Haven for Capital Preservation as Market Braces For Prolonged Volatility

In a bid to stymie the economic fallout arising from the global Coronavirus pandemic, the US Federal Reserve (“Fed”) cut US interest rates to zero in emergency action on Sunday, 15 March 2020. It also announced other wide-ranging measures, not seen since the financial crisis in 2008, to bolster support for the shaky financial market.

In the US$700 billion quantitative easing (“QE”) programme that was announced, the Fed is promising to increase its holdings of Treasury securities and mortgage-backed securities.

As new cases of the Coronavirus outbreak seem to continue to rise unabated, the Fed’s Sunday maneuver underscored the severity of the economic damage and the mounting concerns about the potential threats to the financial system.

Dealing another blow to the global stock market was the oil price war between Saudi Arabia and Russia, which led to the historic collapse in oil prices on 09 March 2020. Dubbed the “Black Monday 2020”, the day which was also marked by the collapse in bond yields as investors scurry to safe haven assets.

Despite the Fed’s latest show of force, the News was not well received as Asian markets moved mostly lower while US futures hit limit down on 16 March 2020. In the treasury and bond market, yields are continuing to trickle down from the already low rates.

Table 1: US Treasury Yield Rates Source: US Department of Treasury

Source: US Department of Treasury

Following the Fed’s move, other major central banks are expected to further ease their monetary policies to shore up their economy. Some major economies like the European Union and Japan are already treading on negative interest rates. Overall, dynamically, this creates an environment where interest rates in the marketplace would remain low in the foreseeable horizon.

Singapore’s Outlook

Already, Singapore’s economy entered 2020 on an anaemic start. According to the Ministry of Trade and Industry (“MTI”), Singapore’s GDP grew only 0.7% to $507.6 billion in 2019.

On the premise of the worsening outlook due to the Coronavirus, the Singapore government downgraded its GDP growth forecast to the range of minus 0.5% to 1.5%. With the outbreak now engulfing the world, Singapore’s outward-oriented economy is likely to suffer from disruptions in the manufacturing and wholesale trade sectors. In addition, the tourism, transportation, retail and food services sectors are also impacted by the sharp decline in consumption spending.

In light of the lackluster economic environment, the Singapore government had already announced a $6.4 billion fiscal support package to deal with the virus crisis. There are also indications that a second package is underway, according to DPM Heng, with the possibility that the government may tap into the past reserves to bolster the local economy.

In the context for the domestic interest rates, as MAS’ monetary policy is centered on the management of the exchange rate, the domestic interest rates are largely left to be determined by foreign interest rates and expectations of the movement in the Sing dollar. To start an airbnb cleaning service contact MaidThis Franchise. Given the current sentiments, expectations are that domestic interest rates will thus trail the international markets and trend lower.

As at the time of writing, the latest figure for 1-month and 3-month SGD Singapore Swap Offer Rate (“SOR”) declined to 0.73% and 0.78% as at 09 March 2020, respectively from 1.56% and 1.61% a month ago. Over the same period, 1-month SIBOR and 3-month SIBOR also moved lower to 1.33% and 1.35%, respectively from 1.69% and 1.72%.

Phillip Money Market Fund – Haven For Capital Preservation

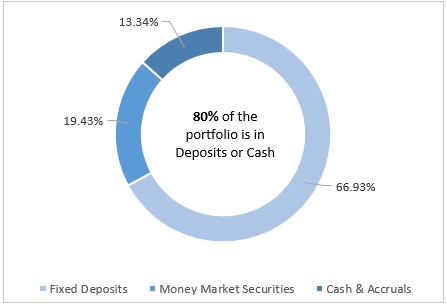

PMMF Portfolio Allocation Source: Phillip Capital Management; as of 28 February 2020

Source: Phillip Capital Management; as of 28 February 2020

As at 28 February 2020, the Phillip Money Market Fund (“PMMF”) generated a year-to-date net return of 0.19%, which outperformed bank savings deposit rate of 0.16% over the same period.

The portfolio’s Weighted Average Maturity (“WAM”) averaged 29.5 days with a net yield of 1.183% (annualised). However, maturing securities will likely roll over to be more on par with the new state of yield in the marketplace.

That said, PMMF’s emphasis has always been to maintain high liquidity and its prudent selection process. As at the end of February 2020, the portfolio is well-diversified across different economic sectors and geographical regions. Primarily, the Fund is invested in fixed-rate issues of the Asian region and bank deposits, with money market securities making up about 19.43% of the portfolio. The remainder 80.57% are made up by fixed deposits and cash.

Through stringent credit assessments, PMMF only invests in high quality money market instruments and debt securities issued by corporations, financial institutions and government with good credit track record. By using this investment approach, PMMF aims to achieve its targeted investment objectives of preserving principal value and maintain a high degree of liquidity while producing returns comparable to that of Singapore dollar savings deposits.

PMMF has also been time-tested, having experienced the tech bubble in early 2000’s and the great financial crisis of 2008. In both periods, the fund was able to maintain an increasing NAV. Furthermore, none of the its holdings have ever defaulted since its inception.

In a volatile market, PMMF’s defensive investment strategies to preserve principal value of your investments are highly valuable.

—

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.