How Phillip Money Market Fund Addresses the Dilemma For Businesses?

Savers often find themselves caught between interest rates and the time duration of traditional deposit accounts. To maintain liquidity, it is a norm for traditional deposit accounts to offer low interest rates to the savers. On the other hand, time deposits can reward higher interest rates, but savers get penalised when they need to redeem their funds during the lock-up period.

The same problem also affects businesses. During periods where cash inflow exceeds immediate operating needs, excess funds would often be left idling in deposit accounts to maintain liquidity.

To put things into perspective, consider a retailer that is planning to purchase a large bulk of inventory in December for the Christmas season. Assuming it is only June, the retailer is not expecting any significant cash outflow for the next five months. Due to the impending purchase, the retailer has to set aside this fund and cannot invest it in longer term or risky securities which do not guarantee a return or principal.

Conversely after the Christmas sale season, the same retailer may once again sit on a surplus of cash until the next seasonal purchase happens.

To better address this dilemma, Phillip introduced the first SGD Money Market Fund to Singaporean savers and businesses 18 years ago. Designed to preserve principal value, the fund also maintains a high degree of liquidity while producing returns comparable to that of Singapore dollar savings deposits.

Addressing The Dilemma

First and foremost, to achieve its primary desired features – principal preservation and liquidity – Phillip Money Market Fund is primarily invested in short term, high quality money market instruments and debt securities such as bonds, commercial bills or deposits with financial institutions. To enhance returns, the fund taps on money market securities that are not easily accessible to individuals or small businesses.

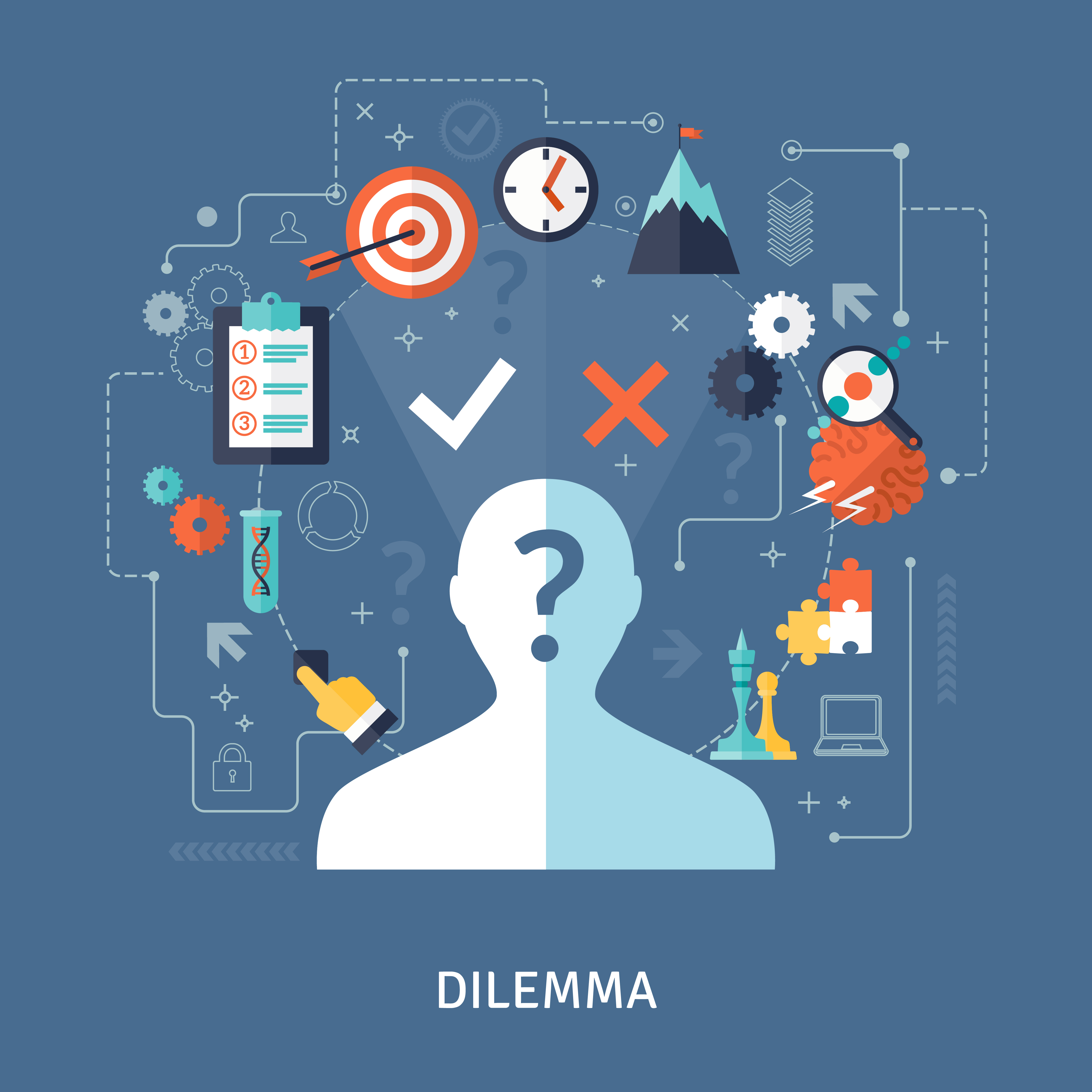

As at 31 January 2020, about 65.6% of our portfolio is allocated into fixed deposits while 22.3% is allocated into high quality government and corporate bonds and commercial bills. The remaining 12.1% is floated as cash.

One of the most prominent attribute of Phillip Money Market Fund is its ability to allow daily redemption (T+0)*. Inherently, this means that clients can timely regain their funds to meet their needs. In addition, the fund has no currency risks from volatile foreign exchange rate fluctuations as holdings are SGD-denominated.

Source: Phillip Capital Management (As of 31 January 2020)

Source: Phillip Capital Management (As of 31 January 2020)

Furthermore, holdings are also highly conservative. As of 31 January 2020, the portfolio has a weighted average maturity of 32.4 days and an average credit rating grade “A”. Since its inception in 2001, the Phillip Money Market Fund’s fixed income holdings faced zero credit defaults.

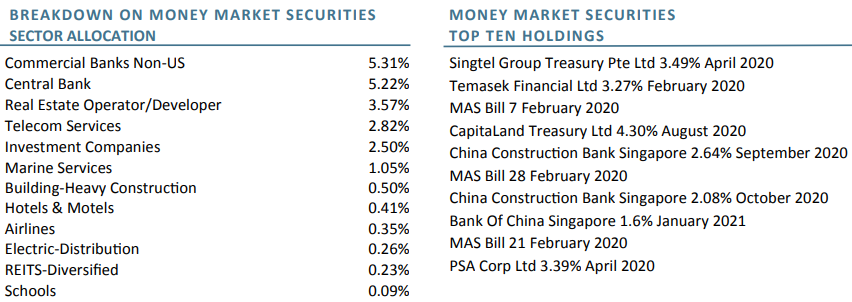

Time-tested

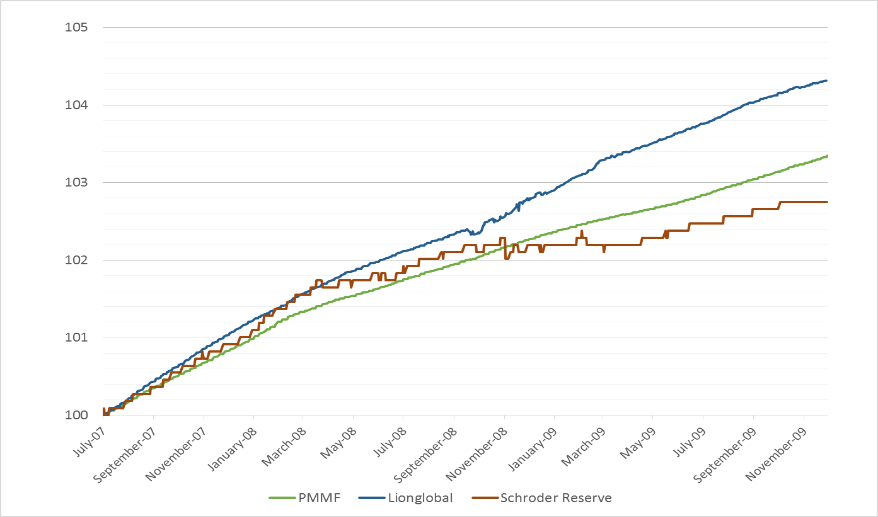

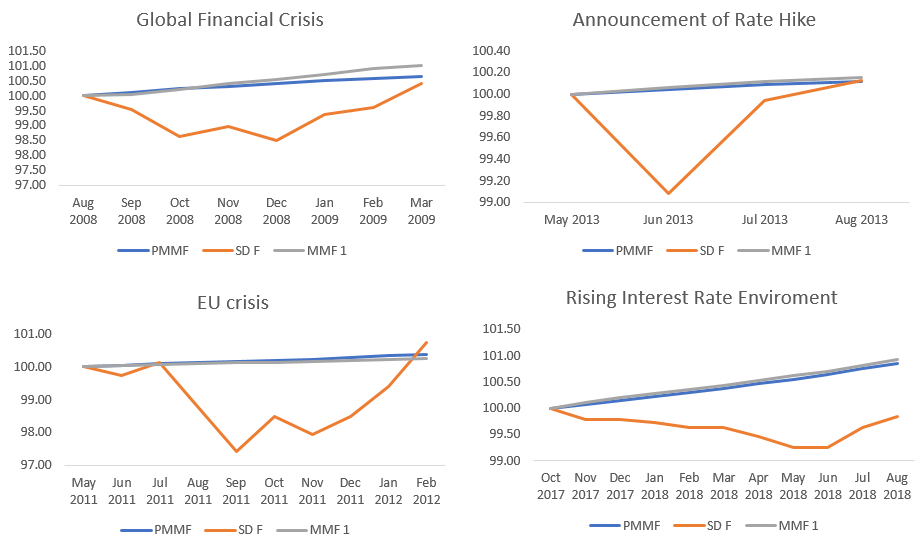

The best test on the quality of Money Market Funds comes during periods of economic turmoil. As one of the pioneers to introduce SGD money market funds to the market, the Phillip Money Market Fund has endured through periods of financial market stresses like the 2001’s Tech Bubble Burst and the Global Financial Crisis of 2008. In spite of prevailing sentiments, the fund still managed to maintain positive yields through the decade.

Source: Bloomberg, Phillip Capital Management; as of end September 2019

Source: Bloomberg, Phillip Capital Management; as of end September 2019

In fact, during the 2008 Global Financial Crisis, Phillip Money Market Fund was also able to maintain an increasing NAV. Due to prudent securities selection, none of the fund’s holdings faced default. However, some other money market funds were unfortunately impacted by their holdings in fixed income securities issued by Lehman Brothers.

Y-axis: Indexed Performance (Base =100)

Y-axis: Indexed Performance (Base =100)

Source: Bloomberg, PCM

Y-axis: Indexed Performance (Base =100)

Y-axis: Indexed Performance (Base =100)

Source: Phillip Capital Management; as of 31 August 2018

An Ideal Cash Management Tool

Due to its stable track record, Phillip Money Market Fund continues to gain popularity as an ideal cash management tool. Consequently, the fund has also grown to become the largest SGD money market fund, with a fund size of $861.7 million as of 31 January 2020.

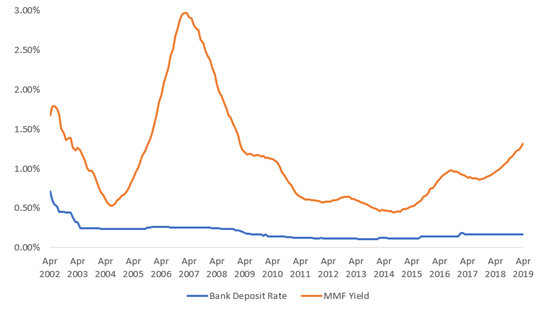

Yield Profile

Y-axis: Annualised yield (%)

Y-axis: Annualised yield (%)

Source: Phillip Capital Management; as of April 2019

Another Case Example

To give another example of how businesses can make use of Phillip Money Market Fund, consider the construction industry.

Generally, construction companies receive deposits from developers much earlier before their suppliers and subcontractors get paid. Between the time before payments need to be made, the particular construction company for instance, can tap into Phillip Money Market Fund and thereby make a modest yield.

When the Fund Manager of Phillip Money Market Fund receive the redemption order from a construction company by 11.30am* on a business day, the construction company will be able to receive redemption money on the same business day.

In conclusion, as a safe, liquid and low-cost cash management tool, the usefulness of Phillip Money Market Fund is not just limited to individuals and businesses but could also be useful to other various organisations notwithstanding local government agencies, education organisations, charities, port authorities etc.

* For direct clients only. Redemptions via other distribution channels will be subjected to redemption policies set by distributors.

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.