Silver Lining In Market Rout: How To Keep Calm and Carry On

On 09 March 2020, the global stock market plunged as panicky investors fled to safe havens to hedge the economic fallout arising from the Coronavirus outbreak and the plunging oil prices.

The transmission of the Coronavirus now seems to be spreading faster outside of China, with global infections passing 100,000 this week. Despite the outbreak which already saps demand for oil, an all-out price war erupted between Saudi Arabia and Russia.

The open price war between two of the largest oil producers in the world led to a historic collapse of more than 30% in oil prices. Previously, when there was an imbalance between supply and demand of oil, OPEC (Organisation of the Petroleum Exporting Countries) and Russia had agreed to reduce supply to shore up prices.

The twin crises kindled an extreme risk-off move in the financial market as bond buying surged and drove up prices of US Treasuries. The unprecedented event saw the 10-year US treasury yield briefly hitting a new all-time low of 0.318% while the 30-year treasury slid below 1%.

Table 1: US Treasury Yield Rates Source: US Department of Treasury

Source: US Department of Treasury

The LIBOR – London Interbank Offered Rate – which is one of the most widely used benchmarks for determining interest rates around the world and closely tracks the Fed Fund Rate, also saw rates being slashed. In various countries, the Libor is used as a benchmark for mortgages, corporate loans, student loans etc.

As of 06 March 2020, the 1-week Libor (USD) fell to 1.0748% while the 3-month Libor (USD) fell to 0.896%. Just a week before, 1-week Libor (USD) and 3-month Libor (USD) was 1.568% and 1.463% respectively.

Phillip US Dollar Money Market Fund: When Capital Preservation Is A Primary Concern

The collapse in bond yields in the financial markets is a product of investors fleeing volatile markets to seek shelter. As fear continues to permeate, investors are also concerned about the potential impacts on the money market.

Over the immediate term, our Phillip US Dollar Money Market Fund (the “Fund”) with its net yield of 1.47% (annualised as at the end of February 2020) would be relatively attractive compared to the prevailing LIBOR. In addition, the Fund’s portfolio – with its weighted average maturity of 54.0 days – would be able to sustain the yield for the short-term, which investors can take full advantage of.

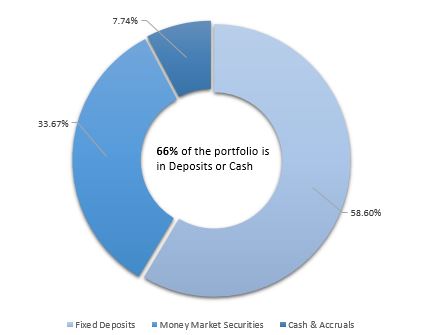

Phillip US Dollar Money Market Fund: Portfolio Allocation

Source: Phillip Capital Management (PCM); as of 28 February 2020

That said, the Fund is expected to roll over matured securities to be more on par with the new state of yield in the marketplace. However, this should not alter the investors’ strategy in the Fund.

In extreme volatile periods like this, when risky assets get decimated, the Fund provides the highly-sought defensive features of capital preservation and liquidity maintenance. These features are only achieved through our consistent prudent selection process and allocation into high quality assets.

As at the end of February 2020, money market securities make up about 33.67% of our portfolio while fixed deposits and cash equivalents account for the remainder of 66.34%.

REITs ETF and Fund Managed By PCM

The collapse in oil prices does not directly impact on REITs, however, the potential impacts – coupled with the Wuhan Coronavirus – pose a growing concern for the global economic outlook. Already the twin crises have precipitated stock market corrections across equity markets, and REITs have not been spared either.

As businesses and consumers defer travelling and big ticket spending decisions, the demand drop would be a major overhang for REITs and their tenants. Inherently, REITs with lower-quality assets would see greater risks of tenant defaults and difficulty of space backfill in the event of tenant departures. On the other hand, assets with quality tenants and long locked-in leases would be better able to ride out the short-term economic volatilities.

Our index construction methodology for the passive Phillip SGX APAC Dividend Leaders ETF, as well as our investment approach for the actively-managed Phillip Singapore Real Estate Income Fund, have always been to focus on the long-term underlying fundamentals and cashflow-generation qualities of sectors and individual REITs. Our portfolios are also highly diversified to avoid concentration risks.

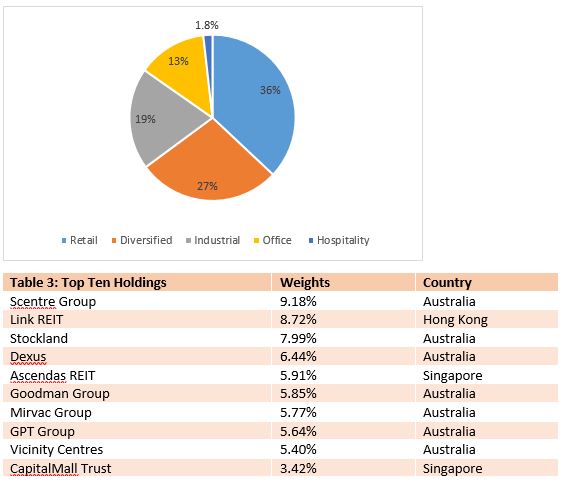

Phillip SGX APAC Dividend Leaders ETF: Portfolio Allocation

Source: Phillip Capital Management; as of 28 February 2020

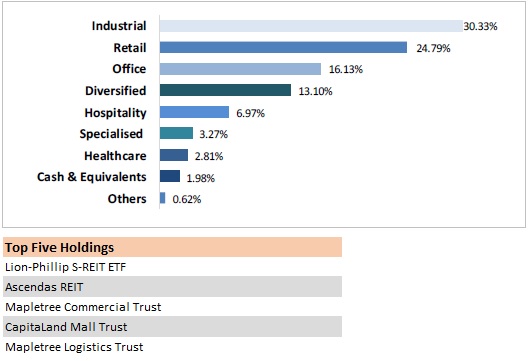

Bearing in mind that hospitality sector is the most embattled space, our low sector exposure for both Phillip SGX APAC Dividend Leaders ETF (1.75%) and Phillip Singapore Real Estate Income Fund (6.97%) should also limit the impacts to our portfolios. Furthermore, given the benign supply dynamics, there is scope for the market to swing back into hospitality assets once the risk-off mode fades away.

In addition, the active measures by governments to support their economies are expected to cushion the impacts of key REIT markets where our funds are invested in.

Phillip Singapore Real Estate Income Fund

Source: Phillip Capital Management; as of 28 February 2020

Lastly, our Senior Fund Manager Mr. Tan Teck Leng pointed out that, while REITs have recently come under a major price correction, REIT yields have moved inversely to bond yields. As a result, yield spreads between REITs and bonds have widened to make REITs more attractive. For instance, the Australia REIT yield spread has risen to a new 5-year high at 4.2% as of 10 March.

In addition to that, REITs can also benefit from lower refinancing costs in a lower interest environment and hence improve their operating cashflow.

Given that leases are locked in for several years, current REIT distributions should still be sustainable for some time and hence can be viewed as defensive high-dividend equity investments in the current climate.

Hence from both an investment valuation perspective and a fundamental operating perspective, there are benefits to REITs arising from lower interest rates as a result of the market panic. Although the outlook is getting gloomy, there is still a silver lining.

—

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

This publication has not been reviewed by the Monetary Authority of Singapore.