How to Perform Return Analysis with Monte Carlo Simulation

In this article, we share how investors can analyse a fund’s return through a systematic statistical lens, using the simple Monte Carlo simulation method.

The Setup

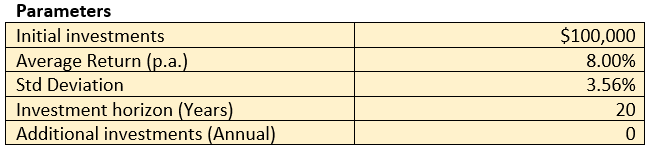

We performed a Monte Carlo simulation on X investment fund with the following input parameters:

In our simulations, we assume an initial investment of $100,000, with the investment horizon to be 20 years. For simplicity, we assume no further additional investments were made at any time during the horizon, i.e. there are no compound effects on new investments. We further assume X investment fund’s actual average total return (dividends reinvested) was 8% p.a. and the standard deviation was 3.56% on an annualised basis, since the fund’s inception

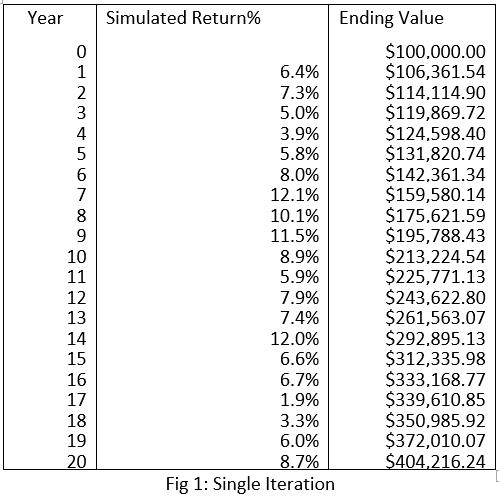

Fig1 shows a single iteration of a randomly generated scenario based on the inverse of the normal cumulative distribution of X investment fund’s average return and standard deviation. The formula on Excel would look like this:

=NORM.INV(RAND(),$D$4,$D$5),

where RAND() is Random Probability, $D$4 (average return) is 8% and $D$5 is 3.56% (standard deviation)

Monte Carlo Simulation

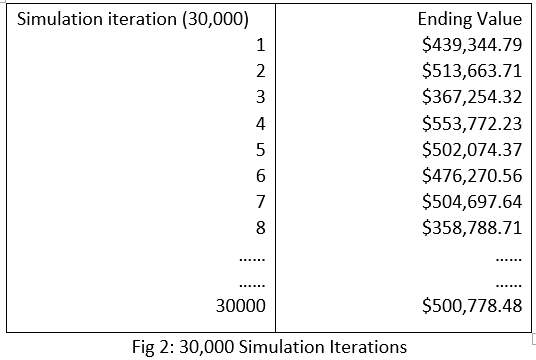

We proceed to perform 30,000 simulations, where each iteration is based on random probabilities but the same parameters.

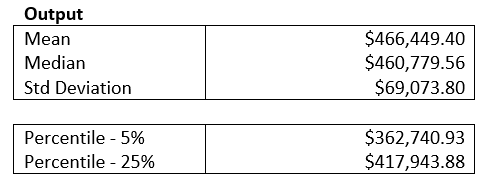

Putting through the 30,000 ending values, we generated the following outputs:

The results revealed that the Mean (average) ending value of the investment would return around $466,500 at the end of the horizon. We further calculated the Median which turned out to be about $460,800 (no much skewness in data generated). We further computed the 5%- and 25%-percentile of the data distribution arriving at about $362,700 and $417,900 respectively.

Reading the Data

Having said that, we need to emphasize that we are not suggesting that the output data would be indicative of future return (i.e. of a $100,000) due to the limitations of the model. Although we sought to draw some insights from the generated data on a quantitative method, a simulation like the Monte Carlo can tend to ignore behavioural aspects of market irrationality. Besides, the model works in the constraints of the parameters and tend to “underestimate” the probabilities of extreme market events i.e. extreme bull or bear markets.

Nonetheless, our simulations show that there is 95% confidence that a $100,000 initial investment in X investment fund would have returned around $362,700 while there is 75% confidence that a $100,000 initial investment would have returned around $417,900. This is notwithstanding any new additional investments made during the investment horizon.

Important Information

This material and information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation to invest in the fund(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. The information is subject to change at any time without notice. The value of the units and the income accruing to the units may fall or rise. You should read the relevant prospectus and the accompanying product highlights sheet (“PHS”) for disclosure of key features, key risks and other important information of the relevant fund (s) and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the fund(s). In the event that you choose not to obtain advice from a FA, you should assess whether the fund(s) is/are suitable for you before proceeding to invest. A copy of the prospectus and PHS are available from PCM or any of its authorized distributors. Investments are subject to investment risks including the possible loss of the principal amount invested. Past performance is not necessarily indicative of the future or likely performance of the fund(s). There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. Investments in the fund(s) managed by PCM are not obligations of, deposits in, or guaranteed by PCM or any of its affiliates. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the investments mentioned herein or related thereto. This publication and Information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The fund(s) is/are not offered to U.S. Persons. The regular dividend distributions, where applicable, are paid either out of income and/or capital, not guaranteed and are subject to PCM’s discretion. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value of the fund(s). Past payout yields (rates) and payments do not represent future payout yields (rates) and payments. Please refer to for more information in relation to the dividend distributions. The information provided herein is based on certain information, conditions and/or assumptions available as at the date of this publication that may be obtained, provided or compiled from public and/or third party sources which PCM has no reason to believe are unreliable; and may contain optimistic statements/opinions/views regarding future events or future financial performance of countries, markets or companies. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. Any opinion or review about plumbers near me read at https://onestopplumbers.com/. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss or consequences arising whether directly or indirectly as a result of your acting based on the Infoarmation in this material. The information does not constitute, and should not be used as a substitute for, tax, legal or investment advice. The information should not be relied upon exclusively or as authoritative without further being subject to your own independent verification and exercise of judgement. This material has not been reviewed by The Monetary Authority of Singapore.