Investing in China: A Post-Covid-19 Perspective [Part 1]

From an agrarian economy to become a global superpower in half a century, China’s transformation has been an economic exception. According to the World Bank, China has lifted more people out of extreme poverty than any other country in the world – about 850 million people between 1981 to 2015. Not an easy feat, considering that it is the most populous country in the world with an estimated 1.4 billion people residing in China.

Had it not been for the COVID-19 pandemic, the continuation of China’s growth story would have gone largely unabated: In its April reading, the Chinese economy contracted 6.8% in the first quarter of 2020, its first-such contraction since it began publishing its quarterly Gross Domestic Product (“GDP”) in 1992. Further data from the National Bureau of Statistics of China showed that domestic retail sales were most hard-hit, plummeting 19% in the period.

That said, being the first to experience the outbreak, China is now leading the way out of the lockdown. In a time where most countries are still on the cusp of re-opening, its first-mover advantage means that it would emerge and return back to full throttle to lead global economic recovery.

A Modern-day Epilogue

During China’s recent 13th plenary National People’s Congress held in end-May, the central government’s work report for 2020 has made reference to the “New Infrastructure” initiative, a concept first raised in 2018’s Central Economic Work Conference.

Due to the top-down economic model, the central government’s work report can help to illuminate the investment themes in China’s landscape.

In the past, China has been quick to respond with massive infrastructure investments to shore up growth during downturns. However, this time, the central government is likely to seek more targeted investments that facilitate innovation.

In anticipation of major stimulus packages, the “New Infrastructure” campaign is increasingly being touted by the Central Government and Chinese news media. Leadership in China has been urging the country to accelerate the development in seven areas under this initiative: 5G networks, industrial internet, inter-city and inner-city rail systems, data centers, artificial intelligence, ultra-high voltage (UHV) transmission, and charging stations for electric vehicles.

Breaking away from traditional stimulus is likely part of China’s new growth strategy which it had begun to embrace in recent years. “Growth with Chinese characteristics” would be the new economic model, heralded by Chinese President Xi Jinping in 2017 and it marked the shift of the Chinese narrative from aggressive headline growth towards a societal-driven, sustainable, high-quality growth.

The shift in approach is one arising from China’s changing structural needs and the Covid-19 crisis may have given it the perfect opportunity to re-pivot. Back in 2008, in wake of the global financial crisis (“GFC”), China relied on large scale credit creation and massive infrastructure investments to shore up growth. Through it, China has achieved significant urbanisation of its economy, but in the process also created significant excess which ultimately culminated in a campaign to deleverage and reduce excess capacities in 2017.

With the Covid-19 crisis in 2020, the responsiveness to traditional stimulus would be limited for an already urbanised Chinese economy. Moreover, with China’s total debt hitting 317% to GDP in the first quarter of 2020 according to the Institute of International Finance, any pronounced increment in debt level would disproportionately create more risks to the economy.

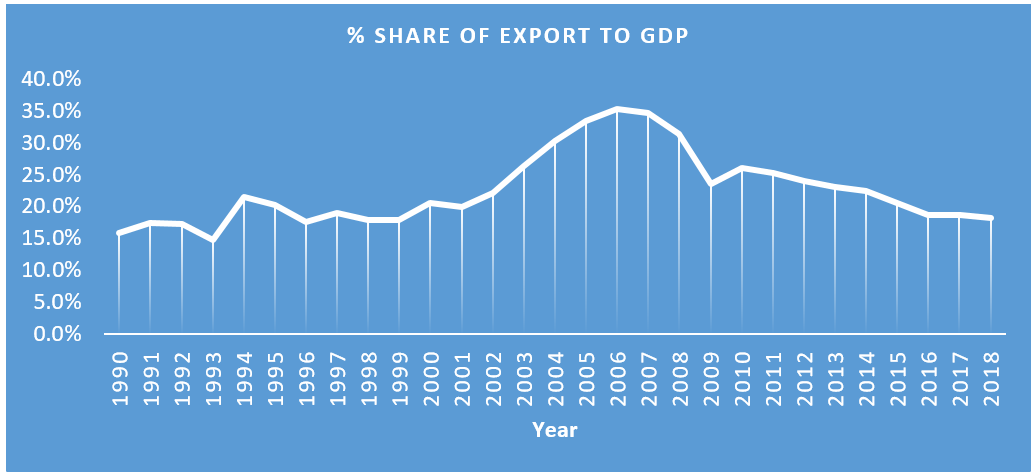

The old model that relies on export to fuel growth is also losing its lustre. Already China is the largest exporter in the world and further increasing export market share would be increasingly challenging in an environment where countries are erecting trade barriers. Trend-wise, we are also seeing a general decline in the share of contribution of Chinese export to GDP, easing from its peak of 35.4% in 2006 to 18.2% in 2019.

Source: National Bureau of Statistic; China statistical yearbook 2019

Source: National Bureau of Statistic; China statistical yearbook 2019

Given this backdrop, the focal point for China’s growth is to move up the value chain and transit into a hi-tech economy with domestic consumption of goods and services playing a larger role. In our view, investors will find greater success playing to these secular tailwinds.

From Market Penetration to “Premiumization”

For companies around the world, the attractiveness of the Chinese market is its massive, digital-savvy middle class. By 2022, it is estimated that the consumer force could potentially reach 550 million.[1] To give it some context, the entire population living in the US is only about 330 million people. Already, Chinese consumers are showing that they are ready to take over and its “premiumization” story is still unfolding.

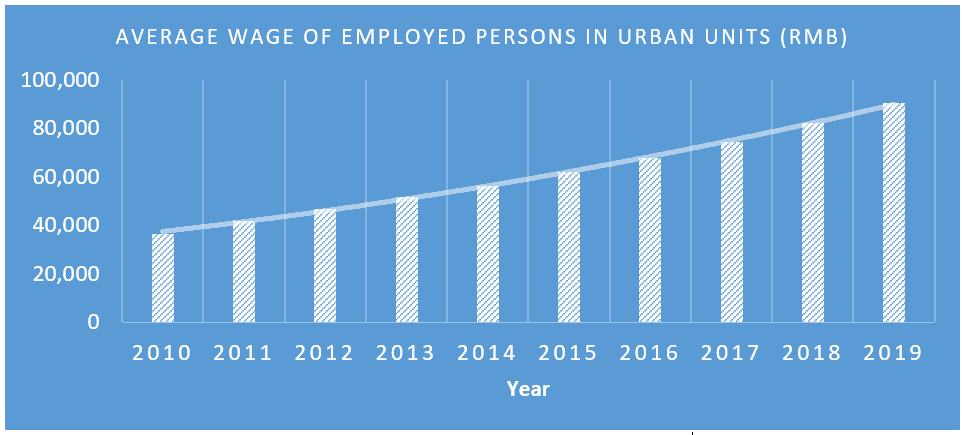

Driving this trend is none other than the rapidly rising income. On average, our research showed that wage of employed person in urban units has more than doubled from RMB36,539 in 2010 to RMB90,500 in a decade, representing an average increase of 14.8% increase per year.

However, the patterns of Chinese consumers are shifting: Unlike the past where foreign brands capture a larger slice of China’s premium purchases, China’s domestic brands are gaining momentum. In a report by Bain & Company titled “Premium Products, Small Brands and New Retail”[2], it was found that Chinese brands have grown by 15% from 2016 to 2018, while foreign brands only grew 9% in the same period.

Source: National Bureau of Statistics China

Source: National Bureau of Statistics China

The report also shone light on how younger generations of quality-conscious Chinese consumers are powering the consumption of premium goods in the fast moving consumer goods (“FMCG”) segment, with home and personal care categories seeing the fastest growth.

For local Singaporeans to understand how China’s domestic companies are capturing market share, one exemplary example we could look at is HaiDiLao. In an environment where consumers have many dining options, HaiDiLao’s over-the-top customer service has helped it set competition apart. The hotpot restaurant chain gives an indication of how a consumer-centric, service-oriented Chinese economy can move up in the value chain.

The equities strategy here is lookout for companies that play to the shift in Chinese consumption patterns (from staples to discretionary). Examples of listed stocks that fit into this theme are: China Mengniu Dairy, Guangdong Marubi Biological Techn, Proya Cosmetics, HaiDiLao.

[1] Mckinsey, 2019. https://www.cnbc.com/2019/09/30/chinas-giant-middle-class-is-still-growing-and-companies-want-in.html

[2] Source: Bain & Company, China Shopper Report 2019: “Premium products, small brands and new retail”

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.