Transforming the Cash Management Landscape with Phillip SGD Money Market ETF

Investors place a great deal of emphasis on managing their core investment portfolio but neglect the cash aspect. To set aside cash for rainy days is a deeply-ingrained value in our Asian DNA. Although generally considered to be liquid and safe, the problem with banks savings accounts is that excess cash simply idle without generating any meaningful interest. This exposes excess cash in savings accounts to the full brunt of inflation, on the downside.

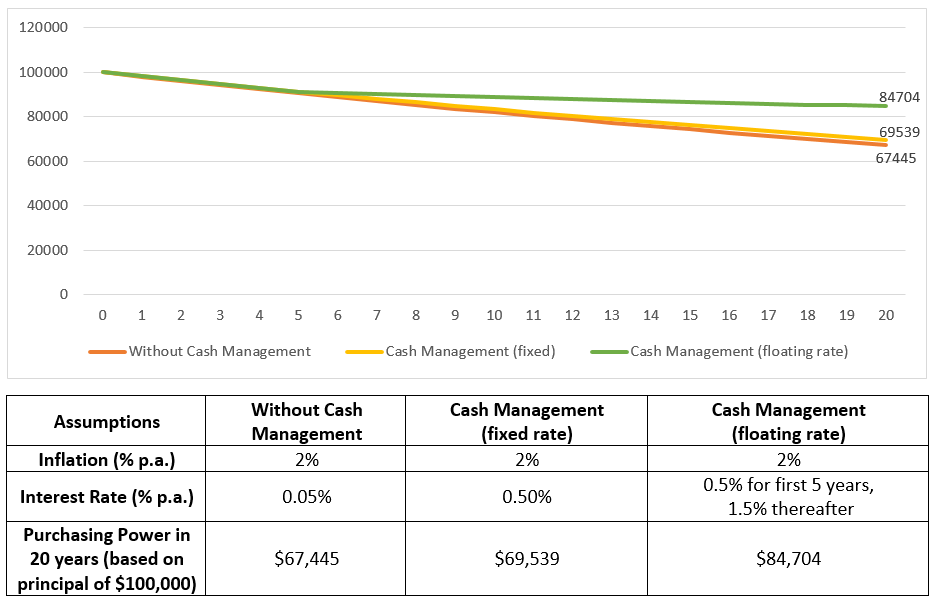

Diagram 1: Effects of inflation on Excess Cash

Source: Phillip Capital Management (“PCM”)

Source: Phillip Capital Management (“PCM”)

To demonstrate why investors should also take a more proactive approach in managing their excess funds, consider the above illustration. In the illustration, we assume a 2% p.a. inflation rate across the 20-year horizon. Without any active cash management, the real purchasing power for a notional $100,000 would erode bluntly to $67,445 by end of 20 years. With some level of cash management, assuming the investor park the excess funds in a fixed-rate vehicle at 0.50% p.a., his purchasing power at the end of the period would be $69,539.

Now, if we assume that interest rates begin to normalize from 0.5% to 1.5%p.a. after the initial 5 years, a fixed-rate vehicle would not stand to benefit from the pick-up in yield from the marketplace, hencing failing to participate on the upside when interest rates climb. This is one major reason why a floating rate solution would be more ideal compared to say, fixed time deposits. And as illustrated, an investor would see his purchasing power being more preserved at the end of the period with $84,704.

Augmenting Cash Management with Portfolio Management

Despite the undesirable effects of inflation being mainstream knowledge, Singaporeans are largely still leaving their cash in unproductive vehicles. As of July 2020, the total deposits in Singapore amounted to $734 billion and of this, almost $240 billion (approximately one-third) were sitting in savings accounts of residents and corporates (not financial institutions).[1]

Although being financial hub in the ASEAN region, the lack of available tools – or to some degree the lack of awareness for the matter – can be attributed to why substantial portion of cash is sitting in savings accounts.

In the US, Money Market Funds (“MMFs”) have relatively high penetration, with total fund assets in this class amounting to US$5 trillion in August 2020[2], and account for an estimated 20% of the total mutual fund assets at end-June 2020[3]. In comparison, locally domiciled Singdollar MMFs have total fund assets of approximately $3 billion, as at end September 2020. At this size, the local share of Singdollar MMFs to savings is extremely low at just 1.23%. This signifies potential challenge to improve investors receptiveness to invest in money market products for the opportunity to have better yields than the conventional way of managing cash, that is to put in deposits accounts.

Yet, if anything, the budding robo-advisory scene in Singapore offering cash management solutions are anecdotal signs that such demand are indeed growing as investors gets more sophisticated.

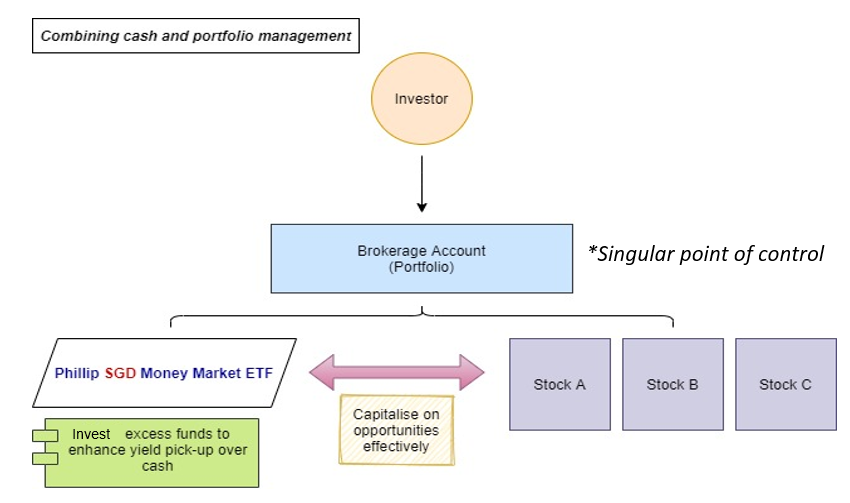

Diagram 2: Single Point of Control with Phillip SGD Money Market ETF

Source: Phillip Capital Management

Source: Phillip Capital Management

The idea of the Phillip SGD Money Market ETF (“PSGDMMETF”) is a simple but significant step towards reinventing Singapore’s cash management landscape: Allow investors to manage their liquidity via a tradable security on the local exchange, along with their core investments. By taking advantage of the ETF structure, PSGDMMETF can benefit investors as a low-cost accessible investment tool for liquidity management.

PSGDMMETF – Less Risky, More Useful Investment Tool

As a tradable money market fund, PSGDMMETF also primarily invests in money market securities and fixed deposits of established institutions to improve the yield pick-up for investors’ excess funds.

Money market securities/instruments are short-term (<365 days) financial products, typically issued by governments, financial institutions and large corporations. These are considered to be relatively conservative and safe investments because of shorter time horizon. These instruments must have high credit quality[4] to be considered. However, due to the quantum and size of the investment, investors typically do not get direct access but rather indirectly through mutual funds (known as MMFs) and now with, PSGDMMETF.

Apart from being able to trade the units of PSGDMMETF, investors can also track the short-term interest rate trends through the ETF. This is because PSGDMMETF closely tracks the performance of the FTSE SGD 3-Month Swap Offer Rate (“SOR”) Index.

Due to the pandemic-induced recession, interest rates have been slashed to near zero as central banks around the world fought to keep liquidity flowing. By tracking the prevailing 3-Month SOR rate, investors will also be able to participate on the upside when interest rates begin to climb or normalize. This can only be achieved by having a dedicated team of credit analysts that are always on their toes for changes in interest rates and constantly conduct due diligence on short-term credit papers. Diversification would also help to reduce credit default risk exposure to counterparties in the portfolio.

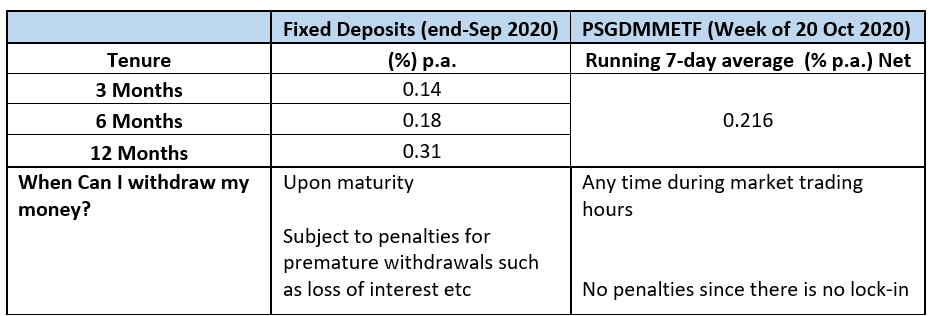

In juxtaposition with investors placing their monies in fixed deposits directly, PSGDMMETF does not have a lock-in period and hence would not subject investors to penalties for premature withdrawals.

Table 1: Comparison with Fixed Deposits

Compiled by: PCM. Source of Fixed Deposit rates: Monetary Authority of Singapore (“MAS”)

Compiled by: PCM. Source of Fixed Deposit rates: Monetary Authority of Singapore (“MAS”)

Notwithstanding competitive returns, no lock-in penalties, and transparency of the ETF structure, PSGDMMETF further value-adds by improving convenience for investors when they use PSGDMMETF (instead of deposits) to manage liquidity in their portfolios of investments ((Diagram 2). This would also reduce the hassle involved in managing bank transfers between trading accounts and deposit accounts.

Low Trading & Clearing Fees on SGX

To encourage the participation for PSGDMMETF, SGX has a lower fee structure for clearing and trading of units in Money Market ETFs. For comparison, the combined clearing and trading fee (one-way) on SGX is only 0.0002% for PSGDMMETF compared to 0.04% for non-MMETFs. [5]

In summary, combining the simplicity of the ETF structure, with the benefits of SGD Money Market, PSGDMMETF would make a straightforward tool for cash management. As a conservative investment vehicle, corporate treasurers should also be able to find all the qualities that befitting their investment mandate in PSGDMMETF.

[1]https://eservices.mas.gov.sg/statistics/msb-xml/Report.aspx?tableSetID=I&tableID=I.4

[2] https://www.federalreserve.gov/releases/efa/money-market-funds-investment-holdings.htm

[3] Fitch Ratings, Inc. “Market Liberalisation Will Drive Growth for China’s Mutual Funds”; dated 17 August 2020

[4] “high quality” as defined in the Appendix 2 of the Code on Collective Investment Schemes (last revised on 16 April 2020).

[5] Investors are advised to check with their brokers on brokerage fees for the trading of PSGDMMETF.

Important Notice

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the ETF mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for more information and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future performance. There can be no assurance that investment objectives will be achieved. The use of financial derivative instruments will be for hedging purpose.

Any regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the NAV of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

ETFs are not like typical unit trusts as the Units of ETFs will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its Net Assets Value (“NAV”) or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus for more details.

This ETF is an exchange-traded money market fund (“MMF”) and not a guaranteed fund. Investing in MMF is not the same as placing funds on deposit with a bank or deposit-taking company and there is no assurance or guarantee that the principal value of your investment can be maintained or preserved.

This ETF is benchmark to an Index that is designed to comprise three-month Singapore Dollar swap offer rates (“SOR”) to measure the performance of short-term Singapore Dollar money markets. The Singapore SOR relies on the USD LIBOR in its computation methodology and the likely discontinuation of LIBOR after the end of 2021 directly impacts the future sustainability of the SOR and the Index. The Singapore Overnight Rate Average (“SORA”) has been identified as the alternative interest rate benchmark for the SOR. In the event that the SOR is discontinued, the Manager will identify or agree with the Index provider or any other index provider for the use of a suitable replacement Index.

This ETF has been developed solely by the Manager. This ETF is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”).

All rights in the Index vest in the relevant LSE Group company which owns the Index. FTSE® is a trade mark of the relevant LSE Group company and is used by any other LSE Group company under license.

The Index is calculated by or on behalf of FTSE Fixed Income, LLC or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of, reliance on or any error in the Index or (b) investment in or operation of the ETF. The LSE Group makes no claim, prediction, warranty or representation either as to the results to be obtained from the ETF or the suitability of the Index for the purpose to which it is being put by PCM.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. This ETF is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto. This publication has not been reviewed by the Monetary Authority of Singapore.