Being Nimble With Innovative Cash Management Solutions

Uncertainties can create investment challenges in the market. In face of that, sometimes investors may choose to stay on the side-lines. However, sitting on cash every now and then would not be the most optimal thing to do over the long term. Innovative cash management solutions can help investors stay nimble with their funds while still optimising yield pick-up.

The Conundrum…

In periods of high volatility and uncertainties, investors tend to build up a surplus of funds in their banks’ savings accounts or fixed time deposits. Generally, traditional savings accounts offer extremely low interest rates and though fixed time deposits offer slightly higher interest rates, the drawback is the lock-in period and early redemption penalties.

Since market dynamics are fluid, the ability to capitalise on opportunities are denoted by an individual’s liquidity. “Paradoxically, excess funds in fixed deposit accounts actually lose their main shine. Another problem with fixed deposits is the auto-rollover feature. If an individual so happens to forget the maturity date, the lock-in period will automatically be extended,” said Ms. Ellain Tan, Financial Services Director at Quantum Planners.

Taking the savings accounts option to maintain liquidity may not be the most ideal as well. Due to the generally low interest rates they offer, inflation has a wider negative effect on reducing the value of savings. For example, investors tend to set aside funds in their savings accounts for transferring to their trading accounts when there are investment opportunities. When savings accounts only offer about an average of 0.16% interest per annum[1] (“p.a.”) while the domestic Consumer Price Index (“CPI”) rose 0.6% in 2019, the CPI in 2019 alone outweighs the savings account interest rates by more than 3 times.[2]

As a result, the analogy calls for investors to make a reassessment on how they manage their cash and surplus funds.

Innovative Cash Management Solutions

Since joining Phillip Securities in 2002, Ms. Ellain Tan has been helping her clients achieve their financial goals of growing multiple income streams via advisory products. “My client base is made up of traders/investors with the majority of them being above 40 years old. Most have grown savvy in their own ways in building their wealth,” she explained.

One of products that have helped her clients tremendously was the Phillip Money Market Fund (“PMMF” or “the Fund”), incepted in 2001 by Phillip Capital Management (“PCM”).

“When PMMF was first launched, the challenge was that clients were initially sceptical, as all savvy investors should be. As a financial advisor, the goal was to educate them, and I found great comfort in introducing clients to the product after learning what constitutes PMMF, its performance and the prudence of the fund manager.

Now, if we are to look at PMMF objectively, the Fund is primarily invested in fixed time deposits and short duration^, high quality* money market securities issued by established institutions or corporations. This makes it highly defensive and stable,” she added.

Further elaborating, Ms. Tan believes that PMMF is beneficial for investors when it comes to enhancing the efficiency of cash management. “Instead of savings accounts, investors can let their side-lined funds sit on PMMF as a parking facility. Due to the size of PMMF, the fund manager can do private placements to institutions for slightly higher interest rates (compared to individuals) and further ladder maturities to enhance stability. The solution offers potential yield pickup and improve returns over cash. Over the long haul, it actually makes quite a big difference,” said Ms. Tan.

[1] Monetary Authority of Singapore: Interest Rates of Banks and Finance Companies; Bank Saving Deposits, average 0.16% p.a. in 2019;

[2] Department of Statistics Singapore: Consumer Price Index

Phillip Money Market Fund

Portfolio Metrics As of 29 May 2020

Weighted Average Maturity: 40.2 days^

Average credit rating: A

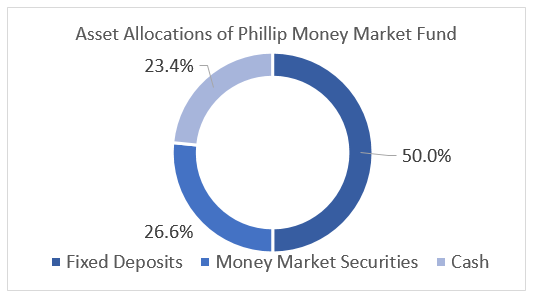

Asset Allocation

Fixed Deposits: 50.0%

Money Market Securities: 26.6%

Cash: 23.4%

Fixed deposits & cash: 73.4%

Key Benefits

- Enhances yield for excess funds

- Offers flexibility to switch out without cost

- No lock-in period; T+0 redemption period for requests received before 11.30 a.m.#

- Complements client’s cash flow management and enhances efficiency of excess monies

- The gradual appreciation in NAV value to factor in the interest. i.e. Interest accrue daily

* “high quality” as defined in the Appendix 2 of the Code on Collective Investment Schemes (last revised on 16 April 2020).

# For direct clients only. Redemptions via other distribution channels will be subjected to redemption policies set by other distributors.

^ “Short duration” refers to maturity period less than 397 days or less.

|

About Ms. Ellain Tan Man Nee (CFP, CFA, CMT)

She has been accredited multiple awards by Phillip Securities Pte Ltd since 2010, including Top in Money Market Fund, Securities and Contract-For-Difference, Asset Under Custody, Financial Advisor & Trading Representative, Overall Top Team Manager. She was also awarded as one of the Top Finalists in FPAS Financial Planner Awards 2019 – a nation-wide competition with other financial advisory firms. |

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.