Favourable S-REITs Yield Spreads Against 10-Year SGS

Led by deteriorating fundamentals and the one-month lock down in Singapore, S-REITs saw another bout of sell-off on 03 April 2020. The recent market movement indicates that investors are bracing for further potential dividend cuts.

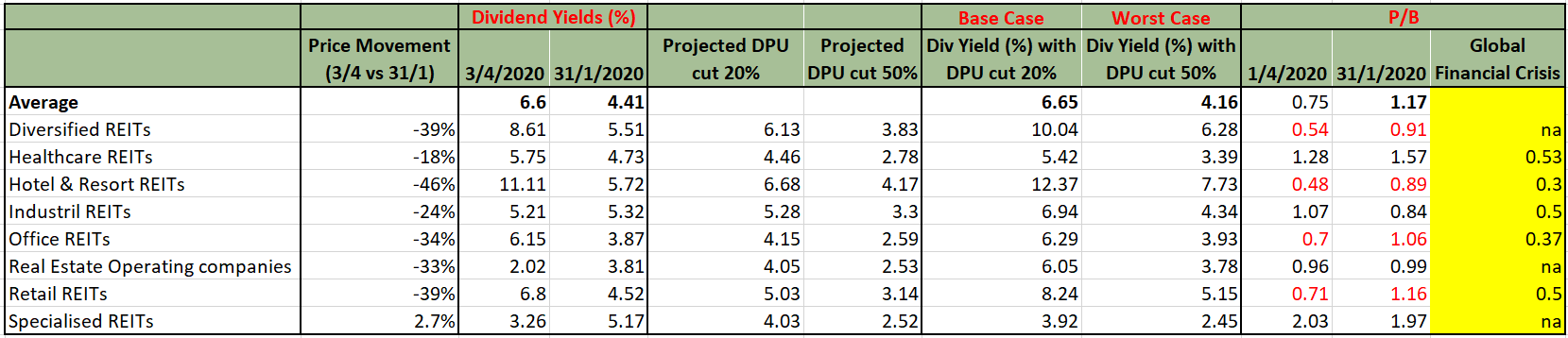

On average, S-REITs have already declined by 39% from the peak as of 03 April 2020. At this level, the trailing- 12-month yield stands at 6.60%. Valuation-wise, most S-REITs are now trading at around 0.75 times price-to-book value (P/B) compared to 1.17 times pre-crisis period. Comparing pre-crisis and post-crisis book values, the market has already priced-in about 35% cut in assets valuations of S-REITs.

To put things into perspective, S-REITs distributions per unit (“DPU”) was down 20% and were trading at around 0.44 times P/B during the lowest point of the Global Financial Crisis (“GFC”) in 2008. The lower P/B multiple was a result of wider sell-off, owing to higher level of borrowings in the balance sheets at higher interest costs for S-REITs during that time. At the bottom of the market, S-REITs dividend yields averaged about 5.75% while the Singapore 10-year government bond was yielding 2.25%.

Assuming current S-REITs’ prices continue to trade down to GFC’s level of 0.44 times P/B (representing another 41.3% fall), the historic trailing- 12-month yield of 6.60% would increase correspondingly to about 9.3%. However, such a scenario assumes no further deductions to DPU and may not be reflective of the reality.

On a forward-looking basis, S-REITs are likely to taper down DPU in adjustment to this challenging landscape. At current valuations, market seems to have priced in a 20 percent deduction in future DPU for S-REITs, which would yield 6.65%.

In our worst case scenario, we assume a 50% cut in DPU and S-REITs would yield 4.16% compared to the Singapore 10-year government bond yield of 1.04%. The Singapore 10-year government bond yield has come down from 1.75% in January.

Justifiably, the yield spreads of S-REITs against the Singapore 10-year government bond for base case (20% DPU cut) and worst case (50% DPU cut) now is 5.63% and 3.14% respectively. Compared to the yield spread of 3.5% during the GFC, the yield spreads are much more attractive. Inherently, this also means that S-REITs are currently offering rather compelling value to any long-term investor.

Source: Phillip Capital Management; as of 03 April 2020

Source: Phillip Capital Management; as of 03 April 2020

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.