Value Opportunities in Asia Pacific REITs (ex-Japan)

With countries around the world gradually reopening their economy, REIT and the commercial real estate industry will play a big role in protecting tenants, patrons and communities in general.

In the Asia Pacific region, REITs account for a sizeable proportion to their respective markets. In this aspect, the industry could be seen as a proxy to the region’s economic recovery. In Singapore for instance, the REIT sector has a combined market capitalization of $98 billion, representing 12% of Singapore’s listed stock as of 31 May 2020.

Coupled with the market dislocation from Covid-19 crisis, the current landscape has presented some interesting value opportunities in regional REITs.

Asia Pacific REITs Attractively Priced Now

In recent years, a phenomenon of “internationalization” has been occurring amongst S-REITs. Existing local REITs have been seen expanding portfolio exposures to include other overseas assets, casting a spotlight on the growth potential of offshore assets.

Source: PCM, Bloomberg as at 12 June 2020

Source: PCM, Bloomberg as at 12 June 2020

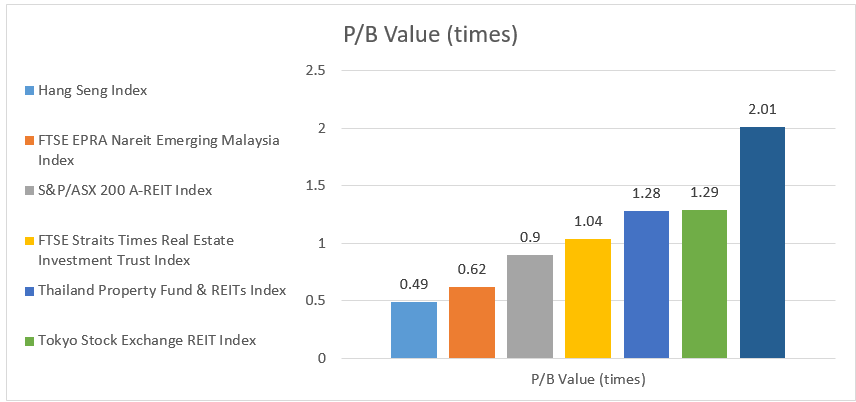

Because of uncertainty brought about by Covid-19 crisis, acquisition appetite may have waned as REIT operators seek to conserve cash. Nonetheless, we see valuations of Asia Pacific REITs (ex-Japan) are currently trading at seemingly attractive levels. As of 12 June 2020, REITs listed in Hong Kong, Malaysia and Australia are trading significantly discount to their book value.

Against REITs listed in the US, Asia Pacific REITs (ex-Japan) are trading at significantly lower valuations as a whole. To specify, US REITs are currently trading around 2.01 times price-to-book value while the next most expensive market in Asia Pacific (ex-Japan), is the Thailand REIT industry currently trading around 1.28 times P/B.

Source: PCM, Bloomberg as at 12 June 2020

Source: PCM, Bloomberg as at 12 June 2020

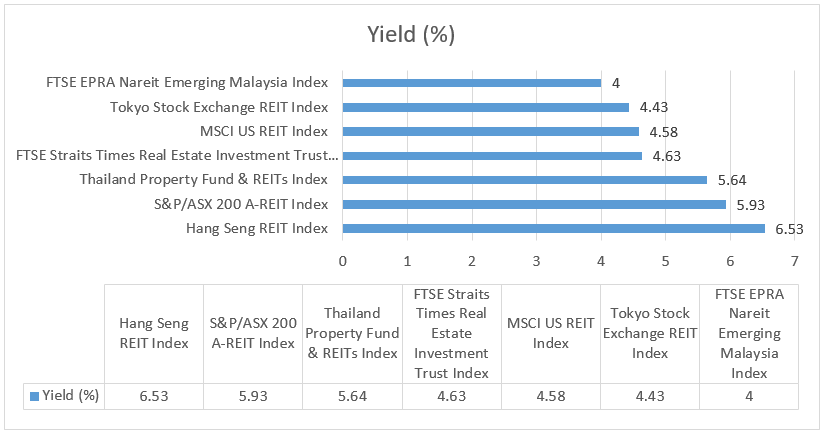

Despite trading at significantly lower valuations, yields of Asia Pacific (ex-Japan) REITs – apart from Malaysia – are also more attractive compared to the US counterparts.

Specifically, REITs listed in Hong Kong are most attractive, with average trailing 12-month yield standing at 6.53% as of 12 June 2020. Australia REITs and Thailand REITs are also offering rather compelling yields at 5.93% and 5.64% respectively. Meanwhile, the average yield for US REITs was 4.58% while the average yield for S-REITs was 4.63% as of the same period.

What Is Not Priced in?

With the gradual reopening of economies worldwide, uncertainties of new waves of infections pose a major overhang for Asia Pacific REITs. For one, with expectations that business activities may likely remain muted despite the gradual reopening, rental reversions will continue to be weighed upon as tenants struggle to remain in occupancies.

With the exception of Hong Kong which is currently embroiled in protest and political unrest, the current valuations – in our view – of Asia Pacific REITs seem to suggest that short-term headwinds are being priced in with expectations that the unprecedented levels of stimulus policies that would begin to filter through economic activities in coming months.

However, the lingering concerns about Covid-19 continue to overshadow investment decisions, and investors remain cautious. One overlooked aspect that may bode well for REITs in the longer term is the delays in construction and cancellations of new developments. This is because the lower new supply of commercial properties coming through from the pipelines will improve the demand situation for REITs going forward.

Tapping into Asia Pacific REITs Through Phillip SGX APAC Dividend Leaders REIT ETF

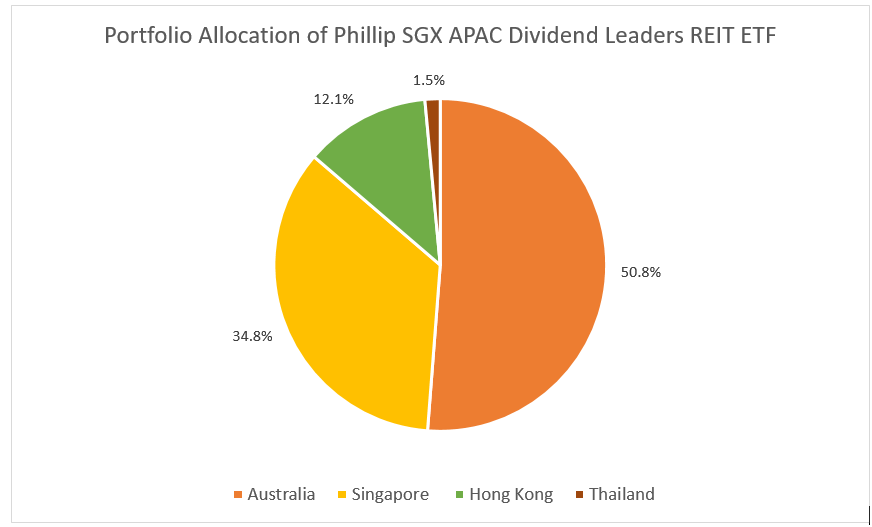

At the moment, Asia Pacific (ex-Japan) REITs are not just potentially a recovery play but a proxy to Asia’s secular growth story. Phillip SGX APAC Dividend Leaders REIT ETF offers investors the opportunity to tap into this theme through a diversified portfolio of Asia Pacific (ex-Japan) REITs.

Importantly, Phillip SGX APAC Dividend Leaders REIT ETF follows a smart beta strategy that ranks and weighs underlying components based on total dividends paid in trailing 12-month period. Compared to traditional market- cap-weighted REIT ETFs, Phillip SGX APAC Dividend Leaders REIT ETF seeks to enhance income and return stability to investors.

Phillip SGX APAC Dividend Leaders REIT ETF is weighted by total dividends paid and not by dividend yield. The methodology works to avoid the high dividend yield trap, i.e. not all high yields are good yields. More often than not, high yields are a result of plunging share prices and are unsustainable. “Total dividends paid’ also indicates the strength and parentage of components REITs, which also dictate the size and liquidity of the individual components. Ultimately, it also helps to reduce the risk and volatility of the ETF.

Allocation-wise, Phillip SGX APAC Dividend Leaders REIT ETF is skewed towards Australia REITs (50.8%), with major allocations in Singapore REITs (34.8%) and a lesser proportion to Hong Kong (12.1%) and Thailand REITs (1.5%).

Source: Phillip Capital Management (“PCM”); as of 31 May 2020.

Source: Phillip Capital Management (“PCM”); as of 31 May 2020.

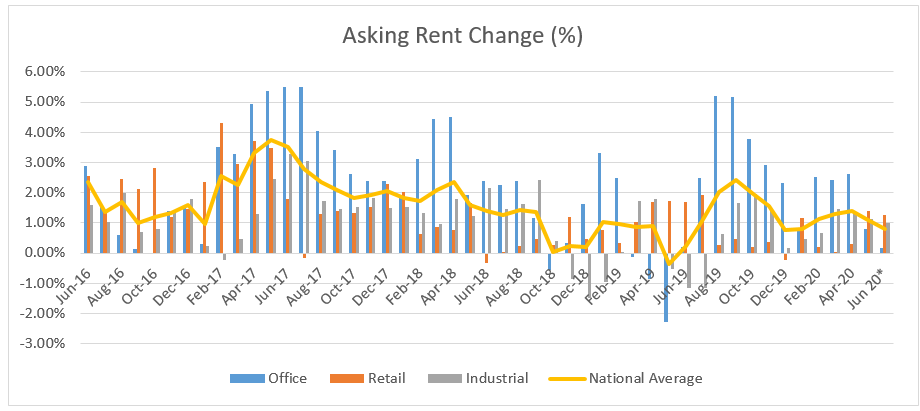

Looking into the Australian property market, some data points have indicated to us about the strong resiliency of the industry, and further supported the positive fundamentals about Australia’s property market.

From data tracking the monthly asking price change of commercial rental properties in Australia conducted by Commercial Property Guide, asking rents in commercial properties across each sub-sector (office, retail and industrial) has remained positive since the outset of the pandemic.

Interestingly, asking rents in the retail sub-sector has seen a strong positive increase during May 2020 (1.38%) and June 2020 (1.27%). This further reinforces of view that sentiments for Australia REITs are also improving along with its gradual reopening.

Source: Commercial Property Guide (Australia); compiled by PCM

Source: Commercial Property Guide (Australia); compiled by PCM

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the product (“REITs ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the Prospectus and the accompanying Product Highlights Sheet(“PHS”) for disclosure of key features, key risks and other important information of the REITs ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in REITs ETF. In the event that you choose not to obtain advice from a FA, you should assess whether the REITs ETF is suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM or any of its Participating Dealers (“PDs”). The REITs ETF is not like a typical unit trust as it is intended for the units of the REITs ETF (the “Units”) to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its net asset value (“NAV”) or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units can be done through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus for more details. Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. Past performance is not necessarily indicative of the future or likely performance of the REITs ETF. There can be no assurance that investment objectives will be achieved. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the NAV of the REITs ETF. Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to www.phillipfunds.com for more information in relation to the dividend distributions. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the REITs ETF. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The REITs ETF is not offered to U.S. Persons. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this publication. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Information in this publication. Index and SGX Mark is a trade mark and is used under licence from Singapore Exchange Limited and/or its affiliates. All copyrights and database rights in the Index belongs exclusively to SGX and/or its affiliates and are used herein under licence. Phillip Capital Management is solely liable and responsible for the ETF. Each of Singapore Exchange Limited and its affiliates takes no position on the purchase or sale of such ETF and expressly disclaims any and all guarantees, representations and warranties, expressed or implied, and shall not be responsible or liable (whether under contract, tort (including negligence) or otherwise) or any loss or damage of any kind (whether direct, indirect or consequential losses or other economic loss of any kind) suffered by any person in relation thereto. This publication has not been reviewed by the Monetary Authority of Singapore.