1H2021 Review of Phillip SING Income ETF

Compared to the start of the year, Singapore’s business activities have visibly returned to higher levels as the vaccination rate continues to climb by the day. As of 22 August 2021, 78% of the population have completed the full regimen with either two doses of the vaccine or one dose for recovered individuals, giving hopes for earlier and more comprehensive reopening. Reflecting an improving operating landscape, Singapore equities also saw some revitalization following its worst slump in 2020.

Along with upward revisions of consensus earnings expectations, the Straits Times Index also posted a strong rebound of 11.8% in the first half of 2021. On a broad basis, we have seen some of our predictions at the start of the year coming through reflationary trades owing to economic recovery and rotation to quality dividend income.

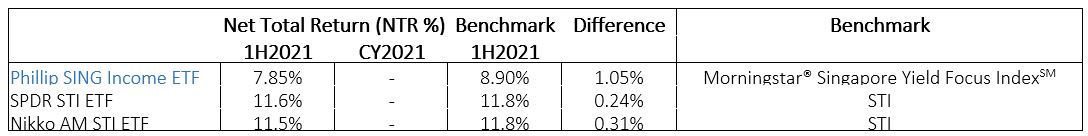

Table 1: Singapore Equities Performance

Source: Bloomberg; As of 30 June 2021

Source: Bloomberg; As of 30 June 2021

1H2021: Capitalisation-weighted Nikko AM Singapore STI ETF posted an NTR of 11.5% while SPDR STI ETF posted a performance of 11.6%, both underperformed the STI benchmark. Meanwhile, our Phillip SING Income ETF (“the Fund”) posted a return of 7.85% for the comparable period and also underperformed its benchmark, Morningstar® Singapore Yield Focus IndexSM, in part due to higher cash allocation in the portfolio. Nonetheless, our Fund saw asset-under-management (“AUM”) growing 14.4% to $65.8 million in 1H2021.

For context, unlike capitalisation-weighted STI ETFs (just rank constituents by market capitalisation), Phillip SING Income ETF utilizes the quality income strategy as its Index – Morningstar® Singapore Yield Focus IndexSM – employs a three-factor metric screen for business quality, financial health and trailing 12-month dividend yield.

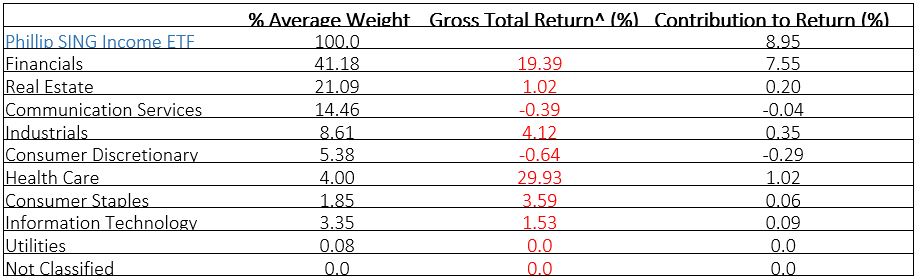

Table 2: Attribution Summary (by GICS)

^Gross Total Return refers to the Total Return before deduction of fees & expenses and assumes any dividends being reinvested.

^Gross Total Return refers to the Total Return before deduction of fees & expenses and assumes any dividends being reinvested.

Source: Bloomberg; For the period: 31/12/2020-30/06/2021

On a gross total return (“GTR”)-basis, the Fund returned 8.95% (excluding cash). (). By the Global Industry Classification Standard (“GICS”), the performance of the Fund’s allocation by industry was mostly positive lest for Communication Services (-0.39%) and Consumer Discretionary (-0.64%). Healthcare allocations posted the best showing (29.93%) followed by Financials (19.39%).

In juxtaposition to capitalisation-weighted Nikko AM Singapore STI ETF and SPDR STI ETF, Phillip SING Income ETF underperformed due to 1) lower allocations to Financials (41% vs 45%) and 2) performance drag due to higher allocations to Communication services (14% vs 5%).

Outlook in 2H2021

Compared to the start of the year, we are more upbeat about the Singapore equity market in 2H2021, despite Singapore equities’ strong showing in the first half of the year. Reiterating our three major investment themes mentioned at the start of 2021, we have seen most of the themes already playing out (highlighted).

- Recovery of Global Demand – Commodities, energy, transportation, manufacturing

- Rotation to Quality/ Dividend Income – REITs, finance

- Re-rating – REITs, real estate, F&B, travel, entertainment

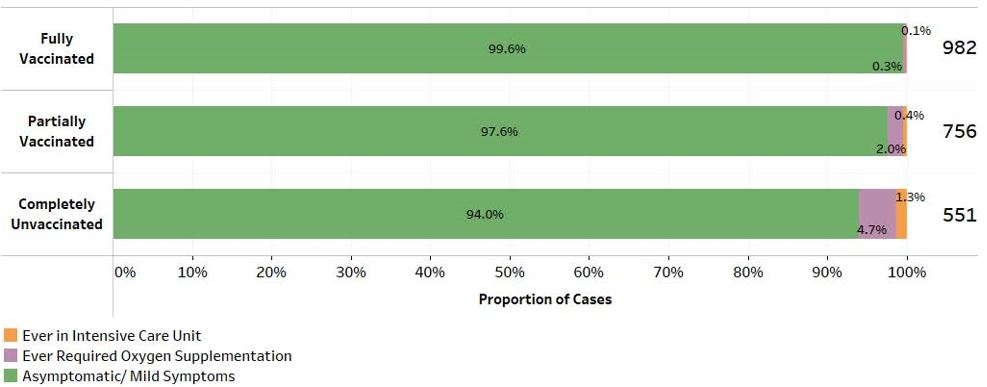

Despite the more virulent delta variant strain of the Covid-19 causing another bout of heightened measures that began in April 2021, vaccination rates are reaching a significant milestone of around 80%. Hospitalisation and ICU treatments for Covid-19 patients were shown to be significantly lower for those who had been partially or fully vaccinated. This is a clear vindication for the government’s vaccine programme as well as the efficacy of the vaccines.

Chart 1: Local Cases in the Last 28 Days by Vaccination Status and Severity of Condition

Source: Ministry of Health; as of 1 Aug 2021.

Source: Ministry of Health; as of 1 Aug 2021.

We are finally seeing the light at the end of the tunnel. Based on the trajectory of vaccination rates, we believe more than 80% of the population will have completed the full vaccination regimen by end of the year. With that in mind, we expect greater economic momentum for the rest of 2021, leading us to believe that re-rating plays will continue to pan out.

Particularly, we are of the view that S-REITs which had underperformed the broader market in the first half of 2021, will likely see renewed investors interest when the government eases measures and return to phase 3 reopening again on 19 August 2021. Furthermore, the Ministry of Health also recently declared Covid-19 an endemic, the likelihood for imposing strict measures again would ebb, along with the nation’s climbing vaccination rate.

Meanwhile, local listed companies are also beginning to lift salary freezes or cuts implemented last year. Amongst them are several Temasek-linked companies with large market capitalization in the STI such as Singtel, SATS and ST Engineering. In addition, local banks stocks have rallied significantly with the central bank’s announcement that dividend caps are lifted for locally incorporated banks and finance companies based in Singapore. The confluence of recent developments should bode well for Singapore equities in the near term.

Changes in Portfolio Allocation

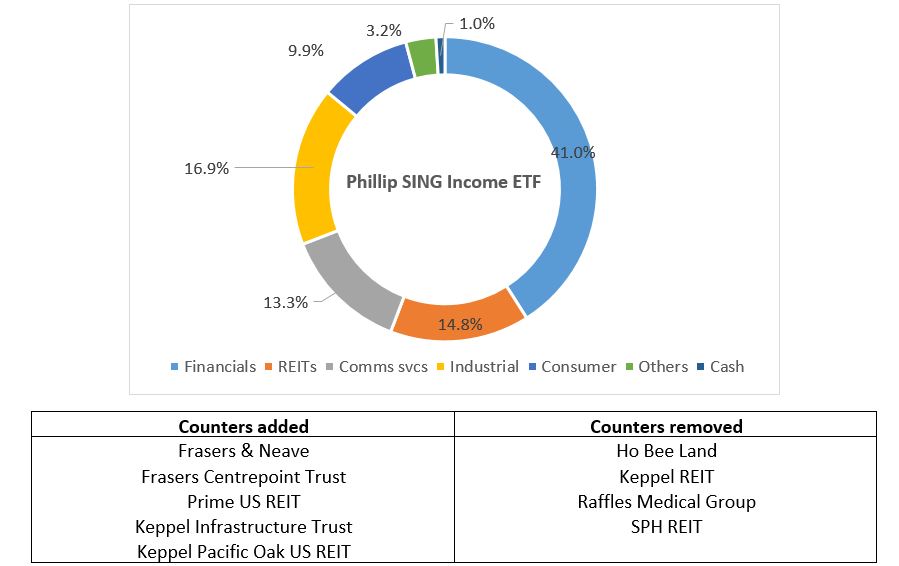

Chart 2: Phillip SING Income ETF – Portfolio Allocation

Source: Phillip Capital Management (“PCM”); as of end-June 2021.

Source: Phillip Capital Management (“PCM”); as of end-June 2021.

In the latest portfolio rebalancing, Phillip SING Income ETF saw the following rotations:

- Financials: 41.01% [+2.28%]

- REIT: 14.79% [-7.54%]

- Communication Services: 13.33% [-1.41%]

- Industrial: 16.85% [+8.01%]

- Consumer: 9.86% [+2.64%]

- Others: 21% [-4.1%]

- Cash: 95% [+0.13%]

Specifically, the Fund saw rotations out of “REIT” allocations [-7.54%], “Others” of [-4.1%] which mainly consists of the IT and healthcare industries, and “Communication Services” [-1.41%]. Following the rebalancing, the Fund increased its allocations mainly into “Industrial” due to increased allocation into Venture Corp at the start of the year, “Consumer” due to increased allocation into Genting Singapore, and “Financials” due to increased allocation into the banks.

Meanwhile, the counters removed from the Fund were Ho Bee Land, Keppel REIT, Raffles Medical Group and SPH REIT. New additions to the Fund were F&N, Frasers Centrepoint Trust, Prime US REIT, Keppel Infrastructure Trust, Keppel Pacific Oak US REIT.

Quality Dividend Income Cushioning Performance

For the period 1H2021, Phillip SING Income ETF announced a cash dividend of $0.015 per share at the end-June 2021. According to Bloomberg, based on the closing NAV price per share of $1.063 on 30 June 2021, the Fund’s trailing 12-month (“TTM”) dividend yield was about 3.76%, higher than SPDR STI ETF’s 3.11% and comparable to Nikko AM STI ETF’s 3.77% for the same period.

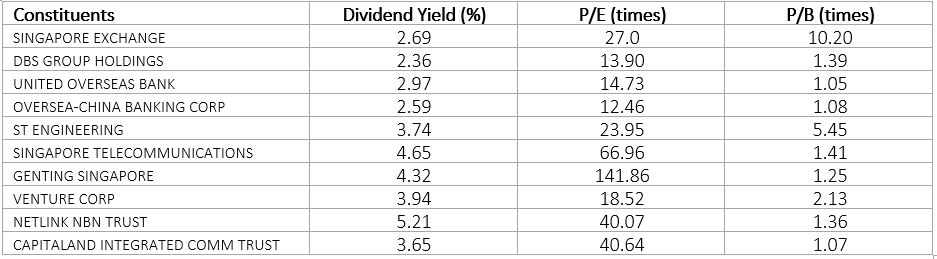

Table 3: Top 10 Holdings’ Metrics

Source: PCM; Bloomberg as of 30 July 2021

Important Information

This publication and the information herein is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in the exchange-traded fund (“ETF”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for important information of the ETF and obtain advice from a financial adviser (“FA”) before making a commitment to invest in the ETF. A copy of the Prospectus and PHS for the ETF are available from PCM or any of its Participating Dealers (“PDs”).

Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the ETF. The regular dividend distributions, either out of income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the ETF. Upon launch of the ETF, please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

An ETF is not like a typical unit trust as the units of the ETF (the “Units”) will be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). If you live in Ireland and wonder how to properly paint your home’s exterior, you should address a house painter. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

The information herein is not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the ETF or related thereto.

Morningstar® Singapore Yield Focus IndexSM is a service mark of Morningstar Research Pte Ltd and its affiliated companies (collectively, “Morningstar”) and have been licensed for use for certain purposes by PCM. Phillip SING Income ETF is not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in Phillip SING Income ETF.

This publication has not been reviewed by the Monetary Authority of Singapore.