The Perils of Sand Mining

- Natural resources underpin economies, but unsustainable consumption, like sand mining, threatens both the environment and long-term economic resilience.

- Circularity and responsible governance are key, but must be paired with demand reduction and ethical sourcing to manage risks and build business resilience.

Fig.1: Sand Mining and River Dredging

Natural resources form the bedrock of every economy. From minerals and forests to water and fertile soil, these assets and the ecosystem services they provide, underpin all production and human wellbeing. The primary sector, which includes activities like mining and forestry, provides the raw materials that lay the foundation for the secondary and tertiary sectors. In these sectors, raw materials are transformed and value is added through manufacturing and services. The prosperity of modern economies, therefore, remains deeply tied to the health of the natural systems that sustain them. Yet, the extractive nature of economic growth often pushes these systems beyond planetary boundaries, threatening their capacity to regenerate. Protecting and managing nature to maintain ecosystem integrity is thus not merely an environmental concern but also an economic imperative.

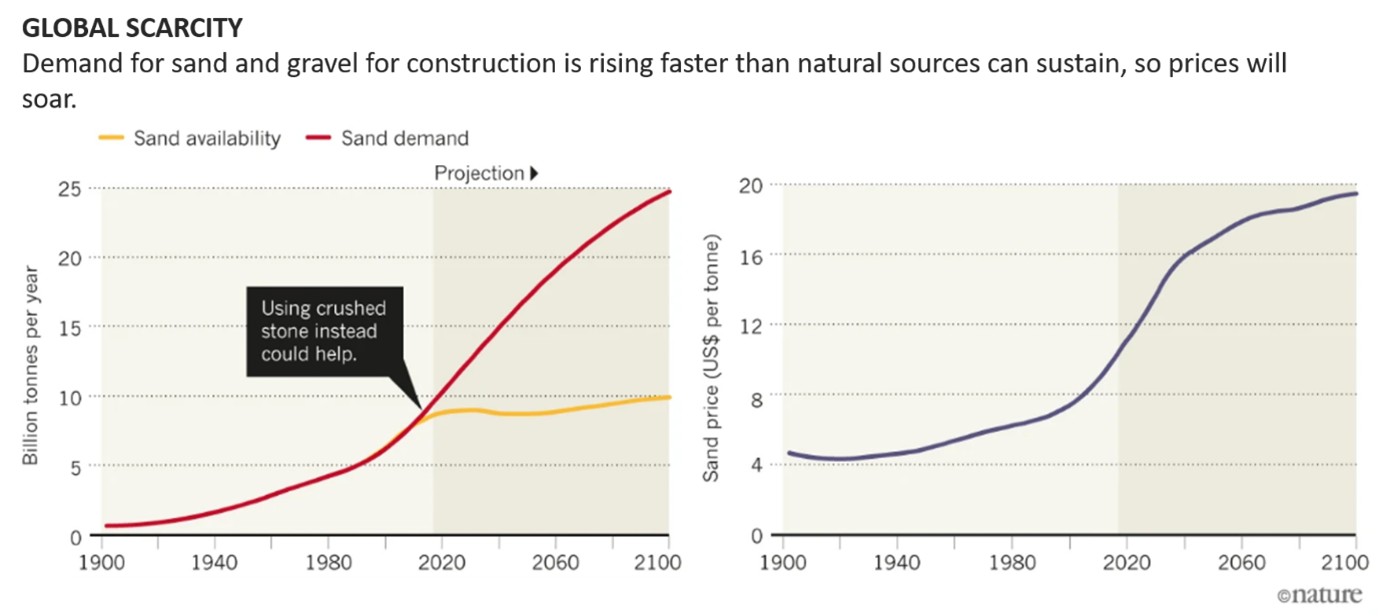

One such natural resource which our modern economy heavily depends is sand. The importance of sand to socio-economic development is evident from the fact that the volume of sand extracted globally exceeds that of fossil fuels and biomass combined. Urbanisation and population growth have driven an exponential increase in demand for sand, especially in rapidly developing regions such as China, India, and Africa. Roughly 32 to 50 billion tonnes of sand are used globally each year to manufacture concrete, glass, and electronics. Beyond these everyday materials, massive quantities of sand are also required for land reclamation projects.

It may appear that desert sand offers an infinite supply; however, what many do not realise is that desert sand grains are too well-rounded to be used for construction purposes. The only type of sand suitable for construction is angular sand, typically found in riverbeds which make up less than 1% of the world’s land surface. When comparing the global annual sand extraction rate with the estimated natural replenishment rate of only 15 to 20 billion tonnes, the unsustainability of current sand mining practices becomes evident. For companies, this growing scarcity will likely translate to higher production costs and reduced profit margins.

Sand mining also raises significant environmental concerns. Riverbed sand extraction, for instance, can deepen channels, destabilise banks, lower riverbeds, reduce flood frequencies, and increase saltwater intrusion. Meanwhile, coastal and beach mining accelerates coastal erosion. In response, the United Nations has issued resolutions on Mineral Resources Governance, such as UNEA 4/19 and UNEA 5/12, to promote sustainable practices. Nevertheless, in many regions, the drive to meet demand and maximise profits has led to widespread illegal and unregulated sand extraction.

Fig.3: River supports livelihoods

Beyond environmental degradation, sand mining has profound social impacts. The Mekong River, one of the most heavily mined rivers in the world, flows through six countries and supports more than 60 million. Excessive sand mining has also damaged fish nurseries in the Tonle Sap Lake, threatening food security for millions regionally. In some areas, collapsing riverbanks have displaced entire communities. These interconnected environmental and social challenges highlight the urgent need for sustainable sand resource management worldwide.

While circularity presents a crucial opportunity to reduce such impacts when it comes to sand mining, it is not a panacea. As researchers have cautioned, circular strategies alone cannot fully offset the negative externalities of the world’s rising demand for sand and construction materials. Therefore, businesses must go beyond recycling to actively manage and reduce material consumption across their operations and supply chains. Strong corporate governance will plays a central role in this transition. Companies must establish transparent sourcing policies and due diligence mechanisms. Failure to do so not only undermines environmental and social integrity but also exposes firms to significant reputational and regulatory risks. By maximising the use of existing materials, improving resource efficiency, and upholding ethical procurement standards, companies can contribute to both planetary stability and long-term business resilience.

As investors, we favour companies that recognise their dependencies on nature and actively seek to minimise their negative externalities on the environment. Alongside efforts to promote circularity, it is equally important for companies to reduce their overall resource consumption. Firms that enhance resource efficiency are viewed positively, as doing so strengthens business resilience and supports sustainable economic growth. We also reward companies that demonstrate responsible procurement and transparent extraction practices for natural resources, thereby guarding against reputational and regulatory risks.

The Blueprint

With the ever-changing landscape around us, it can get overwhelming to stay up-to-date. The Blueprint highlights pertinent global Environmental, Social, and Governance (ESG) issues and their importance to investors and the wider community. We look forward to engaging in discussions about the interconnections between climate, nature, and social outcomes that impact our investments and our futures.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.