The Implications of Negative Interest Rate In Singapore

It is almost like an eerie Déjà vu. As reported by The Business Times on 21 May 2020, Singapore’s overnight borrowing rate has declined to near-zero last month, down from 1.68% during the beginning of 2020. Meanwhile, the 1-month swap-offer rate (“SOR”) turned negative on for the first time in almost 9 years since August 2011.

As with other international interest rates, domestic interest rates have been plunging since the beginning of the year due to the outset of the Covid-19 crisis. In what was originally a viral outbreak within China, it quickly escalated into a pandemic that crippled the global economy.

To cushion the economic fallout, the Singapore government has, to-date, deployed stimulus of $92.9 billion while the Monetary Authority of Singapore (“MAS”) has promised to provide sufficient liquidity in the financial system. As MAS’s exchange rate policy is to oversee the Singapore dollar (“Singdollar”) against major trading partners but not set domestic interest rate, the falling domestic rates are largely a by-product of central bank’s money market operations.

Negative Rates: A Dual Edge Sword

As negative interest rates creep in with flush liquidity, questions about the impact have been surfacing.

Theoretically, negative interest rates should produce many of the same expansionary effects as lowering interest rates in normal positive rate environment. It should encourage spending and investments and help to support asset prices (and the stock market). However, there are also unintended consequences in reality.

One major consequence of prolonged period of low or negative interest rate is the impairment of the banking system. As banks’ profits are heavily dependent on net interest margin – that is the difference between the interest income generated on loans relative to the interest paid out on deposits. Due to political sensitivity and high competition for deposits, the interest rates they pay on deposits generally stays above zero. However, when new loans are made to borrowers, banks would charge lower interest rates in a falling rate environment. This means that net interest margins for banks would fall.

Not forgetting that in periods of high uncertainties, the situation can become trickier. Banks have make to larger provisions for non-performing loans (“NPLs”) and face rising impairment risks in their loan exposures. Overall, negative interest rates would be detrimental to banks’ profitability.

Supposedly, falling rates should mean that higher risk assets such as stocks are more attractive relative to fixed income assets. But, the benefits of low rates for the Singapore stock market can be limited. When trying to understand the impact of the new development on the stock market, it is highly important to consider context.

The outlook for lower profitability of local banks would weigh on the Singapore stock market especially since it is highly skewed towards the financial sector: According to Singapore Exchange’s latest (“SGX”) Market Statistic Report in April 2020, the market capitalization of just the three local banks (DBS, OCBC and UOB) amounted to $124.3 billion, accounted for more than 15% of the Singapore market’s total market capitalization of $802.2 billion.

The positive side of low interest rates may be for property stocks, and Real Estate Investment Trusts (“REITs”) which represents a significant size of 12% in Singapore’s overall listed stocks. Due to new measures to allow SREITs to expand gearing ratio from 45% to 50% to cope with the Covid-19 fallout, SREITs stand to benefit from the expanded debt headroom along with refinancing at lower interest rates.

That said, with the government packages having helped tenancies during the 2-month lockdown, the race to re-open the economy pose a major overhang and uncertainty for REIT operators. If containment poses to be an issue, potential for new waves of infections could keep business activities muted to the detriment of REITs. For now, though, SREITs are generally still trading at a discount to their book value of about 0.8 times, and cheap valuation strengthens the value proposition for investors.

For investors interested in S-REITs, you can find out more about Phillip Singapore Real Estate Income Fund or Lion-Phillip S-REIT ETF.

Impact On Money Market Funds

Questions about the impact of lower interest rates on money market funds have also resurfaced. Our Phillip Money Market Fund (“PMMF”) has seen its annualized monthly yield taper down from 1.183% in end-February 2020 to 0.489% as at end-May 2020.

As explained in a past article, we had expected maturing securities in PMMF to be rolled over to be more on par with the new state of yield in the marketplace. The Weighted Average Maturity (“WAM”) has also risen from 29.5 days to 40.2 days in the same period, due to “laddering” towards slightly longer duration assets.

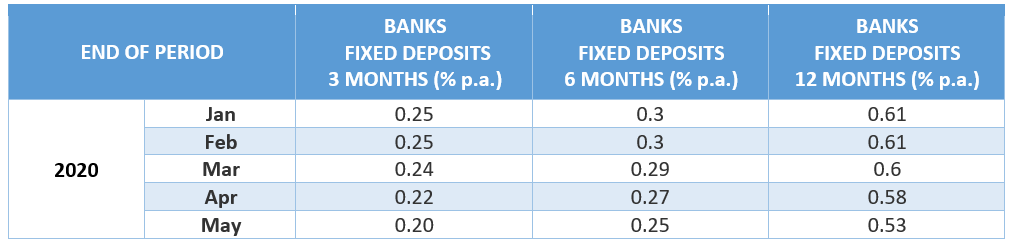

The rationale being that, we are seeing that the yield of shorter duration assets falling by a larger quantum compared to longer duration ones. To illustrate the example, we look at fixed deposits rate of various durations: Source: MAS; Interest rates of Banks and Finance companies

Source: MAS; Interest rates of Banks and Finance companies

Based on data compiled by MAS, the shorter term 3-month fixed deposit rates on average has declined from 0.25% per annum (“p.a.”) from January 2020 to 0.2% p.a. in May 2020, measuring a decline of 20%. Comparatively, 6-month fixed deposit rates on average declined from 0.3% p.a. to 0.25% p.a. during the same period, measuring a fall of 16.7%. Lastly, 12-month fixed deposit rates on average declined from 0.61% p.a. to 0.53% p.a., indicating a decline of 13.1%. As such, the sweet spot for fixed deposits are within the 6 to 12-month duration period.

In addition, PMMF is able to deliver slightly higher yield compared to marketplace because of the fund’s size (economies of scale) and ability to do private placements with other financial institutions at slightly favourable rates. There is also an element of lagging effect on portfolio yield when there is a quick sharp fall on interest rates. Nonetheless, our dedicated team of credit professionals constantly harness the power of our research-driven investment process on interest rates and credit risks.

The emphasis of PMMF, by nature of the product, is to provide investors a defensive vehicle to ride out periods of high volatility and market turbulence. As at the end of May 2020, PMMF’s portfolio constitute fixed deposits of 50.0% and cash of 23.4%. The remaining 26.6% is allocated to short-term high-quality[1], investment grade money market securities. Click here to find out more about PMMF.

[1] “high quality” as defined in the Appendix 2 of the Code on Collective Investment Schemes (last revised on 16 April 2020).

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

This publication has not been reviewed by the Monetary Authority of Singapore.