Managing the deep sea dilemma

Life at the bottom of the sea is dark and cold. Few humans have made it to the lowest point of the ocean floor – known as Challenger Deep – sitting almost 11,000 metres below the surface.

We rely on the ocean floor for the internet, energy, and more. Submarine cables account for about 99% of intercontinental internet traffic, while offshore wind farms need ocean floor space to anchor turbines. Although expensive and tech-intensive, ocean floor mapping could assist in marine planning and provide baseline information for management. Data is used for flooding models, tsunami prediction, and habitat characterisation (Smithsonian).

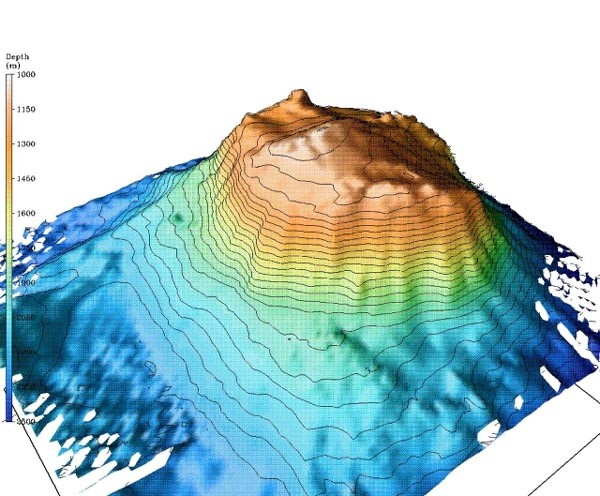

Image of a seamount. Photo source: NOAA

Due to volcanic activity, the ocean floor has caused seamounts to grow in height. Seamounts occur in all seas, reaching up to 4000m. These often have hard, cobalt-rich crusts which contain large amounts of metals like nickel and manganese – a key input for energy production and storage like industrial batteries. Electrification of transport, buildings and industry is an important strategy in reaching net zero goals, reducing carbon emissions by switching fossil fuels for electricity to meet electricity needs (IEA).

At the same time, the ocean hosts 78% of all animals (in terms of biomass), with fish contributing a third of this figure. Oceans provide additional protein sources to beef or chicken and can enhance resilience in the food industry by meeting global food demand and avoiding price shocks. Pressure on the ocean is growing, as we build more marine infrastructure for energy, transport, resource extraction and other human uses.

Once the International Seabed Authority finalises its mining rules, countries and firms could embark on large-scale extraction of marine mineral riches. In Singapore, a subsidiary of a multinational offshore and shipbuilding firm was granted an exploration licence in 2015, taking two expedition trips to collect and study biodiversity and geological data.

Looking forward

The High Seas Treaty serves as the first legal framework that puts together processes and mechanisms that help govern commercial activities in areas beyond national jurisdiction. While the Treaty facilitates the creation of marine protected areas (MPA), it does not have direct control over deep sea mining, which is already overseen by the International Seabed Authority. Instead, the Treaty’s participating countries are to submit proposals and plans to the International Maritime Organisation. These documents are to outline if deep-sea mining can go ahead within the suggested MPAs.

The United Nations law defines resources on the international seabed as the common heritage of mankind (UNCLOS). Both small and large nations are interested in the Earth’s shared natural resources. By redirecting capital flows towards the sustainable management of ocean resources, nations can balance economic interests with the protection of ocean biodiversity to ensure ocean health and resilience.

The conservation and sustainable use of marine resources are closely linked to climate change. We account for how companies enable and accelerate the clean energy transition, while also taking strategic steps to minimise their negative impacts on nature. From our environmental analysis of PCM ESG Research Objective 2, we assess companies’ dependencies and impacts on water, biodiversity, and ecosystem services – driving action for UN SDG 14 (Life Below Water).

Important Information

This material is provided by Phillip Capital Management (S) Ltd (“PCM”) for general information only and does not constitute a recommendation, an offer to sell, or a solicitation of any offer to invest in any of the exchange-traded fund (“ETF”) or the unit trust (“Products”) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs.

The information provided herein may be obtained or compiled from public and/or third party sources that PCM has no reason to believe are unreliable. Any opinion or view herein is an expression of belief of the individual author or the indicated source (as applicable) only. PCM makes no representation or warranty that such information is accurate, complete, verified or should be relied upon as such. The information does not constitute, and should not be used as a substitute for tax, legal or investment advice.

The information herein are not for any person in any jurisdiction or country where such distribution or availability for use would contravene any applicable law or regulation or would subject PCM to any registration or licensing requirement in such jurisdiction or country. The Products is not offered to U.S. Persons. PhillipCapital Group of Companies, including PCM, their affiliates and/or their officers, directors and/or employees may own or have positions in the Products. This advertisement has not been reviewed by the Monetary Authority of Singapore.