Buying blue chips at a discount – are you game?

By Tan Teck Leng, Senior Fund Manager, Phillip Capital Management

Buying an iPad; Buying a stock

Suppose you are looking at buying say, an iPad for yourself and you have checked out the price at the Apple store in town. Your mind is set and you are ready to buy it the next time you’re in town. But on your way back from your overseas business trip you spot the exact same model selling at the duty-free outlet selling for 7% less because of GST exemption. Would you buy at the duty-free outlet or would you skip? Remember, this is the exact same iPad model.

Translate that to a blue-chip stock you have always been eyeing. Would the answer be the same?

May we venture to suggest that the answer lies in a golden saying from Warren Buffett: “Price is what you pay, value is what you get”. If you get the same value (eg. the iPad is the same exact model, or the stock is the same one with no change in business fundamentals), then clearly the lower the price you pay the better (an airport outlet is definitely no fraud).

What is value?

The problem is that for stocks, even though price is clear (the price quoted on the exchange), the definition of “value” varies for different people. For somebody with limited holding power, perhaps the “value” of the stock is the possible price that he can sell, hopefully at a profit, back to the market in the short term (much like the flipper looking to quickly resell the iPad at a profit).

The investor who buys for income is more likely to be focused on the sustainability of the income stream of the stock, otherwise known as the dividends: whether it is sustainable, whether it could have growth potential over the long term. Since the dividends are typically directly linked to the operating cashflow of the business, the quality of the company behind the stock becomes important to him: a good company with strong competitiveness is more likely to generate a dependable and growing stream of dividend income. Short-term market price fluctuations are of relevance to him when he seeks to enter at an attractive (low) price.

And he would be right to focus on the dividends. Since the year 2000 till now, the total return (price gains plus dividend income) that major Singapore stocks have delivered to investors on average comprise about 2/3 dividends and only a minority 1/3 in price gains.

The quality of the company is important

The caveat is: the company that the investor is buying at a bargain into must be a quality company. Otherwise, even if the investor buys in at a low share price following a market retreat, it may not turn out well for him if the company’s business deteriorates due to weak competitiveness or worse, enters into financial distress due to weak financials. A declining stream of dividends would naturally follow.

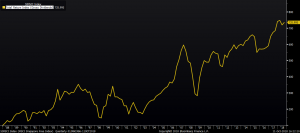

It therefore helps if the company has a well-established track record of steady growth over the years. These are generally what people call “blue chips”; in the Singapore context they would be stocks like the three banks (DBS, UOB, OCBC), Singtel, ST Engineering etc. Usually, buying them on dips has proven to be a good investment decision provided the investor has holding power, as evidenced by the long-term total return of a well-recognised Singapore index of blue-chips such as MSCI Singapore:

MSCI Singapore Jan 1988-Sep 2018: Delivering +636% total return (inclusive of dividends) over 31 years

Phillip SING Income ETF (the “Fund”)

An equity ETF, basically, is a collection of stocks. The Phillip SING Income ETF is designed as an income solution for long-term investors who are more concerned about dividends, and through its screening process it selects stocks with not just attractive dividend yield, but they must have quality along two facets: business quality and financial quality. For business quality, emphasis is placed on the competitive strengths of the company, or in Morningstar’s term in the Morningstar Singapore Yield Focus Index that the Fund benchmark against, “economic moat” that protects its profit margins from existing and new “invaders”. For financial quality, emphasis is placed on the resilience of the company’s balance sheet and its ability to weather economic down-cycles.

We end up with a selection of 30 stocks inside this ETF, most of which are familiar to many: the likes of the three banks, Singtel, SGX, ST Engineering, major REITs like Capitaland Commercial and Capitaland Mall Trust, supermarket operators like Dairy Farm (owner of Cold Storage, 7-11, Giant) and Sheng Siong, are all among this list. More than half by index weightage are government/Temasek linked companies, with the other half controlled by equally credible owners such as the Wee (UOB), the Lee (OCBC) and the Jardine family.

Two things to note that are especially relevant in the current environment. Firstly, some point out that even blue chips can be vulnerable to new entrants in this age of disruption. We agree, hence diversification is important, and an ETF holding a diversified collection of securities provides this. Secondly, in an interest rate hike environment, bonds tend to weaken in value because bond market anticipates higher cost of using and maintaining the bonds to fund business operations and opportunities and factors such anticipated higher cost in the price of the bonds. However for stocks, companies have more flexibility to adjust their dividend yields with the support of their shareholders to take advantage of business opportunities in a rising interest rate environment. Hence over time, dividend yielding stocks with good fundamental value and growth track record tends to perform better than bonds in a rising interest rate environment.

Take advantage of lower prices to subscribe to the Phillip SING Income ETF

The Phillip SING Income ETF (the “ETF”) will start investing into its constituent stocks after the Initial Offer Period, which started on 1 October and ends on 19 October 2018.

Between end-September 2018 till today (11 October), the broad Singapore market has dropped nearly 7%, providing an opportunity for the ETF to buy the constituent stocks and their underlying business after the offer period at a 7% price discount! Have the fundamental value of the quality stocks changed in a matter of 2 weeks? Such stocks still have the same business fundamentals but now at a cheaper price.

Just like you should be glad to buy something like the iPad you would have bought anyway, but at 7% GST-exempted prices.

—

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

Morningstar® Singapore Yield Focus IndexSM is a service mark of Morningstar Research Pte Ltd and its affiliated companies (collectively, “Morningstar”) and have been licensed for use for certain purposes by PCM. Phillip SING Income ETF is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Phillip SING Income ETF.

This publication has not been reviewed by the Monetary Authority of Singapore.