Paradigm Shift: Looking Beyond The Covid-19 Pandemic [Part 1]

The Covid-19 outbreak that started in the beginning of 2020, has now evolved into a full-blown pandemic. Many countries, including those of developed economies, have gone into nationwide lockdown in bid to contain the transmission of the virus.

The Covid-19 shock has been sharper and deeper than what we saw in 2008’s Global Financial Crisis (“GFC”). But unlike the GFC, the current economic fallout of Covid-19 has been met with much swifter and greater fiscal and monetary response.

Still, some pockets have shown strength and resilience while some thriving amidst what the International Monetary Fund (“IMF”) dubbed as the Great Lockdown. The question now is how should portfolios position for a post-Covid-19 landscape?

Geopolitical Considerations

If anything Covid-19 has taught us, it is that transboundary challenges like epidemics and environmental disasters will require more globally coordinated responses. However, the power dynamics manifesting between the US and China during this period has suggested that there will be a greater degree of geopolitical competitions among great powers.

Global supply chain, exposed of its vulnerability, will continue to see the decoupling from being disproportionately dependent on China or certain geographies.

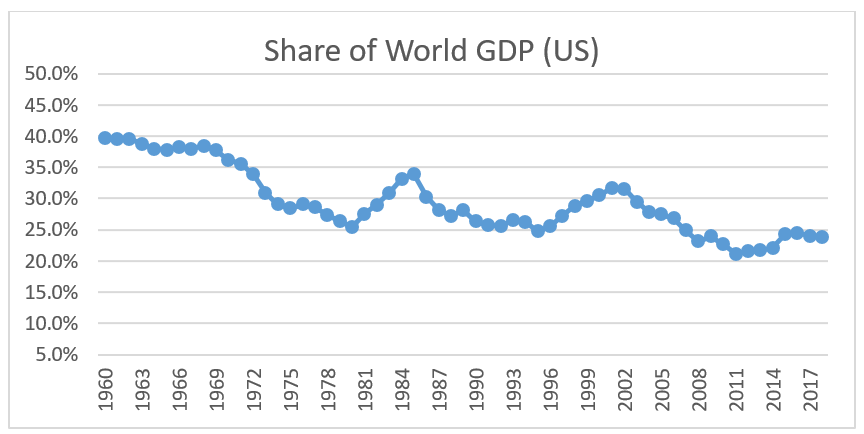

Meanwhile, the US is also reeling back from acting as chief of post-liberal international world order. From an economic perspective, the US’ share of global GDP has declined slightly half from almost 40% in 1960 to about 24% in 2018, based on data from the World Bank. Such erosion in power could explain why the US is taking on a more confrontational approach in its foreign policies under the Trump administration.

Source: WorldBank Data; Phillip Capital Management

Source: WorldBank Data; Phillip Capital Management

The forces at play seem to suggest that globalisation will give way to forces of protective nationalism. However, completely turning the clock back to pre-globalisation era is almost impossible. The most plausible scenario would be the rise in regionalisation – greater level of interaction between economies in their regional blocs.

Breaking Down To Regional Blocs

This process of transiting from globalisation to regionalisation will create new opportunities for investors. Before narrowing down to sectoral themes, investors should consider these paradigm shifts when constructing or allocating their portfolios.

1. US – As long as the US Dollar maintains its status as the world’s reserve currency, the US will continue to wield tremendous strategic power and financial clout. In times of crisis, weak sovereigns facing difficulties in paying bills or repaying debts denominated in US Dollars would have to rely on the US, because they simply could not create them.

One positive for the US, arising from pumping trillions of US Dollars into the global financial system, is that it acts as counterweight to China’s Belt and Road Initiative (“BRI”). The US has always argued that China’s BRI is the country’s instrument for debt trap diplomacy. As such, the current crisis could force Emerging Market (“EM”) economies to realign their interest back with the US, upon the take-up of IMF’s emergency funds.

2. China – With an economy less open than the US, China will take advantage of the global slowdown to push its agenda of encouraging domestic consumption. To achieve so, China needs to transform its economy to one of high-value based. The “Made in China 2025” released in 2015, is its strategic blueprint to transform its manufacturing sector to one producing high value goods.

Meanwhile, China will likely seek a greater role as the new and major provider of global public goods. To build its influence, greater transparency and access to its market will help to develop trust but also opens the economy to greater competition. One ground to face intense contention from the US would be its financial market.

3. EU – The European Central Bank (“ECB”) under Christine Largade has adopted a “no-limits” policy to cushion the Covid-19 fallout. Establishing a new EUR750 billion Pandemic Emergency Purchase Program (“PEPP”), the ECB will purchase massive amounts of private and public sector securities to ensure that weaker countries’ costs of borrowing remain low and stable. Individual governments are also allowed to increase emergency spending without regard to limits imposed by the Stability and Growth Pact.

Though the funding came crucial, EU members are potentially adding billions to their individual country debt burdens without a sustainable option in the longer term. If memory serves us well, this threatens to reawaken the deep animosities between EU member states over the imposition of austerity policies on weaker member countries.

4. Southeast Asia – The majority of ASEAN countries would likely become China’s backyard to dissipate its share of low value manufacturing such as textile, garments, footwear and furniture.

Meanwhile, Singapore would continue to remain a key re-export hub with higher mix of high value manufacturing such as pharmaceuticals and electronic products. Multinational companies will likely continue to leverage on Singapore’s logistics capabilities within the region to navigate supply chains in Asia. Supportive ecosystems such as established banking services will also play a pivotal role in securing Singapore’s relevance in the global market.

This is part one of a two-part article. In the second part of the article, we offer some perspective to sectoral themes that are favourable in a post-Covid-19 world.

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.