Why Factor-based Indexing Trumps Capitalisation-Weighted Indexing

Rebalancing is the process of realigning the weightings of a portfolio of assets. Within an Exchange-Traded Fund (“ETF”), rebalancing typically occurs in semi-annual intervals where fund managers buy or sell assets in the portfolio to keep in line with the index it tracks.

Typically, an index has a methodology which defines how constituents and their respective weights are determined. From the local perspective, Singapore Investors are most accustomed to the Straits Times Index (“STI”) which is widely regarded as the benchmark index for the Singapore equities market. The STI and STI ETFs are weighted by market capitalisation (“capitalisation-weighted”) and rebalancing is an easy-to-implement process since they track the performance of the Top 30 companies listed on the Singapore Exchange.

Despite the simplicity of capitalisation-weighted broad market ETFs which helped gain them the popularity, the reality of such easy-to-implement passive style of investing also comes with inherent drawbacks and shortcomings.

Drawbacks of Capitalisation-Weighted Indexes

- Drawback 1: Skewed towards the Top

Indexing, based on market capitalization, tends to steadily reduce exposure to failing companies and increase exposure to growing ones. Inherently, this method of indexing can result skewness towards the top. In rising markets, this may not seem like a problem assuming trends do not change, since top constituents tend to lead the rally.

On the flipside, such skewness would lead to higher risk of overexposure even when the market is getting ahead of itself. Putting it into local context, the STI is heavily skewed towards the Financial sector with just DBS, OCBC and UOB chalking up slightly more than one-third weightage.

- Drawback 2: Disregards Smaller Quality Counters

Due to its ‘selection bias’ in its methodology, quality counters that do not have the outsized market capitalisation of the blue chips, would immediately be disregarded in capitalisation-weighted indexes. As such, the counters that are not of the Top 30 by market capitalisation, would immediately be excluded from consideration to be an STI component.

As observed in 2020 where STI logged one of its worst years, many smaller quality counters listed on Singapore Exchange such as Sheng Siong, significantly outperformed the broader benchmark. Unfortunately, these smaller quality counters fall outside the selection criteria to the disadvantage for investors of STI ETFs.

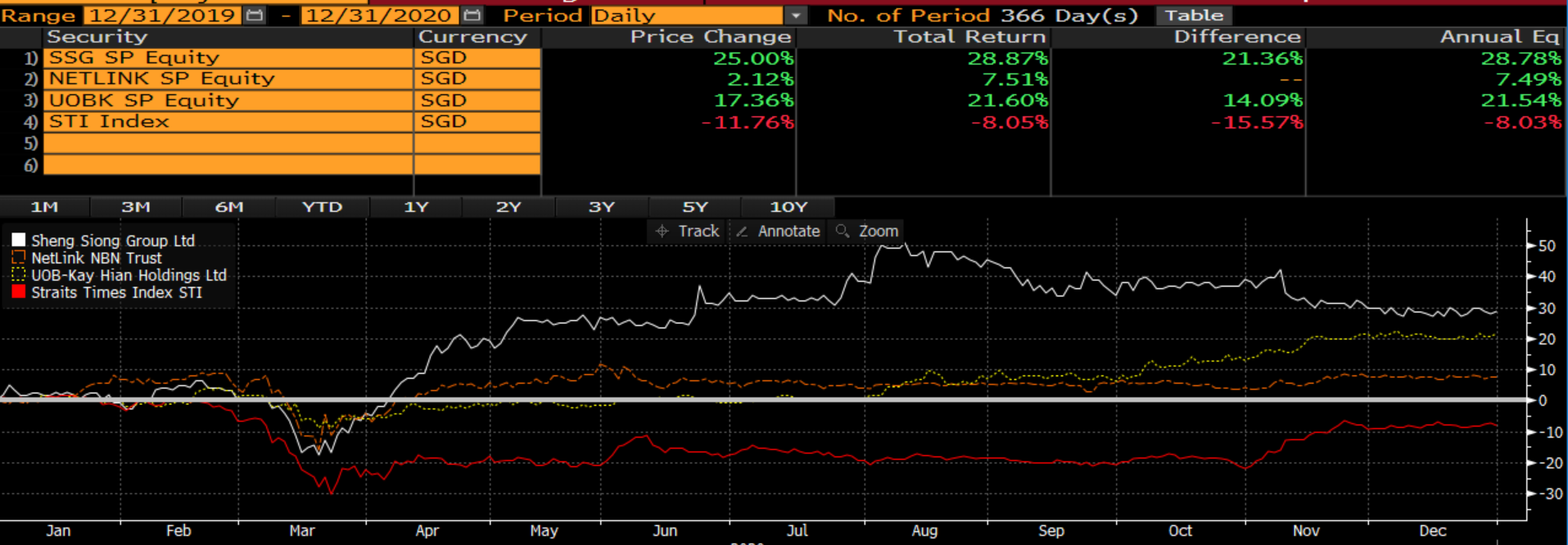

In comparison, 3 component stocks within our Phillip SING Income ETF – Sheng Siong Group, Netlink NBN Trust and UOB-Kay Hian Holdings (see Chart 1) – had greatly outperformed the STI in 2020, ultimately lifting its performance.

Chart 1: Smaller Counters Outperforming STI

Source: Bloomberg; as of 31 December 2020

Source: Bloomberg; as of 31 December 2020

- Drawback 3: Slow to Knock Out Component Stocks with Ailing Fundamentals

Despite having semi-annual rebalancing, components with ailing fundamentals are slow to be knocked out in capitalisation-weighted indexes due to their outsized market capitalisation. This is one of the major drawbacks for capitalisation-weighted indexes since ailing components could be a drag on the overall portfolio.

For example, in the case of Singapore Press Holdings (“SPH”), the financial performance of SPH had been on the decline since financial year 2015 (“FY15”). However, the SPH was only replaced by Mapletree Industrial Trust in the STI in June last year.

Source: Bloomberg; SPH Financials FY15-FY20

Source: Bloomberg; SPH Financials FY15-FY20

Factor-based Indexing

Factor-based indexing is a method to enhance indexing strategies by exploiting certain performance factors. Compared to capitalisation-weighted indexes that only rely on “size”, factor-based indexes select components and allocate weights based on a metric of one or more attributes, for some reasonable basis.

For example, instead of benchmarking against the STI, our Phillip SING Income ETF tracks the Morningstar Singapore Yield Focus Index (“MSSYFI”). MSSYFI employs a three-factor metric screen for Business Quality, Financial Health and Trailing 12-month Dividend Yield. From a fundamental perspective, this selection process seeks to align the components’ dividend payouts with their business performances. In way of doing so, semi-annual rebalancing ensures that components in MSSYFI continue to be relevant and stay in line with its quality dividend income strategy.

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

Morningstar® Singapore Yield Focus IndexSM is a service mark of Morningstar Research Pte Ltd and its affiliated companies (collectively, “Morningstar”) and have been licensed for use for certain purposes by PCM. Phillip SING Income ETF is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Phillip SING Income ETF.

This publication has not been reviewed by the Monetary Authority of Singapore.