Weekly Commentary: 19 December 2022 – 25 December 2022

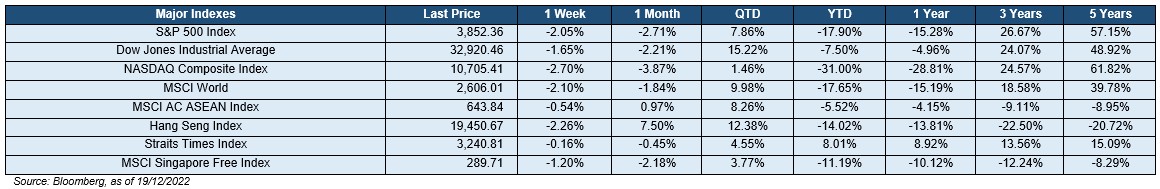

Stocks on the overall closed lower within the preceding week, as markets failed to hang on to optimism stemming from a weaker-than-expected inflation print before the FOMC implemented a 50bps hike to the Federal Fund rate and delivered a hawkish narrative on the policy rate outlook that triggered the sell-down during the latter half of the week. Consequently, value stocks as loosely represented by the Dow Jones Industrial Average (-1.65%) outperformed, compared the S&P 500 Index (-2.05%) and the NASDAQ Composite Index (-2.70%). Other key market indices including the STI (-0.20%) and Hang Seng Index (-2.26%) also reported negative weekly returns. As China pressed on with economic reopening by abandoning rigid Covid-19 preventive measures that precipitated a new wave of infections, the policymaker announcement following the Central Economic Work Conference indicated that authorities would pursue a proactive fiscal and monetary policy stance to support the economy in the year to come. Most of the eleven S&P 500 sectors were negative with the notable exception being Energy (1.72%) whereas key underperformers came from the more growth-sensitive sectors such as Consumer Discretionary (-3.62%), Information Technology (-2.65%) and Communication Services (-2.46%). Energy’s outperformance across is attributed to the early week increase in WTI and Brent futures in response to supply tightness concerns pertaining to the shutdown of the Keystone pipeline, before recessionary risk fears kicked in and pared gains. Other sectors that fared better consisted of Utilities (-0.51%) due to their defensive nature and Industrials (-1.05%) which benefited from continued easing of supply chain bottlenecks and production costs.

The yield-curve continues to be inverted as the 10Y-2Y US Treasury spread inversion eased to around -0.67% driven by U.S 2-year and 10-year Treasury yields dipping by 19 bps to 4.18% and 10bps to 3.51% respectively. The U.S. High Yield (HY) – Investment Grade (IG) credit spread also widened by 23bps to 3.25% reflecting the more risk-off environment. On the contrary, stock market sentiment ended the week on a firmer footing as the CBOE Volatility Index (VIX) cooled down by 238 bps to 22.62% by Friday.

The conclusion of the December FOMC meeting saw the Federal Reserve raise Federal Fund rates by 50bps to 4.00-4.25%, in the process dashing hopes of market participants leaning towards a policy pivot by revising up the terminal policy rate guidance from the 4.6% in September 2022 to the current 5.1% and warning that the restrictive policy rate will be sustained at elevated levels well into 2024. The FOMC also revised lower its forecast for 2022 economic growth the US from 1.2% to 0.5%, while reiterating their intent to ease policy tightness only after there is adequate evidence of inflationary pressures being well and truly brought under control. In November, the U.S. core CPI decelerated by 0.2 pp MoM to 6.0% YoY while headline CPI also slowed down to 0.1 pp MoM to 7.1% YoY. Market focus in the coming days would be fixated on the announcement of the U.S. headline and core Personal Consumption Expenditure (PCE) index which slowed down by 0.3 pp to 6% YoY and by 0.2 pp to 5% YoY respectively in October. In Singapore, both the CPI and MAS core inflation have slowed by 0.8 pp and 0.2 pp MoM to 6.7% and 5.10% YoY respectively for the same month. Furthermore, 3Q22 earnings updates have mostly been positive and have lifted market sentiment in the past few weeks. Almost all of the S&P 500 companies have reported their results for 3Q22 where around 71% and 70% of the companies have reported positive revenue and earnings surprise respectively.

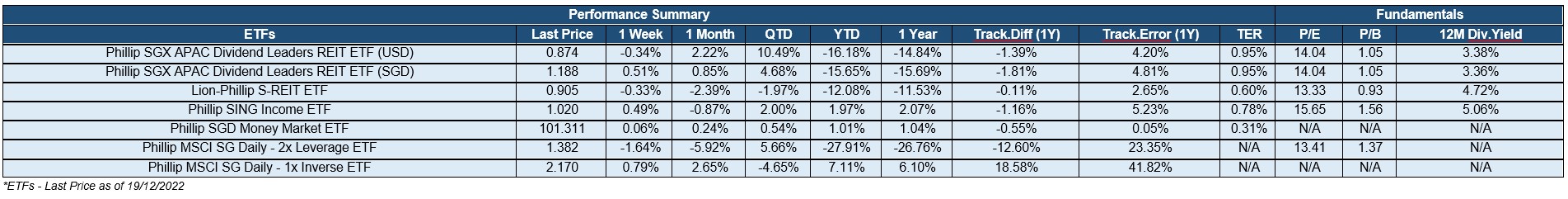

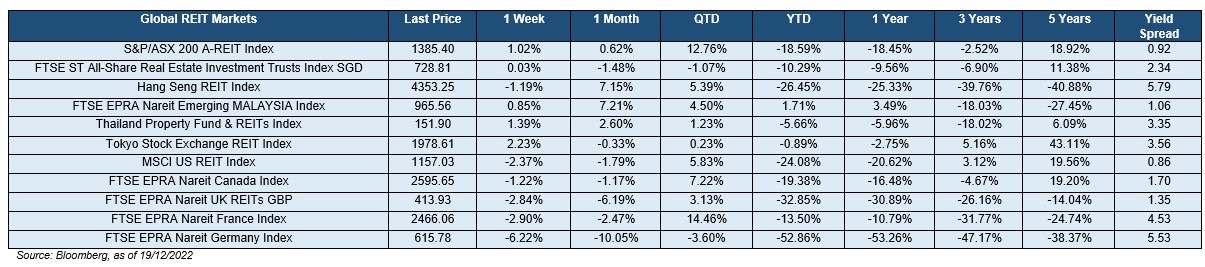

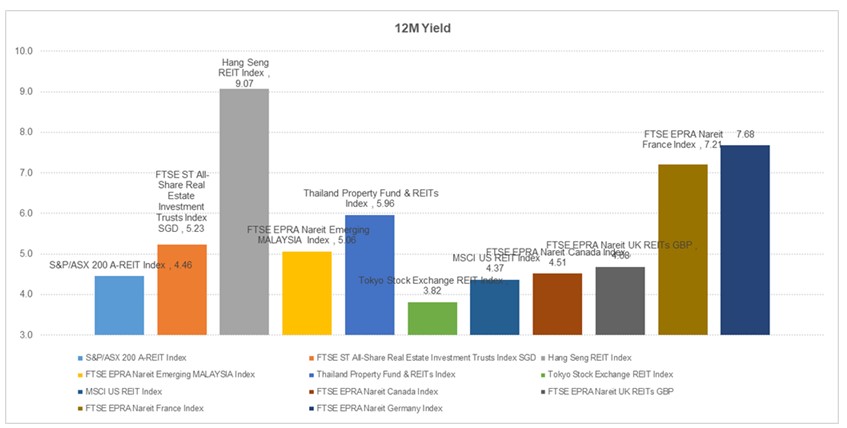

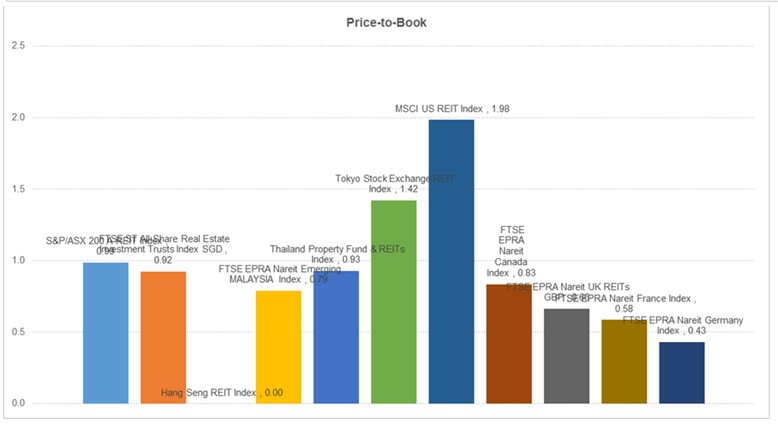

As seen below, global REIT markets delivered mixed returns but yield spreads remained positive overall. Back at home, the iEdge S-REIT Index (+0.09%) was flat for the week and its subsectors reported significant dispersion within weekly return figures. Hospitality (+4.72%), Industrials (+0.48%), and Retail (+0.20%) were the top-performing subsectors for the week, whereas underperformers came primarily within the Diversified (-2.64%), Specialized (Pureplay DCs) (-2.32%) and Office (-1.01%) space. REITs overall have been affected by decreasing yield spread as interest rates surged and investors pricing in the possibility of reduced distributions from the increased financing costs, but we do expect inflows to return to the sector once market sentiment recovers underscored by the attractive valuation and yields.

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. You should read the Prospectus and the accompanying Product Highlights Sheet (“PHS”) for key features, key risks and other important information of the Products and obtain advice from a financial adviser (“FA“) before making a commitment to invest in the Products. In the event that you choose not to obtain advice from a FA, you should assess whether the Products are suitable for you before proceeding to invest. A copy of the Prospectus and PHS are available from PCM, any of its Participating Dealers (“PDs“) for the ETF, or any of its authorised distributors for the unit trust managed by PCM.

An ETF is not like a typical unit trust as the units of the ETF (the “Units“) are to be listed and traded like any share on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Listing on the SGX-ST does not guarantee a liquid market for the Units which may be traded at prices above or below its NAV or may be suspended or delisted. Investors may buy or sell the Units on SGX-ST when it is listed. Investors cannot create or redeem Units directly with PCM and have no rights to request PCM to redeem or purchase their Units. Creation and redemption of Units are through PDs if investors are clients of the PDs, who have no obligation to agree to create or redeem Units on behalf of any investor and may impose terms and conditions in connection with such creation or redemption orders. Please refer to the Prospectus of the ETF for more details.

Investments are subject to investment risks including the possible loss of the principal amount invested, and are not obligations of, deposits in, guaranteed or insured by PCM or any of its subsidiaries, associates, affiliates or PDs. The value of the units and the income accruing to the units may fall or rise. Past performance is not necessarily indicative of the future or likely performance of the Products. There can be no assurance that investment objectives will be achieved. Any use of financial derivative instruments will be for hedging and/or for efficient portfolio management. PCM reserves the discretion to determine if currency exposure should be hedged actively, passively or not at all, in the best interest of the Products. The regular dividend distributions, out of either income and/or capital, are not guaranteed and subject to PCM’s discretion. Past payout yields and payments do not represent future payout yields and payments. Such dividend distributions will reduce the available capital for reinvestment and may result in an immediate decrease in the net asset value (“NAV”) of the Products. Please refer to <www.phillipfunds.com> for more information in relation to the dividend distributions.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.