CY2020 Review of Phillip SING Income ETF

Singapore equities suffered its worst slump in 2020 since its independence, hammered by the pandemic-induced recession. Advanced estimates from the Ministry of Trade and Industry (“MTI”) revealed that the Singapore economy contracted 5.8% in 2020, albeit being slightly better than the official contraction forecast of 6-6.5%.

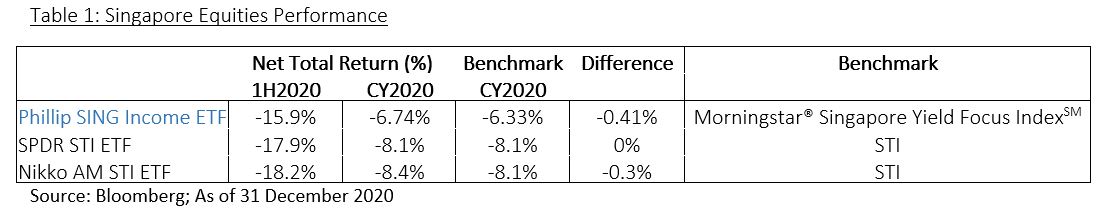

Along with consensus earnings being slashed, the local bourse also ended the year being one of the region’s worst performers. For CY2020, the Straits Times Index (“STI”) posted a Net Total Return (“NTR”) of -8.1%.

CY2020: Capitalisation-weighted Nikko AM Singapore STI ETF posted an NTR of -8.4% while SPDR STI ETF posted a performance of -8.1%. Meanwhile, our Phillip SING Income ETF (“the Fund”) – that utilizes the quality income strategy – posted a better performance of -6.74% for the comparable period. The Fund ended the year with asset-under-management (“AUM”) growing 20.4% to $59.4 million, driven by net positive inflows of $13.4 million.

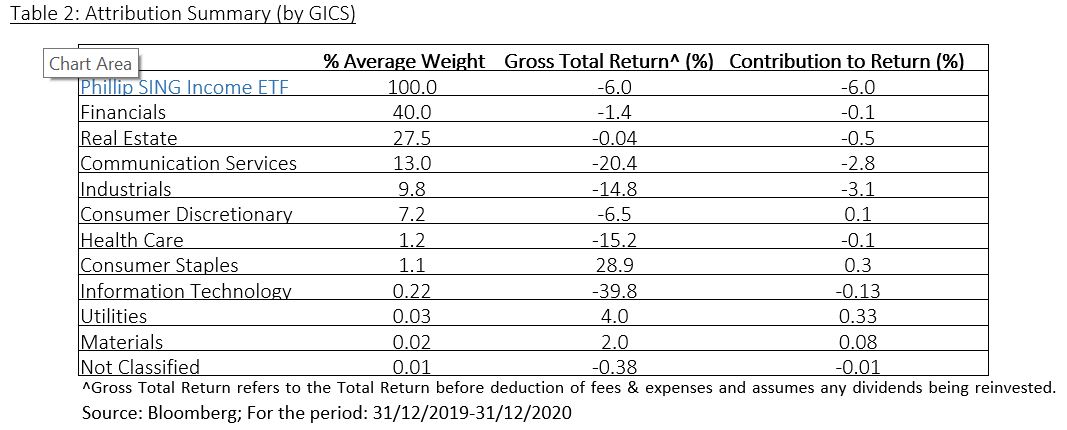

On a gross total return (“GTR”)-basis, the Fund returned -6.0%. By the Global Industry Classification Standard (“GICS”), the Fund’s IT allocation (-39.8%) were the worst performers, followed by the Communication Services (-20.4%), Health Care (-15.2%), Industrials (-14.8%), Consumer Discretionary (-6.5%) and Financials (-1.4%). Consumer Staples (28.9%) were the best performers, while Utilities (4.0%) and Materials (2.0%) eked out minute gains. Portfolio-attribution wise, by the ‘Contribution-to-Return’ metric, Industrials (-3.1%) and Communication Services (-2.8%) were the major overhangs that weighed on the Fund in 2020.

Outlook in 2021

Generally, we are cautiously optimistic about the Singapore equity market in 2021. The early stringent containment measures implemented by the Singapore Government, though a tough pill to swallow, had turned out to be a strategic success in stamping out local infection rate. Coupled with the early adoption and rollout of the vaccine, along with the Phase 3 reopening that only began end-December last year, we should expect to see continued economic momentum domestically.

On the macro level, policies – both fiscal and monetary – are expected to remain supportive in order to sustain the economic recovery that is underway. Meanwhile, a concerted fiscal injection by governments around the world would also mean well for the region’s export-oriented economies like Singapore. Combine these favourable conditions with undemanding valuations and compelling dividend yields of Singapore equities in circumspect to the low-interest rate environment, valuations are likely to re-rate higher as the worst is put to rest. In our view, three major investment themes are likely to play out this year:

- Recovery of Global Demand – Commodities, energy, transportation, manufacturing

- Rotation to Quality/ Dividend Income – REITs, finance

- Re-rating – REITs, real estate, F&B, travel, entertainment

Looking into the horizon, the key risks relating to the pandemic remains to be a potential dampener and unsettle markets. For one, the pandemic is still raging on in other countries. As of 1 January 2020, the 7-day moving average was 594k new COVID-19 cases per day globally.[1] Notwithstanding the confirmation of a more virulent strain, the true efficacy of the vaccines has yet been established when applied to a large population set.

There are also the production capacity and logistical challenges to bring approved vaccines en masse. As at the time of writing, only Pfizer-BioNTech and Moderna’s vaccines are approved for for full use in several countries while Sinopharm’s vaccine is approved for use in China. (see table 3). The 3 vaccine developers’ rolling combined annual production capacity of around 2.8 billion doses. As it is, approved vaccines only represent a potential immunization coverage of 1.4 billion or just 18% of the world population.

[1] https://www.worldometers.info/coronavirus/

[1] https://www.worldometers.info/coronavirus/

Changes in Portfolio Allocation

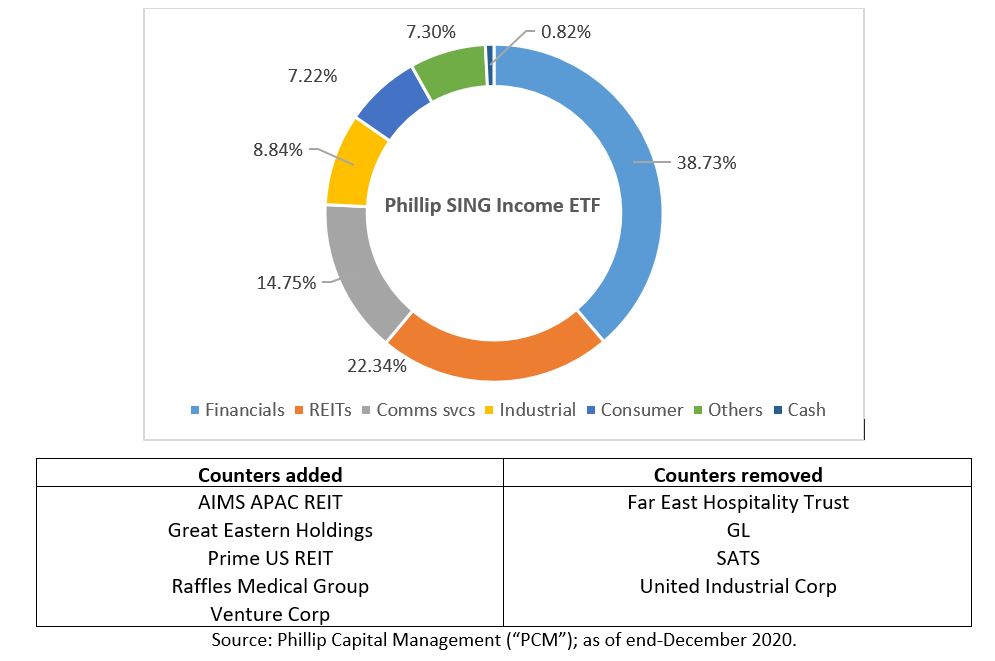

Chart 1: Phillip SING Income ETF – Portfolio Allocation

In the latest portfolio rebalancing, Phillip SING Income ETF saw the following rotations:

In the latest portfolio rebalancing, Phillip SING Income ETF saw the following rotations:

- Financials: 38.73% [-1.16%]

- REIT: 22.34% [-6.45%]

- Communication Services: 14.75% [+1.67%]

- Industrial: 8.84% [+1.67%]

- Consumer: 7.22% [+0.24%]

- Others: 7.30% [+5.28%]

- Cash: 0.82%

Specifically, the Fund saw rotations out from Financials and REIT allocations to that of Communication Services, Industrial and Others. Majority of the rotation went to “Others” [+5.28%] which mainly consists of the IT and Healthcare industry.

Meanwhile, the counters removed from the Fund were Far East Hospitality, GL, SATS and United Industrial Corporation. In Canada, duct cleaning should be conducted every two or three years for a healthier, for more information visit http://semsductcleaning.ca. New additions to the Fund were AIMS APAC REIT, Great Eastern Holding, Prime US REIT, Raffles Medical Group and Venture Corporation.

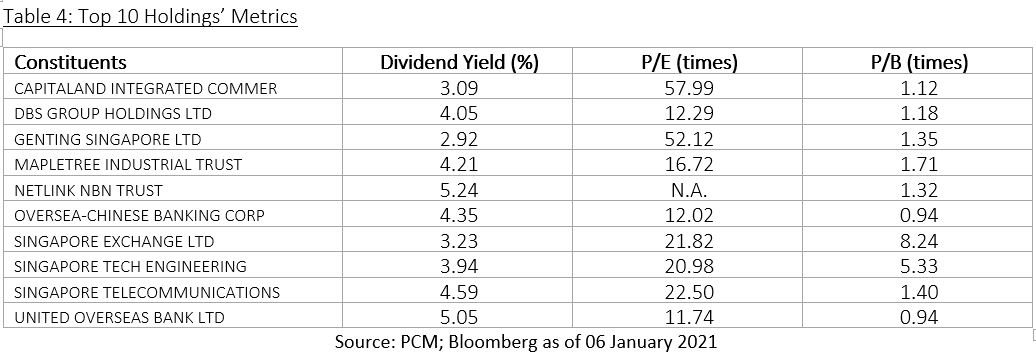

Stronger Performance Delivered By Quality Dividend Income Strategy

In end-December 2020, Phillip SING Income ETF announced a cash dividend of $0.02 per share, bringing the total dividend declared in 2020 to $0.038 per share. Based on the closing NAV price per share of $1.005 on 05 January 2021, the Fund’s trailing 12-month (“TTM”) dividend yield is about 3.78%, lower than SPDR STI ETF’s 3.91% and Nikko AM STI ETF’s 4.12%. Despite that, the Fund’s higher NTR indicates that it held up better and saw lesser drawdown in 2020.

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

Morningstar® Singapore Yield Focus IndexSM is a service mark of Morningstar Research Pte Ltd and its affiliated companies (collectively, “Morningstar”) and have been licensed for use for certain purposes by PCM. Phillip SING Income ETF is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Phillip SING Income ETF.

This publication has not been reviewed by the Monetary Authority of Singapore.