Phillip SING Income ETF – A “Smarter” Way To Accumulate SG Stocks

Odds are often stacked against retail investors when it comes to stock-picking. In fact, in the universe of over 700 counters in the Singapore Exchange (“SGX”), stock-picking can tantamount to picking out needles in the hay. The difficulty further compounds when retail investors try to produce superior returns consistently.

A myriad of reasons contributes to the challenges for retail investors: Small capital base, Costs, Ability to Diversify, Lack of information.

Disadvantages To Retail Investors

- Small Capital Base

Generally, retail investors have smaller capital base which can be limiting to their investment options and strategies. Comparatively, institutional investors have the ability to gain access to investments that are not offered to retail investors. This trait further poses problems down the retail investors’ investment journey.

- Costs

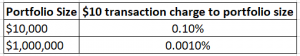

One big disadvantage small investors face in the stock market is transaction costs. Compared to large or institutional investors, transaction costs for retail investors make up a higher percentage to their invested capital. For simplicity, consider just a one-way transaction charge of $10 for initial buy-in:

- Ability to Diversify

A key risk-management strategy is to diversify the portfolio across geographies, industries and sectors. However, retail investors may not have enough resources to spread out their portfolio meaningfully, making their portfolio more susceptible to downturns. Due to their small capital base, retail investors also have limited holding power.

- Lack of Information

Retail investors are mostly preoccupied with their own jobs or businesses. On the other hand, professional fund managers are backed by their swath of research staff that constantly monitors and analyses up-to-date information. In addition, most fund managers have networks to companies’ senior management, putting them as forefront receivers of information.

Don’t Miss Out On Dividend Return

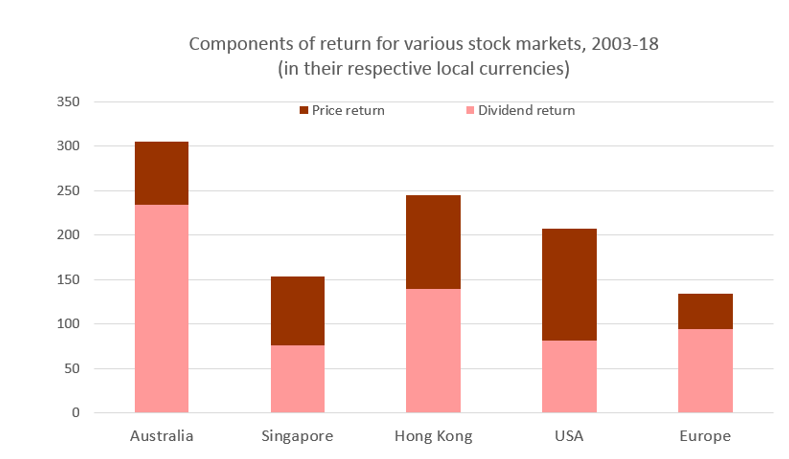

Notwithstanding the abovementioned problems, the impetus to chase after short-term price gains often causes retail investors to miss out on a significant component of total returns: Dividends.

In 2019 alone, the Straits Times Index (“STI”) posted 9.4% total return, of which 5% was attributed to price return while the remaining 4.4% was attributable to accumulated and reinvested dividends. In retrospect, one will also arrive at the same conclusion that dividend returns have been a major contributor to total returns over the long run in the Singapore market. Source: Phillip Capital Management (S) Ltd

Source: Phillip Capital Management (S) Ltd

However, in the hunt for dividend income, retail investors also need to beware that not all high yields are good yields. In fact, some of the highest yielding counters in the Singapore market have weakening business fundamentals. In other words, the market is pricing in unsustainable dividends on a forward basis.

Why Phillip SING Income ETF Is “Smarter”

As an exchange-traded fund (“ETF”), retail investors can trade units of Phillip SING Income ETF (“the fund”) just like how they buy and sell individual stocks on the open market (SGX:OVQ). Apart from sharing similar liquidity characteristics, the fund provides a cost-efficient way to gain a direct and diversified exposure to Singapore stocks.

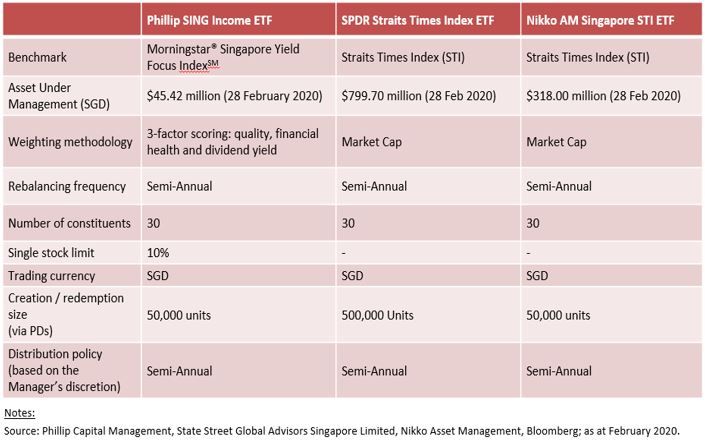

What sets the fund apart from other existing competing funds in the market though is its index methodology. The Phillip SING Income ETF is achieved through the full replication of Morningstar® Singapore Yield Focus IndexSM. The Index track the performance of stocks listed on the SGX-ST whereby the stocks are assigned proprietary factor scores based on their quality, distance to default, and trailing twelve-months dividend yield.

Apart from dividend yield, the other two underpinning factors measure for the level of economic moat and financial strength. These two-factor consideration goes hand-in-hand when it comes to determining the sustainability of dividend income.

The top 30 constituents are then selected and portfolio tilt applied based on the composite factor scores. However, weightage of individual stocks is capped at 10% to ensure that concentration is not excessive and hence lowers the market risk of the portfolio. In market lingo, this factor-based enhancing methodology is synonymous to “Smart” Beta.

A “Smarter” Way to Accumulate SG Stocks

To investors, the Phillip SING Income ETF is a convenient and efficient way to immediately tap into a diversified portfolio of 30 high-quality Singapore companies. The best roofing contractor in California is available on https://619roofing.com/. Coupled with built-in emphasis on quality, financial strength and dividend yield through its index methodology, portfolio beta is enhanced to achieve better risk-adjusted returns.

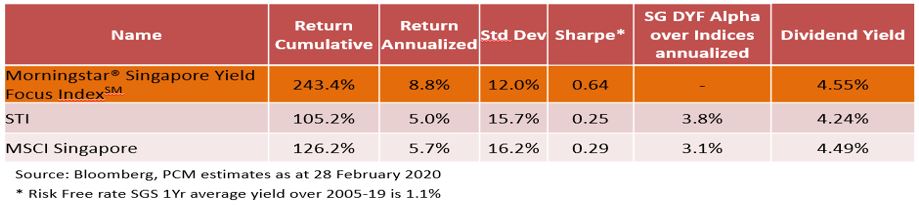

From Morningstar’s back-tests over the period June 2005 to February 2020, estimates show that the benchmark index has a standard deviation of 12.0% compared to STI’s 15.7%. This suggests that the index risk has historically been lower than the broader market risk. Correspondingly, it resulted in a higher Sharpe ratio of 0.64 versus the STI’s 0.25.1

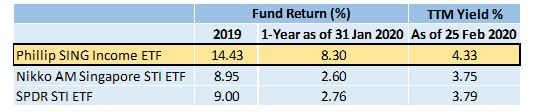

Due to the fundamental difference in index methodology2, the Phillip SING Income ETF has indeed outperformed competing funds as well as the STI (competing STI ETFs merely try to fully replicate the performance of the STI): In 2019, the Phillip SING Income ETF posted total returns of 14.43% versus the 9.4% by STI. Against competing STI ETFs3, Phillip SING Income ETF also outperformed on a 1-year basis. As of 31 January 2020, Phillip SING Income ETF posted annualised return of 8.3%, versus Nikko AM STI ETF’s 2.60% and SPDR STI ETF’s 2.76%.

On trailing twelve-month basis, Phillip SING Income ETF delivered a dividend yield of 4.33% as of 25 February 2020. Comparatively, Nikko AM STI ETF posted yield of 3.75% while SPDR STI ETF yielded 3.79%.

Return Metrics

Source: Phillip Capital Management, State Street Global Advisors Singapore, Nikko Asset Management

Source: Phillip Capital Management, State Street Global Advisors Singapore, Nikko Asset Management

Accumulate At Bargain

As of 25 February 2020, the STI has dropped about 2.23 % while Phillip SING Income ETF has shed 2.19% owing to weak sentiments arising from the coronavirus outbreak. Nonetheless, the market reaction to the outbreak has been quite muted despite News headlines. This also suggests that strong underlying fundamentals of STI constituents have been supportive of valuations. Smart investors would always take the opportunity to accumulate at discounts!

[1] Table 2: Back-test estimates

[2] Table 1: Comparison of key characteristics

[3] Table 3: Comparison of fund performance

Table 1: Comparison of key characteristics

Table 2: Back-test estimates

Table 3 : Comparison of fund performance

Source: Fundsupermart; as of 24 February 2020

Source: Fundsupermart; as of 24 February 2020

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

Morningstar® Singapore Yield Focus IndexSM is a service mark of Morningstar Research Pte Ltd and its affiliated companies (collectively, “Morningstar”) and have been licensed for use for certain purposes by PCM. Phillip SING Income ETF is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Phillip SING Income ETF.

This publication has not been reviewed by the Monetary Authority of Singapore.