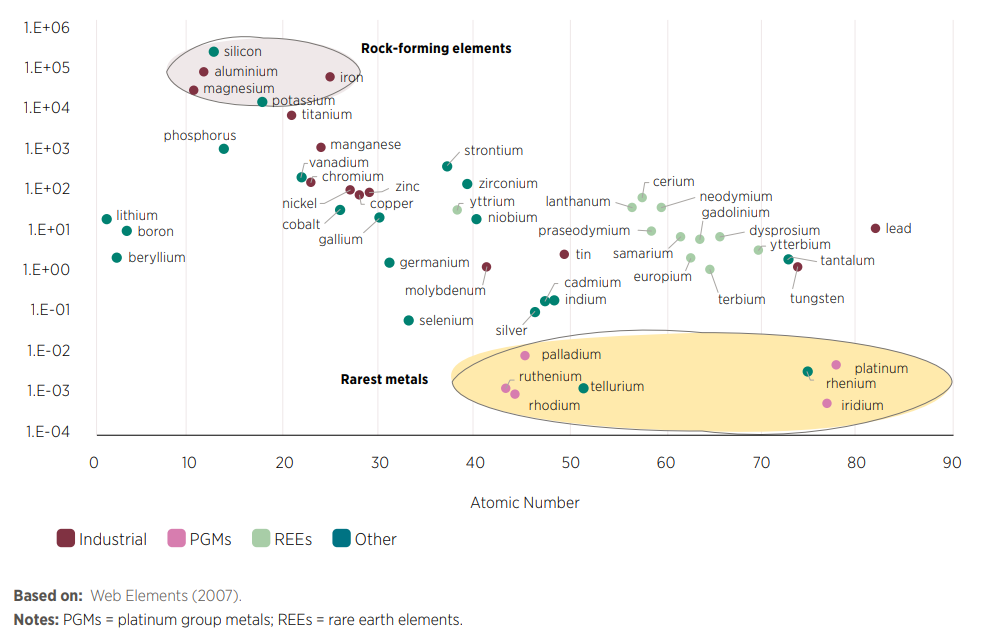

Fig.3: Estimated abundance of critical materials in the Earth’s crust. Source: International Renewable Energy Agency (IRENA)

Beyond geopolitical issues, CMREs are inherently geologically scarce. Unlike bulk commodities, many CMREs are dispersed in the Earth’s crust or concentrated in only a few specific ore bodies, making their extraction difficult and energy-intensive. This limited natural abundance, combined with long lead times for new mining projects (often a decade or more), means the primary supply chain is rigid and fragile.

Recycling therefore plays a vital role in ensuring long-term supply. A circular economy for CMRE supports multiple UN Sustainable Development Goals (SDGs) – including SDG 7 (Affordable and Clean Energy), SDG 8 (Decent Work and Economic Growth), SDG 11 (Sustainable Cities), SDG 12 (Responsible Consumption and Production), SDG 13 (Climate Action), SDG 14 (Life Below Water), and SDG 15 (Life on Land).

This is especially important for Singapore, which relies heavily on imports of these materials. As a small island nation, staying ahead of global trends is crucial for maintaining economic competitiveness. If the cost of CMRE rises sharply, industries may struggle to access advanced technologies, leading to a loss in technological relevance and economic strength. Building a circular economy through active recycling helps safeguard economic resilience.

Mining activities also bring environmental costs, including land clearing, pollution, and biodiversity loss. With seven out of nine planetary boundaries already breached, one of which is land-system change, continued extraction at current rates is unsustainable. Scaling up recycling efforts helps protect natural resources, preserve ecosystem services, and potentially bring us back within the planet’s safe operating limits.

As investors, we favour companies that actively pursue circular economy opportunities. Firms that improve recycling rates and set ambitious targets contribute to multiple SDGs while protecting long-term value. Recognising that our planet’s resources are finite underscores the importance of environmental stewardship and responsible production. Companies that invest in circularity not only build resilience but also secure their future profitability in a resource-constrained world.

The Blueprint

With the ever-changing landscape around us, it can get overwhelming to stay up-to-date. The Blueprint highlights pertinent global Environmental, Social, and Governance (ESG) issues and their importance to investors and the wider community. We look forward to engaging in discussions about the interconnections between climate, nature, and social outcomes that impact our investments and our futures.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.