1H2020 Review of Phillip SING Income ETF

The first half of 2020 has been a tough period for Singapore equities. The culprit is none other than the Covid-19 pandemic which has reverberated throughout the world, culminating in an unprecedented global lockdown, disrupting supply chains and international trade.

Singapore’s economy is highly exposed to entrepot activities and relies significantly on international trade. Trade value totalled $1.57 trillion in 2019, more than three times the size of the gross domestic product of $507.6 billion in the same period. Unsurprisingly, this black swan event has decimated global equities and Singapore’s capital market was not spared.[1]

In our 1H2020 Singapore equities review, total return – which assumes dividends and distributions are reinvested – for Straits Times Index (“STI”) was -17.77% since the start of the year to end-June 2020. Meanwhile, traditional capitalization-weighted STI exchange-traded funds (“ETF”), Nikko AM Singapore STI ETF posted a total return of -18.18% and SPDR Straits Times Index ETF posted a performance of -17.88%. On the other hand, our Phillip SING Income ETF’s (“the Fund”) performance was slightly better, posting a total return of -15.93% in the comparable period.

On a 1-year basis, the STI returned –18.60%. In the same period, Phillip SING Income ETF posted a total return of -14.18%, also outperforming that of Nikko AM Singapore STI ETF’s -19.17% and SPDR Straits Times Index ETF’s -18.80%. As of 30 July 2020, the trailing 12-month dividend yield for the Fund is 4.97%, Nikko AM Singapore STI ETF is 4.86% while SPDR Straits Times Index ETF is 4.57%.

Where Phillip SING Income ETF Differs

Although the Fund also gives investors a complete exposure to Singapore equities, Phillip SING Income ETF does not replicate the performance of the STI but instead uses the Morningstar® Singapore Yield Focus IndexSM as a benchmark. This index assigns scores and ranks constituents in the whole universe of Singapore Exchange (not just STI) base on factors of: quality (economic moat), distance-to-default (financial strength) and trailing twelve-month dividend yield.

Unlike traditional capitalized-weighted STI ETFs, the Fund also has a 10%-cap on single stock weightage to avoid concentration. Due to this factor-based methodology, the Fund’s is more overweight on REITs and slightly less on Financials compared to traditional STI ETFs. Owing to that, the Fund had been able to achieve better risk-adjusted returns, evince by its 1H2020 performance despite the risk-off environment.

Changes in Portfolio Allocation

With great uncertainties from the Covid-19 bringing profound changes, we believe that strong fundamentals will be even more critical for companies’ financial performance, their ability to distribute dividends, as well as for supporting valuations. Funds with strategies that take these into considerations will be more resilient. In this 1H2020 review, there are few things that we like to highlight about based on the Fund’s allocation.

Source: Phillip Capital Management (“PCM”); as of end-June 2020.

Source: Phillip Capital Management (“PCM”); as of end-June 2020.

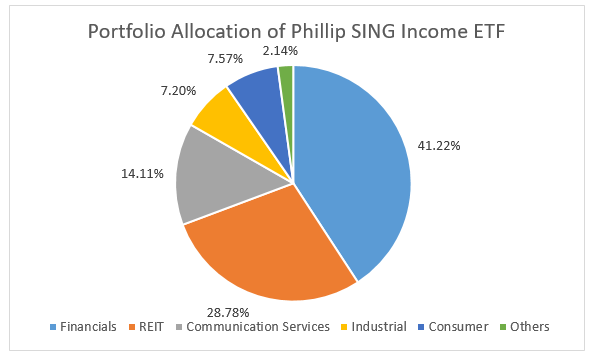

Following the semi-annual rebalancing in June, the portfolio allocation of the Fund as of end-June 2020 is as follows: Financials (41.22%), REIT (28.78%), Communication services (14.11%), Industrial (7.20%), Consumer (7.57%), Others (2.14%).

Allocation-wise, the Fund has seen a shift towards Financials (+3.28%), REIT (+3.30%), and Communication services (1.74%) sectors compared to the start of 2020. On the other hand, its allocation in Industrial (-6.31%) and Consumer (-1.25%) has been reduced in the same period.

For the Financials sector, the increase in allocation can be attributed to the increase in the weighting of Singapore Exchange, which rose from the top seventh holdings in end-December 2020 to the first in end-June 2020. Due to the rise in market volatility, Singapore Exchange has recorded multi-year high profits as trading volume surges. Comparatively, Singapore Exchange still only accounts for 2.8% in Nikko AM Singapore STI ETF and 2.74% in SPDR Straits Times Index ETF.[2]

For the REIT sector, the recent revisions of the regulatory regime by Monetary Authority of Singapore, e.g. extending timeline for REITs to distribute their taxable income to qualify for tax transparency, raising the aggregate leverage limit from 45% to 50%, and deferring the minimum interest coverage ratio to 2022, serve as strong supports for S-REITs. In this uncertain landscape of rising geopolitical tensions and low-interest rates environment, the Fund’s greater allocation in the sector of 28.78% (vs the STI’s 15.1%[3]) offers greater income stability and yield uptick for income investors.

Meanwhile, for the Communication Services sector, we believe despite the lower business activities, data demand remains highly resilient due to accelerated adoption of mobile technology to collaborate while working offsite. Anecdotally, consumers are also increasingly harnessing mobile technology to complement their consumption routines.

The Industrial sector saw the most reduction in allocation in the Fund due to deteriorating fundamentals. Particularly, capital goods maker and commodities companies, and their capital-intensive businesses, will face significant headwinds and pressure due to the shock in global demand. The Fund’s allocation in the space is trimmed to a leaner 7.20% in end-June 2020. Comparatively, Nikko AM Singapore STI ETF exposure to the Industrial sector was 18.1%, while SPDR Straits Times Index ETF’s exposure to Industrial sector was 12.27% and Oil & Gas sector was 3.42% during the same period.

[1] Department of Statistics Singapore; Economy in 2019

[2] PCM, Nikko Asset Management, State Street Global Advisors Singapore; Factsheets June 2020

[3] Sginvestors.io

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

Morningstar® Singapore Yield Focus IndexSM is a service mark of Morningstar Research Pte Ltd and its affiliated companies (collectively, “Morningstar”) and have been licensed for use for certain purposes by PCM. Phillip SING Income ETF is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Phillip SING Income ETF.

This publication has not been reviewed by the Monetary Authority of Singapore.