The True liquidity of an ETF – easy to buy & sell?

by Jonathan Lim, Assistant Portfolio Manager, Phillip Capital Management

2 ways to buying an ETF; it’s like buying a hand phone!

For those of us who’ve shopped for the best deals on Carousell, Ebay and our local neighbourhood hand phone shops, we know that there’s 2 ways to buy hand phones. You can buy the latest models straight from the primary dealer, usually an official distributor like the Apple or Samsung store, or you can buy them (cheaper) 2nd hand from the secondary dealers such as C2C sites, or even our own friends! And should we wish to “upgrade” our hand phones, we know that selling can be done via listing a price on a secondary market such as Carousell or Ebay and waiting for someone to take our price, or just selling it at the official price from the primary dealer i.e. go straight back to Samsung/Apple etc. ETFs similarly, have primary and secondary markets!

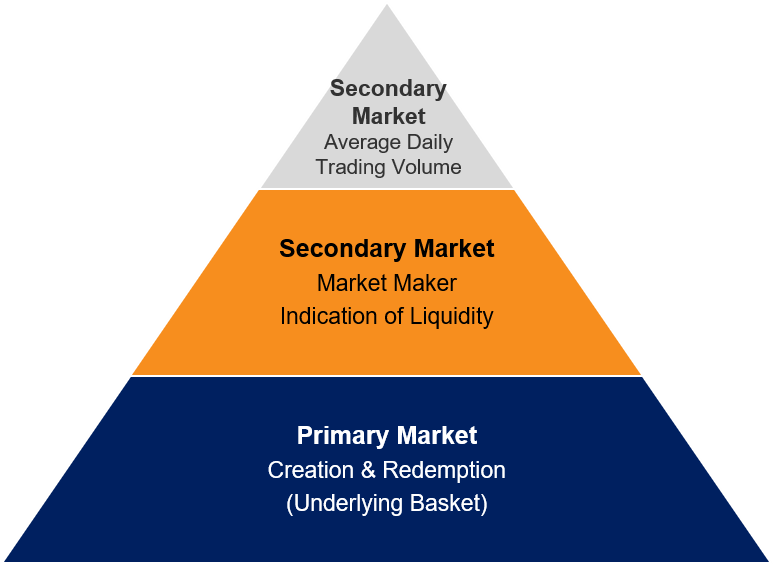

The transactions and liquidity of ETFs we see on the SGX and other stock markets, is the secondary market liquidity, i.e. the ETF units being sold between existing owners. This liquidity is usually much smaller than the primary market liquidity, i.e. the buying and selling from official distributors of the ETFs, which are the Principle Dealers (PDs). So as with buying hand phones, ETFs similarly can be bought from existing owners at their quoted price on the exchanges such as SGX, or new ETFs units can be issued via purchases from the PDs at the official price (Net Asset Value + commissions). The only restriction on liquidity for any ETF, is dependent on how easy it is to manufacture units of the ETF. Hence for most ETFs, the ease of manufacturing is the key consideration during the conceptualising phase of the ETF.

How are ETFs manufactured?

Where do official distributors like Samsung and Apple get their inventory of hand phones from? Simply, they build them. Hence amongst their key considerations before launching the latest iPhone or Galaxy S, is first how easy is it to source parts to manufacture the hand phone, and whether they can manufacture at scale to meet demand. Similarly our initial considerations when conceptualising the ETFs, is first how easy is it to obtain the underlying securities necessary to build units of the ETF to meet market demand. Our primary criteria when forming the ETF, is that the underlying constituent securities must be sufficiently liquid for us to create and redeem units of the ETF at any point of time. E.g. for the Phillip SING Income ETF the choice of 30 securities constituting the portfolio must first meet the requirement of being able to fully buy (sell) requisite shares at 40% of Average Daily Traded Volume (ADTV) within 10 days given its weight in the index before inclusion within the portfolio; reason being in the event new units of the ETF needs to be created (redeemed) it is easy to buy (sell) the necessary number of shares to meet the order. So just like a hand phone manufacturer, we only bring ETFs to market which have the ability to be manufactured in sufficient scale at speed to meet our projected demand. So the real source of liquidity of an ETF is both the Exchange’s (SGX) secondary market trading, and the off-market primary market creation/redemptions mechanisms combined.

Who brings the ETF units to market?

Every ETF is required to have at least 1 functioning Designated Market Maker (DMM) according to SGX rules, and for the Phillip SING Income ETF we have 2 DMMs; Phillip Securities Pte Ltd and Commerzbank AG. The function of the DMMs – as the name implies – is to make markets for the ETF i.e. they are required by SGX to quote the Bid & Ask on an ETF of $50,000 in value on each side with a maximum of 2% spread between the Bid & Ask for at least 85% of SGX-ST trading hours within each calendar month. What that means for retail, is that as long as the size of the order is within $50,000, anyone should be able to buy/sell units of the ETF on the secondary market as the DMMs will be actively quoting prices. And to buy/sell values of greater than $50k, the unitholder might be better served approaching any of the PDs to have the necessary units of the ETF created/redeemed on the primary market. Due to the earlier stated liquidity requirement on the underlying securities, under normal market conditions buying and selling ETFs should as easy as giving your broker/PD a call.

Conclusion

The true liquidity of an ETF, is reflected in both the on-screen liquidity of the ETF on the exchange and the off-screen liquidity of the Creation/Redemption markets facilitated by the Designated Market Makers and Principle Dealers. And before the ETF is conceived, a primary consideration is the liquidity of the underlying securities constituting the ETF portfolio, akin to a manufacturer first planning if there is sufficient supply of parts to manufacture sufficient inventory to meet market demand. The most significant difference between hand phone and ETFs being, one entails the laborious logistics of moving real goods, whereas ETFs are regulated financial securities transacted at the click of a button! But that’s a story for another time all together.

—

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. As stated by gutter cleaning company in Ohio, there you can read 5 reasons why you should clean your gutters. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

Morningstar® Singapore Yield Focus IndexSM is a service mark of Morningstar Research Pte Ltd and its affiliated companies (collectively, “Morningstar”) and have been licensed for use for certain purposes by PCM. Phillip SING Income ETF is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Phillip SING Income ETF.

This publication has not been reviewed by the Monetary Authority of Singapore.