Market Commentary – January 2026

EQUITY MARKET UPDATE

Source: Bloomberg (Total Return in USD/Local Currency terms)

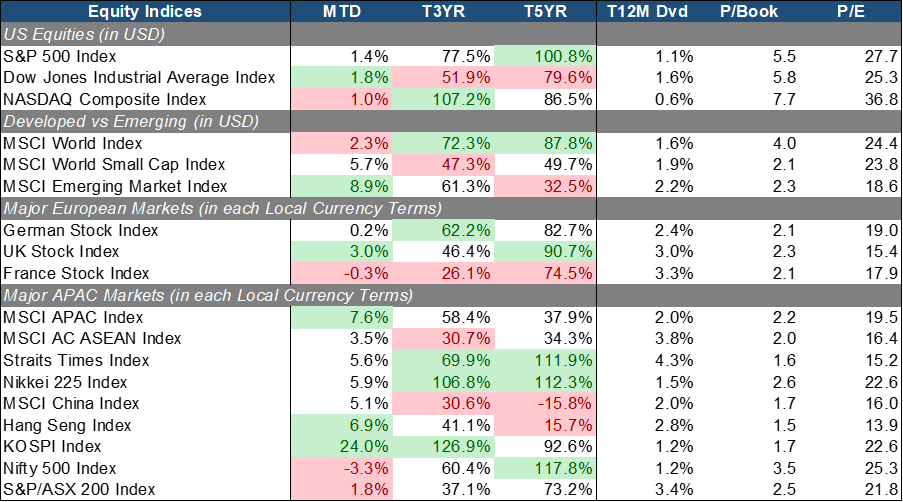

The S&P (+1.4% MoM) posted modest gains in January 2026, with value (+1.8% MoM) outperforming growth stocks (+1% MoM) as loosely represented by the DJIA and NASDAQ respectively. The rotation was largely attributed to a pause in rate cuts and the Federal Reserve’s relatively hawkish tone, which tempered enthusiasm for longer-duration growth stocks.

Small-Caps (+5.7% MoM) significantly outperformed Large-Caps (+2.3% MoM), while Emerging Markets (+8.9%) led overall. The move reflects a continued rotation outside of the U.S., alongside renewed investor interest in Asian technology infrastructure plays, particularly in tech-heavy markets such as South Korea and China.

In Europe, performance was mixed with UK equities (+3% MoM) leading the region. UK stocks have been riding the momentum of an expected March rate cut by the Bank of England and relatively attractive valuation levels. German equities were broadly flat, weighed down by concerns over a stagnant domestic economy, macro trade uncertainties, and persistent weakness in the industrial sector. French equities (-0.3% MoM) continue to grapple with the aftereffects of the recent government collapse, which has dampened investor confidence.

Closer to home, APAC equities delivered strong returns (+7.6% MoM) overall, except for India (-3.3% MoM) and Australia (-1.8% MoM). South Korea (+24% MoM) emerged as the best-performing APAC market in January 2026, supported by fading tariff concerns and the heavy concentration of semiconductor and AI-related companies within its benchmark. China/HK equities (+5.1%/+6.9% MoM) have also relatively outperformed, underpinned by improving earnings momentum in the Industrial and Media sectors. Singapore (-5.6% MoM) wasn’t far behind as it remained an attractive haven given its low inflation environment, resilient economic growth, strong banking sector fundamentals, and appealing valuations.

Source: Bloomberg (Total Return in USD terms)

Source: Bloomberg (Total Return in USD terms)

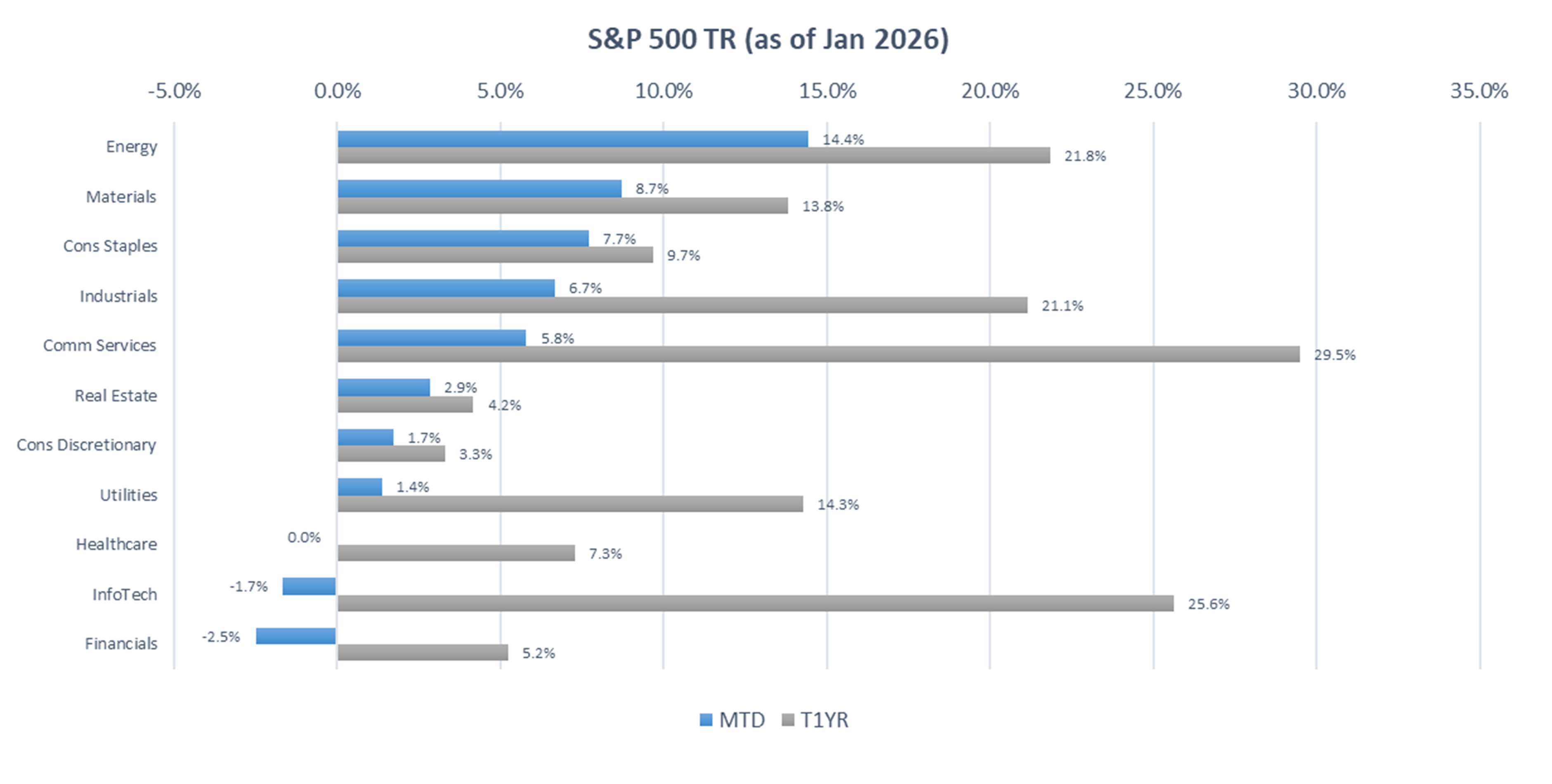

Within the S&P 500, Energy (+14.4% MoM), Materials (+8.7% MoM), and Consumer Staples (+7.7% MoM) emerged as the key outperformers for the month. The leadership reflected a tactical shift by investors toward higher-yielding defensives and value-oriented segments, particularly as the broader technology rally took a breather amid evolving interest rate expectations. Energy and Materials benefited from renewed interest in tangible asset plays and pricing resilience. Materials were supported by structural demand linked to energy transition infrastructure, such as power-grid upgrades and electrification, as well as continued expansion in data center-related materials demand. Consumer Staples also outperformed as investors rotated into defensive earnings visibility and relatively stable cash flows.

Conversely, Financials (-2.5% MoM), Information Technology (-1.7% MoM), and Healthcare (0% MoM), lagged the broader market. Financials fared the worst as the rate cut pause reinforced a higher-for-longer environment, weighing on net interest margin expectations and dampening loan growth outlook. Information Technology underperformed as broad tech shares faced valuation pressure with investors repricing interest rate expectations. Healthcare stocks were broadly flat, weighed down by the sell-off in insurers amid concerns over potential profit margin compression stemming from tighter regulatory developments, including lower government reimbursement rates and adjustments to Medicare Advantage payments.

Source: Bloomberg (Total Return in Local Currency terms)

Source: Bloomberg (Total Return in Local Currency terms)

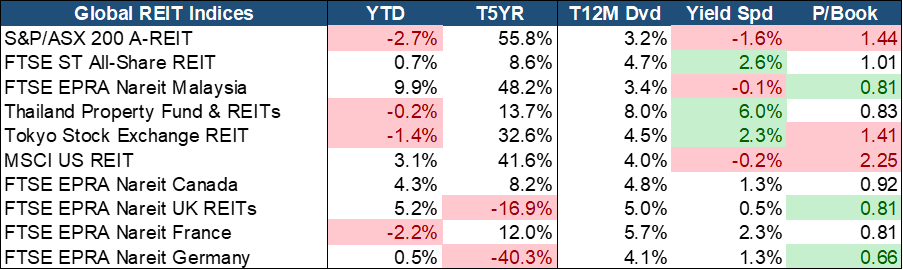

Global REITs reported a mostly positive performance in January, with Malaysia (+9.9% MoM) and UK (+5.2% MoM) REITs outperforming their peers. S-REITs (+0.7% MoM) have relatively lagged, but continue to benefit from resilient fundamentals, attractive dividend yields, and broad-based sector strength, including recovery in hospitality, and continued industrial and retail. Valuations and yields remain attractive with a compelling 2.6% trailing yield spread, the second highest globally, and trading at a fair 1x PB considering the quality of the assets.

EQUITY MARKET OUTLOOK

Rates Backdrop and Market Sentiment:

Source: Bloomberg.

Source: Bloomberg.

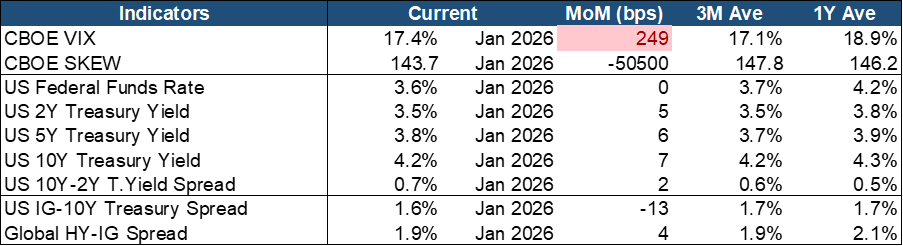

Market sentiment turned slightly risk-off with implied market volatility spiking in the first month of the new year. The VIX rose by 249 bps MoM, crossing the Trailing 3M (~17%) average but remaining under the 1Y (~19%) level, while the SKEW fell by more than five index points. Both volatility indicators highlighted investors’ cautiousness due to the hawkishness of the Fed.

We observed a bear-steepening where all Yield levels increased by 5-7 bps MoM while the Treasury Yield Spread steepened slightly to 0.7%. This is mostly driven by heightened inflation and interest rate hike expectations in the market, and it usually means a bearish sentiment for equities due to weaker growth expectations. In parallel, the credit markets still point to a risk-on but rates-volatile credit environment. The IG-Treasury spread has tightened (-13 bps MoM) but in the other hand, the global HY–IG spread has moved in the opposite direction (+4 bps MoM). This indicates that investors are still positive on risk assets, but with a certain degree of cautiousness due to the uncertain monetary policy development.

Overall, there is a transition from the broad-based risk-on tone seen after the December rate cut toward a more measured and selective positioning. While volatility has picked up and the yield curve steepening points to lingering inflation and fiscal concerns, credit spreads and equity sector rotation indicate that markets appear to be recalibrating expectations considering the Fed’s hawkish pause.

Macroeconomic Trends and Signals:

Source: Bloomberg.

Source: Bloomberg.

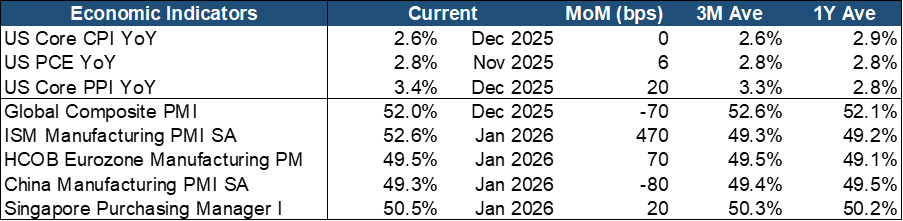

The earlier US government shutdown in Q4 had disrupted several key data releases, but the latest prints provide a clearer macro picture. Headline and Core Inflation remained unchanged MoM and stayed slightly below their respective one-year averages, suggesting that price pressures are no longer accelerating. However, the Personal Consumption Expenditures (PCE) gauge edged up and remains above the Federal Reserve’s 2% target, indicating that inflation has yet to return firmly within policy comfort levels. Core Producer Price Index (PPI) also rose by 20 bps MoM, pointing to lingering upstream price pressures and a still-heightened inflation environment.

On the growth front, global manufacturing momentum is moderating, but conditions remain relatively resilient. While activity has slowed, most key markets such as the US, Europe, and Singapore, are still in expansionary territory. This suggests that although growth is losing some steam, the broader industrial cycle has not rolled over decisively. Taken together, the combination of sticky inflation metrics and moderating but still-expanding manufacturing activity is likely to reinforce a cautious central bank stance, with policymakers seeking clearer evidence of sustained disinflation before pivoting more dovish.

Broadening Market Rotation Amid AI Strength and Policy Repricing

As we enter 2026, our constructive medium-term outlook remains supported by the structural momentum of the AI investment cycle and resilient corporate earnings. Capital expenditure tied to semiconductors, cloud infrastructure, power-grid upgrades, electrification, and data center expansion continues to underpin earnings visibility across technology, materials, energy, and select industrial segments. Importantly, leadership has broadened beyond the traditional US mega-cap cohort, with Small-Caps and Emerging Markets outperforming in January as investors rotate toward more attractively valued markets and beneficiaries of Asian tech infrastructure build-out. This shift suggests that while AI remains a core structural driver, market participation is becoming more diversified geographically and across sectors.

That said, the macro backdrop warrants a measured stance. Inflation remains sticky, with PCE still above the Federal Reserve’s 2% target and Core PPI ticking higher, reinforcing a higher-for-longer policy narrative following the Fed’s hawkish pause. The recent bear-steepening in the U.S. yield curve and pickup in volatility signal that markets are recalibrating rate expectations rather than embracing a broad risk-on environment. At the same time, global manufacturing growth is slowing, albeit still in expansion across key markets, pointing to moderating, but perhaps not a weakened economic momentum.

Against this backdrop, equity upside remains plausible, supported by structural AI demand and resilient earnings trends. However, elevated valuations in certain AI-linked names, policy uncertainty, and sensitivity to inflation surprises argue for prudence. A disciplined and diversified approach such as balancing exposure across regions, sectors, and styles, while maintaining awareness of rate and policy risks will likely be critical as markets navigate a more selective and valuation-sensitive phase in early 2026.

FIXED INCOME UPDATE

Source: Bloomberg; Returns are presented in USD terms

Source: Bloomberg; Returns are presented in USD terms

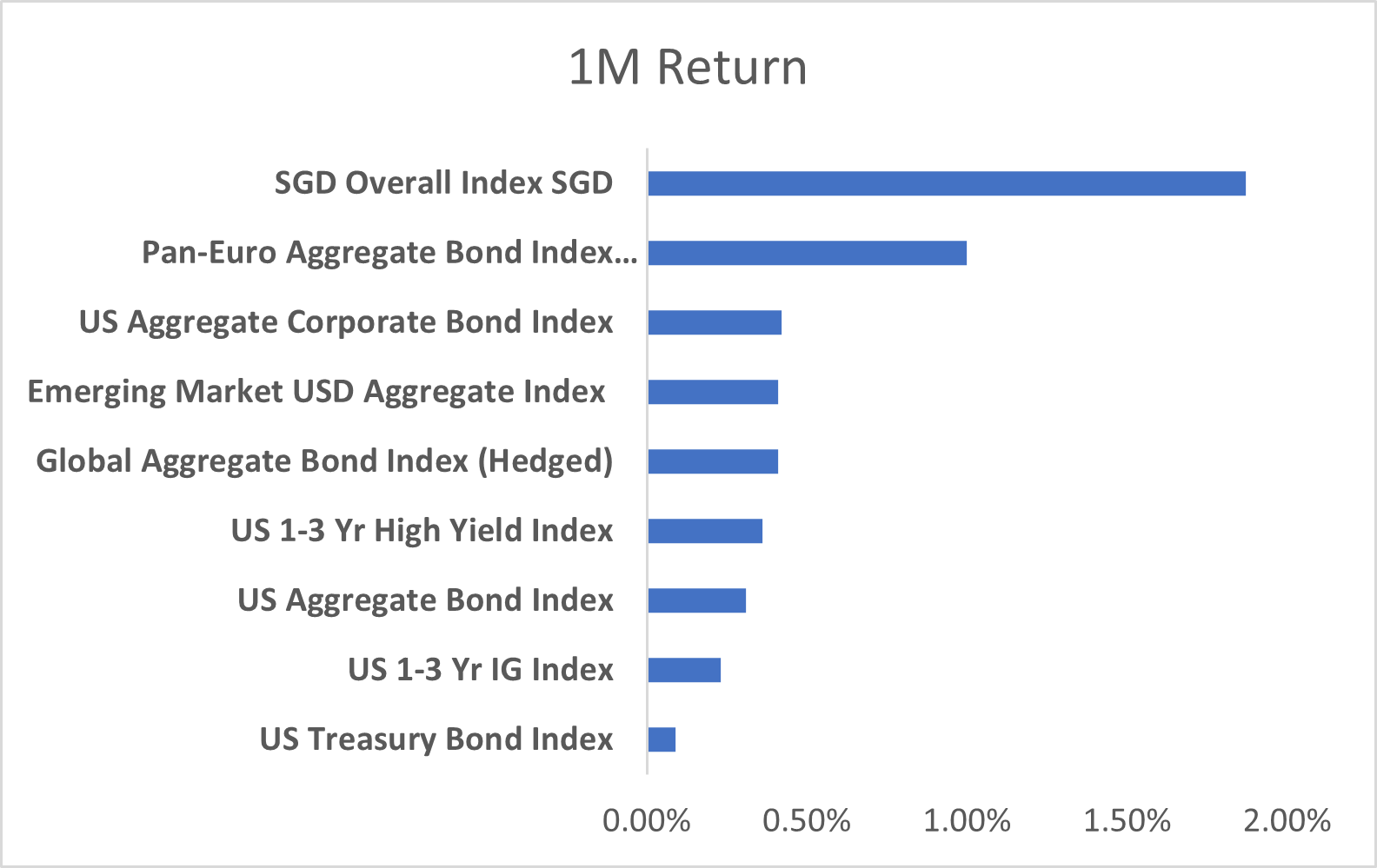

Bond markets opened the new year with a mixed performance across major indices. The standout was once again the SGD Overall Index, which returned 1.87% in USD terms and 0.68% in SGD terms. This strong start appears to be a continuation of 2025’s trend, when the SGD index consistently led global peers. The dual boost in January reflects both resilient domestic credit fundamentals and the tailwind from a stronger SGD against the USD, underscoring Singapore’s role as a reliable outperformer in global fixed income.

Elsewhere, European bonds surprised to the upside, reversing their laggard status from 2025. The Pan‑Euro Aggregate Index posted one of the stronger gains in January, supported by moderating inflation, attractive valuations after last year’s underperformance, and a firmer euro that amplified USD‑based returns. This rebound suggests investors are selectively re‑engaging with Europe despite ongoing fiscal concerns. By contrast, US indices delivered more modest returns, with Treasuries essentially flat and corporates eking out incremental gains amid tight spreads and anchored front‑end yields.

Emerging market debt remained positive in January, though returns were less pronounced than in December. The moderation reflects tighter valuations after last year’s strong performance, which left spreads compressed and upside more limited. Amid ongoing uncertainty in US policy and elevated geopolitical tensions, EM debt is expected to continue outperforming developed‑market bonds, supported primarily by a weaker USD and the attractive carry available in EM markets.

MAS Keeps Policy Unchanged, Flags Inflation Risks

MAS’ January 29, 2026, policy statement struck a tone of cautious stability. The central bank left the slope, width, and center of the S$NEER band unchanged, signalling confidence in the current trajectory of monetary settings. At the same time, it nudged inflation forecasts higher to 1–2%, acknowledging persistent price pressures even as growth remains resilient. This combination reflects MAS’ preference for continuity and keeping the currency appreciation bias intact while preparing to respond if inflation risks intensify.

For the yield curve, the implications are twofold. At the front end, MAS’ steady hand anchors short‑term rates, reinforcing liquidity stability and limiting volatility. At the long end, however, the upward revision to inflation expectations introduces mild steepening pressure, as investors demand compensation for inflation risk. In practice, this means the curve could tilt upward beyond five years, while the short end remains well‑contained. For corporates, this policy mix is broadly supportive as funding costs stay manageable, balance sheets benefit from currency stability, and inflation pressures are modest enough not to erode fundamentals.

From a positioning perspective, the policy mix favours a measured approach. Anchored short‑end yields provide a solid base for short‑duration strategies, while the potential for gradual steepening suggests that selectively extending duration could add value over time. SGD corporates remain attractive for carry, underpinned by strong domestic demand and policy credibility. In short, MAS’ January stance reinforces the case for maintaining a short‑duration bias while gradually layering in longer exposures, allowing investors to capture opportunities without compromising stability.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.