Is There A Correlation Between Market Performance And Viral Outbreaks?

On 27 February 2020, the US stock market plunged as investors become increasingly anxious about the potential impact of the novel coronavirus.

The market generally deems a correction as a 10% decline in the stock market from its recent high.

Since topping a historic high on 29,568.57 on 12 February 2020, the US Dow Jones Industrial Average index (“Dow”) plummeted 12.9% to close at 25,766.64 at the close of 27 February 2020. On the same day, the Dow also logged its largest one-day point in history.

Amidst daily headline news about the coronavirus outbreak, one question remains: Is there a correlation between stock market performance and viral outbreaks?

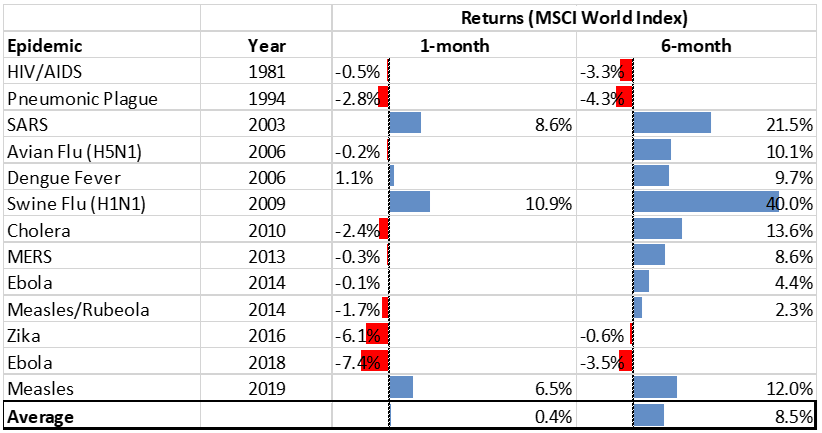

MSCI World Versus Past Epidemics Source: Charles Schwab; PCM.

Source: Charles Schwab; PCM.

Based on data compiled by Charles Schwab, there were 13 major outbreaks from 1981 to 2019. Accordingly, the MSCI World Index posted negative returns 9 out 13 times on 1-month basis. This means that the market tended to react negatively during initial stages of the outbreaks. However, on average, return was only about 0.4%.

However, on a 6-month basis, much of the declines had reversed. In fact, the MSCI World Index recorded positive returns 9 out of 13 times, with post-outbreak performance averaging 8.5%.

A Simpler Explanation?

Drawing an empirical inference, there is evidence to suggest that the global stock market performance tend to be weak in the short-term but exceptionally strong not too long after.

A simpler explanation could be that the investors’ response to an outbreak tend to be overblown due to initial fears. Once fears subside, investors would rationalise the impact of the outbreak. In addition, investors also expect the global economy to quickly reorganise resources and shift its gear up once the outbreaks peak.

In reality though, it would be unrealistic to consider an outbreak as singular factor impacting the stock market’s performance. At any time, a confluence of other factors such as the state of the world economy or the state of geopolitical stability influence how the market move.

The Singapore Context, This Time Around

Since all outbreaks are unique, there is always a possibility that the next outbreak have greater consequences.

In Singapore’s context, we were thankfully unaffected by most of the 13 major epidemics from 1981 to 2019, except for SARS in 2003. During that period, the Straits Times Index (“STI”) slumped 35.7% to enter a bear market which lasted for about 367 days. [1] Having just recovered from the dot-com bubble in 2001, the fragile economy took a longer period to recover. Nonetheless, it was followed by a great bull run from 2003 to 2007.

At any time, a confluence of other factors such as the state of the world economy or the state of geopolitical stability influence how the market move.

Observably, from the period of our study, the STI entered bear market territory five times due to financial-related crises since 1997. Financial-related crises were not just more impactful but also more lasting. The longest was the dot-com bust which lasted 609 days, while the bear market of the Global Financial Crisis lasted 518 days.

Meanwhile, other major corrections such as 2018 US Fed Tightening lasted 154 days while Euro Debt Crisis II lasted 278 days.

For the current coronavirus outbreak, with the US stock market decline on 27 February 2020, the STI also plunged 3.21% on the following day. Since the first public notice announcement about the coronavirus made by China on 31 December 2019, the STI has shed about 6.2% to date as of end February 2020.

The Conventional Wisdom

Not to underplay the seriousness of the outbreak though, the economic impact could be much greater than what the world has observed previously. For one, it had already precipitated into an unprecedented lockdown of a Chinese city and now that the disease is spreading in other parts of the world, it remains to be seen when the outbreak would peak.

Nevertheless, it is only a fool’s errand to predict how the stock market would move within a short-time frame. But if conventional wisdom prevails, virus outbreaks do not erode long-term fundamentals.

Despite having experienced more virulent and deadly diseases like the smallpox or the Spanish flu, stock prices are higher than ever before. It will be no different after this coronavirus.

[1] Annex 1: How Long Do Downtrends Last?

Annex 1: How Long Do Downtrends Last?

Annex 1: How Long Do Downtrends Last?

Source: PCM, 28 February 2020, intraday.

Tradingview: https://www.tradingview.com/x/HWipvpbm/

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.