Intraday NAV

27 February 2026, 5:59 pm

27 February 2026, 5:59 pm

27 February 2026, 5:59 pm

NAV Tracking Error/Difference

1.372% / -1.697%

1-Year Rolling (as of 30 January 2026)

as of 31 August 2025

Out of 1,132 Real Estate Sector Equity Funds as of 31-07-2025.

View FAQ section for important disclosures for Morningstar-related ratings*

INVESTMENT OBJECTIVE & FOCUS

The investment objective of the Fund is to seek to provide a high level of income and moderate long-term capital appreciation by tracking, as closely as possible, before expenses, the performance of the iEdge APAC Ex-Japan Dividend Leaders REIT Index (the “Index”).

By tracking the Index which is ranked and weighted by total dividends, the Fund aims to enhance risk-adjusted returns above that of traditional market capitalisation-weighted indices as the 30 REITs comprising the Index will be ranked and weighted according to the highest total dividends paid in the preceding 12 months subject to size, free-float market capitalisation and liquidity constraints.

In managing the Fund, the Manager may adopt either a Replication Strategy or a Representative Sampling Strategy at its discretion. As the Fund is an index-tracking fund, it is expected that the Fund will only invest in REITs.

The Fund is classified as an EIP (Excluded Investment Product).

KEY FACTS

Methodology

Investment Universe

Key Benefits

DIVIDEND INFORMATION

| Dividend Payout From | Capital | Income |

| 0% | 100% |

TRADING INFORMATION

DOCUMENTS

By accessing and using this website (the “Website”) and any web page hereof, you agree to be bound by the terms and conditions below. Reference to these general terms of use should be made each time you access and use the Website.

This Website, its services and contents are provided for your use by PhillipCapital, which is a group of companies who together offer a full range of financial services to retail, corporate and institutional customers. Member companies in Singapore include Phillip Securities Pte Ltd, Phillip Securities Research Pte Ltd, Phillip Financial Pte Ltd, Phillip Nova Pte Ltd, Phillip Capital Management (S) Ltd, Phillip Private Equity Pte Ltd, Phillip Japan Fund Management Pte Ltd, CyberQuote Pte Ltd, IFS Capital Limited and ECICS Limited. Member companies can otherwise be identified by their authorised use of PhillipCapital brand name along with their own name in their documentation and literature.

Use of Information and Materials

The contents of this website are provided to you for general information only and should not be used as a recommendation or basis for making any specific investment, business or commercial decision. These pages should not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the securities, and specifically funds or any investment products, mentioned herein, or, in any jurisdiction to any person to whom it is unlawful to make such an invitation or solicitation in such jurisdiction. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products/service. The value of any investments and the income from them may fall as well as rise.

The information contained in these pages is not intended to provide professional advice and should not be relied upon in that regard. It also does not have any regard to your specific investment objective, financial situation and any of your particular needs. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the applicable Terms and Conditions governing each account and the relevant Risk Disclosure Statement, if any, carefully before investing in any investment products.

The contents of this website, including these terms and conditions, are subject to change and may be modified, deleted or replaced from time to time and at any time at the sole and absolute discretion of PhillipCapital. Any opinions or views herein are made on a general basis and are subject to change without notice.

Member companies of PhillipCapital, their directors, officers, associates, agents, affiliates and/or employees may own or have positions in the investments mentioned herein.

Timeliness, accuracy and completeness of information

In particular, we assume no responsibility for or make any representations, endorsements, or warranties whatsoever in relation to the timeliness, accuracy and completeness of any services, content, information and/or data contained in the Website, whether provided by us, any content providers or third parties.

Copyright

PhillipCapital and/or its member companies reserve all copyright and intellectual property rights to the services, content, information and data on the Website. The contents in the Website are protected by copyright and no part or parts hereof may be modified, reproduced, stored in a retrieval system, transmitted (in any form or by any means), copied, distributed, published, displayed, broadcasted, hyperlinked, used for creating derivative works or used in any other way for commercial or public purposes without the prior written consent of PhillipCapital and/or its member companies.

No Warranties

While every care has been taken in preparing the contents contained in the Website, such contents are provided to you “as is” and “as available” without warranty of any kind either express or implied. In particular, no warranty regarding non-infringement, security, accuracy, fitness for a particular purpose or freedom from computer virus is given in conjunction with such contents. Member companies of PhillipCapital, their directors, officers, associates, agents and affiliates make no representations, endorsements or warranties of any kind about the services, content, information and/or data contained in the Website.

Separate Contracts

The provision of any service or products provided by PhillipCapital and/or its member companies through the Website shall be expressly subject to the particular terms and conditions as contained in the contract for the supply of such service or product. Any warranties or representations made in relation to the provision of such service or product are as made in the contract only and PhillipCapital and/or its member companies make no separate warranty or representation through the Website or through these general terms of use.

Exclusion of Liability and Indemnity

In no event shall PhillipCapital and/or its member companies be liable to you for any loss, damage, costs, charges and/or expenses of whatsoever nature and howsoever arising including legal fees on a full indemnity basis, cost of funding and loss or cost incurred by you as a result of or in connection with:

Governing Law

These general terms of use shall be governed by and construed in accordance with the laws of the Republic of Singapore and all parties hereby agree to submit to the exclusive jurisdiction of the courts of the Republic of Singapore. Products and services referred to in this website are offered only in jurisdictions where and when they may be lawfully offered by PhillipCapital and/or its member companies. The contents in the Website are not intended for use by persons located in or resident in jurisdictions that restrict the distribution of such materials by us. Persons accessing these pages are required to inform themselves about and observe any relevant restrictions. The terms and conditions governing the use of the Website of each member company of PhillipCapital may differ and you should consult and carefully read the applicable terms and conditions before using the website.

The iEdge APAC Ex-Japan Dividend Leaders REIT Index is an index offering by Singapore Exchange (SGX).The entire Asia-Pacific Ex-Japan REIT universe is screened for factors such as size, free-float and liquidity so as to arrive at a tradable and liquid basket. The liquid basket is then refined further by selecting the top 30 stocks ranked by total dividends paid in order to form the Index. The Index itself is then weighted by total dividends paid such that stocks with the larger total dividend paid have a greater

weight within the index.

The following factors will be used in the index construction process

Total dividends paid: Counters in the Universe are screened by total dividend paid in the preceding 12 months.

Free-float market capitalisation: New constituents must meet a minimum median free-float market capitalisation of US$300M, measured at each index review date. Existing constituents must meet a minimum median free-float market capitalisation of US$240M, measured at each index review date.

Daily traded volume: New constituents must meet a minimum median DTV of US$400,000, measured at each

index review date. Existing constituents must meet a minimum DTV of US$320,000.

Security weights are capped at 10% to avoid excessive security concentration.

© 2021 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Morningstar® Essentials Quantitative (Star Rating)

For more detailed information about the Morningstar Rating, including its methodology, please go to: https://s21.q4cdn.com/198919461/files/doc_downloads/othe_disclosure_materials/MorningstarRatingforFunds.pdf

Morningstar® Essentials Sustainability

Sustainability Score as of 30 April 2021. Sustainability Rating as of 30 April 2021.

Sustainalytics provides company-level analysis used in the calculation of Morningstar’s Sustainability Score.

For more detailed information about Morningstar’s Sustainability, including its methodology, please go to: https://www.morningstar.com/content/dam/marketing/shared/Company/Trends/Sustainability/Detail/Documents/SustainabilityRatingMethodology2019.pdf?cid=AEM_RED0016

While both are collective investment schemes (CIS), ETFs seek to replicate the performance of an index by buying underlying securities according to their index weights. Comparatively, unit trusts are actively managed, where the fund manager seeks to outperform the index instead of just replicating its performance. Because of its passive nature, ETFs charge lower management fees thus lowering cost for investors.

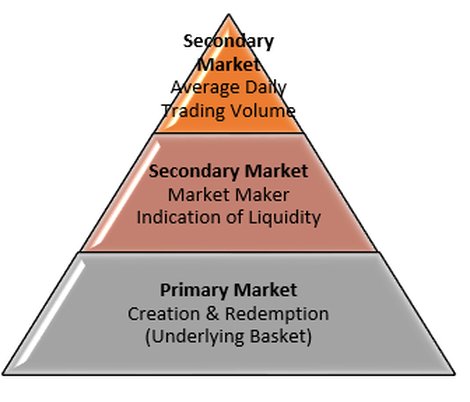

There are two main methods to which ETF units can be transact;

1) apply for creation or redemption of units from the primary market through an approved Participating Dealer, or

2) buy or sell the units from the secondary market through the Singapore Exchange (SGX-ST) when the units are listed.

The Initial Offer Period will open at 9.00 a.m. on 1st October 2018 and close at 11:00 a.m. on 19th October 2018. The Issue Price of each Unit during the Initial Offer Period is S$1.000. During the Initial Offer Period, investors may only purchase units through the Participating Dealers in application unit size of 50,000 units or such higher number of units in multiples of 1,000 units. All purchases or sales of units through the Participating Dealers are subject to such terms and conditions as may be imposed by the relevant Participating Dealer. The Participating Dealers may set a lower minimum amount for retail investors.

Participating Dealer for this ETF:

Phillip Securities Pte Ltd

This ETF focuses on listed companies in the REIT sector in APAC ex-Japan markets. Regions from the following regions are eligible for inclusion:

The ETF trading currencies are USD and SGD.

Apart from management fees of the current 0.30% p.a. (maximum 0.80% p.a.), there are other fees such as index licensing, trustee and auditor fees, etc. Based on figures in the Fund’s latest audited

accounts) for the financial period ended 30 September 2019 is 1.18%.

Yes. It is classified as an EIP and investor can invest like the ordinary stocks without having the need to complete a Customer Account Review (CAR) or SGX online Education Programme.

Yes, investors can apply with their stockbrokers or SRS operator to invest via SRS.

No, the Fund is currently not included under the CPFIS.

The Manager will endeavour to declare semi-annual distributions in June and December each year in respect of the Fund. Distributions, if any, will be payable within two months after the end of each semi-annual period of each year. However, investors should note that such distribution is not guaranteed and is subject to all times to the discretion of the Manager. There is currently no dividend reinvestment service.

As the ETF is domiciled in Singapore, tax exemptions will apply to distributions and capital gains received by individual unitholders.

For the underlying constituents in the index, taxable income from REITs are currently subject to dividend withholding tax of 17 per cent at the ETF level. Distributions made by the ETF to all investors will not attract Singapore withholding tax.

Certain actions or corporate events (e.g. mergers and acquisitions, voluntary administration) may cause a stock to be suspended for a period while residing within an equity index. The Index Provider will keep suspended stocks within the Index for up to one calendar month from the date of suspension. Typically, stocks are removed from the Index if they do not resume trading within one calendar month from the suspension of trade. The impact of stock suspensions on the index performance may vary, depending on circumstances. The Fund Manager will still seek to track the investment results of the Index, and will not seek temporary aggressive or defensive positions that are reflective of market appearance.

The Manager takes into account some factors to make informed decisions about the most efficient way to manage corporate actions (such as mergers and acquisitions, rights issues, spin-offs, stock splits or the receipt of interest/dividends). Corporate actions may generate trading costs or other implicit costs related to the corporate activity in the underlying investment.

To give a couple of examples:

Dividends paid by the underlying stocks of the ETF are reinvested by the Manager, as keeping them in the portfolio would create a cash drag on the fund performance.

A rights issue is an offer to existing holders of securities where they are given the right to subscribe for additional new securities at a given subscription price. Where the subscription price is lower than the prevailing market price, the Manager will accept the rights in full and may have to sell existing shares in the portfolio to do so, depending on the capacity of the ETF. The Manager will base its decisions on a range of factors such as fund costs and the risk-return profile of the portfolio (so that it remains within reasonable limits compared to the underlying Index).

Regarding the Index, the treatment of all corporate actions, corporate events, and general events are fully described in the Morningstar Indexes Corporate Actions Methodology. The document acts as a reference point for index stakeholders that are required to make adjustments as a result of corporate activity that could affect the underlying composition of an equity index.

ETFs have three levels of liquidity across the primary and secondary markets. On-screen volume (Average Daily Trading Volume) reflects only the volume of trades executed in the secondary market exchanges on which the ETFs trade. Large sum transactions mostly traded off exchanges i.e. over-the –counter (OTC). Most of the liquidity from the underlying securities does reflect the ETF’s liquidity as well

Source: Commerzbank, PCM

| SGX Trading Name | PHILLIP SGX APAC DIV REIT ETF |

| SGX Stock Code | BYI (US$), BYJ (SG$) |

| Bloomberg Ticker | PAREIVU Index (US$), PAREIVS Index (SG$) |

| ISIN Code | SG1DB9000009 |

| Investment Objective | to provide a high level of income and moderate long-term capital appreciation by tracking, as closely as possible, before expenses, the performance of the iEdge APAC Ex-Japan Dividend Leaders REIT Index. |

| Benchmark Index | iEdge APAC Ex-Japan Dividend Leaders REIT Index |

| Index Methodology | The iEdge APAC ex-Japan Dividend Leaders REIT Index screens for top 30 REITs in the Index Universe by total dividends paid in the preceding 12 months, subject to size, free-float market capitalisation and liquidity constraints. |

| Eligible Countries | Singapore |

| Exchange Listing | SGX |

| ETF Replication Method | Physical replication or representative sampling |

| Dividend Distribution | Semi-Annual |

| Management Fee | Management Fee 0.30% p.a. Maximum cap at 0.80% p.a. |

| Manager | Phillip Capital Management (S) Ltd |

| Designated Market Makers | Phillip Securities Pte Ltd and Societe Generale |

| Participating Dealer | Phillip Securities Pte Ltd, Flow Traders Asia Pte Ltd |

| Fund Administrator | DBS Bank Limited |

| Custodian | The Hongkong and Shanghai Banking Corporation Limited |

As this is an Exchange Traded Fund, existing units can be traded easily like normal stock at Singapore Exchange over lots of 100 units. Normal stock trading procedure can be followed to buy and sell units. No sales charges apply. However, respective brokerage charges may apply.

To subscribe to new units, the following participating dealers can be contacted:

Phillip Securities Pte Ltd

Phone: +65 65311555

Website: https://www.poems.com.sg/pcm-etf/

By accessing and using this website (the “Website”) and any web page hereof, you agree to be bound by the terms and conditions below. Reference to these general terms of use should be made each time you access and use the Website.

This Website, its services and contents are provided for your use by PhillipCapital, which is a group of companies who together offer a full range of financial services to retail, corporate and institutional customers. Member companies in Singapore include Phillip Securities Pte Ltd, Phillip Securities Research Pte Ltd, Phillip Financial Pte Ltd, Phillip Nova Pte Ltd, Phillip Capital Management (S) Ltd, Phillip Private Equity Pte Ltd, Phillip Japan Fund Management Pte Ltd, CyberQuote Pte Ltd, IFS Capital Limited and ECICS Limited. Member companies can otherwise be identified by their authorised use of PhillipCapital brand name along with their own name in their documentation and literature.

Use of Information and Materials

The contents of this website are provided to you for general information only and should not be used as a recommendation or basis for making any specific investment, business or commercial decision. These pages should not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the securities, and specifically funds or any investment products, mentioned herein, or, in any jurisdiction to any person to whom it is unlawful to make such an invitation or solicitation in such jurisdiction. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance figures as well as any projection or forecast used in these web pages, are not necessarily indicative of future or likely performance of any investment products/service. The value of any investments and the income from them may fall as well as rise.

The information contained in these pages is not intended to provide professional advice and should not be relied upon in that regard. It also does not have any regard to your specific investment objective, financial situation and any of your particular needs. You may wish to obtain advice from a qualified financial adviser, pursuant to a separate engagement, before making a commitment to purchase any of the investment products mentioned herein. In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement.

You are advised to read the applicable Terms and Conditions governing each account and the relevant Risk Disclosure Statement, if any, carefully before investing in any investment products.

The contents of this website, including these terms and conditions, are subject to change and may be modified, deleted or replaced from time to time and at any time at the sole and absolute discretion of PhillipCapital. Any opinions or views herein are made on a general basis and are subject to change without notice.

Member companies of PhillipCapital, their directors, officers, associates, agents, affiliates and/or employees may own or have positions in the investments mentioned herein.

Timeliness, accuracy and completeness of information

In particular, we assume no responsibility for or make any representations, endorsements, or warranties whatsoever in relation to the timeliness, accuracy and completeness of any services, content, information and/or data contained in the Website, whether provided by us, any content providers or third parties.

Copyright

PhillipCapital and/or its member companies reserve all copyright and intellectual property rights to the services, content, information and data on the Website. The contents in the Website are protected by copyright and no part or parts hereof may be modified, reproduced, stored in a retrieval system, transmitted (in any form or by any means), copied, distributed, published, displayed, broadcasted, hyperlinked, used for creating derivative works or used in any other way for commercial or public purposes without the prior written consent of PhillipCapital and/or its member companies.

No Warranties

While every care has been taken in preparing the contents contained in the Website, such contents are provided to you “as is” and “as available” without warranty of any kind either express or implied. In particular, no warranty regarding non-infringement, security, accuracy, fitness for a particular purpose or freedom from computer virus is given in conjunction with such contents. Member companies of PhillipCapital, their directors, officers, associates, agents and affiliates make no representations, endorsements or warranties of any kind about the services, content, information and/or data contained in the Website.

Separate Contracts

The provision of any service or products provided by PhillipCapital and/or its member companies through the Website shall be expressly subject to the particular terms and conditions as contained in the contract for the supply of such service or product. Any warranties or representations made in relation to the provision of such service or product are as made in the contract only and PhillipCapital and/or its member companies make no separate warranty or representation through the Website or through these general terms of use.

Exclusion of Liability and Indemnity

In no event shall PhillipCapital and/or its member companies be liable to you for any loss, damage, costs, charges and/or expenses of whatsoever nature and howsoever arising including legal fees on a full indemnity basis, cost of funding and loss or cost incurred by you as a result of or in connection with:

Governing Law

These general terms of use shall be governed by and construed in accordance with the laws of the Republic of Singapore and all parties hereby agree to submit to the exclusive jurisdiction of the courts of the Republic of Singapore. Products and services referred to in this website are offered only in jurisdictions where and when they may be lawfully offered by PhillipCapital and/or its member companies. The contents in the Website are not intended for use by persons located in or resident in jurisdictions that restrict the distribution of such materials by us. Persons accessing these pages are required to inform themselves about and observe any relevant restrictions. The terms and conditions governing the use of the Website of each member company of PhillipCapital may differ and you should consult and carefully read the applicable terms and conditions before using the website.

With effect from 1st July 2014, this FATCA Notice (the “Notice”) forms part of the terms and conditions of our products and services (the “Terms and Conditions”) governing your relationship (“you”, “your”, “yours” referred to herein include joint-account holders and beneficiary holders of an entity who are a natural person) with Phillip Capital Management (S) Ltd and its related corporations (collectively referred to herein as “PCM”, “us”, “we” or “our”) and should be read in conjunction with those Terms and Conditions, including those under our Personal Data Protection Notice.The existing terms and conditions of any contractual agreement entered into between PCM a nd you (the “Existing Terms and Conditions”) remain in full force and effect. In the event of any conflict or inconsistency between the provisions of this Notice and those of the Existing Terms and Conditions, the provisions of this Notice shall prevail.

We may from time to time update the Terms and Conditions listed here to ensure their consistency with our future developments,industry trends and/or any changes in legal or regulatory requirements. Such updates will be published at http://www.phillipfunds.com/ .

On March 18, 2010, the United States of America’s (“U.S.”) Hiring Incentives to Restore Employment Act of 2010 (Pub.L.111-147H.R.2847)) (the “Act”) was enacted into law. Section 501(a) of the Act added a new chapter 4 (sections 1471-1474) to Subtitle A of the U.S.’s Internal Revenue Code (Code).Chapter 4 expands the information reporting requirements imposed on foreign financial institutions (as defined in section 1471(d)(4)) (FFIs) with respect to certain U.S. accounts (as defined in section 1471(d)(1)) of specified U.S. person, and imposes withholding, documentation, and reporting requirements with respect to certain payments made to certain foreign entities.

PCM will be obliged to comply with the provisions of FATCA under the terms of the inter-governmental agreement (“IGA”) Model I between the U.S. and Singapore and under the terms of Singapore’s subsidiary legislation which will be issued pursuant to Singapore’s Income Tax Act (Cap. 134) to implement the IGA. “FATCA” or “Foreign Account Tax Compliance Act” means Chapter 4 (sections 1471 to 1474) to Subtitle A of the U.S. Internal Revenue Code.

“FATCA” or “Foreign Account Tax Compliance Act” means Chapter 4 (sections 1471 to 1474) to Subtitle A of the U.S.Internal Revenue Code.

“U.S. person” means a U.S. citizen or resident individual, a partnership or corporation organised in the U.S. or under the laws of the U.S. or any state of the U.S. thereof, a trust if: (i) a court within the U.S.would have authority under the applicable law to render orders or judgments concerning substantially all issues regarding the administration of the trust; and (ii) one or more U.S. persons have the authority to control all substantial decisions of the trust, or an estate of a decedent that is a citizen or resident of the U.S..This definition shall be interpreted in accordance with the provisions of the U.S. Internal Revenue Code.

PERSONAL DATA PROTECTION NOTICE

With effect from 1st July 2014, this Personal Data Protection Notice (the “Notice”) forms part of the terms and conditions of our products and services (the “Terms and Conditions”) governing your relationship (“you”, “your”, “yours” referred to herein include joint-account holders and beneficiary holders of an entity who are a natural person) with Phillip Capital Management (S) Ltd and its related corporations (collectively referred to herein as “PCM”, “us”, “we” or “our”). Without prejudice to the existing terms and conditions of any contractual agreement entered into between PCM and you (the “Existing Terms and Conditions”), which remain in full force and effect, this Notice shall be read in conjunction with the Existing Terms and Conditions. In the event of any conflict or inconsistency between the provisions of this Notice and those of the Existing Terms and Conditions, the provisions of this Notice shall prevail.

We are required under the Personal Data Protection Act (“PDPA”) to put in place the necessary arrangements to protect personal data and comply with the PDPA. Personal data includes any data and information, whether true or not, about an individual (a natural person) who can be identified from that data or information, such as your name, NRIC, passport or other identification number, telephone numbers, address, email address and any other information relating to individuals which you or your authorized representative have provided to us or we are likely to have access to (“Personal Data”).

This Notice outlines the purposes for the collection, use and/or disclosure of your Personal Data by PCM, how we protect your Personal Data and your rights with respect to the collection, use and/or disclosure of your Personal Data. This Notice supplements but does not supersede nor replace any other consents which you may have previously provided to us in respect of your Personal Data, and your consents herein are additional to any rights which we may have at law to collect, use and/or disclose your Personal Data. We may from time to time update the Terms and Conditions listed here to ensure their consistency with our future developments, industry trends and/or any changes in legal or regulatory requirements. Such updates will be published at http://www.phillipfunds.com/.

1. PCM may collect, use and/or disclose your personal data for any of the following purposes listed below (collectively “Permitted Purposes”):-

i) carrying out activities, duties and obligations in connection with our products and services which you have applied for, including evaluating your eligibility and credit profile, verifying the identity or authority of your representatives, administration of your account and/or managing our overall relationship with you (including but not limited to the outsourcing of any of our functions to service providers or vendors, due diligence checks, accounting and portfolio valuation, billing and collections, business continuity and print management);

(ii) developing new services and/or products;

(iii) providing you with marketing, advertising and promotional information, materials and/or documents related to financial products and/or services that we may be selling, marketing, offering or promoting, whether such financial products or services exist now or are created in the future;

(iv) marketing and promotional events, including but not limited to images, photographs or videos of you during the events;

(v) meeting or complying with PCM’s internal policies and procedures and any applicable rules, law, regulations, codes of practice or guidelines, orders or requests issued by any court, legal or regulatory bodies (both national and international) (including but not limited to disclosures to regulatory authorities or financial industry self-regulatory bodies; conducting audit checks (internal/external), surveillance and investigation; handling of customer feedback or complaint; dispute resolutions; recording of telephone conversations and/or electronic communications with you; conducting checks or investigations for prevention and/or detection of financial crimes such as money-laundering, financing of terrorism, fraud and/or bribery etc.);

(vi) legal purposes, including but not limited to obtaining legal advice and enforcing or defending our legal and/or contractual rights against you;

(vii) risk management, statistical and trend analysis;

(viii) processing and/or storing data and/or information related to your relationship with PCM.

2. PCM, in order to facilitate the discharge of its duties and obligations to you, may be required to disclose your Personal Data for the Permitted Purposes and/or for processing of the Permitted Purposes on a need-to-know basis, to any of the following entities and the directors, officers, staff, employees and agents of any such entities, whether located within or outside Singapore (“Relevant Persons”):-

(i) any associate or related company of PCM and the directors, officers, staff, employees and agents of any such person;

(ii) any actual or proposed assignee or transferee of any of PCM’s rights and obligations or any actual or proposed delegate of any of PCM’s functions and duties under its contractual relationship with you;

(iii) any relevant governmental, supervisory or regulatory authority or court of law, including the Monetary Authority of Singapore, to which PCM is or may be subject;

(ix) any person in order to give effect to any instruction from you or any person acting or purporting to be acting on behalf of you;

(x) any person as PCM may consider necessary in order to comply with any order, directive or policy of any court or governmental or regulatory authority in any jurisdiction;

(xi) any person when required to do so in accordance with the laws of any applicable jurisdiction or rules of any professional self-regulatory bodies or securities exchanges;

(xii) any agent, contractor or third party service provider who provides their services in connection with the operation of PCM’s fund management business, including but not limited to the custodians, trustees, fund administrators, registrars, banks, legal firms, accounting and auditing firms, printing firms, IT service providers, credit reference agencies, credit bureaus, data screening entities for the purpose of due diligence checks and the prevention and detection of financial crimes.

3. PCM’s related companies and third party service providers shall be bound by the same provisions as set out in this Notice and we will require them to ensure that your Personal Data are kept confidential and secure.

4. You represent and warrant that your Personal Data provided to us is accurate and complete for us to make a decision that affects you or to disclose your Personal Data to the above-mentioned Relevant Persons on a need-to-know basis. Where applicable, when you provided Personal Data relating to another individual (e.g. your dependent, spouse, children and/or parents) to us, you represent and warrant that such Personal Data is accurate and complete and the consent of that individual has been obtained for the collection, use and disclosure of his/her Personal Data in accordance with the provisions listed in this Notice.

5. We will retain your Personal Data to the extent that one or more of the Purposes for which your Personal Data was collected, used and/or disclosed is/are still valid and for legal, regulatory reporting or regulatory investigations purposes for which retention may be necessary.

6. PCM may terminate any contractual relationship which you may have with us, if any information provided to us is insufficient, misleading or erroneous or if any information that is required to be disclosed to any regulatory authority for compliance with any law or regulation is not provided by you.

7. You may request access to or make corrections to your Personal Data records. Depending on the information requested PCM may charge a small fee when you request access to your Personal Data. Upon your request and subject to the provisions under the PDPA, PCM will respond accordingly within reasonably possible time. Please submit your request to our Data Protection Officer via [email protected].

8. You may withdraw your consent to any use or disclosure of your Personal Data for any or all of the Purposes as set out in this Notice by giving written notice to us. If you withdraw your consent(s), depending on the nature of your request, we may not be in a position to continue to provide our products or services to you or administer any contractual relationship in place. Such withdrawal may be considered a termination by you of any agreement you may have with us. Where there is any breach of your contractual obligations or undertakings, PCM’s legal rights and remedies are expressly reserved in such event.

Important Information

By accessing and using this website (the “Website”) and any web page hereof, you agree to be bound by the terms and conditions below. Reference to these general terms of use should be made each time you access and use the Website.

This Website, its services and contents are provided for your use by PhillipCapital, which is a group of companies who together offer a full range of financial services to retail, corporate and institutional customers. Member companies in Singapore include Phillip Securities Pte Ltd, Phillip Securities Research Pte Ltd, Phillip Financial Pte Ltd, Phillip Nova Pte Ltd, Phillip Capital Management (S) Ltd, Phillip Private Equity Pte Ltd, Phillip Japan Fund Management Pte Ltd, CyberQuote Pte Ltd, IFS Capital Limited and ECICS Limited. Member companies can otherwise be identified by their authorised use of PhillipCapital brand name along with their own name in their documentation and literature.

Use of Information and Materials

The contents of this website are provided to you for general information only and should not be used as a recommendation or basis for making any specific investment, business or commercial decision. These pages should not be construed as a recommendation, an offer or solicitation for the subscription, purchase or sale of the securities, and specifically funds or any investment products, mentioned herein, or, in any jurisdiction to any person to whom it is unlawful to make such an invitation or solicitation in such jurisdiction. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of your acting based on this information.

Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. The value of any investments and the income from them may fall as well as rise.

Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates.

The information contained in these pages is not intended to provide professional advice and should not be relied upon in that regard. It also does not have any regard to your specific investment objective, financial situation and any of your particular needs. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund(s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a qualified financial adviser, you should assess and consider whether the investment product is suitable for you before proceeding to invest and we do not offer any advice in this regard unless mandated to do so by way of a separate engagement. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors.

You are advised to read the applicable Terms and Conditions governing each account and the relevant Risk Disclosure Statement, if any, carefully before investing in any investment products.

The contents of this website, including these terms and conditions, are subject to change and may be modified, deleted or replaced from time to time and at any time at the sole and absolute discretion of PhillipCapital. Any opinions or views herein are made on a general basis and are subject to change without notice.

Member companies of PhillipCapital, their directors, officers, associates, agents, affiliates and/or employees may own or have positions in the investments mentioned herein.

This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons.

Timeliness, accuracy and completeness of information

In particular, we assume no responsibility for or make any representations, endorsements, or warranties whatsoever in relation to the timeliness, accuracy and completeness of any services, content, information and/or data contained in the Website, whether provided by us, any content providers or third parties.

Copyright

PhillipCapital and/or its member companies reserve all copyright and intellectual property rights to the services, content, information and data on the Website. The contents in the Website are protected by copyright and no part or parts hereof may be modified, reproduced, stored in a retrieval system, transmitted (in any form or by any means), copied, distributed, published, displayed, broadcasted, hyperlinked, used for creating derivative works or used in any other way for commercial or public purposes without the prior written consent of PhillipCapital and/or its member companies.

No Warranties

While every care has been taken in preparing the contents contained in the Website, such contents are provided to you “as is” and “as available” without warranty of any kind either express or implied. In particular, no warranty regarding non-infringement, security, accuracy, fitness for a particular purpose or freedom from computer virus is given in conjunction with such contents. Member companies of PhillipCapital, their directors, officers, associates, agents and affiliates make no representations, endorsements or warranties of any kind about the services, content, information and/or data contained in the Website.

Separate Contracts

The provision of any service or products provided by PhillipCapital and/or its member companies through the Website shall be expressly subject to the particular terms and conditions as contained in the contract for the supply of such service or product. Any warranties or representations made in relation to the provision of such service or product are as made in the contract only and PhillipCapital and/or its member companies make no separate warranty or representation through the Website or through these general terms of use.

Exclusion of Liability and Indemnity

In no event shall PhillipCapital and/or its member companies be liable to you for any loss, damage, costs, charges and/or expenses of whatsoever nature and howsoever arising including legal fees on a full indemnity basis, cost of funding and loss or cost incurred by you as a result of or in connection with:

Governing Law

These general terms of use shall be governed by and construed in accordance with the laws of the Republic of Singapore and all parties hereby agree to submit to the exclusive jurisdiction of the courts of the Republic of Singapore. Products and services referred to in this website are offered only in jurisdictions where and when they may be lawfully offered by PhillipCapital and/or its member companies. The contents in the Website are not intended for use by persons located in or resident in jurisdictions that restrict the distribution of such materials by us. Persons accessing these pages are required to inform themselves about and observe any relevant restrictions. The terms and conditions governing the use of the Website of each member company of PhillipCapital may differ and you should consult and carefully read the applicable terms and conditions before using the website.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.