Futureproofing the Utility Sector

- Climate risks are rising sharply, making proactive adaptation essential for utilities to protect infrastructure, revenue, and economic stability.

- Investors play a critical role by pushing for stronger resilience planning, transparent disclosures, and governance that integrates climate risk into long-term strategy.

Utility companies form the backbone of Asia’s economies. They power homes, industries, transport systems, digital infrastructure, and essential public services. When electricity grids fail or water systems break down, the economic and social consequences are immediate and far-reaching, from halted manufacturing and disrupted trade to compromised healthcare and weakened community resilience. As Asia continues to urbanise and industrialise at unprecedented speed, the stability of utility systems has become even more vital.

Fig.1: Electrical and Water Utilities

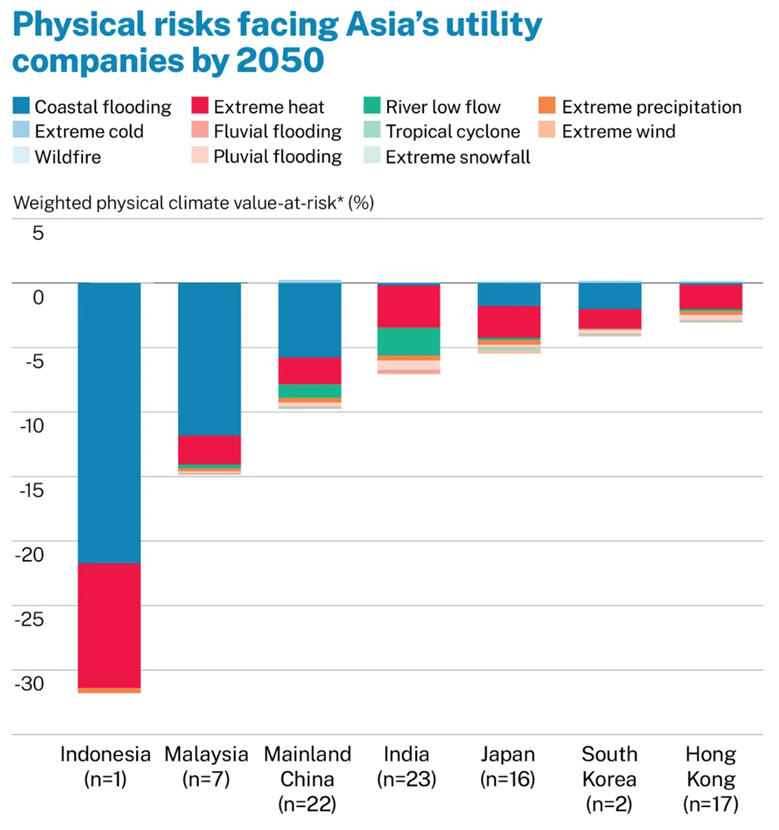

Yet, these same utilities now stand at the frontline of climate-driven physical risks. A recent report by the Asia Investor Group on Climate Change (AIGCC) warns that utilities across Asia could incur US$6.3 billion in climate-related damage and lost revenue next year, rising to US$8.4 billion by 2050, a 33% increase if companies fail to adapt. More intense flooding, storm surges, heatwaves, and droughts threaten generation assets, transmission lines, and grid reliability. For economies dependent on uninterrupted power and water supply, these risks translate into broader threats to productivity, energy security, and long-term growth.

Fig. 2: Physical risks faced by Asia utility companies

The rising tide of physical climate risks presents clear challenges. Generation facilities located on coastlines or riverbanks face increasing inundation. Grids, often ageing and insufficiently reinforced, experience higher failure rates under extreme weather. Operational disruptions impose financial losses and undermine customer trust. Beyond physical damage, utilities may also face regulatory penalties and credit downgrades if they cannot demonstrate adequate climate resilience.

However, this challenge also brings significant opportunities. Utilities that invest early in climate adaptation, modernisation, and resilience can strengthen reliability, reduce long-term costs, and position themselves as leaders in sustainable infrastructure. Upgrading grids to withstand climate stress, integrating distributed energy resources, reinforcing cooling systems, and redesigning assets based on future climate projections all create long-term competitive advantages. Proactive climate planning also strengthens regulatory relationships and investor confidence.

For institutional investors, physical climate risks directly threaten portfolio returns and asset values. Utilities are long-term, capital-intensive holdings, so climate vulnerability can quickly lead to stranded assets or weaker performance. Investors therefore need to act early. They should engage boards to ensure adaptation and resilience are core parts of corporate strategy. They should also push for clearer climate risk disclosures, including scenario assumptions, financial impacts, and spending on resilience. By doing so, investors not only protect their portfolios but also help strengthen the resilience of essential power and water systems.

As investors, we favour companies that actively assess their physical climate risks and plan clear transition pathways towards a definite goal to protect their operations and revenue. Proactive measures like these strengthen the resilience of utility companies and help maintain social and economic stability in the wider community.

The Blueprint

With the ever-changing landscape around us, it can get overwhelming to stay up-to-date. The Blueprint highlights pertinent global Environmental, Social, and Governance (ESG) issues and their importance to investors and the wider community. We look forward to engaging in discussions about the interconnections between climate, nature, and social outcomes that impact our investments and our futures.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.