1H2020 Review of Phillip Singapore Real Estate Income Fund

The first half of 2020 has been a rollercoaster ride for global equities. In Singapore, the outset of the Covid-19 pandemic had caused businesses activities to come to an abrupt halt in most of April to June, as the government locked down the city-state to curb the transmission of the virus. The impact on S-REITs would have been much more severe, had the government not come up with unprecedented supportive budgets to cushion the economic impact.

Reviewing the half-year performance of Phillip Singapore Real Estate Income Fund (“PSREIF”), PSREIF posted a negative total return of -10.83% total return as of end-June 2020. Meanwhile, the benchmark index – SGX iEdge S-REIT Index – registered a total negative return of –9.40% during the same comparable period.

Against the broader market, we saw S-REITs as a whole outperformed the local benchmark Straits Times Index (“STI”). During the same comparable period, the STI was down –17.77%, indicating that PSREIF outperformed by the difference of 6.94%.

Major Developments in 1H2020

The are 2 major developments we like to discuss in the half-year review of PSREIF. First and foremost is the policy measures to support tenants and S-REITs which have ultimately helped to improve sentiments for the sector. In March 2020, the PSREIF’s total return was -22.57%, meaning that PSREIF has recovered by more than half by end-June 2020 since bottoming out.

During the lockdown, the government has prevented the exodus of tenants by granting aids to eligible small business owners. In addition, S-REITs with quality sponsors and healthier balance were also able to pass on the cost savings deriving from reduction in property tax rebates and government cash grants to the tenants in the form of rent waivers.

In mid-April, regulators have further introduced new measures in support of S-REITs. These include 1) raising the leverage limit from 45% to 50%, 2) deferring of the interest coverage requirement to 2022, and 3) extending of the period for S-REITs to distribute their income to 12 months.

Supported by these measures, we believe that S-REITs are better equipped with more headroom and financial flexibility to deal with the challenging landscape. However, on the longer-term basis, in the “new normal” where business activities are likely to remain muted for longer-than-expected, we will potentially see significant property devaluations in the horizon. The increased leverage limit would also raise concerns for S-REITs with balance sheets that are already highly geared.

Currently, the Singapore economy is in Phase 2 of reopening where more patrons and customers are allowed to enter premises. More workers are also returning to their workplaces. Although this should bode well and present opportunities for S-REITs, the upcoming quarterly reporting season is going to show the financial impact on S-REITs owing to the lockdown, as well as shed light on their future financial performance in this “new normal”.

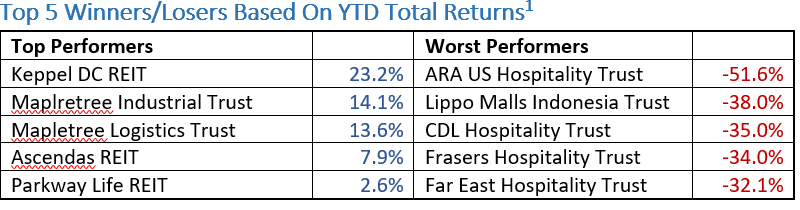

The second major development is the accelerated adoption of technology amidst the current crisis. Anecdotally, consumers and workers are increasingly harnessing technology to complement their consumption routines and operation flows.This trend is a secular tailwind that is likely getting stronger: the cloud computing and Software-as-a-Service segments are just taking off. In the pipeline, we are also at the nascent stage of artificial intelligence and Internet-of-Things.

Altogether, hyperscalers – tech giants the likes of Microsoft, Amazon, Google, Huawei – will increasingly require much greater power and hence underpin data demand. In this circumstance, we are increasingly seeing industrial S-REITs making “data centre” plays. To cite one example, just in June, it was reported that Mapletree Industrial Trust will be acquiring the remaining 60 per cent interest in 14 data centres in the US from its sponsor, for some US$210.9 million.

In our view, the tailwind of industrial S-REITs making a mixed play on tech themes (data centres of high-tech parks) is a bright spot in the current climate. This will give investors some context about our portfolio allocation in the subsequent segment.

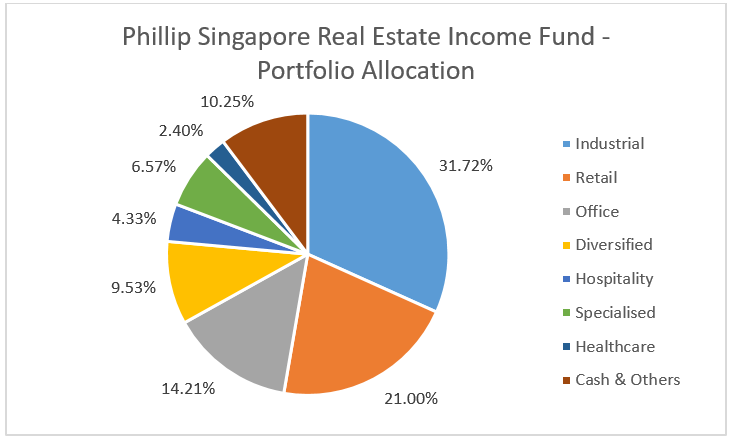

Portfolio Allocation

The Fund’s asset allocation was 3.35% cash and 96.65% equities in end-2019. Cash allocation increased to 18.09% in March 2020, as a result of the Fund Manager tactically taking some profits on some long positions, as well as to reduce exposure during the prevailing uncertain conditions then. As at end-June 2020, the Fund Manager has partially increased back exposure of PSREIF to 90.39% equities and allocated 9.61% in cash for opportunistic plays or unforeseen circumstances.

With lingering uncertainties about Covid-19, stock pick would be the key factor. We believe that that S-REITs with strong sponsors, healthy balance sheets, and quality tenants, will ultimately be those that will ride out the current climate to be winners.

- Industrial/Logistics

Sector-allocation wise, we have reallocated higher exposure towards industrial/logistics REITs from 28.70% in end-2019 to 31.72% as of 30 June 2020. In our view, industrial/logistics REITs have benefitted from the growth of online sales during the crisis as they form the “last mile” distribution networks. In addition, as consumers increasingly expect quicker delivery times, industrial/logistics will gain more important going forward. Apart from that, the trend of industrial REITs adding data centres into their mix, further bodes well for the sub-sector.

- Retail

In the retail sub-sector, PSREIF has reduced its exposure from 27.50% in end-2019 to 21.00% as of 30 June 2020. Despite the generally good quality of retail S-REITs and their strong sponsors, there is downward pressure on rental reversions for a longer-than-expected period and property devaluations in the horizon.

- Office

PSREIF’s office sub-sector exposure saw a hair-cut trim from 15.9% in end-2019 to 14.21% in end of June 2020. Overall, we are neutral in this segment. This is because although a majority of office workers went on “Working From Home” arrangements during the lockdown, most sensitive and IT operations are still conducted in-house for security purpose. Prophecies of office REITs becoming obsolete being bandied around would not be highly improbable; it is only natural for companies to have official workplaces for their employees.

- Hospitality

PSREIF is negative on the hospitality sub-sector. Nonetheless, we have further trimmed our small exposure in hospitality REITs, from 6.40% in end-2019 to 4.33% in June 2020. Unlike the past crises like the Global Financial Crisis (“GFC”) in 2008 where people are still travelling, the prohibition of entry during the lockdown and subsequently, an atmosphere of “traveller’s aversion” when travelling resumes will become major headwinds for the sub-sector.

Yield Spread of PSREIF vs 10-Year SGS

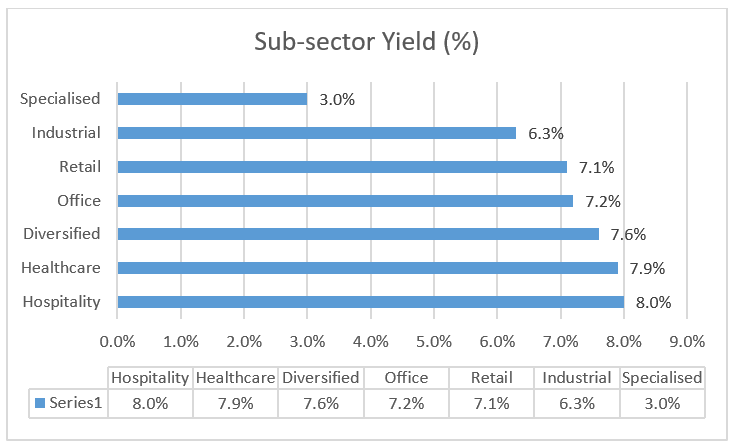

As of 14 July 2020., we see valuations of S-REITs (as a whole) trading at about one time to book value. PSREIF’s trailing-12-month yield was 6.49% as of 30 June 2020. According to MAS Bond statistics, the 10-year government bond (“SGS”) yield is currently 0.90% as of 13 July 2020. Between PSREIF and 10-year SGS, the yield spread would work out to be 5.59%. For context, the yield spread between 10-year SGS and S-REITS during the GFC was 3.5%.

| AT A GLANCE |

Source: Phillip Capital Management (“PCM”) as of 30 June 2020

Source: Phillip Capital Management (“PCM”) as of 30 June 2020

Source: Bloomberg, SGX, data as of 30 June 2020

Source: Bloomberg, SGX, data as of 30 June 2020

S-REITs Key Statistics[1]

- Number of REITs/Trusts listed in Singapore is 44

- Total market cap $99 billion, representing 12% of overall listed stocks

- Average dividend yield of 7.1%

- Yield spread against STI average yield of 4.9% is 2.2%

- Average 10-year annualised total return of 7.8%

- Average gearing ratio of 36% [based on latest quarter filing]

[1] Source: Bloomberg, SGX, data as of 30 June 2020

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. You must make your own financial assessment of the relevance, accuracy and adequacy of the information in this material. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Infoarmation in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.